[ad_1]

The blockchain research company Messari has recently published an in-depth report on the state of the Cosmos ecosystem in Q2 2024, highlighting very interesting data.

While Cosmos awaits the ICF roadmap for 2025, the DAO has moved on the governance level by approving 11 out of the 14 proposals put forward by the community.

The cryptographic project, based on IBC connectivity, is significantly improving its interoperability by having started to communicate with Bitcoin at the beginning of the year.

However, the financial data of the blockchain are not the best and the ATOM coin is affected by inflation and the sharp drop in prices in recent months.

Let’s see everything in detail below.

Messari: the financial data of the Cosmos blockchain ecosystem

Messari, a well-known provider of crypto intelligence tools, recently published the report in which it analyzes the progress of the Cosmos blockchain in Q2 2024.

First of all, the researcher focuses on the financial data of the cryptographic ecosystem, reporting results below expectations.

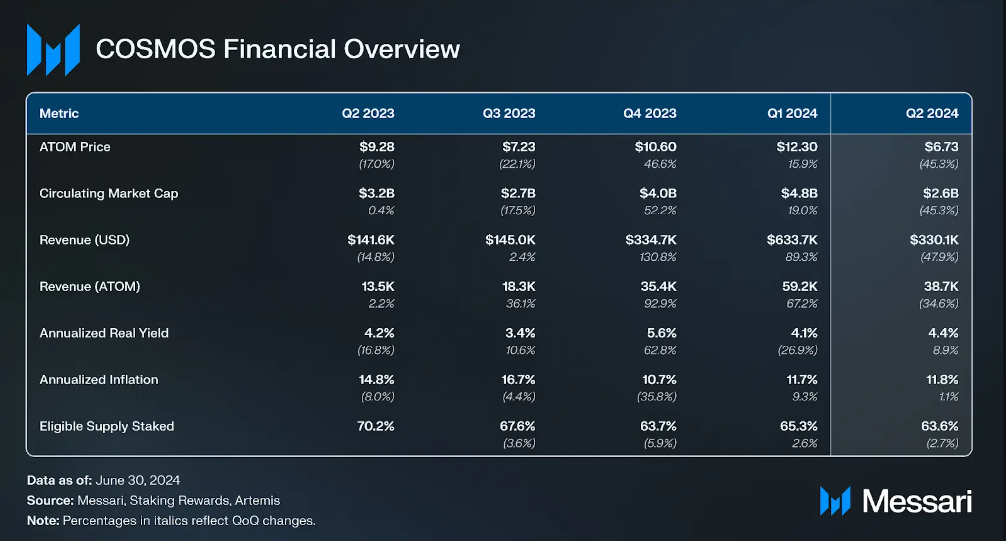

First of all the price of ATOM, gas and governance token of the Cosmos blockchain, decreased by 45.3% QoQ dropping from 12.63 to 6.73 dollars. Consequently, the market cap also saw a strong decline, falling from 4.8 to 2.6 billion dollars.

The decline, however, came after the currency had grown by 46.6% in the previous two quarters, rising from 7.2 to 12.30 dollars.

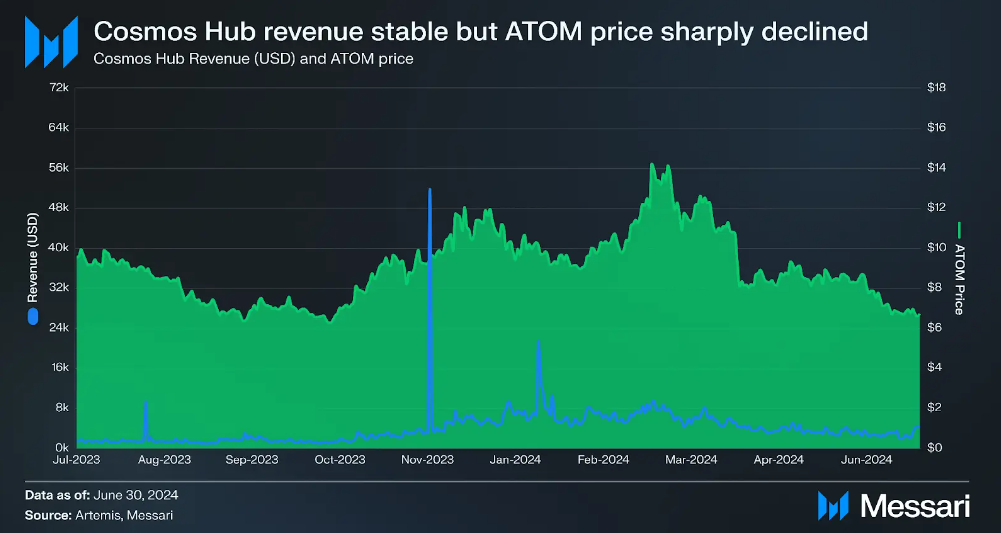

Furthermore, as reported by Messari, even the network revenues reflect a decreasing trend, with revenues recording a 47.9% QoQ drop, from 634,000 to 330,000 dollars.

At the same time, the revenues of Cosmos denominated in ATOM have decreased less aggressively with a lower share of 34.6% QoQ, going from 59,200 to 38,700 ATOM.

On the other hand, the annualized real yield increased marginally from 4.1% to 4.4% in the second quarter. The annualized inflation remained almost stable while the percentage of ATOM supply locked in stake decreased by just 2.7% QoQ going from 65.3% to 63.6%.

Messari specifies the reasons that have led to such a marked divergence between the revenues of the Cosmos blockchain denominated in USD and those in ATOM currency.

The project integrates a network fee adjustment mechanism, in which the fees are regulated in ATOM to maintain a stable cost in USD.

As a result, the reduction in the price of the cryptocurrency has caused an amplification of the reduction in revenues in USD rather than those denominated in ATOM.

The general decline in revenue is not, however, to be attributed to wrong choices by the Cosmos Hub but to a common market condition. Other chains, in fact, have also experienced downward trends in metrics QoQ.

The inflation rate of the Cosmos blockchain and the ATOM 2.0 proposal

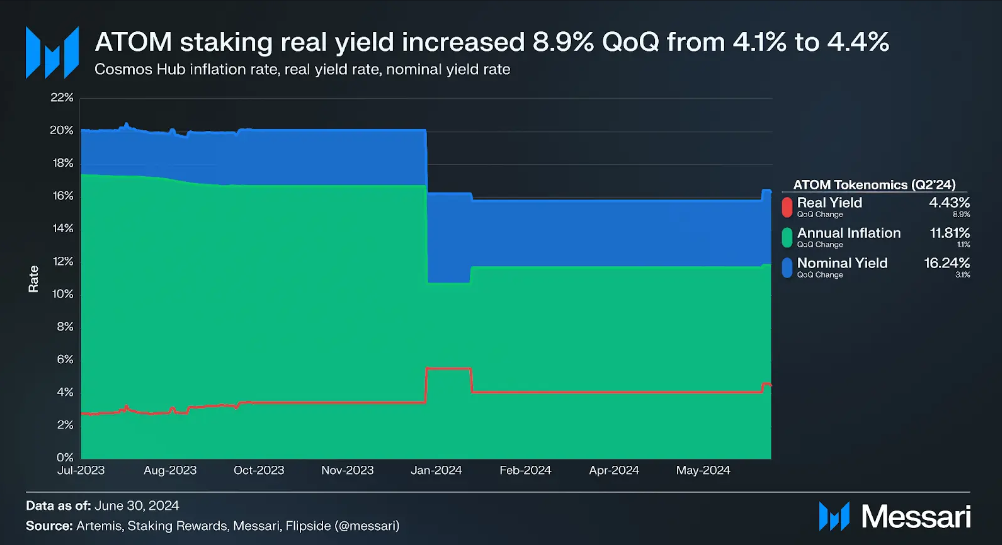

Messari delves into its report also the role of inflation of ATOM within the financial logics of the Cosmos blockchain.

The index of the decrease in purchasing power in ATOM remained almost stable in Q2 2024 increasing marginally by only 1.1%.

We are talking about an increase in circulation that goes from 11.7% in the previous quarter to the current rate of 11.8%.

The dilutive effects of this inflation have been minimized by the growth of the real yield, which increased by 8.9% QoQ, from 4.1% to 4.4%.

As a result the net-positive divergence has positively impacted the value collected by ATOM holders, who still have to face the depreciation of prices.

Compared to the beginning of the year, the real yield has seen a constant increase that reflects the implementation of governance proposals and the continuous adjustments of the blockchain.

Messari observes how the stability of the inflation rate at 10% suggests Cosmos’ adherence to a particular monetary policy.

With the Proposal 848, passed to governance in Q4 2023, the blockchain ecosystem reduces the issuance of new coins from 20% to 10%.

The balancing of this quota does not depend on the price action of ATOM or the more or less flourishing activity of the stakers. The proposal has been particularly controversial, generating the highest turnout in the history of Cosmos Hub governance.

In recent months, Cosmos has also set up 3 deflationary mechanisms to address the devaluation of the token. We are talking about a tax system that burns ATOM, slashing to validators, and on-chain governance burning activities.

The ultimate goal of Cosmos, as Messari reminds us, is to systematically reduce ATOM emissions until inflation is completely offset.

With the vision of the ATOM 2.0 project, which was originally discussed in the second quarter of 2022, the blockchain aims to improve the efficiency of the currency.

The Cosmos Hub community is still discussing these proposals, with ongoing efforts to bring some of them to an on-chain governance vote soon.

At stake are 8 different proposals that address critical areas such as governance structures, liquid staking, and treasury management,

Messari analyzes IBC transfer volumes: strong divergence between incoming and outgoing transactions

The latest focus of Messari is on the divergence of IBC transfer volumes of the Comsos blockchain in the last quarter.

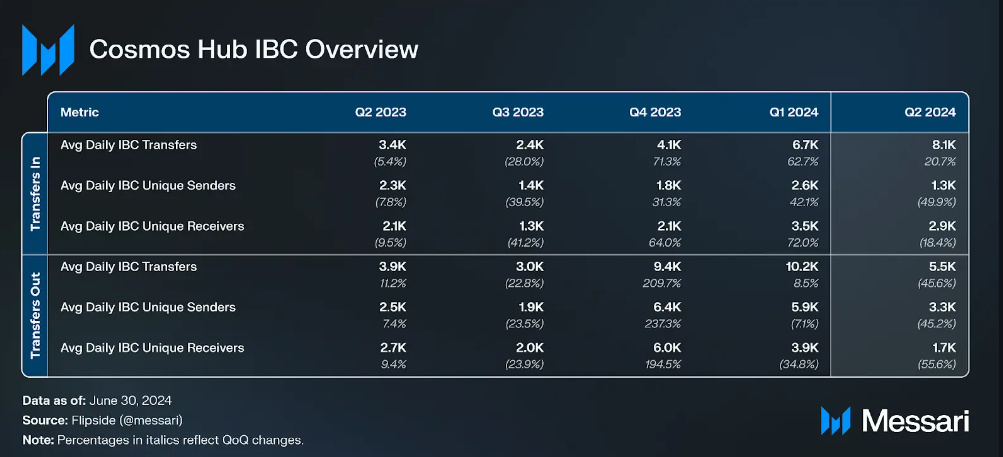

The following table represents the quarterly data of IBC transfers, diversified by incoming and outgoing operations and by senders and receivers.

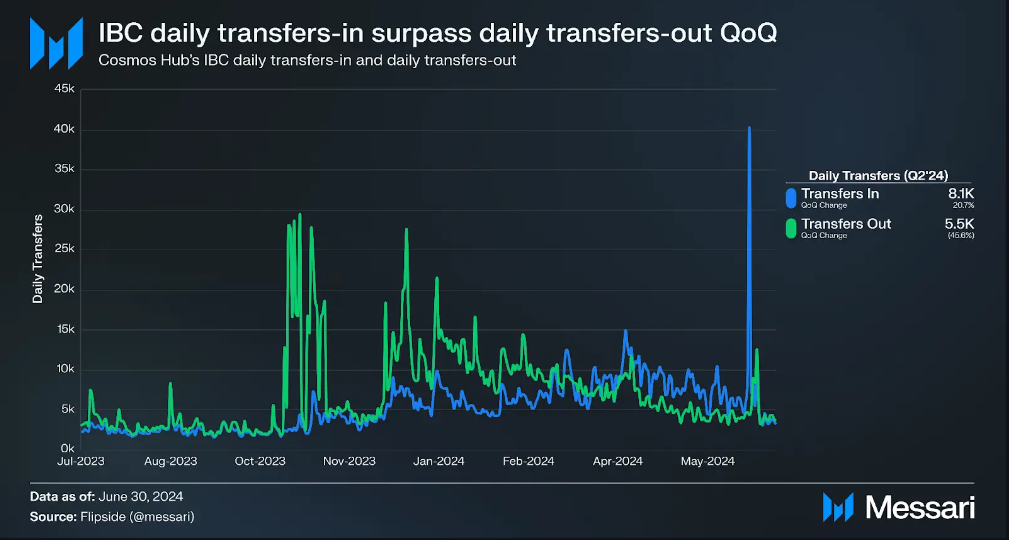

Despite a strong QoQ decline in unique daily IBC senders and receivers, IBC-In transfers increased by 20.7%, rising from 6,700 to 8,100 units. At the same time, daily IBC-out transfers decreased by 45.6% QoQ, dropping from 10,200 to 5,500 units.

This divergence reflects a trend in which interactions between chains through incoming transfers have increased despite the decline in daily active addresses.

This suggests how a smaller number of daily active addresses are engaging in more frequent incoming transactions. Users and protocols are also becoming more strategic in their interchain activities, focusing on specific use cases offered by the connected chains.

At the same time, outgoing activity becomes increasingly concentrated and less frequent compared to the last quarter.

Historically, there has never been such a marked divergence in this metric: in fact, in previous quarters, incoming and outgoing transfers were closely aligned.

Between Q4 23 and part of Q1 24, outgoing transfers consistently exceeded incoming transfers, with the trend reversing in the following months.

Overall Q2 2024, as revealed by Messari, the blockchain of Cosmos had 67 Peer INC (distinct counterparts) and 463 IBC channels (available paths).

[ad_2]