[ad_1]

A strategic partnership between Usual, Ethena, and Securitize, the tokenization platformfor the BlackRock USD Institutional Digital Liquidity Fund(BUIDL), is reshaping DeFi by combining liquidity, yield, and composability.

What’s Changing for Users?

- USDtb Collateral Integration: In the coming weeks, the combination of USDtb and BUIDL can be accepted as collateral for USD0, bridging TradFi-grade stability with DeFi innovation. It will provide Usual diversification of collateral and increase USD0 decentralization.

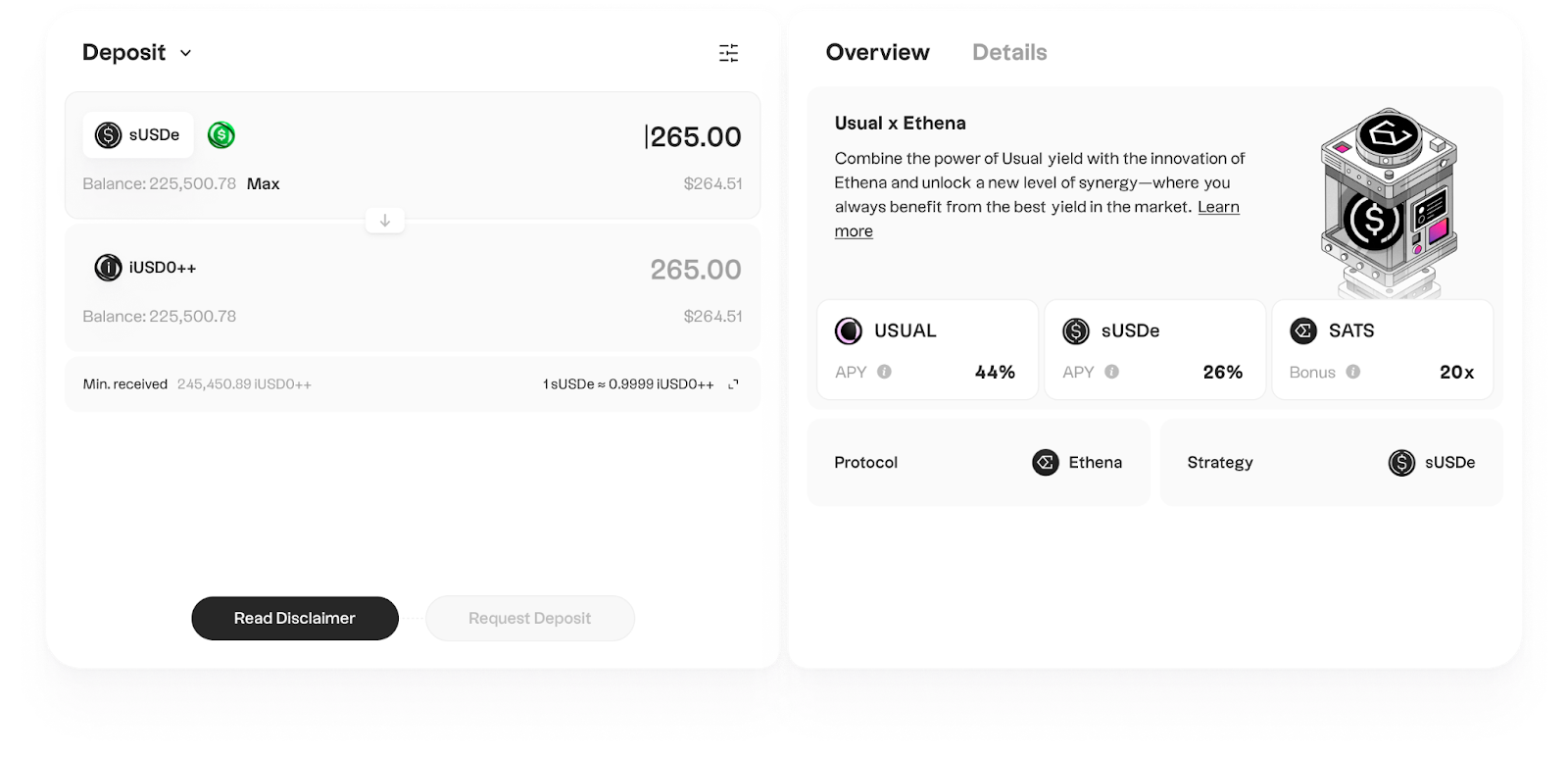

- Maximized Yield Opportunities: USD0++ holders can access a 1:1 incentivized vault in USUAL and sats for sUSDe, unlocking higher yields through delta-neutral strategies and fully subsidized rewards. These vaults will be isolated and won’t affect USD0++ backing.

- Unmatched Composability: All these communicating layers show the real power of DeFi. Usual and Ethena aim to drastically improve the stablecoin landscape and provide users increased safety, composability, and profitability.

- Enhanced Liquidity: A seamless 1:1 swap mechanism between USDtb, USD0, and USDe reduces reliance on secondary pools, ensuring strong peg and pristine liquidity as efficient capital flows between stablecoins and the rest of the market.

- Yield and treasury diversification: Ethena will allocate a portion of its reserves to USD0++, driving adoption, increasing TVL, and expanding yield opportunities for users. Usual’s collateral will diversify its yield sources through the integration of USDtb and BUIDL.

In the rapidly evolving landscape of DeFi, a new alliance emerges to redefine what’s possible. Usual, Ethena, and the BUIDL fund tokenized by Securitize —three of the fastest-growing names in their respective domains—are joining forces to create a groundbreaking layer of liquidity, composability, and yield optimization. Together, they form a “Holy Trinity” designed to drive a DeFi and stablecoin renaissance, enhancing stability, maximizing yield, and optimizing liquidity across both TradFi and DeFi ecosystems.

A Holy Partnership Built for Growth

This collaboration is not just about aligning three powerhouses—it’s about creating synergy across every layer of the ecosystem:

- BlackRock USD Institutional Digital Liquidity Fund (“BUIDL”), tokenized by Securitize, anchors this partnership by providing institutional-grade liquidity to DeFi. BUIDL offers secure, productive collateral that enables decentralized protocols to build applications backed by assets from traditional finance.

- Usual Protocol bridges traditional and decentralized finance by offering an RWA-backed stablecoin designed to redistribute ownership through usage. Acting as financial infrastructure, Usual offers a stablecoin backed by on-chain T-bills, ensuring solidity and protecting stablecoin holders from any counterparty risk. Its goal is to diversify collateral, aggregate T-bill liquidity on-chain, and deliver a stable, payment-ready asset. Users can stake their stablecoin as an Liquid Staking Token to earn ownership in the protocol through the USUAL token, which redistributes the value created.

- Ethena Protocol enhances the offering with delta-neutral strategies and unmatched composability, providing users with high yield: Ethena is a synthetic dollar protocol on Ethereum, offering a crypto-native alternative to traditional banking infrastructure and a globally accessible dollar-denominated rewards instrument, the “Internet Bond”.

Layering Growth for Maximum Impact

At every level of the ecosystem, these three players create value for users by enabling increased composability and inherent liquidity in DeFi while offering users the best yields:

- Unmatched Composability: Bridging TradFi and DeFi in groundbreaking ways. Through the integration of BUIDL and USDtb as collateral, USD0 becomes a RWA stablecoin that unifies fragmented RWA liquidity. By enabling USD0++ holders to gain exposure to USDe, Usual empowers users to optimize their USUAL assets while boosting Ethena’s TVL across all market conditions.

- Maximized Yield Opportunities: By combining Usual’s Alpha yield with Ethena’s delta-neutral strategies, users can maximize returns in any market environment. They will enjoy a merged yield of sUSDe and USD0++.

- Enhanced Liquidity: The seamless integration between USD0, USDtb, and USDe creates a pristine liquidity layer, ensuring low-slippage swaps and fluid capital flows.

With this alliance, Usual, Ethena, and BUIDL, tokenized by Securitize, are reshaping the financial landscape, combining the best of TradFi and DeFi to deliver the ultimate product: the most liquid, composable, and profitable layer in decentralized finance.

Unite to Redefine Your DeFi Experience

The strategic partnership introduces a transformative layer of innovation for users, combining stability, yield, and liquidity to bridge the gap between TradFi and DeFi. Here’s what this game-changing collaboration means for you:

- USD0 Meets USDtb as Collateral

The combination of USDtb and BUIDL will be accepted as collateral for USD0. This partnership will bridge TradFi-grade stability with DeFi innovation, offering a robust and reliable collateral foundation.

2. Maximized Yield with USD0++ Exposure to sUSDe

USD0++ holders will gain access to a dedicated vault that provides 1:1 exposure to sUSDe, Ethena’s synthetic dollar. This isolated and incentivized vault offers an unparalleled opportunity for yield maximization, with Usual fully subsidizing rewards until sUSDe’s yield meets or exceeds the Fed rate. Ethena further strengthens this by committing incentives to the USD0++ sUSDe vault, ensuring liquidity growth and user engagement.

3. Unlocking Maximum Liquidity

A 1:1 swap mechanism between USDtb, USD0, and sUSDe will simplify liquidity flows, reducing reliance on secondary pools while maintaining optimal liquidity levels. To further enhance these flows, both Usual and Ethena will incentivize vault participation and secondary market liquidity growth.

4. Yield and treasury diversification

To bolster USD0++ adoption, Ethena will allocate a significant percentage of its idle reserves to support its integration. This move will unlock new layers of composability, encouraging participation, driving liquidity growth, and expanding user options within the DeFi ecosystem.

[ad_2]