[ad_1]

Decentralized derivatives protocol Synthetix is launching a perpetual derivatives DEX on Ethereum, which will use a hybrid onchain-offchain order matching system to bypass Ethereum mainnet’s latency and high gas fees.

The launch will debut with Bitcoin, Ethereum, and Solana derivatives with up to 50x leverage, surpassing most competitors, which typically offer between 20x and 40x leverage on their largest assets.

In the future, the Synthetix perp DEX plans to offer features including multicollateral margin, RWA support, incentives programs, and future integrations and compatibility across Ethereum DeFi, according to a press release shared with The Defiant.

Central Limit Order Book

The Synthetix perp DEX will feature a Central Limit Order Book (CLOB) system, where assets are held and trades are executed onchain, while order matching takes place offchain. CLOB DEXs have become increasingly popular following the success of Hyperliquid’s fully onchain CLOB design.

The DEX will be supported by its Synthetix Liquidity Provider (SLP) vault, which serves as the exchange’s market-making engine. Synthetix stablecoin (sUSD) holders can contribute sUSD to the SLP vault to earn, or lose, yield at the expense of perp traders on the other side of SLP’s trades.

Competing perp DEXs have mostly opted to launch their own blockchain networks or join new and incentivized blockchains, but Synthetix is choosing to launch its product on Ethereum, and aims to become the mainnet’s first successful CLOB perp DEX.

“The last 2 months have seen Synthetix successfully execute 2 trading competitions featuring hundreds of the best perp traders, all of whom have put Synthetix through intense, high-volume trading scenarios,” Benjamin Celermajer, Synthetix’s head of strategy, said. “We’re confident Synthetix is now poised to meet the demands of global traders and solidify ourselves as one of the leading platforms in the competitive perps space.”

Perp DEX Explosion

Synthetix is the latest to launch in a long line of perp DEXs, contributing to the erosion of Hyperliquid’s market dominance.

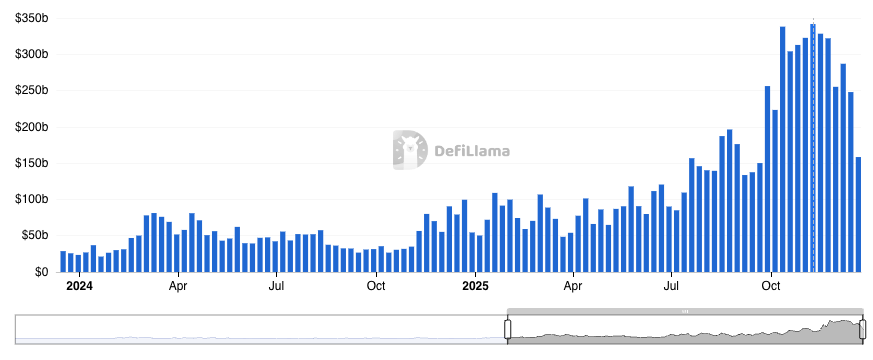

The top five perp DEXs by volume are each processing between $19 billion and $48 billion in weekly volume, more than double Hyperliquid’s weekly average before its token launch in November 2024. The sector reached a new all-time high volume in the first week of November, when more than $340 billion were traded across all perp exchanges in just seven days.

Total Perpetual Swap Volume – DeFiLlama

[ad_2]