The discussion happening in the Senate about the so-called crypto market structure bill has slowed down as the debate has reached key issues. According to Variant CLO Jake Chervinsky, it is unlikely for this bill to be approved before February.

Crypto Market Structure Bill Slows Down in Senate, Key Issues Still Being Discussed

The market structure bill has reached the Senate, and now lawmakers are trying to define the elements that will gain consensus during a full vote. While drafts have already been prepared, as both committees draw closer to markup, several key aspects remain undecided, given their controversial character.

Jake Chervinsky, CLO of Variant, remarked that the discussion is not likely to advance as both the banking committee, which is currently working on the securities part of the bill, and the Agriculture committee, which is dealing with the commodity-linked part of the bill, still have not reached consensus on these key issues.

Chervinsky detailed that these “disputes,” as he called them, were three: the stablecoin yield dilemma, the current Administration’s links to crypto, and decentralized finance protections.

Read more: Understanding the GENIUS Act: US Stablecoins Revolution

Stablecoin Yield

Banks have been complaining about how the GENIUS Act excludes stablecoin issuers from paying yield to third parties holding stablecoins. Nonetheless, the regulation did not exclude third parties from doing so, and this is currently enraging the banking lobby, which has called this a “loophole” that must be plugged.

Chervinsky states that while this is silly, given that banks themselves agreed to the GENIUS Act’s fine print, it can hurt the bill’s chance of passing.

“Banks are influential and they might be able to get a few senators to agree. That could be enough to kill the bill,” he assessed.

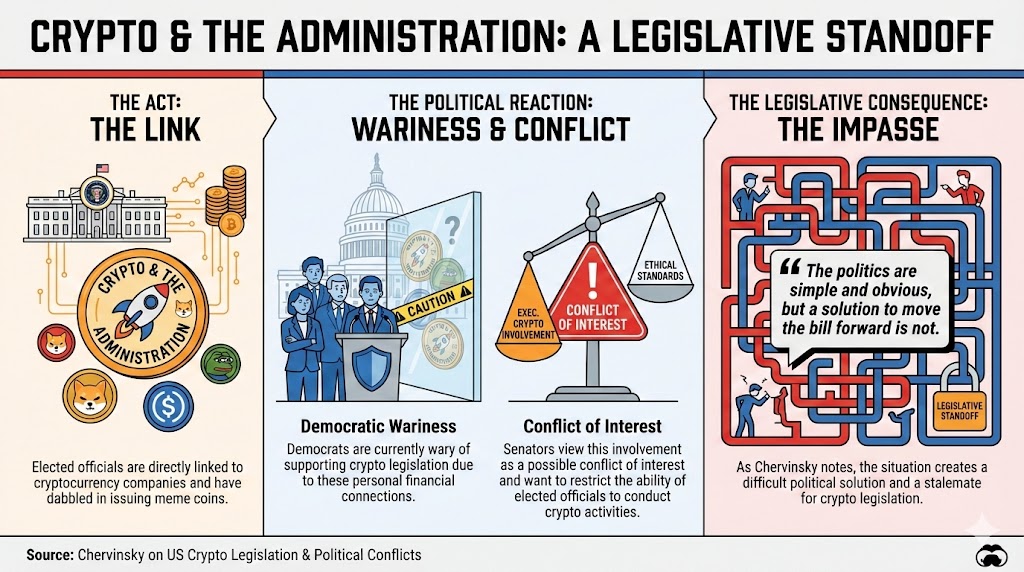

Government Involvement

The current administration’s ties to crypto, as the President and his family are involved with cryptocurrency companies and have even dabbled in issuing meme coins, are elements that are making Democrats wary of supporting legislation regarding crypto.

Chervinsky states that some Senators see this involvement as a possible conflict of interest, and they want to issue restrictions on elected officials’ ability to be involved in cryptocurrency activities.

“The politics are simple and obvious, but a solution to move the bill forward is not,” he stressed.

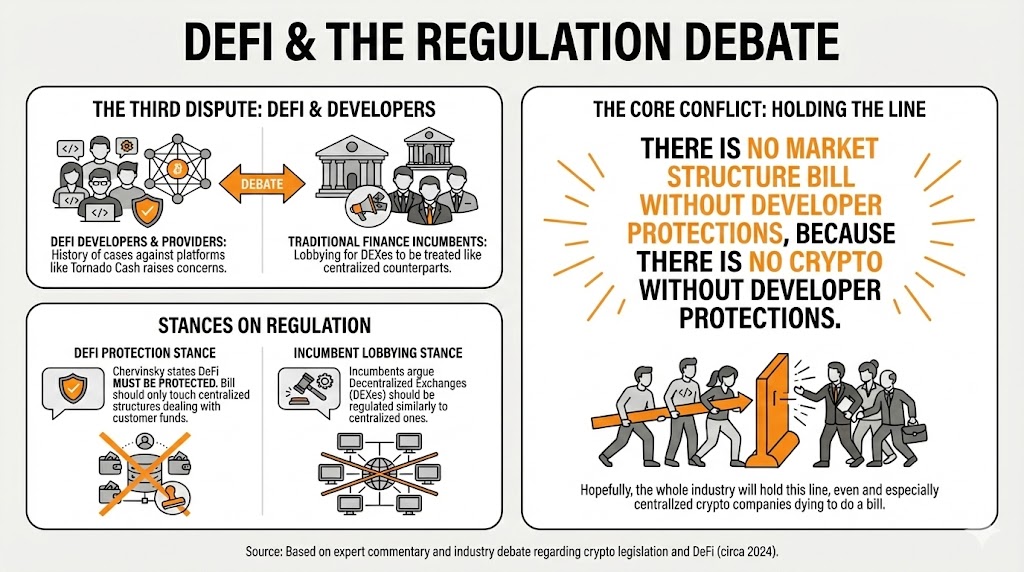

Decentralized Finance

The third and final dispute deals with decentralized finance (DeFi) developers and service providers, as there is a history of cases against platforms like Tornado Cash and others.

While Chervinsky states that DeFi must be protected, as the bill only touches centralized structures dealing with customer funds and their regulation, traditional finance incumbents are lobbying for decentralized exchanges (DEXes) to be treated similarly to their centralized counterparts.

“There is no market structure bill without developer protections, because there is no crypto without developer protections. Hopefully, the whole industry will hold this line, even and especially centralized crypto companies dying to do a bill,” he declared.

Looking Forward

Given the complexity of these issues and the discussion surrounding them, Chervinsky believes that we are still far from the approval of this bill, as he points out that lawmakers will keep discussing these issues before February.

“There’s nothing more important than getting this right. We won’t have a second chance,” he concluded.

FAQ ❓

-

What is the current status of the market structure bill?

The bill has reached the Senate, with lawmakers working to define key elements ahead of a full vote. -

What key disputes are holding up the bill’s progress?

Jake Chervinsky highlights three major issues: the stablecoin yield dilemma, government involvement in crypto, and protections for decentralized finance (DeFi). -

What concerns exist around stablecoin regulation?

Banks argue that the GENIUS Act allows a loophole for third parties to pay yields on stablecoins, frustrating the banking lobby and potentially jeopardizing the bill. -

How does government involvement affect the bill?

Concerns over the current administration’s ties to crypto, including elected officials’ activities, have made some lawmakers wary of supporting cryptocurrency legislation.