[ad_1]

According to Jag Kooner, head of derivatives at Bitfinex, the FED will soon have to make choices that will significantly impact the trend of the crypto markets.

On December 18, the next “FOMC meeting” is expected, during which the American institution will have to express itself on the next maneuver regarding interest rates.

The probabilities lean towards a moderate cut of 25 basis points, but there could also be surprises that will spill over into the prices of the speculative stock exchanges.

All the details below.

Bitfinex and USA macro data: economists predict a solid labor market

According to what was reported by Jag Kooner, head of derivatives at the Bitfinex exchange, some very important macro data will soon be released for the FED to analyze.

In particular, tomorrow the highly anticipated “non-farm payrolls” report will be released, by the U.S. Department of Labor, identifying the state of the U.S. labor market.

The report refers to the change in the number of payrolls during the last month for workers not engaged in the agricultural sector.

The results of this report will be fundamental for tracing the health of USA employment and reflecting on the upcoming economic policies of the Nation.

According to the analysts at Bitfinex, this time around, an addition of over 200,000 jobs is expected to be recorded in the month of November.

This would be a strong positive rebound after the meager increase of 12,000 units in October, which was strongly influenced by hurricanes and worker strikes.

October’s Non-Farm Payroll (NFP), which recorded an increase of just 12,000—marking its lowest since December 2020—was affected by disruptions caused by Hurricanes Helene and Milton, Boeing strikes, layoffs in the automotive industry, and slow hiring in the professional services… pic.twitter.com/pmG4CXXHJm

— Kasy Jackson (@kacijacksonfx) December 5, 2024

Strong employment in the United States would put the FED in a position to consider a less expansive monetary policy than usual during the next FOMC meeting.

Normally, the Federal Reserve is more incentivized to implement quantitative easing maneuvers when there is lower demand for work.

In fact, the strong labor market can indicate greater inflationary pressure, as wages rise and companies can increase the prices of their products and services.

Tendenzialmente il tasso di occupazione dovrebbe rimanere stabile al 4,1% influendo in modo leggermente negativo sui mercati speculativi, compresi quelli crypto.

Here are the words of the Bitfinex expert:

“The next employment report in the United States, scheduled for release on Friday, December 6, 2024, is set to significantly influence both the Federal Reserve’s policy decisions and the cryptocurrency market.”

FED ready for a rate cut: the interpretation of the Bitfinex analyst

The reflection of Jag Kooner from Bitfinex regarding the US labor market is reflected in the upcoming decisions of the FED regarding interest rates.

A solid employment report could lead the American central bank to consider a softer approach, with the horizon of unchanged rates as the framework.

Rates steady at 450-475 bps would strengthen the US dollar and impose downward pressure on riskier assets like Bitcoin and crypto.

On the contrary, a weaker report would push the FED to make a cut of 25 bps, potentially improving the liquidity of speculative markets.

At the moment, despite the non-farm payrolls forecasts being above expectations, the higher probabilities on the cut front are for a reduction of 25 basis points.

At least this is what is reported by the FedWatch tool of GME Group.

Extreme scenarios such as a 50 basis point reduction or on the opposite side an increase in the yield on government bonds are not expected.

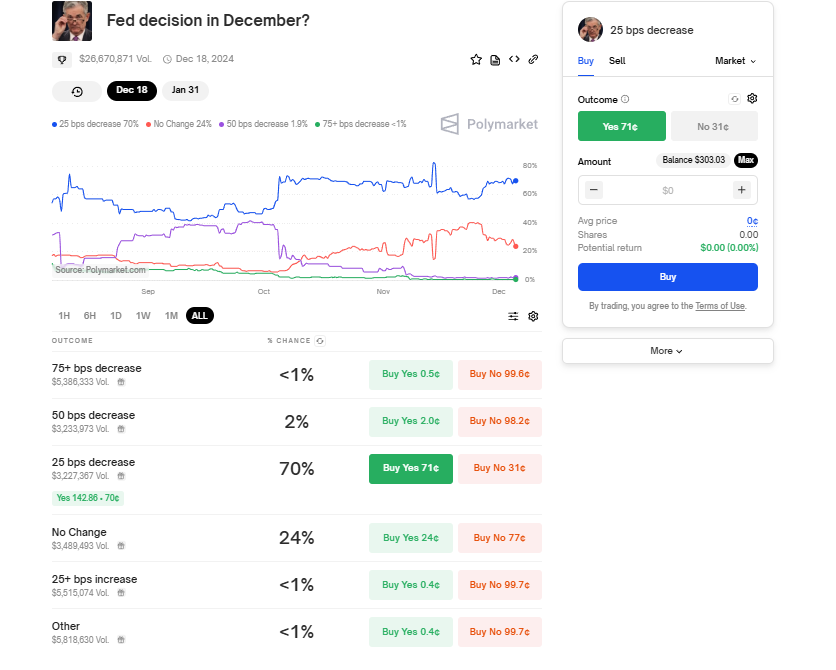

The prediction market Polymarket is also in line with these expectations.

According to the query “Fed decision in December”, the highest probabilities are for a gradual cut of 25 points.

Compared to the projections of the previous tool, here there is also a 3% spread potentially monetizable with the bets on the platform.

From October to today, the chances of a simple cut have increased, while in parallel, those of a more marked cut of 50 points have decreased, now about 2%.

At the same time, however, the projections of a “no change” have increased significantly, now at 24% given the update on the USA labor market.

As reiterated by the analysts at Bitfinex, the decisions of the FED will unequivocally determine the short-term trend of many risk-on assets.

Source: https://polymarket.com/event/fed-interest-rates-december-2024/fed-decreases-interest-rates-by-25-bps-after-december-2024-meeting?tid=1733385575279

The month of December begins in a strongly bullish way for Bitcoin and crypto

Beyond the forecasts of Bitfinex and what the approach of the FED will be, Bitcoin continues to set new records by crossing today the much-anticipated threshold of 100,000 dollars.

During the night, the cryptocurrency broke through the psychological barrier, even reaching a top of 104,000 dollars.

It therefore seems that the asset is not worried about the complex scenario of interest rate cuts and continues on its path towards the bull.

Most likely, crypto investors are confident that there will be no surprises on the macro front, and that the crypto market will react well to the upcoming FOMC.

It will be crucial to observe how Bitcoin and the rest of the sector will move as the FED meeting deadline approaches.

For the moment there are no signals that might suggest a drop in prices or graphical weakness in relation to the event.

A 25-point cut as predicted would help fuel the bull run currently underway, pushing Bitcoin towards new price horizons.

In all this, we must obligatorily report what happened yesterday in a CNBC interview where Jerome Powell (head of the FED) unexpectedly praised Bitcoin.

The president of the American institution, usually against the crypto industry, stated that the coin competes as a digital alternative to gold.

This sentence from Powell fuels the narrative of seeing the orange coin as a store of value asset, in line with the theories of the bitcoiner.

BREAKING: 🇺🇸 Fed Chair Jerome Powell says #Bitcoin is a competitor to gold, not the US dollar. pic.twitter.com/YQHFiThTBo

— Bitcoin Magazine (@BitcoinMagazine) December 4, 2024

[ad_2]