$WULF targets 250-500 MW of new HPC signings each year, and still plans to mine Bitcoin through at least the end of 2026.

The following guest post comes from BitcoinMiningStock.io, a public markets intelligence platform delivering data on companies exposed to Bitcoin mining and crypto treasury strategies. Originally published on Nov. 13, 2025, by Cindy Feng.

It’s earnings season again, and while many companies had interesting updates, TeraWulf’s Q3 2025 call really caught my attention. Not because of earnings numbers, but because it hinted at what could be the next operating model for Bitcoin miners. Beneath all the talk of AI/ HPC, leases, and gigawatts, it is now obvious that some miners are evidently becoming energy-infrastructure providers for the AI era.

Let’s break it down.

Growing Deal Sizes

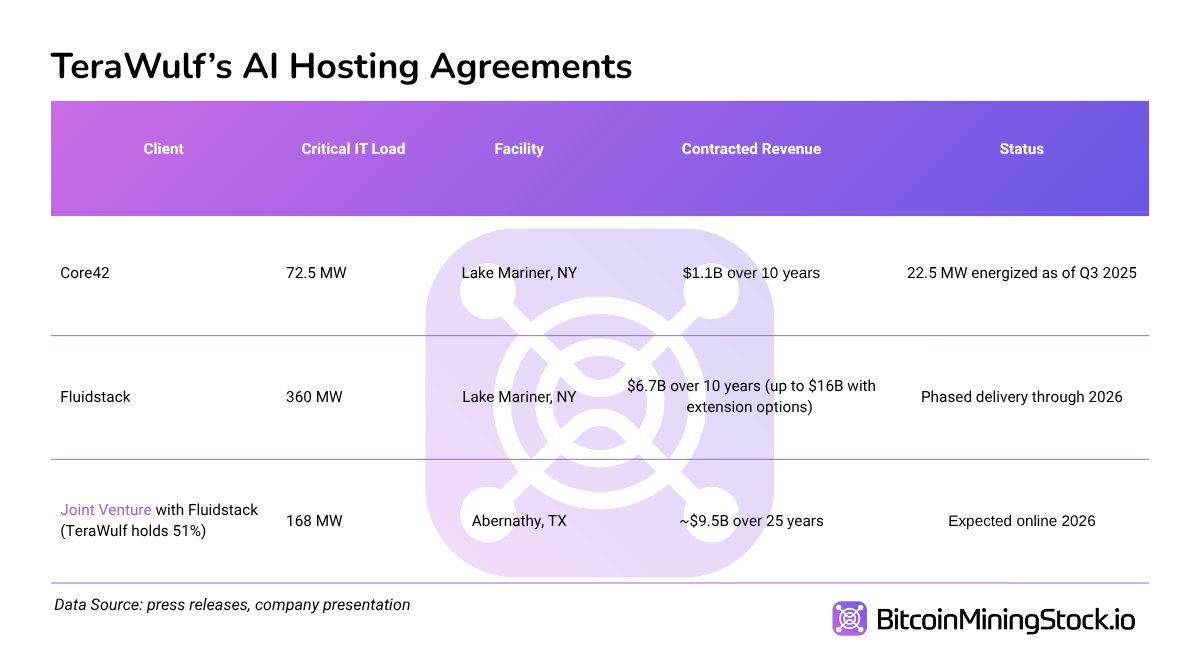

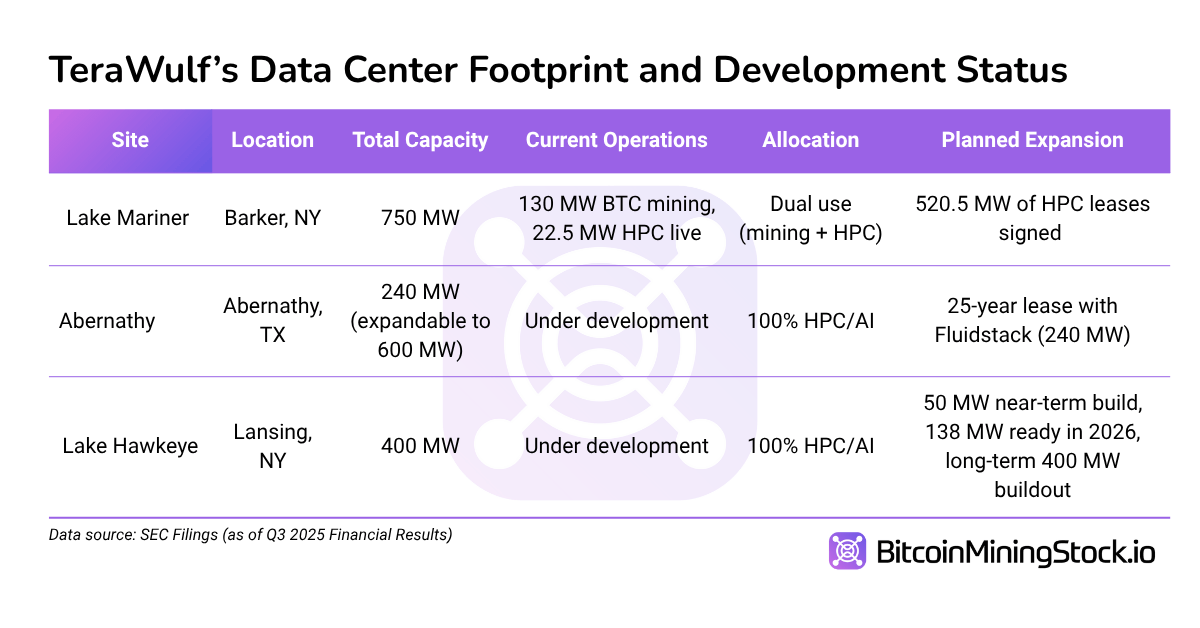

Back in August, TeraWulf inked two HPC lease deals with Fluidstack, totaling 360 MW. Those deals brought something new into the mining sector: Google. The tech giant backstopped the leases, putting institutional credibility behind what had previously been considered speculative crypto infra buildouts.

In November, TeraWulf reported 520 MW+ in total contracted HPC IT load. That’s one of the largest sizes we have seen in the bitcoin mining sector, and it happened within a few months.

Notably, the 72.5 MW Core42 lease, signed at the end of last year, is still part of the mix. But it’s Fluidstack who’s emerged as the key partner in this play. Beyond lease size, the two companies (along with Google credit enhancement) have formed a joint venture to co-develop the Abernathy site into a 240 MW HPC campus, with expansion potential up to 600 MW.

This marks a subtle but important shift: instead of leasing land or space to a hyperscaler, TeraWulf is now co-building.

Joint Venture in Texas

The Abernathy joint venture has been structured differently from what we have seen in the industry. The deal includes a 25-year lease with Fluidstack (longer than typical AI leases), backstopped by a $1.3B Google credit enhancement. TeraWulf holds up to 51% controlling interest and rights to participate in an additional 200 MW Fluidstack-led buildout.

This layered approach comprising of land ownership, lease structuring, client partnerships, and access to hyperscaler credit, offers something rare in mining: long-term visibility.

Interestingly, this wasn’t even WULF’s idea. CEO Paul Prager said on the earnings call that it was Google who asked to anchor the JV in Abernathy. That comment reveals how hyperscalers may be thinking. Forget the mining label, what matters is grid access, execution history, and site control. WULF, like it or not, has all three.

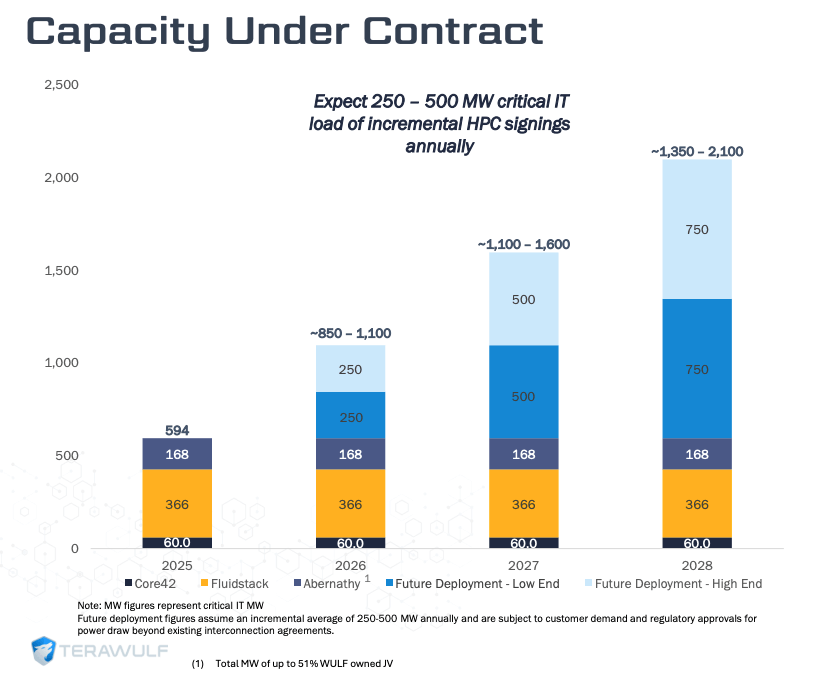

Targeting 250-500 MW of New HPC Signings Annually

Perhaps the boldest moment from the Q3 call came when TeraWulf raised its annual target for HPC signings. Previously guided 100-150 MW per year, the new goal is 250-500 MW annually. If realized, that translates into $465M – $930M in incremental revenue per year (assuming the math holds at $1.86M/MW).

Screenshot from the TeraWulf investor presentation (page 10)

While execution risks remain, management expressed strong confidence in reaching those targets, citing the 150+ sites evaluated last year and a scaled-up dev/acquisition team. Part of their $5.2B capital raised is to support these expansions, though capital needs will remain steep, especially for purposely built HPC data centers ($8–11M per MW, conservatively).

In comparison to traditional miners chasing hash rate and halving cycles, this model aims for recurring revenue with client demand as the lead driver, instead of block rewards.

The Future of Its Bitcoin Mining Biz

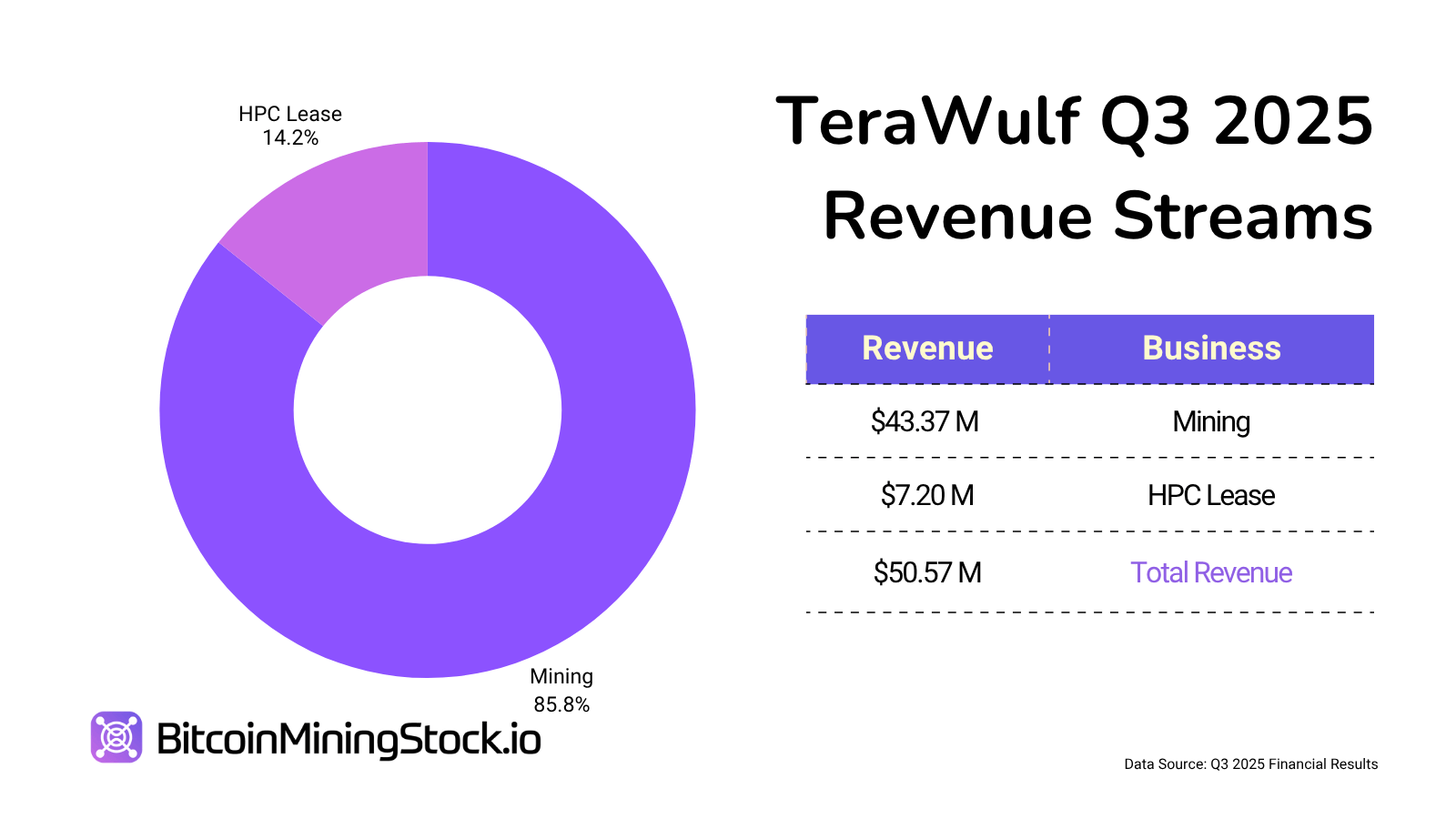

While HPC is the company’s new frontier, Bitcoin mining remains the primary revenue contributor today. In Q3, TeraWulf self-mined 377 BTC (down from 485 BTC in Q2), as it began to retire older mining units and reallocate infrastructure to HPC.

Future developments at its flagship site Lake Mariner, where the HPC transition is in full swing, will be exclusively AI/HPC-focused. The company made it clear that no new Bitcoin mining infrastructure is being built unless it supports dual-use capabilities.

Still, TeraWulf said it intends to mine Bitcoin “through at least the end of 2026″.

This approach isn’t unique, but it sets a clear signal. Some miners may have talked about AI pivots, TeraWulf has now hard-coded it into site-level strategy, capex priorities, and annual KPIs.

Final Thoughts

TeraWulf’s Q3 shows more than just lease wins, it shows a path other Bitcoin miners could follow in the AI era. Instead of simply leasing infrastructure, the company is leveraging what it already controls (land, power, and project execution) to form long-term, equity-aligned partnerships. By doing so, it has secured multi-billion dollar HPC/AI commitments and de-risked its roadmap. The question is no longer whether miners can attract AI deals, but whether they’re positioned to scale fast. Few have the resources to copy this playbook, but the market is watching who moves next.