CleanSpark delivered an outstanding financial quarter, but its market performance didn’t reflect the same strength. This analysis breaks down key financials, operational insights, and strategic directions to understand the full picture.

CleanSpark Executive Overview: Strong Execution Amid Market Ambivalence

The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on Feb. 20, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

While doing research for my Bitcoin Mining Annual Report back to Dec 2024, CleanSpark stood out with multiple key metrics, such as gross margin, hash rate expansion, M&A activities, and fleet upgrades. At that time, I believed the company was positioned for a strong year ahead—assuming Bitcoin’s price continued its upward momentum.

Screenshot from the annual report (co-authored with Nico Smid from Digital Mining Solutions)

However, following CleanSpark’s fiscal Q1 2025 earnings call on February 6, 2025, the company’s stock price remained flat and even declined. This market reaction raised some questions for me: What numbers surprised investors? Did the company provide guidance that concerned investors? Let’s take a closer look at the numbers and break down what might be happening.

Financial Highlights: Revenue & Profitability Surged

CleanSpark’s fiscal Q1 2025 (Oct 1 – Dec 31, 2024) was an outstanding quarter financially, demonstrating robust revenue growth and strong profitability, driven by Bitcoin’s price increase and improved operational efficiency.

Key Income Statement Metrics:

- Revenue: $162.3 million (+120% YoY) vs. $73.8 million in Q1 2024. This was primarily driven by an increase in Bitcoin price, offset by a lower number of Bitcoin mined due to the halving event in April 2024

- Net Income: $246.8 million (+854% YoY) vs. $25.9 million in Q1 2024, largely dues to fair value Bitcoin revaluation.

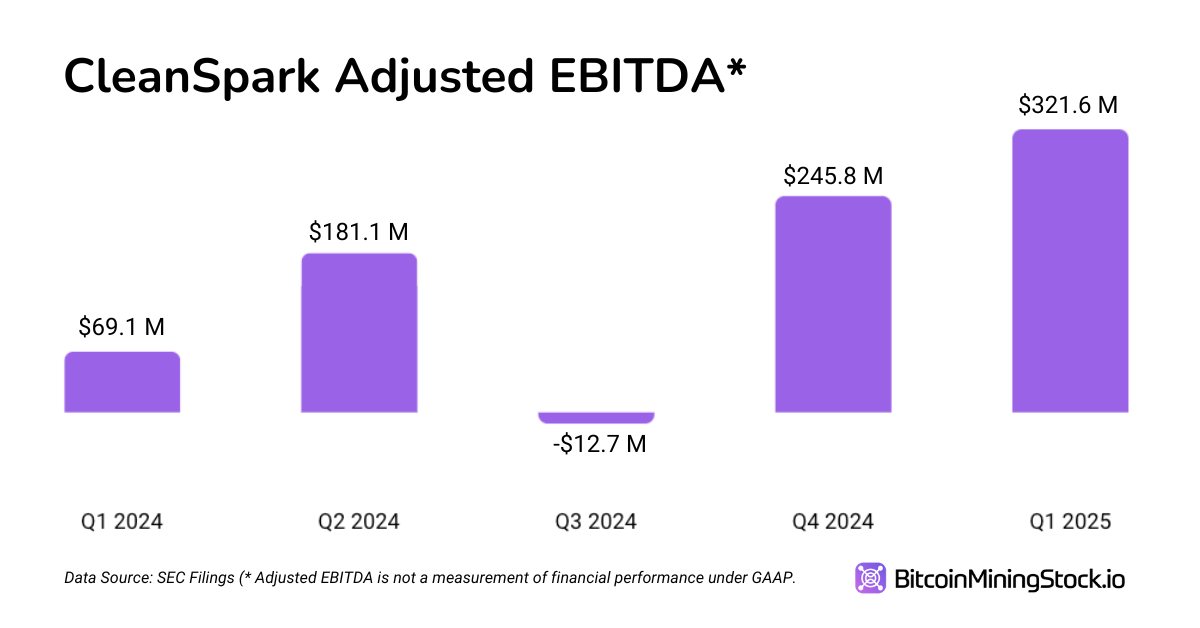

- Adjusted EBITDA: $321.6 million from $69.1 million, setting a new record. (*This reported number include $218.2 million fair value gain)

- Gross Margin: 57%, slightly lower than 60% YoY due to increased operational costs (particularly energy costs and mining infrastructure expansion)

- Bitcoin Production: 1,945 BTC, down slightly from 2,020 BTC in Q1 2024 due to the Bitcoin halving event in April 2024.

Key Balance Sheet Metrics

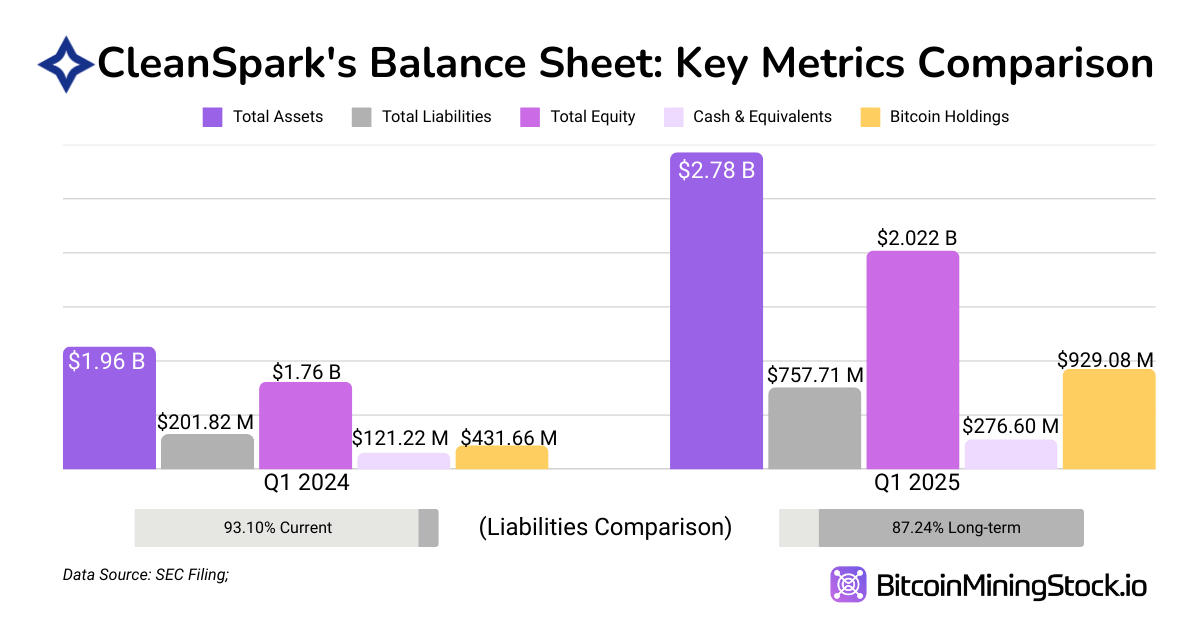

- Total Assets: $2.78 billion (+41.6% YoY), vs $1.96 billion in Q1 2024. Largely driven by increase in Bitcoin holdings and data center expansions & new mining infrastructure.

- Total Current Liabilities: $96.7 million dropped from $187.9 million, mainly due to loan repayments ($52.2M paid off)

- Long-term Liabilities: $641.4 million (vs $7.2M), primarily due to new convertible debt issuance

- Stockholders’ Equity: $2.02 billion (+14.8% YoY), vs $1.76 billion in Q1 2024

- D/E ratio: 0.32 (vs 0.08), indicating that CleanSpark has significantly increased its leverage over the past year, by taking on more debt to fund growth.

Key Cash Flow Metrics

- Operating Cash Flow: $119.5 million net cash used in operations

- Investing Cash Flow: $255.9 million used (including $126.9 million for new miners and $57.4 million for fixed assets)

- Financing Cash Flow: $531.1 million inflows (including $186.8 million in equity offerings +$635.7 million in loan proceeds-$145 million treasury stock repurchases)

- Company expects cash, BTC holdings, and operational cash flow to be sufficient for 12+ months, but financing may be needed for further expansion

Valuation Metrics & Enterprise Value

CleanSpark’s market cap currently stands at $2.61 billion (Marketing closing on Dec 31, 2024). To better understand its valuation, I compiled a few key financial metrics:

- Enterprise Value (EV): $2.16 billion (Market Cap + Debt – Cash & Bitcoin Holdings).

- EV/EBITDA Ratio: 6.71x ($2.16B / $321.6M), which is relatively low for a high-growth Bitcoin miner.

- P/E Ratio: 10.57x ($2.61B / $246.8M), suggesting the company is trading at a discount compared to tech growth stocks.

- BTC Holding as % of Market Cap: 35.6%, meaning more than one-third of its valuation is backed by Bitcoin holdings alone.

I’ll come back and compare with other miners, who have a similar operational scale, once data becomes available.

Operational Metrics: Hash Rate Growth & Efficiency Improvement

Key Hash Rate & Efficiency Metrics:

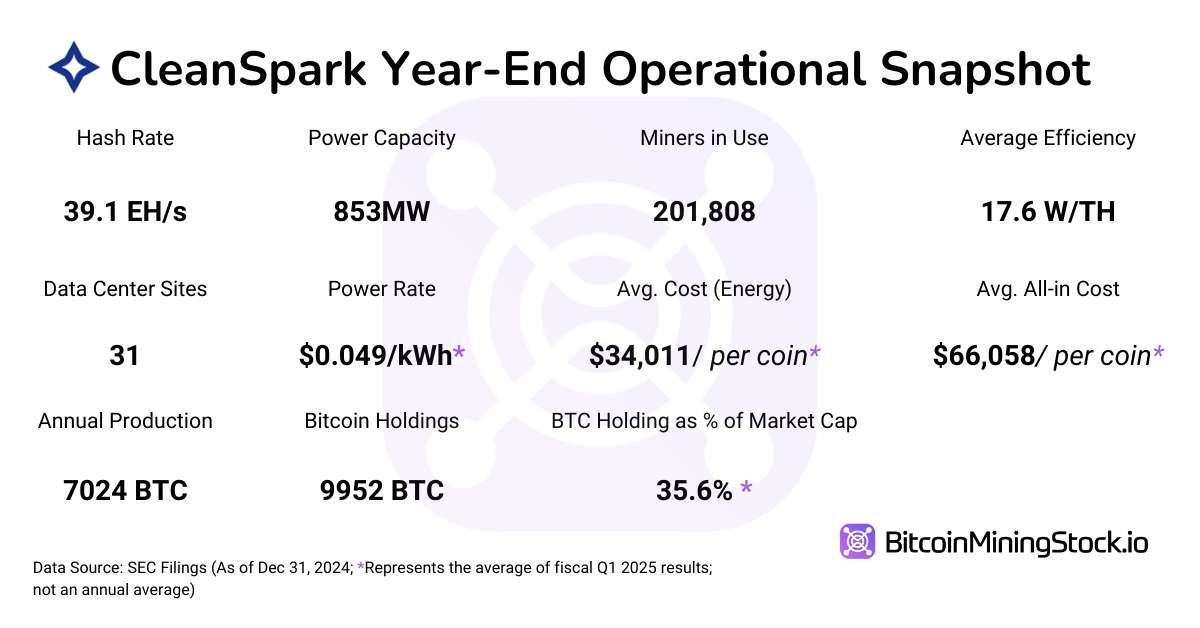

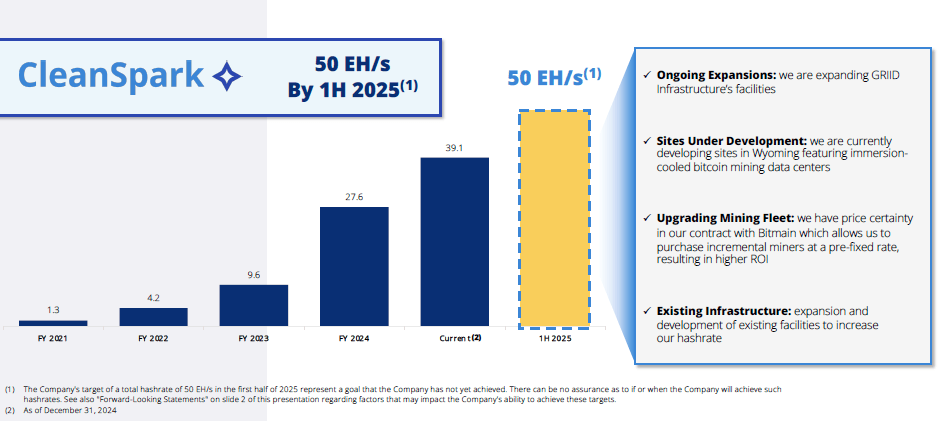

- Hash Rate: 39.1 EH/s (4.87% of global hashrate), a 4x increase YoY (10.0 EH/s in Q1 2024).

- Operating miners: 201,808 in operation, up from 88,559 YoY.

- Average Efficiency: 17.6 W/TH, improved from 26.4 W/TH YoY.

- Bitcoin Production Cost (Direct Energy Cost Per BTC at owned Facility):$34,011, up from $12,808 YoY.

- Total Cost Per BTC (Including Depreciation & Financing): $66,058, up from $24,429 YoY.

Energy Cost Analysis & Mitigation Strategies

- Power rate: $0.049/KWh (vs. $0.044/KWh YoY).

- 40.4% of Bitcoin revenue is used for energy costs, up from 35% YoY.

- Hurricane Helene led to temporary operational curtailments, reducing efficiency.

- Energy Mitigation Strategies:

- Diversified Geographic Expansion: New sites in Wyoming, Tennessee, and Georgia with lower power rates.

- High-Efficiency Mining Rigs: Deployment of S21 XT immersion units for lower power draw.

- Flexible Power Contracts: Agreements to optimize energy usage and cost but remains exposed to price volatility

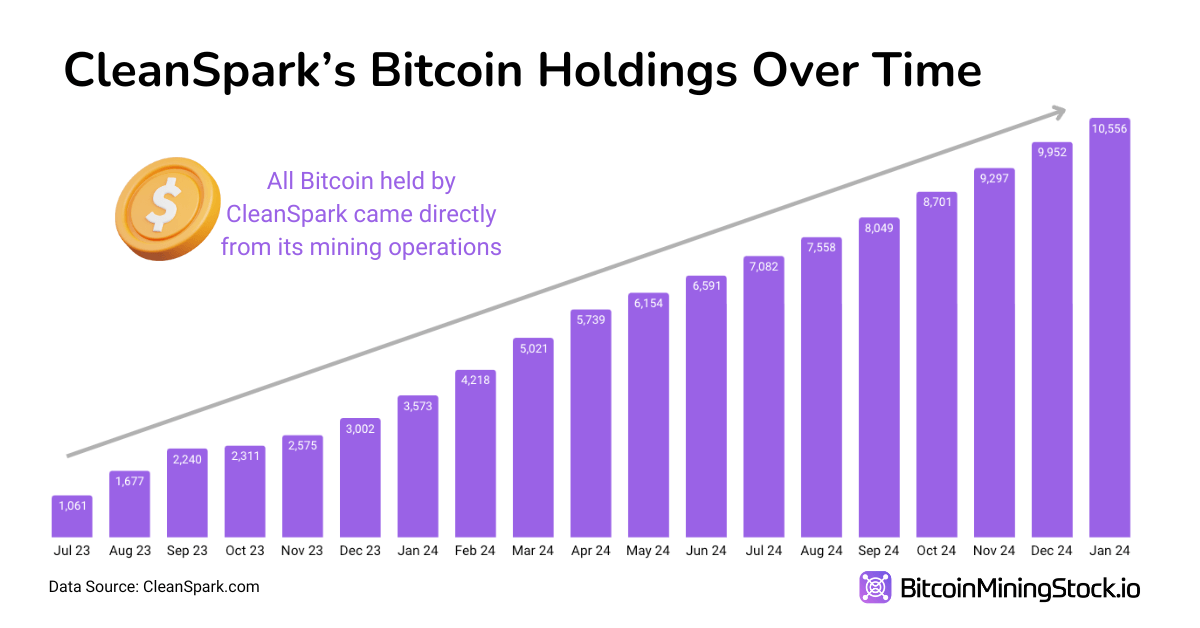

Bitcoin Holding & Treasury Strategy: HODL Over Sell

BTC Treasury:

- Total Bitcoin Held: 9,952 BTC (valued at $929 million; up from 6,819 BTC compared with the previous quarter).

- 99% of BTC in cold storage, 1% in hot wallets.

- BTC Sold During the Quarter: 3,413 BTC ($3.4 million worth) compared to 43,300 BTC ($43.3 million) in Q1 2024

- BTC Used as Collateral (to the Coinbase): $8.86 million transferred, $129.18 million retrieved from collateral accounts.

- Funding Operations: Relied on external financing ($635.7M convertible debt) instead of BTC sales.

- No BTC Lending or Yield Strategies Reported.

Expansion & M&A: Scaling Up for 50 EH/s

Growth & Expansion Plans:

- Goal: 50 EH/s by mid-2025, with potential expansion to 60 EH/s.

-

New Mining Sites Acquired:

- Tennessee Site: $29.9M investment.

- Mississippi Site: $3M investment, plus $2.9M for infrastructure.

-

Fleet Growth:

- 60,000 S21 miners secured, with an option to buy 100,000 more at $21.50/TH, 37% below market price.

- 285,098 total miners owned, with ~83,290 pending deployment.

CleanSpark’s Hash Rate Growth Roadmap (screenshot from the company presentation)

Thoughts: The Big Picture & Key Considerations

By looking at numbers from the financial report, I still believe CleanSpark holds a strong position in the Bitcoin mining sector. The company positions itself as a premier American Bitcoin miner, which could become even more advantageous under the current U.S. administration.

However, my main concern remains Bitcoin’s price movement. Historically, CleanSpark’s stock price is tightly correlated with BTC performance. If Bitcoin surges, CleanSpark can become more attractive; but if BTC stagnates or dips, CLSK may face massive sell-offs.

Another key factor to consider is how CleanSpark manages revenue across different market cycles. Unlike peers diversifying into AI/HPC, CleanSpark remains committed to Bitcoin mining. Its CEO stays skeptical of HPC, statingthat “ repurposing a Bitcoin mining facility for high-performance computing is far more complex than it may appear”, and reinforcing CleanSpark’s long-term focus on Bitcoin as an efficient, proven, and scalable business model. This indicates the company is unlikely to pivot like its peers any time soon.

That said, the company may find ways to leverage its BTC holdings strategically—perhaps through treasury strategies that minimize counterparty risks while enhancing financial flexibility.

Ultimately, CleanSpark boasts one of the largest mining operations, top range efficiency, disciplined capital management and excellent executions (exceeded their annual hash rate target), and ambitious expansion plans. I currently see no strong reason to be bearish on CleanSpark as long as Bitcoin mining remains a viable industry.

Even if we talk about the current trending Bitcoin Treasury Strategy, Cleanspark can be a compelling investment opportunity. In comparison with Strategy (MSTR)- the most well-known advocate of this strategy, CleanSpark holds a critical advantage: they can obtain Bitcoin at a significantly lower price (all-in cost: $66,058 per coin) by mining. As people say “If you can mine at a lower price, why buy?”