[ad_1]

Curve Finance was created to solve inefficiencies in trading stablecoins and similar crypto assets by offering deep liquidity with minimal slippage, tailored for decentralized finance users who require efficient and predictable swaps.

The Origins of Curve Finance

Curve Finance emerged in early 2020 as a decentralized exchange (DEX) optimized for stablecoin trading. Traditional decentralized exchanges like Uniswap enabled permissionless trading but struggled with stable assets due to their automated market maker (AMM) design, which often led to higher slippage. Curve introduced an innovative stable swap algorithm that made trading pegged assets highly efficient.

This design was driven by the rapid growth of stablecoins such as USDT, USDC, and DAI. These tokens underpin much of the decentralized finance (DeFi) economy, acting as a medium of exchange, collateral, and a store of value. Curve positioned itself as the infrastructure to facilitate seamless swaps among them, ensuring stability and cost efficiency.

How Curve Finance Works

At its core, Curve Finance is a decentralized liquidity protocol. Liquidity providers (LPs) deposit assets into pools, and traders can swap between them. Unlike traditional order book exchanges, Curve uses AMMs with tailored formulas that minimize slippage for correlated assets.

The Stable Swap Algorithm

The unique component of Curve is its stable swap invariant. This formula balances assets more tightly than constant product formulas, enabling low-cost swaps between tokens that are supposed to remain close in value, such as stablecoins or wrapped assets. This innovation has been compared to optimization models found in financial engineering (Wikipedia on Optimization Problems).

For example, when trading USDC for DAI, the algorithm ensures the pool maintains balance without penalizing users with high price impact, even on large trades. This efficiency draws heavy usage from traders and arbitrageurs.

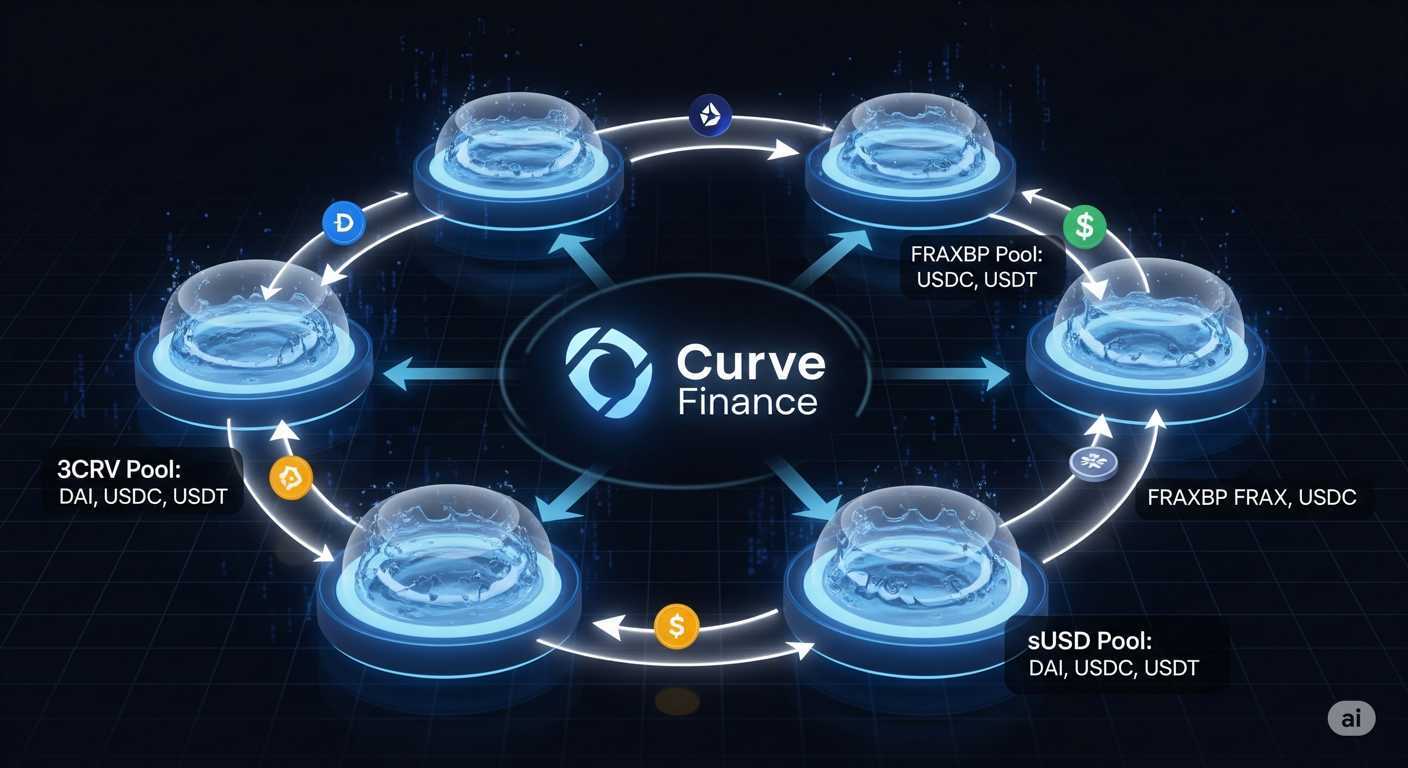

Liquidity Pools

Liquidity pools are the foundation of Curve Finance. Each pool consists of pairs or groups of tokens, often stablecoins, but also tokenized versions of Bitcoin and Ethereum. LPs earn a share of trading fees and, in some pools, additional incentives such as governance tokens.

Governance and CRV Token

Curve Finance is governed by its native token, CRV. The token underpins the decentralized autonomous organization (DAO), where stakeholders decide on pool incentives, protocol upgrades, and treasury management. CRV was distributed to liquidity providers and early adopters as part of a community-driven launch.

Voting Escrow System

The governance model relies on a mechanism called vote-escrowed CRV (veCRV). Holders can lock their CRV tokens for periods up to four years, receiving veCRV in return. The longer the lock, the greater the voting power and potential boost on liquidity rewards. This mechanism encourages long-term alignment between token holders and the protocol.

Incentive Alignment

Curve’s system creates a powerful incentive alignment where participants who commit capital for longer durations influence the future of the platform more heavily. This design echoes governance theories studied in institutional economics (Harvard Business Review discussions on governance structures).

Curve Finance and the DeFi Ecosystem

Curve does not operate in isolation. Its design integrates seamlessly with the broader DeFi ecosystem. Protocols such as Yearn Finance, Aave, and Convex leverage Curve pools to optimize yield strategies, while decentralized autonomous organizations use its pools for treasury management.

Composability with Other Protocols

Curve’s pools are deeply composable. Yearn vaults, for instance, deposit into Curve pools to maximize returns, while Convex amplifies CRV staking rewards by aggregating user deposits. This interconnectivity is part of what is often described as “DeFi Legos”, where different protocols interact modularly to build complex financial systems.

Importance in Stablecoin Infrastructure

As stablecoins have become critical to decentralized markets, Curve emerged as the backbone for their liquidity. Major platforms rely on its pools to maintain peg stability and to ensure deep markets. This infrastructure role is often understated but vital for the functionality of DeFi as a whole.

Technical Architecture

Curve Finance is built on Ethereum but has expanded to other blockchains through cross-chain deployments. The protocol relies on a series of smart contracts audited for security, each responsible for managing liquidity pools, swaps, and governance mechanics.

Smart Contracts

Every pool is governed by a smart contract. These contracts define the assets, the algorithm used for pricing, and the fee structure. The modular design allows for rapid deployment of new pools while ensuring consistency across the platform.

User Interface and Accessibility

The Curve Finance front-end is known for its retro aesthetic, reminiscent of early web interfaces. Despite this, it has become iconic within the crypto community. Many users also interact with Curve through aggregators or other DeFi applications, bypassing the need for direct interface usage.

Cross-Chain Expansion

Curve has launched on multiple blockchains beyond Ethereum, including Avalanche, Polygon, and Arbitrum. This expansion reduces fees for traders and increases accessibility, aligning with the broader shift toward multichain DeFi. The technical bridge mechanisms connecting Curve across chains echo developments in distributed computing (TechRadar on distributed computing).

Curve Wars: Competition for Influence

One of the most discussed phenomena in DeFi is the so-called Curve Wars. This term refers to the competition among protocols and DAOs to acquire CRV or veCRV in order to direct liquidity incentives to their preferred pools. This dynamic created a new layer of game theory within the ecosystem.

Role of Convex Finance

Convex Finance plays a central role in the Curve Wars. It aggregates user deposits, giving individuals exposure to boosted rewards without locking tokens themselves, while Convex amasses significant voting power in Curve governance. This shift altered the balance of influence and has become a defining feature of DeFi power structures.

Strategic Importance

Protocols with deep exposure to stablecoin markets, such as Frax Finance, actively participate in these governance battles. By steering CRV emissions, they enhance their liquidity depth, which in turn strengthens their platforms. This battle for influence resembles strategic positioning often observed in traditional corporate environments.

Yield Farming on Curve Finance

Yield farming became a defining feature of Curve’s adoption. By depositing assets into pools, users not only earn trading fees but also liquidity mining rewards in CRV tokens. This dual-income stream attracted large amounts of capital, making Curve one of the largest DeFi protocols by total value locked (TVL).

Boosted Yields

Through the veCRV mechanism, liquidity providers can “boost” their rewards depending on their governance commitment. This creates a competitive layer where sophisticated users optimize their positions for maximum yield.

Integration with Aggregators

Aggregators like Yearn and Convex optimize yield on behalf of users by automating deposits, withdrawals, and governance participation. This integration allowed even passive investors to benefit from Curve’s reward mechanisms without the complexity of active management.

Use Cases of Curve Finance

Curve Finance’s primary use case is swapping between stablecoins. However, its design has expanded to cover multiple areas of decentralized finance, making it one of the most versatile protocols in the space.

Stablecoin Swaps

Traders use Curve for efficient stablecoin swaps when moving between different platforms or ecosystems. For example, moving from DAI to USDC in preparation for collateralizing a loan in another DeFi protocol.

Wrapped Assets

Curve also supports pools with wrapped Bitcoin (WBTC, renBTC) and staked Ethereum derivatives (stETH, rETH). These pools provide liquidity for synthetic versions of volatile assets, ensuring they can circulate efficiently across the DeFi economy.

Cross-Protocol Arbitrage

Arbitrageurs use Curve to profit from price discrepancies across pools and exchanges. Because stablecoins are pegged, small differences in price present predictable opportunities, making Curve a key hub for professional trading strategies.

Advanced Pool Structures

Curve Finance pioneered advanced pool structures that expand beyond simple two-token pairs. These structures enhance capital efficiency and allow more complex liquidity provisioning without compromising the stability of trades.

Meta Pools

Meta pools allow a new stablecoin to be paired with an existing base pool. For example, a new stablecoin can be linked to Curve’s 3Pool (USDT, USDC, DAI), gaining access to deep liquidity immediately. This innovation helps bootstrap liquidity for emerging tokens without requiring them to form entirely new pools.

TriCrypto Pools

TriCrypto pools combine both stablecoins and volatile assets, such as USDT, WBTC, and ETH. This design expands Curve’s utility beyond stable assets, allowing users to trade across a broader range of tokens while maintaining the efficiency of its algorithm. These pools are particularly relevant for traders who want exposure to both stability and volatility within the same liquidity framework.

Liquidity Providers and Incentives

Liquidity providers (LPs) form the backbone of Curve Finance. By depositing assets into pools, they enable trading activity and in return earn a portion of the fees. However, the incentive design of Curve is multifaceted and includes more than simple transaction fee sharing.

Fee Distribution

Curve charges trading fees that are distributed to liquidity providers. The stable swap algorithm keeps trades efficient, generating consistent volume that translates into predictable earnings. Over time, the fee-sharing model has attracted both retail users and institutional liquidity providers.

Liquidity Mining

Beyond fees, LPs also receive CRV token rewards through liquidity mining programs. These incentives were designed to attract initial liquidity to pools and continue to play a role in maintaining Curve’s market dominance. Liquidity mining rewards are influenced by governance decisions, tying participation closely to Curve’s decentralized structure.

Boosted Rewards

Through the veCRV system, providers who lock their CRV tokens gain boosted rewards. This creates a tiered system where long-term participants earn significantly more than short-term opportunists. The mechanism adds strategic depth to liquidity provision, as providers weigh lockup commitments against yield maximization.

Curve’s Role in Staking and Derivatives

With the rise of proof-of-stake blockchains, staked asset derivatives have become increasingly important. Curve pools provide liquidity for these derivatives, ensuring they can circulate and be used in DeFi without being locked away.

stETH and Ethereum Staking

The stETH pool, consisting of ETH and stETH (a token representing staked ETH), is one of the most heavily used pools. It allows users to swap between liquid ETH and its staked counterpart, ensuring flexibility in staking participation while maintaining liquidity in the ecosystem.

Other Staked Assets

Beyond Ethereum, Curve has integrated pools for other staking derivatives, such as rETH and BETH. These pools make staked tokens more useful, enabling them to be traded, collateralized, or integrated into yield strategies.

Security and Auditing

As a protocol managing billions in total value locked (TVL), security is paramount for Curve Finance. The platform relies on a layered approach to safeguarding funds.

Smart Contract Audits

Curve’s smart contracts undergo repeated auditing by third-party firms. These audits test for vulnerabilities in the code, ensuring the pools and governance mechanics function correctly. While no audit can guarantee complete security, the consistent focus on independent review strengthens confidence.

Bounty Programs

Curve also supports bug bounty programs that incentivize independent developers to identify weaknesses. By rewarding discoveries, the protocol leverages the expertise of the broader developer community, following a practice also common in traditional cybersecurity environments.

Historical Incidents

Although Curve itself has remained largely resilient, its pools have occasionally been targeted through vulnerabilities in integrated assets or tokens. These events highlight the interconnected risks of DeFi composability, underscoring the importance of constant monitoring and transparency.

Community and Governance Dynamics

The Curve Finance community extends beyond liquidity providers. It includes DAOs, aggregators, traders, and independent token holders. Governance debates often center on how CRV emissions should be distributed, reflecting the strategic importance of liquidity incentives.

DAO Proposals

Governance proposals cover topics such as launching new pools, adjusting fee structures, or reallocating CRV rewards. veCRV holders cast votes, often influenced by broader alliances such as those formed during the Curve Wars. This creates a competitive but transparent decision-making environment.

Community Engagement

Curve’s forums, social channels, and governance portals provide spaces for debate. The protocol’s retro web interface has become an emblem of its no-nonsense approach, fostering a culture focused on technical precision rather than marketing gloss.

Influence of Aggregators

Aggregators like Convex amplify the influence of retail users by pooling votes. This has shifted governance dynamics, where individual token holders may delegate influence through larger platforms, altering the balance of power within the Curve DAO.

Curve Finance Across Chains

While Curve began on Ethereum, high transaction fees encouraged cross-chain deployment. Today, Curve exists across multiple blockchain ecosystems, enhancing accessibility and reducing barriers for retail adoption.

Deployment on Layer-2 Solutions

Curve has expanded to Layer-2 networks such as Arbitrum and Optimism. These deployments allow users to trade and provide liquidity with lower gas costs while benefiting from Ethereum’s security guarantees. The rise of Layer-2 scaling is one of the most significant infrastructural shifts in the blockchain industry.

Deployment on Other Blockchains

Beyond Layer-2, Curve has launched on Avalanche, Polygon, and Fantom. These blockchains offer different fee structures, consensus models, and ecosystems, enabling Curve to capture liquidity wherever DeFi activity occurs.

Bridging Mechanisms

Cross-chain bridges and interoperability solutions facilitate the movement of assets between Curve deployments. This ensures liquidity remains fluid across ecosystems and allows users to arbitrage between different instances of the protocol.

Integration into DeFi Infrastructure

Curve has become a cornerstone of DeFi infrastructure. Its pools are used by lending protocols, yield optimizers, and stablecoin issuers to ensure efficient liquidity and peg stability.

Lending Protocols

Platforms like Aave and Compound integrate Curve pools for sourcing liquidity. For instance, collateralized loans may rely on Curve pools to ensure users can swap stablecoins quickly and efficiently during liquidation events.

Stablecoin Issuers

Algorithmic and collateral-backed stablecoin issuers use Curve pools to maintain peg stability. By incentivizing liquidity, these issuers ensure that their tokens remain usable across the DeFi ecosystem.

Yield Optimization Platforms

Yearn and Convex are prime examples of platforms that automate Curve strategies. They allocate deposits into Curve pools while handling governance, reward boosting, and compounding, giving users seamless access to complex DeFi strategies.

Curve Finance in the Context of DeFi History

Curve’s launch in 2020 coincided with the rise of “DeFi Summer,” a period of explosive growth in decentralized finance. Its introduction of efficient stablecoin trading pools marked a turning point, establishing it as a foundational layer for decentralized markets.

Comparison to Other Protocols

Compared to Uniswap, Curve is specialized for assets of similar value. While Uniswap thrives on general-purpose token swaps, Curve’s niche focus on stablecoins and wrapped assets has made it indispensable. This specialization echoes historical parallels in financial markets where niche exchanges thrived alongside generalist venues.

Expansion of DeFi Use Cases

Curve’s influence extends into derivatives, staking liquidity, and governance systems. Its pools enable innovation across DeFi, from lending and borrowing to synthetic assets and algorithmic stablecoins. The ecosystem continues to build atop Curve’s liquidity foundations, making it one of the most integrated protocols in the sector.

Educational and Research Role

Beyond its direct use cases, Curve has become a subject of academic research and technical analysis. Its algorithms are studied in the context of market efficiency, game theory, and tokenomics.

Algorithmic Innovation

The stable swap invariant has been highlighted in financial research for its ability to model correlated assets. This mathematical approach is studied alongside optimization models used in portfolio theory and risk management.

Governance Studies

Curve’s vote-escrow model is frequently cited in research on decentralized governance. It provides a live example of how token lockups can align incentives and reduce short-termism in decision-making, which has parallels in corporate governance systems.

Educational Material

Numerous courses, explainer videos, and technical blogs use Curve as a case study. This has elevated its role from a trading protocol to a benchmark for DeFi education, drawing attention from both crypto-native and traditional finance audiences.

How does Curve’s amplification parameter (A) actually work?

FAQ: What are Curve Finance

The amplification parameter (A) flattens the pricing curve around the peg so swaps between like-priced assets (e.g., USDC↔DAI) incur very low slippage. A higher A means the pool behaves more like a constant-sum AMM near parity, keeping the price stable for larger trades. If the pool becomes imbalanced, the curve steepens, nudging prices to attract arbitrage. In practice, A is tuned per pool to balance stability, depth, and responsiveness as liquidity conditions change.

What fees exist on Curve and who earns them?

Curve pools apply a swap fee that’s shared with liquidity providers (LPs). Many pools also set an admin fee (a portion of the swap fee) that funds the protocol/DAO. On top of fees, some pools emit CRV via gauges, which is separate from on-trade fees. Outcome for LPs: they typically earn (1) swap fees, (2) protocol-directed incentives (CRV or partners), and (3) any external rewards routed by integrated platforms, all accruing while their liquidity stays deposited.

What are LP tokens and gauges, and why do they matter?

When you deposit assets, you receive LP tokens that represent your proportional share of the pool. Staking those LP tokens in the pool’s gauge makes your position eligible for CRV emissions (and sometimes partner rewards). Gauges measure deposited LP tokens and distribute incentives according to governance-set weights. In short: LP tokens prove your claim on liquidity and fees; gauges connect that position to protocol incentives, amplifying the total yield from a given deposit.

How do Meta Pools route liquidity through a Base Pool?

Meta Pools pair a new or niche stablecoin with an established Base Pool (e.g., 3Pool). Under the hood, trades can hop through the base liquidity, letting the meta asset tap deep reserves immediately. Example: swapping MetaUSD→USDC uses MetaUSD/3Pool liquidity and then the 3Pool’s internal balances. This design enables capital efficiency, faster bootstrapping for new assets, and consistent pricing without fragmenting liquidity across many separate, shallow pools.

How does the veCRV boost formula affect rewards?

Locking CRV yields veCRV, which can boost the CRV emissions on your staked LP tokens. The boost depends on your veCRV balance relative to your LP stake and the pool’s overall gauge parameters. Practically, users with longer CRV locks and sensible position sizes receive a higher multiple of CRV rewards than unboosted stakers. This creates a long-term alignment mechanism: deeper commitment (time-locked CRV) translates into more influential governance and improved emissions.

Does Curve rely on oracles for pricing?

Traditional stable pools on Curve price assets via the AMM invariant rather than external oracles. Because assets are intended to be near-parity, the invariant and pool balances guide execution prices. Some mixed or volatile pools (e.g., TriCrypto variants) use hybrid mechanics that may reference external feeds for safety bounds or rebalancing logic, but classic stable-swap behavior is oracle-light, relying on market forces and arbitrage to keep prices near the peg.

How do TriCrypto-style pools price both stables and volatile assets?

TriCrypto pools combine a stable-swap component with logic suitable for volatile assets (e.g., WBTC, ETH). The design preserves low slippage for stable segments while letting prices move appropriately for risk assets. The result is a hybrid invariant that supports cross-asset routing inside a single pool. Traders get efficient paths between stables and majors; LPs capture fees from flows that, historically, were split between purely stable AMMs and volatile-only DEX pools.

How are rewards synchronized across chains and what should users check?

Curve runs on multiple chains/L2s with chain-specific gauges and emissions. Governance decisions may allocate CRV differently per network. Before depositing, users typically review: (1) the pool’s gauge status, (2) incentive schedules on that chain, and (3) bridge/wrapper details for the assets. A quick checklist helps ensure emissions are active where you deploy, preventing mismatches between expected rewards and the reality of a given pool’s cross-chain configuration.

Which pool metrics matter on the dashboard and why?

Key indicators help decode pool health and expected performance:

Together, these metrics frame liquidity depth, fee generation, and price stability.

How does arbitrage help pools restore a broken peg?

When a stablecoin drifts, Curve’s invariant tilts the price to incentivize arbitrage: the cheaper side becomes more attractive to buy, and the expensive side to sell. Arbitrageurs trade until the pool rebalances and the peg pressure eases. This self-correcting loop is particularly strong in deep pools (e.g., those referencing 3Pool). Traders profit from the spread; LPs benefit as imbalances resolve and swap activity—and thus fee income—typically increases during the process.

What practical steps should newcomers follow before providing liquidity?

Before depositing, consider:

- Asset choice: Ensure you’re comfortable holding the pool’s constituents.

- Pool metrics: Check TVL, volume, A, and virtual price.

- Gauge & boost: Confirm gauge status and your veCRV boost potential.

- Chain fees: Compare gas/bridge costs across L1/L2.

- Exit path: Review withdrawal math and potential imbalances.

This prep helps align expected yield with actual mechanics, minimizing surprises once funds are committed.

[ad_2]