[ad_1]

From Trey Walsh, Executive Director of The Progressive Bitcoiner

I’ll start off by saying I have many reservations about the United States pursuing a Strategic Bitcoin reserve, with the major plans I’ve observed including legislation proposed by Senator Lummis and a draft Executive order from the Bitcoin Policy Institute (this does not include those proposed state-by-state, which is a different focus and a bit more straight forward given they hold some bitcoin to diversify their assets). My reservations include timing, political (polarizing) ramifications, mechanisms/cost of obtaining Bitcoin, why the U.S. would pursue this as a nation already leading as the world reserve currency, government getting more involved with Bitcoin could lead to more involvement/influence with Bitcoin’s development, and ramifications on Bitcoin as money for U.S. citizens (would privacy, medium of exchange, self-custody be at greater risk?). I think Nic Carter wrote an excellent piece questioning the SBR and advocating against the U.S. pursuing this which I’d highly encourage you to read.

While I have seen support for the SBR from Bitcoin proponents, mostly GOP politicians and Trump (in fairness Democratic Rep. Ro Khanna has said he’s supportive in theory I believe), there has yet to be any attention paid to this in a positive way from progressives. In fact, really only criticism. While I have my reservations and criticisms as I’ve clearly stated to be transparent here, I’d like to focus on some ways in which a U.S. Strategic Bitcoin Reserve could actually be a positive thing for Americans, from a progressive’s lens and values with an emphasis on social safety net spending. This has yet to be discussed at any scale, and I’d like to offer some thoughts, and some actual social good this could do besides just “strengthen the United States as a global power and strengthen the dollar.” Ok, but what could this do for actual, every day people in America? That’s what I care about, and probably you too.

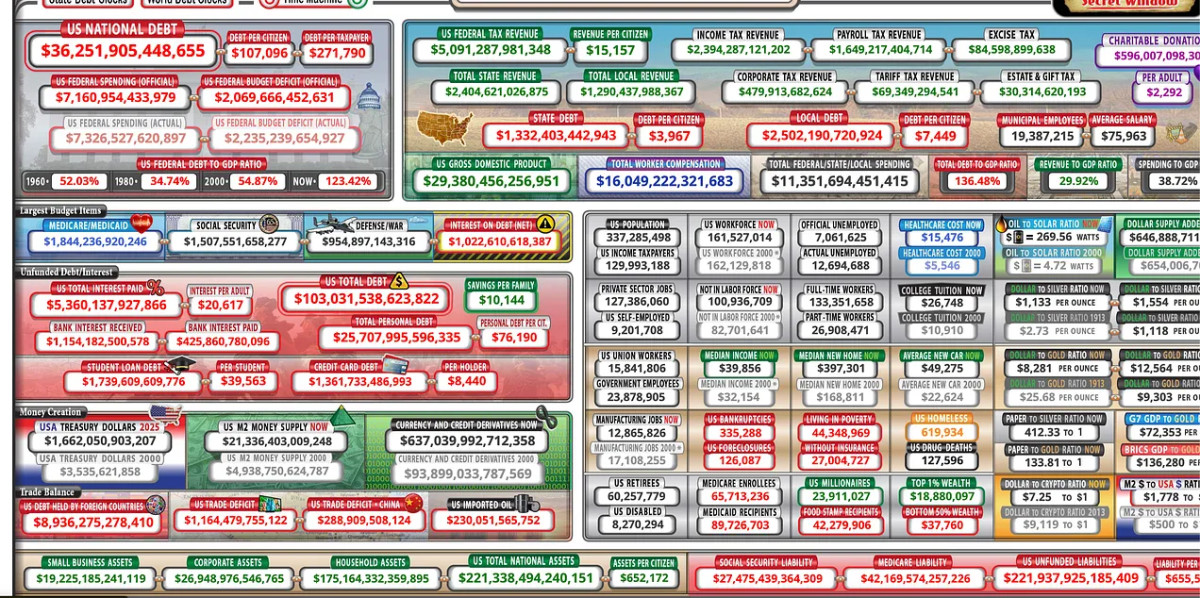

This overwhelming image was captured today from https://www.usdebtclock.org/. What the U.S. doesn’t have a solid answer for is how we are going to pay for the vital services needed and expected from citizens at this point when facing a debt and spending crises compared to our budget/tax receipts. Depending on who you ask and which economic theories you subscribe to, there are different ways for handling this—but the issue remains: the U.S. is kicking the can down the road regarding debt, spending and refusing to either raise taxes or cut spending dramatically and catastrophically. I wanted to set the stage first, and then offer some strategic use cases of a SBR toward social safety net spending, the budget deficit, and a government by the people, for the people with Bitcoin.

1. Hedge Against Inflation to Protect Public Programs

- Stability for Social Spending: Inflation and currency devaluation erode the purchasing power of government budgets, reducing the effectiveness of social safety net programs. A Bitcoin reserve, as a deflationary asset, could serve as a hedge against such economic risks, ensuring stable funding for programs like Medicare, Medicaid, and Social Security. As things get more expensive in fiat terms (salaries, healthcare bills, vital hospital technology, medications, treatments, etc) they get cheaper in Bitcoin terms.

- Future-Proofing Benefits: Bitcoin’s limited supply could protect against long-term depreciation of fiat currency, ensuring that entitlement programs maintain their value and benefit recipients in the decades to come.

2. Revenue Generation for Safety Nets

- Asset Appreciation: Bitcoin has shown significant price appreciation over the long term. A government-held Bitcoin reserve could be leveraged during times of financial need to generate additional revenue for funding social programs. The key here is a long-term view, not short term trading.

- Controlled Liquidation: Under a progressive framework, the government could design strict protocols for selling portions of the reserve during economic downturns or crises to avoid undermining the reserve’s long-term value while supporting public welfare.

3. Alternative to Taxpayer Burden

- Reducing Taxpayer Reliance: Traditionally, funding for social safety nets comes from taxes, which can disproportionately impact middle- and lower-income households. A Bitcoin reserve could provide an alternative funding source, reducing the reliance on direct taxation for safety net programs.

- Reducing deficit spending: One of the leading cases of inflation is deficit spending via money printing mechanisms from the Fed, Treasury and Congress passing legislation well beyond our assets and tax receipts. A SBR could be used to help us rely less on the money printing that is responsible for overwhelming inflation on the lower and middle class that is often use to fund our government and social safety net programs. By including Bitcoin alongside traditional reserves like gold, the government could enhance its fiscal capacity to sustain welfare programs without relying on deficit spending.

4. Emergency Financial Assistance

- Crisis Mitigation Fund: During financial crises, the government often struggles to rapidly mobilize resources for safety net expansions. Bitcoin, being highly liquid and accessible globally, could act as an emergency reserve for direct cash transfers or funding unemployment benefits in times of economic distress.

- Global Remittance Efficiency: Bitcoin’s borderless nature could streamline the delivery of international aid or remittances to support diaspora communities or vulnerable populations abroad, aligning with progressive values of global equity.

5. Promoting Financial Inclusion for Vulnerable Populations

- Bridging the Wealth Gap: A Strategic Bitcoin Reserve could be paired with policies that encourage public ownership of Bitcoin, offering individuals and communities the ability to participate in a financial system that is less dependent on traditional banking structures. Look to programs such as the Alaska Permanent Fund which pays dividends based on Alaska’s oil reserve and production

- Direct Redistribution Mechanisms: The government could use gains from Bitcoin reserves to fund Universal Basic Income (UBI) programs or targeted assistance for low-income households. Margot and I discussed this possibility with Scott Santens, a leading expert on UBI on our podcast.

While not directly connected to the SBR, the acceptance of Bitcoin at this stage could open the door for more possibilities regarding Bitcoin mining and the community.

6. Incentivizing Green Bitcoin Mining for Job Creation

- Jobs for At-Risk Communities: Bitcoin mining operations, if incentivized to use renewable energy, could create jobs in underserved regions, providing a dual benefit of economic revitalization and environmental progress.

- Revenue for Local Governments: Tax revenues generated from sustainable Bitcoin mining operations could be redirected to strengthen local safety nets, such as affordable housing or community healthcare initiatives.

7. Economic Resilience to Fund Long-Term Programs

- Buffer Against Economic Crises: In times of economic downturns or geopolitical instability, Bitcoin’s independence from fiat currency systems could provide a financial buffer. This could ensure that critical safety net programs continue to operate without disruption.

- Strengthening the Social Contract: By maintaining a reserve that safeguards national economic security, the government reinforces its commitment to protecting vulnerable populations, which is a core progressive principle.

8. Enhancing Public Trust in Social Programs

- Transparent Funding Mechanism: Bitcoin’s blockchain technology ensures a transparent ledger. Using a Bitcoin reserve to partially fund social programs could increase public trust in how resources are allocated and managed, reducing skepticism about government waste or corruption. The SBR bitcoin addresses would be made public (like El Salvador does)

- Public Ownership: Progressives could propose allocating a small portion of Bitcoin gains directly to citizens through rebates or credits tied to social programs, creating a tangible connection between national reserves and public benefit. Again, back to a dividend or UBI approach

This is just the tip of the iceberg for how progressives might theoretically approach a Strategic Bitcoin Reserve. While this is more of an intellectual exercise at this point, and my focus continues to be on grassroots adoption of Bitcoin and how this can transform individual’s lives and communities around the world, it raises an important point — what social good could we imagine Bitcoin providing in our ever evolving, changing, and fiscally challenging world? Beyond just number go up, crypto traders, and wall street getting richer, what role can Bitcoin play in improving the lives of everyday people at a deep, structural level? We’ll continue to explore these questions here at The Progressive Bitcoiner.

This is a guest post by Trey Walsh. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]