Imagine you own an investment property: a valuable asset that’s just sitting there.

One day you list your property on Airbnb, so you can earn additional income. You still own the property, but now it’s working for you, earning money while you sleep – by giving guests a place to sleep.

Coinbase Wrapped Bitcoin (cbBTC) is like that investment property.

If you’ve already invested in bitcoin (your long-term “investment property”), you can convert it to a form that’s compatible with Ethereum (like converting to a rental property). This lets you use your bitcoin in new ways to earn additional income.

In this guide, you’ll learn how to convert your BTC to cbBTC, how to use it to earn money while you sleep, and the biggest investment opportunity unlocked by cbBTC.

How to Buy cbBTC

You don’t “buy” it in the traditional sense: you convert bitcoin you already own into cbBTC. Here’s how.

Step 1: Own Bitcoin on Coinbase. To start using cbBTC, you need to hold bitcoin in your Coinbase account. (See our guide here.) If you don’t have bitcoin yet, you can easily purchase it on Coinbase through the app or website.

Step 2: Convert BTC to cbBTC. Once you have bitcoin in your Coinbase wallet, you transfer your bitcoin to an address on either the Ethereum or Base network. This transfer automatically converts your bitcoin to cbBTC at a 1:1 ratio, which lets you use it with many DeFi applications.

Note: You still own the bitcoin! It’s like converting an investment property into a rental property.

Step 3: Store and Manage cbBTC. Your cbBTC can be stored in any Ethereum-compatible wallet, including Coinbase Wallet. You can also manage and trade cbBTC on decentralized exchanges (DEXs) like Uniswap, Aerodrome, and Curve.

Note: If you sell the cbBTC, or trade it for another token, this is like selling your rental property. You sell the underlying BTC, and receive cash (or another token) in return. You also pay taxes on the transaction.

How to Earn Income with cbBTC

You can’t make money just by holding cbBTC, because 1 BTC = 1 cbBTC. Instead, you earn money by making your BTC more useful.

With cbBTC, you are converting your bitcoin to an Ethereum-compatible ERC-20 token, which means you can put your bitcoin to work on DeFi websites. Here are the three most popular ways to earn:

1. Lending cbBTC (Aave, Compound)

1. Lending cbBTC (Aave, Compound)

Lending cbBTC is like depositing your money in a savings account at a bank. The bank lends out your money, and pays you interest in return.

When you send bitcoin to platforms like Aave or Compound, you are depositing your cbBTC into a lending pool. This pool is available for other users to borrow from, by providing their own crypto as collateral. In return, you earn interest, which is paid by the borrowers.

Here’s how it works:

Deposit your cbBTC into the lending pool. From Coinbase, you send your bitcoin to a smart contract on Aave, Compound, or similar platforms. This contract holds your cbBTC along with other users’ deposits, creating a pool of assets that can be borrowed. In return, you receive a “receipt token.”

Earn interest on your deposit. As borrowers take out loans from the pool, they pay interest. That interest is distributed proportionally among all the lenders in the pool, including you. The rate of interest can fluctuate based on the supply and demand for cbBTC loans at any given time.

Withdraw at any time. You can withdraw your bitcoin from the pool at any time, along with any interest you’ve earned, by sending your receipt token back to the original smart contract address.

Benefit: Aave and Compound let you earn interest income on your cbBTC without selling it. They are both trusted platforms that are generally safe to use.

Risks: The interest rates fluctuate based on market conditions. Additionally, while the platforms are decentralized, there are still small risks of smart contract bugs or vulnerabilities.

2. Providing Liquidity with cbBTC (Uniswap, Curve)

2. Providing Liquidity with cbBTC (Uniswap, Curve)

Imagine owning a small currency exchange booth where you profit from people swapping currencies.

By providing cbBTC (along with another token) to liquidity pools on decentralized exchanges like Uniswap or Curve, you enable others to trade. In return, you earn a portion of the trading fees.

Here’s how it works:

Deposit cbBTC and another asset into a liquidity pool. You need to supply two assets in equal value—for example, BTC and ETH—into a single smart contract address on Uniswap or Curve. This pool holds both assets, and facilitates trades between them for other users on the platform.

Receive Liquidity Provider (LP) Tokens. In exchange for providing liquidity, you receive LP “receipt” tokens that represent your share of the pool. You can redeem them at any time to get back your original deposit, plus any fees earned, by sending them back to the original smart contract address.

Earn fees on every trade. Each time someone uses the pool to swap between cbBTC and the other asset (e.g., ETH), they pay a small fee. This fee is distributed proportionally to all the liquidity providers (LPs) in the pool, including you. The more they trade, the more you earn.

Benefit: You earn a percentage of trading fees in the pool, giving you a steady source of income as long as people trade.

Risk: There’s a risk of impermanent loss, where the value of the assets you’ve deposited changes compared to when you initially added them to the pool. (See our guide here.) Additionally, there is a small risk of smart contract bugs or vulnerabilities, though Uniswap and Curve are generally safe.

3. Earning Yield with cbBTC (Mellow, Veda)

3. Earning Yield with cbBTC (Mellow, Veda)

Using yield vaults is like putting your money in an investment fund. The fund managers (in this case, automated algorithms) move your money between different opportunities to get you the highest possible return, without needing to manage it yourself.

Yield vaults like Mellow and Veda are DeFi platforms that move your cbBTC between various lending platforms, liquidity pools, and other strategies, optimizing for the highest yield. Essentially, they do the hard work of finding the best ways to earn income on your cbBTC, so you don’t have to.

Here’s how it works:

Deposit your cbBTC into a yield vault. You start by sending your bitcoin from Coinbase into a yield vault’s smart contract. You will receive vault tokens: a “receipt” that can be used to track the value of your deposit as it grows over time.

Earn yield on your cbBTC. As your cbBTC is deployed across different DeFi strategies, you earn yield in the form of interest, trading fees, or rewards. The vault reinvests these earnings, compounding your returns over time.

Withdraw at any time. You can withdraw your cbBTC and the earned yield by redeeming your vault tokens (e.g., sending them back to the original smart contract). The value of your withdrawal will include the original bitcoin you deposited, plus any profits the vault has generated.

Benefit: Yield vaults provide a hands-off way to maximize your returns, allowing you to earn the highest possible yield without actively managing your cbBTC.

Risk: Higher returns often come with higher risks. Yield vault strategies can involve volatile DeFi protocols, and there’s always a risk of smart contract vulnerabilities or sudden market changes impacting your returns.

Remember, while these methods can potentially generate income, they also come with risks. Always research thoroughly and only invest what you can afford to lose. Additionally, be aware that you’ll need to pay taxes on any additional income you earn (e.g., when you convert cbBTC back to BTC).

Wrapped Bitcoin (wBTC) vs. Coinbase Wrapped Bitcoin (cbBTC)

Both Wrapped Bitcoin (WBTC) and Coinbase Wrapped BTC (cbBTC) allow bitcoin holders to use their BTC in Ethereum-compatible DeFi apps. However, there are important differences between the two.

Custody and Trust: WBTC is managed by a consortium, led by BitGo, while cbBTC is fully backed and managed by Coinbase. WBTC has faced concerns over governance changes, while cbBTC benefits from Coinbase’s established reputation as the leading “bitcoin bank.”

Conversion Process: WBTC conversion requires third-party merchants to wrap and unwrap bitcoin, which can take longer. In contrast, cbBTC offers a direct, seamless conversion integrated with Coinbase, making the process much faster and simpler.

Blockchain Support: WBTC is primarily used on Ethereum, while cbBTC is available on both Ethereum and Base (Coinbase’s layer-2 network), with plans to expand to more chains in the future. This means cbBTC will be cheaper and easier to use.

Adoption and Use Cases: WBTC has been widely adopted in DeFi since 2019 and is integrated with many platforms. cbBTC is newer, but supported by major DeFi apps from day one and is expected to grow quickly due to Coinbase’s large user base.

The Biggest Investing Opportunity

Perhaps the best investment of all is simply buying Coinbase stock ($COIN).

The company is far more than a crypto exchange: it’s the leading “bitcoin bank,” holding nearly 1 million bitcoin (currently valued at over $57 billion). It is the largest custodian for bitcoin ETF providers, and the company has over 100 million users worldwide.

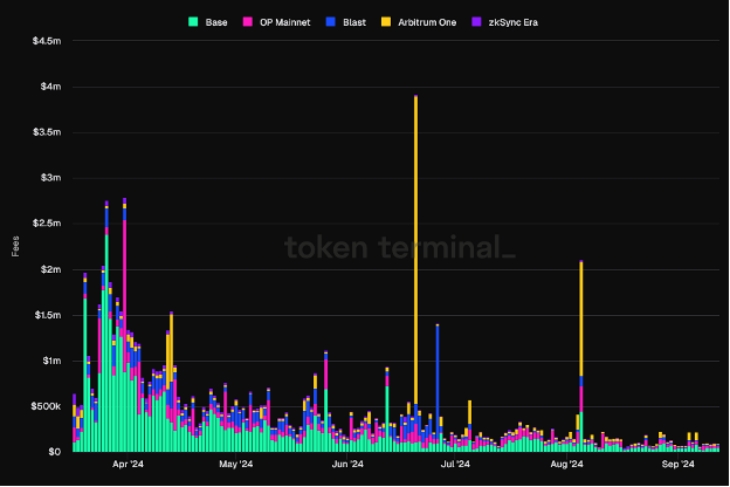

With cbBTC, Coinbase is building the infrastructure to allow customers to earn income with their bitcoin. It is likely to become the biggest “wrapped bitcoin” solution on the market, just as Coinbase’s layer-2 technology Base has become the top layer-2 by fees and revenue:

Coinbase has over a decade of experience in securely managing billions in bitcoin. And as a publicly-traded company, Coinbase offers transparency and regulatory compliance.

It’s now easier to convert your investment property (BTC) into a rental property (cbBTC), and earn additional income while you sleep. But don’t forget the bank that’s underwriting your mortgage (Coinbase). Buying $COIN stock is an investment opportunity in itself.