The following is a guest post and analysis from Vincent Maliepaard, Marketing Director at Sentora.

The Bitcoin market cap recently surpassed $2 trillion, and with over 50 million bitcoin addresses with a balance, the value of the asset is becoming undeniable. However, where traditional currencies like dollars or euros typically pay interest on holdings, Bitcoin provides no such rewards for simply holding the asset. More recently though, two distinct pathways have emerged to change that picture:

- Native Bitcoin “staking” – lock BTC in the Babylon protocol and earn fees.

- Liquid‑staking tokens (LSTs) – mint a tradable receipt such as LBTC that keeps the staking rewards flowing while restoring liquidity.

These two solutions provide a viable route to earning stable yield on your Bitcoin. Let’s dive into what this entails and how it works.

From Proof‑of‑Stake to Proof‑of‑Bitcoin

Babylon went live on mainnet in late‑2024, letting BTC holders time‑lock coins on the Bitcoin chain and delegate them to so‑called Bitcoin‑Secured Networks. The networks pay out fees in BTC, producing a yield of roughly 1 – 2 % currently.

The idea has caught on quickly: Babylon reports more than $4 billion in BTC staked on the protocol since last year.

Key features

- No wrapping or bridges: BTC never leaves its native chain.

- Main risks: a protocol bug or “slashing” if a delegated validator misbehaves.

- Drawback: staked coins stay immobile until an unbonding timer expires.

Liquid staking: LBTC puts mobility back on the menu

Lock‑ups are a deal‑breaker for many traders. Liquid‑staking tokens fix that by issuing a transferable asset that represents the underlying stake plus its future rewards.

An example of such a liquid staking token for Bitcoin is LBTC from Lombard Finance

- 1:1 minting: stake BTC through Lombard’s Babylon contracts and receive LBTC on an EVM chain. (Lombard)

- Seven‑day exit: burn LBTC to trigger the same unbond period as native Babylon staking, about a week. Nonetheless, users can easily exit LBTC by trading it on DEXs.

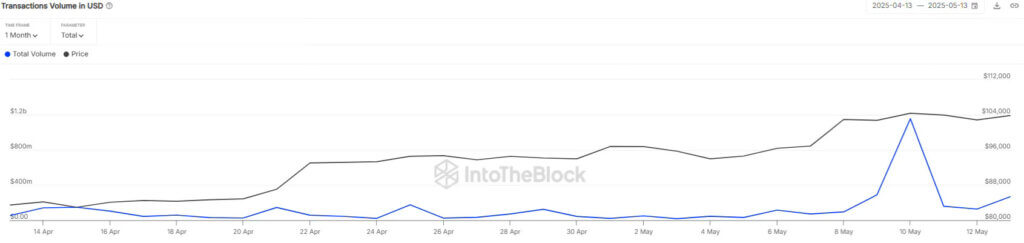

- Real liquidity: daily on‑chain volume averages more than $200 million, and liquidity is large enough to facilitate transactions up to $30 million without significant slippage; enough for most portfolio‑sized exits.

- Custody trade‑off: holders must trust Lombard’s mint‑and‑burn smart contracts and the Babylon validator set.

While LBTC inherits the base staking reward, its real super‑power is capital efficiency: users can post LBTC as collateral, spin it into DeFi pools or simply sell it on a DEX while the original BTC keeps working.

Vaulting the yield curve

While this sounds enticing, earning a notable return with your Bitcoin LST can be complicated. As a retail user, you have to understand complex dynamics in DeFi related to risk and return of different protocols and strategies.

Even if you do have a basic understanding of these factors, users must still actively manage their positions, as returns often fluctuate depending on the markets. That means that to sustain a notable APY, users have to occasionally switch strategies or take action to keep their position profitable.

Fortunately, there are other options. Lombard offers a variety of vaults that aim to simplify this process and keep earning yield on Bitcoin as straightforward as possible. Let’s take a look at one recently launched vault; the Sentora DeFi vault.

Sentora, born from the merger of IntoTheBlock’s with Trident’s Digital, launched a BTC Yield Vault on Lombard recently. The product accepts either wBTC or LBTC and targets an APY of ~6 %, significantly more than plain staking.

How it earns the spread

The vault automatically executes several different strategies in different capacities depending on the market conditions. This is all automated and requires no manual action from users or vault managers. Some of these strategies include the following:

- Over‑collateralised lending – lends BTC‑derived assets on lending markets like Aave for interest.

- Pendle yield trading – splits and sells future yield streams, front‑loading extra return.

- Delta‑neutral borrows – borrows other assets such as stablecoins to deploy in delta-neutral high yield strategies

Every one of these strategies is plugged into Sentora’s real‑time DeFi risk engine; the same data institutions use to monitor risk exposure across DeFi. Positions that drift beyond preset limits are automatically rebalanced.

Risk‑reward snapshots

- Native staking: tight risk surface, modest return. Ideal for cold‑storage purists who can tolerate lock‑ups.

- LBTC alone: same base yield, but tokens stay liquid, at the cost of smart‑contract and bridge exposure. Users can amplify yield by interacting with DeFi protocols.

- Sentora Vault: broader risk because multiple DeFi venues are involved, but mitigated by automated risk management and hedges.

What to watch next

Holding Bitcoin can finally pay off beyond price appreciations. With different options available for different needs and risk appetites, Bitcoin holders can finally benefit from advancements in DeFi. And with the recent increases in LBTC volume, it is becoming feasible for larger institutional trading desks to utilize these strategies, likely further pushing innovation in the Bitcoin staking area.