[ad_1]

Yesterday, the famous Symbiotic restaking protocol raised the deposit cap of its pools to 210,600 wstETH, as part of the scaling path.

Incredibly, in just 4 hours users staked 800 million dollars in crypto reaching the maximum availability.

Thus, the TVL of Symbiotic has surpassed the billion-dollar threshold, thanks also to the help of an airdrop incentive program.

The project is getting closer and closer to the competitor EigenLayer, threatening to reduce its market share.

Let’s see all the details below.

Symbiotic increases the deposit cap and fills 800 million dollars in 4 hours

Yesterday, the protocol of restaking Symbiotic increased the deposit cap of its pools, with a view to the widespread scaling process.

In detail, the project has added 210,600 wstETH to its deposit limit in order to offer the possibility for anyone to participate.

Extraordinarily though, the cap was reached in just 4 hours, adding 800 million dollars as liquidity. We are talking about a huge flow of capitals, committed at a rate of 200 million dollars per hour.

The Symbiotic team celebrated on X the excellent result, reminding the community that new limits will be added from now on.

These are the words used to describe the ongoing works:

“More resources will be added as we continue the initial scaling of the protocol”.

After 4 hours, Symbiotic’s 210,600 wstETH cap has been reached.

Other assets can still be staked, and caps will be increased over time.

More assets will be added as we continue the initial scaling of the protocol.— Symbiotic (@symbioticfi) July 3, 2024

Symbiotic is currently in a bootstrapping phase that includes the integration of restaked guarantees, and rewards with point campaigns for users.

Like EigenLayer, Symbiotic aims to solve the challenges of network security by reallocating the capital from ether staking.

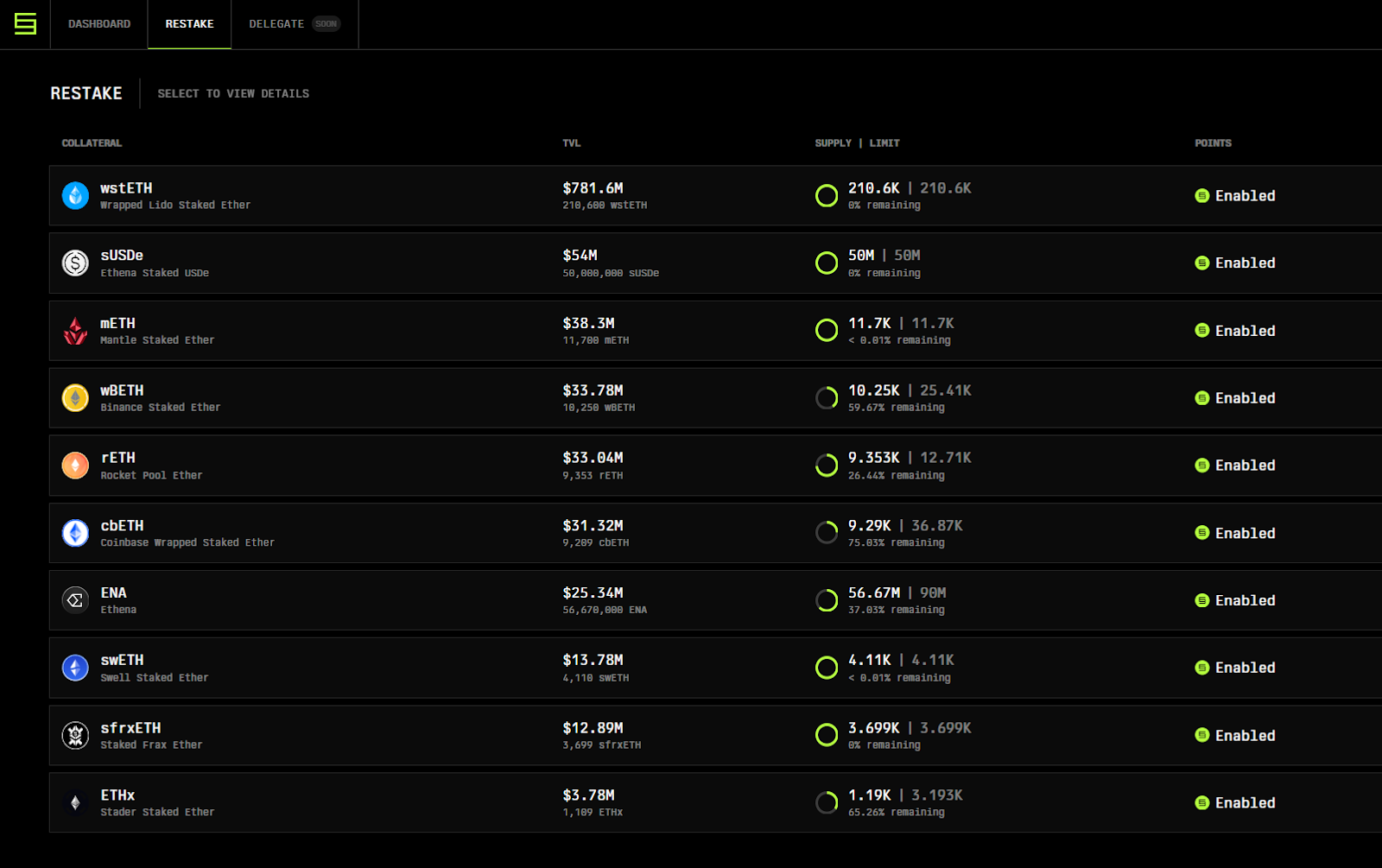

At the time of writing, the wstETH pool is completely filled, as are those in sUSDe, mETH, swETH, and sfrxETH.

However, I remain available for the restaking pool denominated in wBETH, rETH, cbETH, ENA, and ETHx.

Source: https://app.symbiotic.fi/restake

We remind you that, as reported by CrunchBase, Symbiotic has raised as much as 5.8 million dollars in the “seed funding” phase.

The project is supported by the well-known VC Paradigm, known for being a successful investor and having participated in several airdrops of new tokens.

Among the supporters of the protocol, tasked with accelerating the development of the platform, we also find Cyber.Fund.

The war in the restaking sector: EigenLayer, Karak and Symbiotic

After the increase of the deposit cap of Symbiotic, promptly filled by the users, the TVL of the protocol has surpassed the threshold of 1 billion dollars.

With the latest increase in internal liquidity of 800 million dollars, the project now threatens the future of other competitors such as EigenLayer and Karak.

Currently, EigenLayer leads the restaking market with 16.18 billion dollars of total value locked. The assets of Karak, on the other hand, amount to 833 million dollars.

Both have seen a slight decrease in their market share after the advent of Symbiotic.

Source: https://defillama.com/protocol/symbiotic?denomination=USD

Symbiotic stands out from the main competitors for its more flexible approach, which allows the restaking of a wide range of ERC-20 resources such as ENA, in addition to various LST and stablecoin.

On EigenLayer, however, all direct deposits (in any currency) are converted into ETH to participate in restaking.

From the point of view of interoperability Symbiotic is limited because it operates only on the Ethereum network (like EigenLayer) while Karak boasts multichain availability.

All three projects are fighting to take control in the restaking war by offering various incentives such as airdrop points and bonus fees.

The real engine of change for Symbiotic is the flexibility of its infrastructure: in addition to allowing staking on a wide range of tokens and expanding its level of security it offers an arbitrary customization.

The same operators can indeed choose the most appropriate way to manage rewards and slashing of the stakers.

It is also worth noting how the project uses immutable contracts, that is, non-upgradable: this greatly reduces governance risks while offering less freedom of movement by the community.

Everyone: Hey where is the restaking research 😡?

Poopman: lock and loaded 🔒🔄Here’s a sneak peek from “The Restaking War, 2024”

Full research out S-O-O-N ,

Thank you for all your support 🙏 pic.twitter.com/u2z2bk41np— Poopman (💩🧱✨) (@poopmandefi) July 1, 2024

We eagerly await the launch of the first AVS (Actively Validated Services) on Symbtioc.

New airdrop incentives: farming on Mellow, Etherfi, Swell, and Renzo

As mentioned, Symbiotic along with EigenLayer and Karak is also carrying out an airdrop campaign with the aim of driving traffic from new users.

The protocol aims to attract as much capital as possible, being able to take greater advantage of the staking of ether and grow its ecosystem more quickly.

As an incentive, Symbiotic is offering points that will later be converted into the next native token of the platform.

The launch is expected in Q3 2024, therefore in the coming months, and the valuation of the resource could easily exceed one billion dollars at the TGE.

I have absolutely zero insider insight into Symbiotic.

But it seems they’ll launch by the end of summer and potentially a Symbiotic airdrop might become tradable before $EIGEN. pic.twitter.com/tVcAcdVeMX

— Ignas | DeFi (@DefiIgnas) June 11, 2024

In the world of finance, the terms “bull” and “bear” are often used to describe market trends. A “bull” market is characterized by rising prices, while a “bear” market is marked by falling prices. Understanding these concepts is crucial for investors.

Several external protocols have announced partnerships with Symbiotic to offer a boost in airdrop rewards, in order to drive the adoption of the platform.

Among these, the name of Mellow Finance immediately stands out, an application supported by the leader of liquid staking Lido Finance.

On Mellow we can already stake resources on various vaults, which allow us to farm both Mellow Points and Symbiotic Points simultaneously.

We remind you, however, that as long as the cap of Symbiotic is not further increased, we will not obtain Symbiotic Points but a 1.5x multiplier on Mellow Points.

It is still an excellent way to anticipate the moment when new deposits will be reopened on the restaking protocol, as you will have priority over new users.

Symbiotic has increased its limits today. For Mellow depositors that were in the queue – congrats! You got into the first window and are now earning 1x Symbiotic and 1x Mellow points.

Choose your favorite risk curator for the next caps increase: https://t.co/OjKZohaDOQ

You… pic.twitter.com/QKl8UnuMXO

— Mellow Protocol (@mellowprotocol) July 3, 2024

Also, Etherfi has announced its vault in collaboration with Symbiotic.

The Vault offers the opportunity to farm at the same time the airdrop of Etherfi for season 3, that of Veda, and indeed that of Symbiotic.

It is an excellent incentive since we are talking about a very solid and established application in the DeFi landscape.

For its season 3, we remind you that Etherfi has allocated a sum of 50 million ETHFI tokens, for a value of 115 million dollars.

The season officially started on July 1st and will end in September.

The Super Symbiotic LRT is now fully restaked and ready for more ETH to earn those sweet sweet @symbioticfi points 😋

Ape in degens! https://t.co/hWAyClFsuL https://t.co/2Xh11uxv8d

— ether.fi (@ether_fi) July 3, 2024

Also the protocols Swell and Renzo offer methods for staking on Symbiotic and enjoying additional rewards for their respective airdrop phases.

[ad_2]