[ad_1]

- Bolivia’s Bitcoin mining hash rate grows to 0.29% globally as inflation devalues the national currency.

- Venezuela’s advanced USDT adoption offers lessons on risk management and corporate financial protocols.

Bolivia’s economy is navigating a complex scenario marked by a scarcity of foreign currency. The national currency, the boliviano, faces consistent pressure on its value. Within this context, Bitcoin mining and the use of stablecoins like USDT have gained traction as practical alternatives for the population and businesses.

Growth of Bitcoin Mining in a Challenging Economic Environment

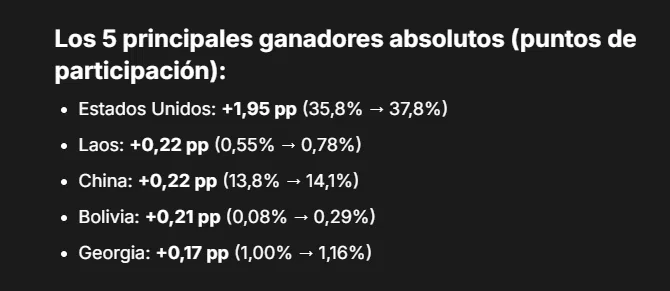

The global heat map from the Hashrate Index for the fourth quarter of 2025 placed Bolivia with a 0.29% share of the global Bitcoin hashrate. This figure, although small in the global landscape, represents a quantifiable growth compared to previous quarters.

Source: Hashrate Index

The country moved from a share of 0.08% to the current 0.29%, an increase of 0.21 percentage points. This increment places Bolivia among the five countries with the highest absolute growth in that specific period, categorizing it as an emerging player in global mining.

The primary motivation for this growth is not found in exceptional mining profitability, but in the local economic situation. Junior, a miner and activist from Costa Rica, pointed out that interest in Bitcoin mining in Bolivia arises as a method of protection against currency devaluation.

The Bolivian economy reports inflation that has reached 80%, with a devaluation of the boliviano reaching 50% in 2025. The official exchange rate remains at BOL 6.96 per dollar, but in the parallel market, the currency trades around BOL 16.50, implying a depreciation of 137% between both markets.

Fidel Torricos, chemistry expert and CEO of Solvexco

“Harnessing waste gas for cryptocurrency mining could diversify Bolivia’s economy, generate significant revenue, and address challenges such as foreign currency shortages and monetary volatility.”

Testimonies from local miners detail this reality. Carlos, a Bolivian miner, reported that income in local currency was insufficient due to inflation of 130% and the devaluation experienced in 2024. For him, digital mining became a necessary option. He clarified that, while mining in Bolivia does not present the same profitability as in countries like Paraguay or Costa Rica, high internal inflation has made it a viable activity.

Another miner, Huáscar Miranda, offered a more technical perspective on costs. Miranda explained that generating BOL 100 in Bitcoin consumes approximately 72 kWh of energy, a cost equivalent to 80 dollars in electricity. After considering additional expenses, the net profit is reduced to just BOL 10 per operation.

Diego Monroy, Sales and Applications Engineer at Luka Industries LLC.

“Machines that demand high levels of energy could operate efficiently and profitably in remote locations.”

This thin margin highlights the importance of optimizing operational costs. Miranda and other sector actors emphasize that mining is only competitive in Bolivia when using residual gas as an energy source. Fidel Torricos, a chemistry expert and CEO of Solvexco, supports this view. Torricos indicates that leveraging residual gas for Bitcoin mining can diversify the Bolivian economy. This practice could generate income and simultaneously address challenges like currency scarcity and monetary volatility.

USDT as a Tool for Financial Stability for Citizens and Businesses

Parallel to mining development, the use of the USDT stablecoin has experienced a pronounced increase in Bolivia. This digital currency pegged to the US dollar has become a fundamental tool for individuals and businesses to protect their capital from the instability of the boliviano. International automotive brands such as Toyota, Yamaha, and BYD have begun accepting payments in USDT within the country. This phenomenon is replicated in smaller-scale commerce, from local stores to restaurants, in cities like La Paz and Santa Cruz.

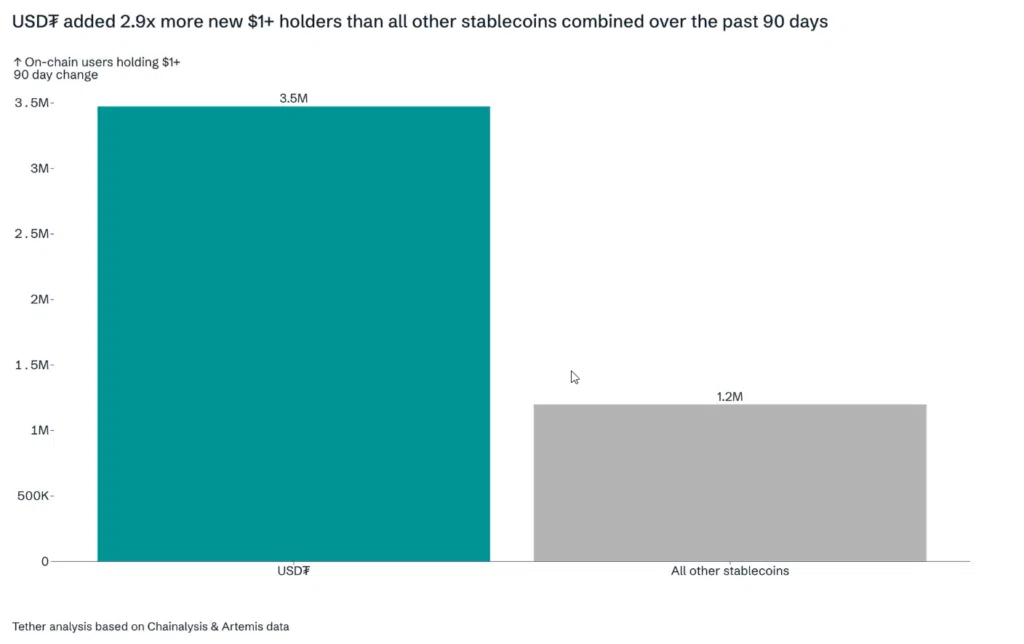

For Tether, the company issuing USDT, the Bolivian case validates its strategy in emerging markets. Global data from the company indicates that its stablecoin has added 2.9 times more holders with balances over $1 in the last three months, compared to all other stablecoins combined.

Source: X/Paolo Ardoino.

In Bolivia, USDT is consolidating alongside Bitcoin as a digital refuge against the erosion of the local currency’s purchasing power. In an interview, economist César Vargas Díaz revealed that the country’s gold reserves suffered a drastic reduction, falling from 40,000 tons to just 0.9 tons in the state’s vaults.

Vargas Díaz stated that the current monetary base lacks solid backing. He specified that money issuance reaches 9,000 million dollars, but the real monetary base is situated near 3,000 million, making the situation unsustainable. The economist proposed a fundamental change: switching the gold backing for lithium.

He suggested the creation of a new currency, the BSL, composed of 80% in paper format and 20% digital, backed by lithium reserves that he estimates at 184,000 million dollars. While this proposal is debated, the population has already made practical decisions. Bolivians conducted transactions worth 430 million dollars in Bitcoin and other cryptocurrencies within a twelve-month period.

Lessons from Venezuela: The Responsible Management of Stablecoins

In Venezuela, USDT has become deeply integrated into the daily operations of businesses. José Miguel Farías, a Venezuelan financial commentator, confirms that more and more companies use the stablecoin for payments, treasury management, and operations with clients or partners outside the country. Farías issues a crucial warning: the simple adoption of the digital asset does not guarantee adequate handling. He emphasizes that USDT is a tool that demands management, control, and applied financial criteria.

Cada vez más empresas en Venezuela están incorporando USDT en su operativa diaria: para pagos, gestión de tesorería u operaciones con aliados o clientes fuera del país. Pero hacerlo bien no se trata de subirse a una tendencia, sino de incorporar una herramienta que exige gestión,…

— José Miguel Farías (@Jmfariasu) October 9, 2025

Farías expressed that digital operations do not exempt the need for an operational structure; on the contrary, they demand it to a greater extent. He urges following the example of companies that manage USDT responsibly.

More and more companies in Venezuela are incorporating USDT into their daily operations: for payments, cash management, or transactions with partners or customers outside the country. But doing it right is not about jumping on a trend, but rather incorporating a tool that requires management, control, and financial judgment. Digital does not exempt you from structure: it demands more.

These companies establish clear internal policies that define the percentage of their treasury held in the asset, select the platforms on which they operate, and determine custody protocols for the funds. Farías emphasized that documenting every transaction, recording exchange rates, and backing the origin of funds is not mere bureaucracy, but a form of essential protection.

The first step is to recognize that using stablecoins is not an experiment, but a management tool. Companies that do it right establish clear policies: what percentage of their treasury will be in USDT, on which platforms it will be traded, and who has custody. Documenting every transaction, recording rates, and backing up sources of funds is not bureaucracy: it is protection.

The commentator clarified that using USDT is not equivalent to simply buying physical dollars. Behind the stablecoin there is a technology, a blockchain network, and an operational logic that companies must understand to maintain control over their resources.

Using USDT is not the same as buying dollars. Behind it lies a technology, a network, and an operating logic that companies must make an effort to understand. Those who do not understand how the money they manage moves around take risks they cannot see. And in this environment, ignorance is not paid for with devaluation, but with a direct loss of control.

Ignorance of how digital money moves generates invisible risks, such as the mismanagement of private keys or non-compliance with tax obligations. Farías recommends that companies develop internal capabilities, train their accounting teams, establish custody protocols, and evaluate the tax impacts of operating with digital assets.

🚨 ¿El Banco Central de Venezuela 🇻🇪 y el Banco de Venezuela van a añadir USDT a su sistema?

Te explico en este video versión extendida lo que realmente está pasando 👀 pic.twitter.com/FNt4r6Uq4m

— Criptolawyer (@criptolawyer) September 9, 2025

Economist Criptolawyer pointed out that the Venezuelan state increasingly uses USDT to make settlements, even above physical dollars, especially in operations linked to private companies and the oil sector.

Data from Chainalysis places Venezuela among the Latin American economies with the highest retail activity in cryptocurrencies, with over 44,600 million dollars in transactions recorded between July 2022 and June 2025. The demand for USDT is such that its price in Venezuelan bolívars surpassed 300 bolívars per unit in September, after an increase of almost 44% from the 208 bolívars recorded at the beginning of the same month.

[ad_2]