Today, enjoy the On the Margin newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the On the Margin newsletter.

Welcome to the On the Margin Newsletter, brought to you by Ben Strack, Casey Wagner and Felix Jauvin. Here’s what you’ll find in today’s edition:

- Felix shares his takeaways from yesterday’s Fed cut, and the FOMC’s future economic/rate projections.

- A former president walks into a bar and buys burgers…with bitcoin. Big deal, or no?

- What analysts and execs are saying about the latest 50bps rate cut, and a look at what to watch for next.

Digging deeper into yesterday’s FOMC meeting

And so concludes the most uncertain Federal Open Market Committee (FOMC) meeting of the past decade. Going into the meeting, implied probabilities were evenly split between the Fed going for a cut of 25 basis points and 50bps.

As it turned out, the Fed went for a 50bps reduction with a 10-1 vote. The one dissenting vote, from Governor Michelle Bowman, was the first governor dissent since 2011. Considering Fed president speeches right before the blackout period, I would have expected more dissent, as many were talking up going for 25bps.

The one thing we do know, however, is that Powell gets what he wants and he is a pro at consensus building. So 50bps it is, for the first rate cut since March 2020.

Setting aside the rate decision, we also received the quarterly update on the FOMC’s Summary of Economic Projections (SEP) that includes its economist forecasts and projection of the federal funds rate.

Let’s dig into the economic forecast first:

- The FOMC revised its end-of-year forecast for the unemployment rate (UR) from 4% to 4.4%, expecting it to remain flat in 2025 before decreasing in 2026. Considering we are already at 4.2%, and it was at 4.3% just a month ago, I find this forecast to be a bit complacent and optimistic. The UR tends to trend and has high momentum, so when it starts going it tends to continue higher. To think it will just go up a couple of basis points from here seems unlikely. But similar to the June SEP, during which they forecasted 4%, the FOMC could be setting itself up for further easing given the committee has said they don’t welcome further labor market weakness. This could be viewed as the strike price of the Fed put, in which any surprise uptick in the UR will lead to further ratcheting up of easing.

- I find the lack of change on the Fed’s GDP forecast surprising. To think we will just sit at 2% for the next four years is simply ridiculous. I would view this as the FOMC just not having a clear read on economic growth from here.

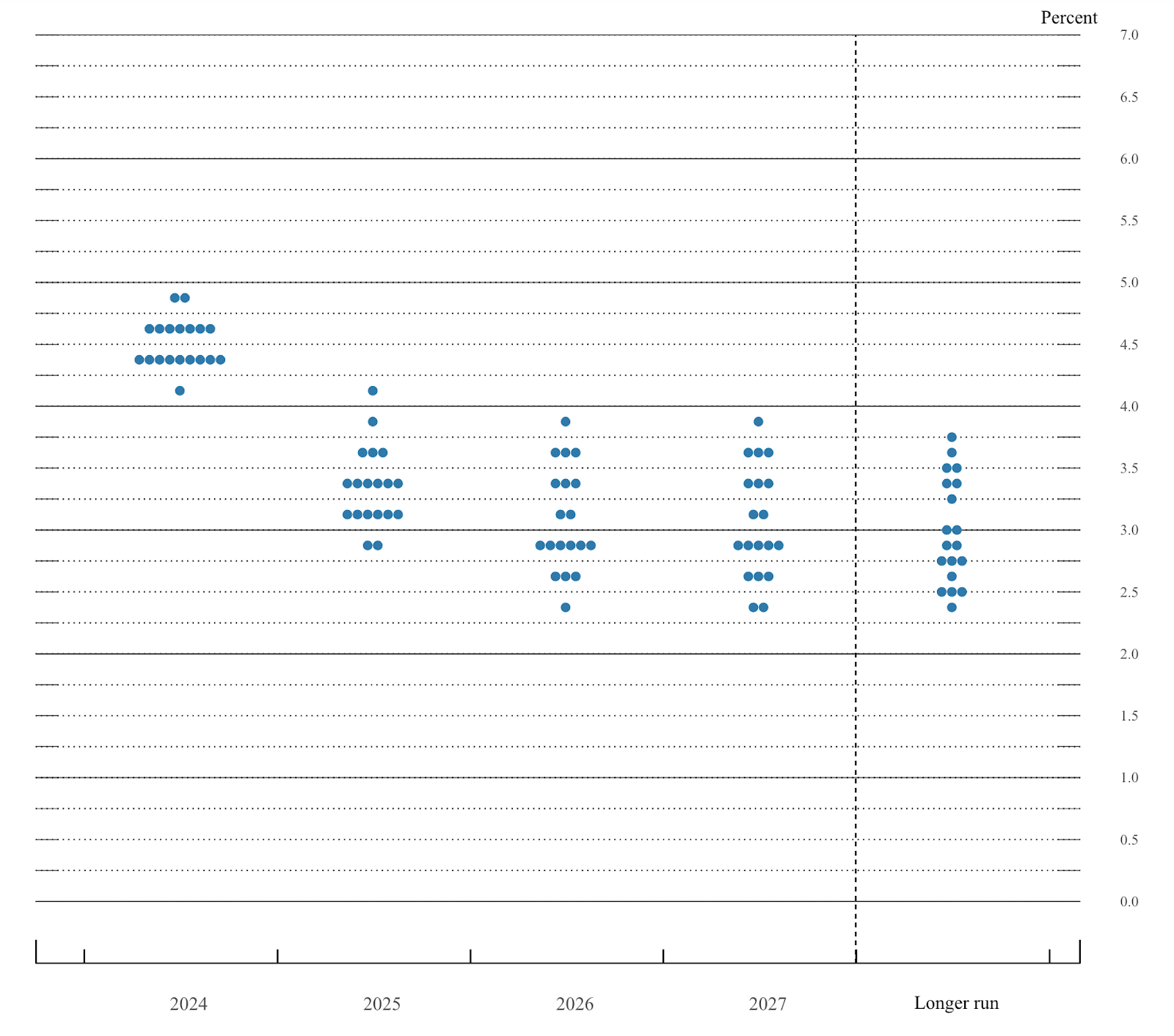

That uncertainty around the path from here on out is also reflected in the FOMC’s dot plot forecast of future interest rates:

The dispersion in views of where the federal funds rate will be is huge, and that dispersion gets wider as we get further into the future.

Some FOMC members see the funds rate netting out around 3% in 2025 — what many see as the post-pandemic neutral rate. However, others actually view us to be below that neutral rate, which could imply an accommodative monetary policy.

Into the more distant future, the FOMC expects us to settle somewhere between a range of 2.5% and 3.75%.

Overall, yesterday’s meeting emphasizes a few things:

- The FOMC does not welcome any further weakness in the labor market. Considering where inflation stands, it is ready and willing to go big on easing if need be to ensure this occurs.

- The committee is highly uncertain about the medium-term outlook, and there is a large dispersion in economist forecasts with respect to where the economy goes from here.

- The FOMC’s trajectory of cuts is less aggressive than what the market has priced in, although not by as much as some had thought.

— Felix Jauvin

49

The number of days until the next FOMC meeting, set for Nov. 7.

Yes, the 50bps reduction happened just 24 hours ago. But it’s always good to keep looking ahead, right? The countdown is especially relevant given the Fed is expected to cut interest rates again this year.

Committee member projections published Wednesday show the median interest rate target by the end of 2024 falling in the 4.25%-4.5% range — 50bps lower than the current level.

The BTC transaction heard ’round the world (or at least Crypto Twitter)

Stopping into an NYC bar on a Thursday night is hardly groundbreaking. But Republican presidential nominee Donald Trump turned it into a historic event when he made a purchase using bitcoin at crypto hotspot PubKey.

PubKey — a so-called “bitcoin-themed bar” in Greenwich Village (they have a live ticker displaying BTC’s price and a sign proclaiming “central bank digital currencies enslave”) — received the first payment made in bitcoin by a former US president (and his aides).

Trump paid roughly $950 in bitcoin for a round of burgers and diet cokes. The transaction was largely hands-off for Trump, as in he didn’t appear to be the one holding his devices. See here for a video.

There was some confusion as to why the transaction seemed to take longer than normal. The delay was caused by the many camera flashes creating a glare on the screen, plus the invoice having been left open for a while in preparation for Trump’s arrival, according to Will Cole, head of product at bitcoin payments company Zaprite.

Regardless of whether or not Trump actually knew how to pay in bitcoin (or if he even cared about the transaction in the first place) seemed irrelevant to his bitcoin-maxi fans. Last night’s event was largely hailed on Crypto Twitter as a massive success and turning point for an industry that has felt misunderstood and targeted by the government and public.

We are 47 days out from the election, so we will have to see if Trump releases a formal crypto policy plan or shares plans to appoint crypto-focused cabinet members.

— Casey Wagner

Analysts, execs digest the Fed rate cut

We wrote about the Fed rate cut moments after it happened yesterday, and Felix gave valuable additional insight above.

But how are industry analysts and executives digesting the move? The consensus seems to be: We must keep an eye on what has so far been a tailwind for crypto, as the longer term economic outlook remains uncertain.

Bitcoin has jumped about 6% since the FOMC revealed the 50bps cut — going from about $60,000 at 2 pm ET yesterday to roughly $63,600 just 24 hours later.

As Bybit’s Chris Aruliah pointed out: Lower interest rates generally drive more investment into riskier assets like crypto, due in part to the diminished returns from traditional investment vehicles.

“However, the broader global economic slowdown stipulated by softer economic indicators and geopolitical complexities is tempering investor sentiment,” he said in a statement.

While the rate cut offered a “short-term boost” to crypto markets, Aruliah added, “it is crucial to remain vigilant regarding the potential challenges posed by economic uncertainty and market fluctuations.”

Ruslan Lienkha, chief of markets at YouHodler, gave a similar warning.

The cut is favorable for equity markets and offers a “risk-on signal” for traders in the short term, he explained. It could even push BTC closer to its all-time high (above $73,000, reached in March).

But the move, as some indicated prior, could be seen as an “emergency measure” that suggests the Fed “misjudged the optimal timing for easing,” Lienkha added.

“Over the next three months, it will become clearer whether the Fed can guide the economy toward a soft landing and avoid a recession in this cycle.”

To that point, yesterday was likely just the first of several expected cuts.

Fed Chair Jerome Powell said at yesterday’s presser that the Fed is “not on any pre-set course,” adding that rate decisions would be made meeting by meeting based on evolving economic data.

The US central bank “has a lot going for it” in terms of averting a deep recession, said FalconX research head David Lawant.

“This cooldown commences from a comparatively elevated interest rate baseline, household balance sheets appear relatively robust, and inflation generally seems to be trending in the right direction,” Lawant added. “Nevertheless, unforeseen shocks should never be ruled out.”

There’s a presidential election coming up too, of course, slated for the same week as the next FOMC meeting. That should make for a fascinating few days for journalists like us and readers like you.

— Ben Strack

Bulletin Board

- BMO Capital Markets raised its 2024 year-end forecast for the S&P 500 to 6,100 on Thursday. Brian Belski, the firm’s chief investment strategist, famously was one of the few analysts to correctly predict the 2023 stock market rally.

- Two important central bank meetings were scheduled for Thursday. The Bank of England met this morning and opted to hold interest rates, which was expected. And later this evening, we will hear from the Bank of Japan. Analysts doubt the BOJ will raise rates today, but are eyeing an increase in December.

- In yet another instance of a historic crypto payment, the state of Louisiana accepted its first payment over the Bitcoin Lightning network. It was a fine paid to the Louisiana Department of Wildlife and Fisheries.