[ad_1]

The Bitcoin halving is a critical event in the cryptocurrency market, where the rate of new BTC supply issuance is halved. This reduction is expected to increase scarcity and potentially drive up the price, particularly if demand remains constant or increases.

The upcoming Bitcoin halving has sparked significant interest and speculation, with many experts predicting substantial price increases.

How the Next Bitcoin Halving Will Impact Prices

Historically, Bitcoin has experienced significant price hikes following halving events, though not immediately. Hannah Phung, Lead Data Analyst at SpotOnChain, told BeInCrypto that price increases tend to occur around 6 to 12 months post-halving.

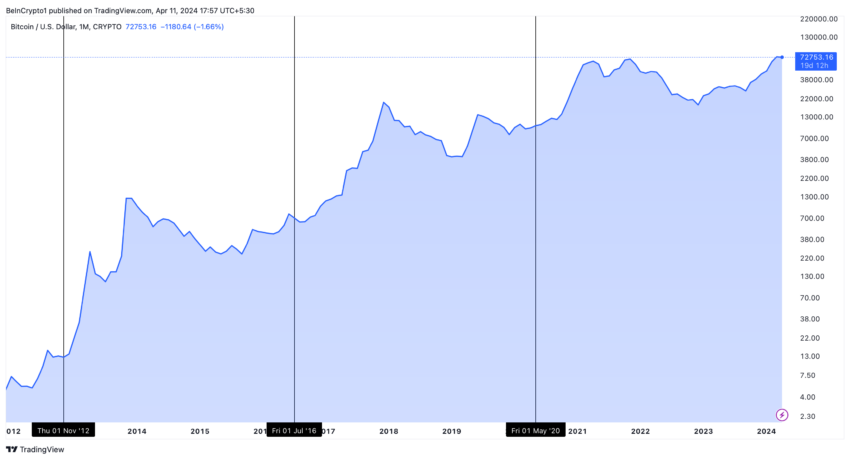

For instance, after the first halving in November 2012, the price rose from around $12 to over $1,000 by late 2013. Similarly, the second halving in July 2016 saw the price of Bitcoin skyrocket from around $650 to nearly $20,000 by December 2017. The third halving in May 2020 resulted in the price surging from around $8,000 to an all-time high of $69,000 by November 2021.

“In theory, the supply reduction increases scarcity, consequently driving up the price, especially if demand remains stable or rises. Moreover, the reduced supply also means miners have fewer BTC to sell to cover their costs, decreasing selling pressure,” Phung emphasized.

Bitcoin Price Performance. Source: TradingView

The cryptocurrency market has evolved significantly since these earlier halving events. With wider adoption and growing institutional interest. Indeed, demand from Bitcoin exchange-traded funds (ETFs) may introduce additional complexity to price dynamics as well as the potential easing of monetary policy.

For these reasons, some analysts predict Bitcoin’s price could rise to $200,000 or $500,000. However, the precise timing and scale are still unclear.

“While past trends offer some insight, the cryptocurrency market is unpredictable. There’s no guarantee the upcoming halving will follow the exact pattern of previous ones. The Bitcoin market is much larger and more established compared to earlier halvings. Still, I am very optimistic about a price increase after the halving, but the exact timing and magnitude remain uncertain,” Phung added.

Market Sentiment as a Barometer for BTC Price

Market sentiment typically undergoes distinct phases leading to and following a Bitcoin halving. Pre-halving, anticipation builds, leading to a generally bullish sentiment. Post-halving, sentiment may experience a short-term boost as the reduced supply of new BTC begins to take effect.

Investors should pay attention to several indicators during these phases to gauge market sentiment and potential price movements, including technical analysis, news and social media, and on-chain analysis.

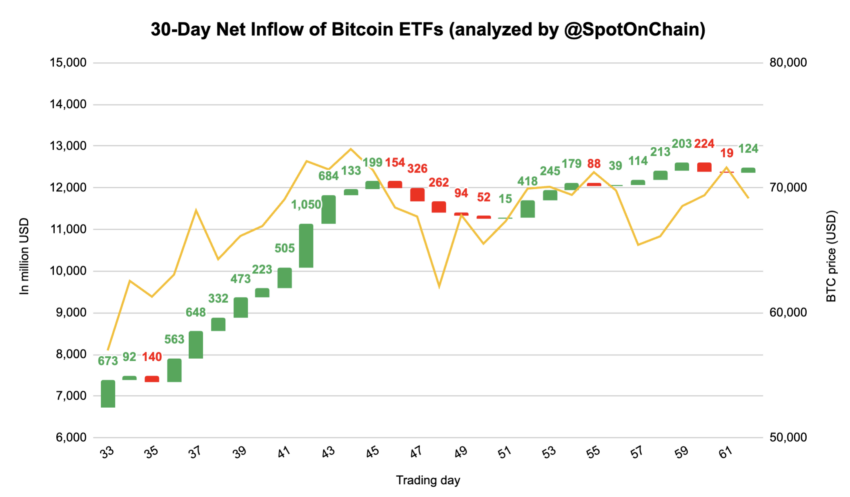

“Technical indicators like price charts and trading volume can provide insights into market sentiment. Meanwhile, news and social media discussions around Bitcoin and the halving can reveal investor sentiment. Analyzing on-chain data, such as active addresses or exchange inflows/outflows, can also indicate investor behavior. Finally, net inflows into Bitcoin ETFs signify purchasing behavior,” Phung explained.

Bitcoin ETF Net Inflows. Source: SpotOnChain

According to Phung, investor behavior also exhibits notable changes in response to Bitcoin halvings. Increased risk tolerance, a focus on long-term holding, and the entry of institutional investors are common trends.

While a surge in buying due to FOMO (fear of missing out) might be short-lived, the increasing institutional involvement suggests a focus on long-term holding that could lead to a more mature market with a lasting impact. This narrative surrounding the halving may encourage institutions to view the reduced supply as a positive factor for long-term price appreciation.

However, institutions will likely approach Bitcoin investment with robust risk management strategies. They may weigh the potential benefits against the inherent volatility of the asset.

“While Bitcoin offers the potential for high returns, it also carries higher risk compared to most traditional assets. Thus, investors should carefully assess these trends and correlations when integrating Bitcoin into their investment portfolios,” Phung concluded.

As a long-term store of value, akin to gold, Bitcoin’s limited supply and decentralization appeal to investors seeking inflation hedges. The integration with traditional finance systems has further legitimized Bitcoin. Given these market conditions, the upcoming Bitcoin halving could lead to increased price stability in the long run due to reduced supply.

[ad_2]