[ad_1]

Stablecoins make up 30% of DeFi revenues, and are key to the sector’s development, discovered research by Keyrock Trading. Year-on-year, the weight of stablecoins in DeFi revenues has grown seven times.

Stablecoins are becoming central to DeFi revenues, making up 30% of inflows for most DeFi projects. In the past year, stablecoins not only increased their supply, but developed new use cases, tapping the generally bullish crypto trend.

Keyrock Trading discovered that stablecoins became key engines for protocol activity, going beyond a mere tool for transfers between exchanges. The year of relative stability meant both asset-backed and crypto-collateralized stablecoins could serve within the DeFi space.

Ethereum and L2 draw in higher revenues from stablecoin usage

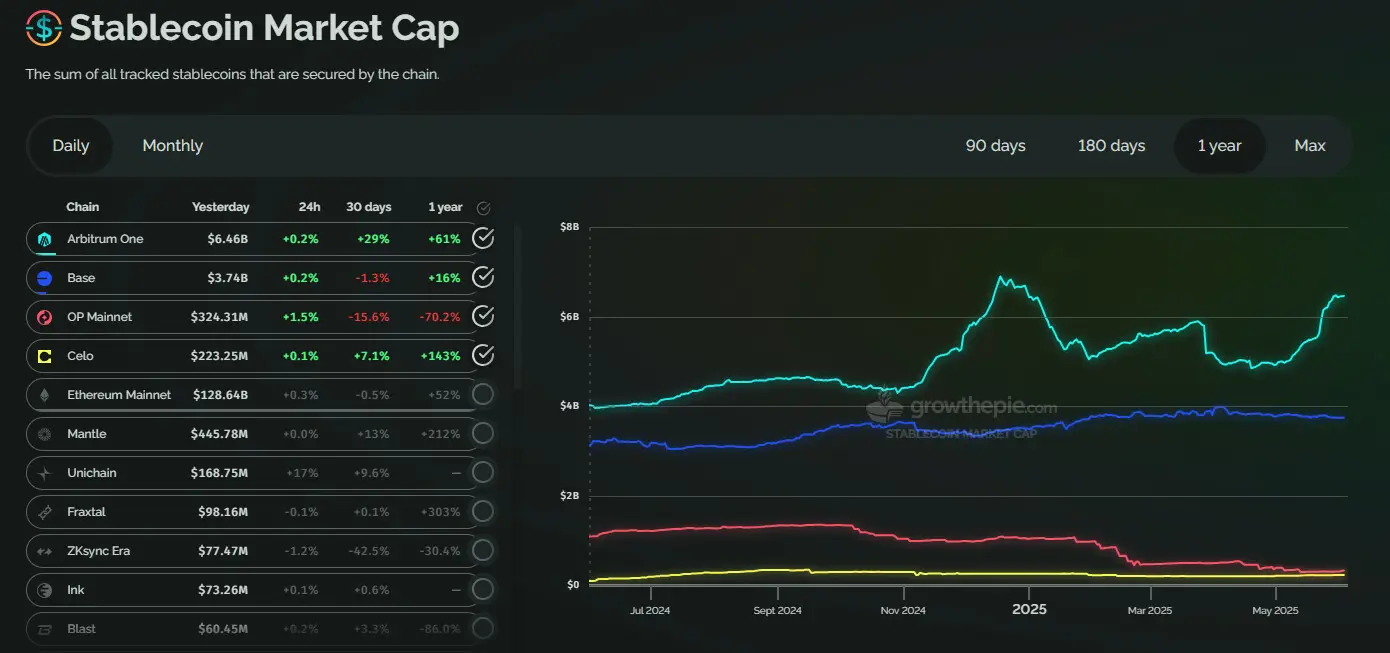

Stablecoins grew to a total supply of $246.1B, with DeFi becoming the second most active use case, following centralized trading. A total of $17.7B in stablecoins flowed into DeFi in a five-year time span, with rapidly increasing liquidity for specific protocols. Stablecoins returned to Arbitrum in the past month, injecting $6.4B into the L2 chain and its DeFi apps. Arbitrum is also recovering its stablecoin-related revenues, with almost constant growth from March onward.

Stablecoins returned to Arbitrum, one of the most active L2 chains for DeFi. | Source: GrowThePie

DEX and lending protocols have a different stablecoin profile. Some protocols retain a higher share of stablecoin-based revenues, while for others, the growth is marginal.

Keyrock discovered Ethereum and its L2 produced the most significant revenues from stablecoins usage. Despite the active transfers on TRON and Solana, the Ethereum ecosystem was still a hub for large-scale trading activity, DEX swaps, and perpetual futures trading.

Ethereum saw 23% in stablecoin-driven revenues for DeFi apps, while L2 achieved 23%. Solana only had 13% in stablecoin-driven revenues.

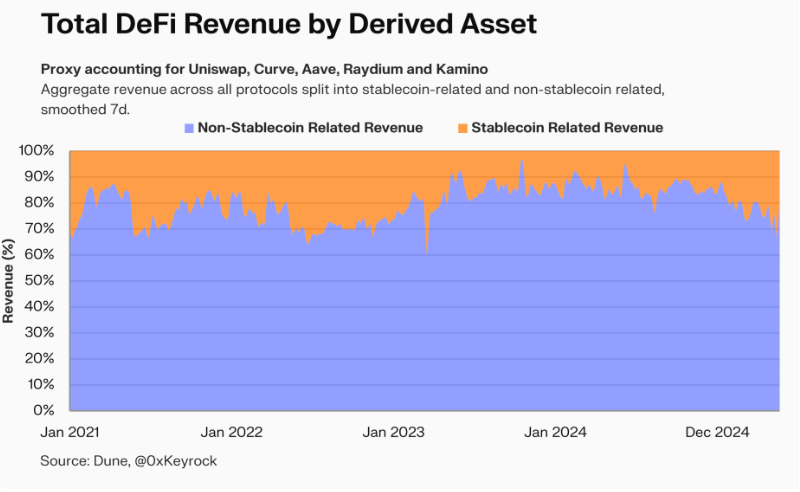

Stablecoin-derived revenues map out the return of a more active bear market. The current levels of DeFi revenues return to their range in 2021 when 35% of DeFi revenues hinged on stablecoins. During the lows of the bear market, stablecoin-driven revenues sank as low as 3%, as the market instability and corrections could not support revenue minting and sufficient collaterals.

The share of stablecoins in DeFi revenues is cyclical, with inflows marking bullish periods with more confidence in decentralized protocols. | Source: Keyrock Research

Keyrock discovered that stablecoins are not only a safe haven during bear markets. When used in DeFi protocols, stablecoin-driven revenues are a marker for overall bullish sentiment. Confidence in the market direction builds trust in lending protocols, DEX liquidity pools, and other DeFi apps for passive income.

Other discoveries show that in the short term, stablecoins are also used to protect realized gains, as tokens are held closely and not deployed into DeFi protocols. Stablecoin supply and usage have also decoupled from the performance of BTC, as some of the liquidity moved directly into DeFi.

The percentage of stablecoin revenues is more directly correlated to lending protocol yields. During periods of confidence, most lending protocols increase their rates, leading to an inflow of stablecoins and increased revenues. High yields mean there are also borrowers aiming to chase hot markets while paying a premium for access to stablecoin liquidity.

Stablecoins are also expanding their share of revenues for DEX. Stablecoin-derived revenues recovered to around 20% in 2025, from 10% at the end of 2025. DEX still uses other tokens to form pairs, but stablecoin liquidity is gaining importance for perpetual swaps, meme token trading, and general token swaps.

[ad_2]