[ad_1]

Last week, S&P Global assigned a “B-” issuer credit rating with a stable outlook to Sky Protocol — formerly known as Maker — a decentralized lending platform that issues the USDS stablecoin.

The credit rating agency cited centralization concerns, including a “high concentration of depositors,” “centralized governance,” “high regulatory risk from uncertainty about regulatory frameworks for decentralized protocols,” and “weak risk-adjusted capitalization” in its decision.

In its rating report published on Aug. 7, S&P Global Ratings said that these risks are “partly offset by the protocol’s good track record of limited credit losses since 2020, and modest earnings.” The report specifies that an better rating “is highly unlikely within the next 12 months, and would require significant improvements to governance and capital position,” while a downside scenario could involve deterioration in liquidity, high loan losses, or adverse regulatory moves.

In coming to the B- rating, the credit agency said that it assessed the creditworthiness of Sky’s token liabilities, including USDS, as well as its DAI stablecoin, which the protocol said during its rebrand will eventually be phased out and replaced by USDS. Other liabilities include related savings tokens, sUSDS or sDAI. In the report, the analysts assessed the risk of Sky defaulting on the tokens, defining a default in this case as a haircut — meaning a reduction in value — for token holders.

S&P Global’s report noted that the key risks that could lead to such a default on its tokens include “depositor withdrawals of more than the liquidity available in the peg stability module (currently held in USDC, a centralized stablecoin), and credit losses that would exceed available capital.”

Key Risks

Speaking about Sky Protocol, Andrew O’Neill, managing director and analytical lead for digital assets at S&P Global Ratings, told The Defiant that, beyond the overall pace of change in DeFi, the project is undergoing “a period of significant change through its Endgame roadmap, affecting its governance and capitalization.”

He said that S&P used on-chain data and governance transparency to monitor developments relevant to its rating analysis.

O’Neill also explained that the analysis considers both the current governance and operational framework as well as the roadmap’s strategic direction. Any major shift would prompt a review. If a fork were created to take the protocol in a new direction, he stressed that “the existing rating only applies to the existing protocol.”

O’Neill told The Defiant that S&P’s ratings are generally reviewed annually, and “on an ad hoc basis when we observe developments that impact credit quality.”

Centralization Concerns

The S&P Global report said that governance of Sky Protocol remains effectively controlled by co-founder Rune Christensen due to low voter turnout, and warned of strategic disruption risks, despite that fact that Christensen owns just 9% of governance tokens.

S&P’s analysis showed that Sky’s capital ratio at 0.4% as of late July, with 35% of assets in tokenized real-world assets, namely U.S. Treasury bills and USDC. The report noted that Sky’s liquidity reserves, including tokenized money market funds, provided a buffer but could be tested in a run scenario.

Stablecoin Reports

This was not S&P’s first foray into crypto ratings. In December 2023 it launched a 1-5 rating of stablecoin stability that looked at reserve quality, custody and market or credit risk, plus mitigants such as collateralization, redeemability, liquidation rules and operational controls.

Under that framework, S&P assessed eight stablecoins at the time: Sky’s DAI, First Digital USD (FDUSD), Legacy Frax Dollar (FRAX), Gemini Dollar (GUSD), Pax Dollar (USDP), Tether (USDT), True USD (TUSD) and Circle’s USDC.

The market cap of Sky’s USDS stablecoin — which was launched after these ratings came out, in September 2024 — currently stands at $7.9 billion, ranking it fourth among stablecoins, behind Tether’s USDT, Circle’s USDC and Ethena’s USDe.

At the time, FRAX and TUSD received the weakest score — a 5, which the firm defines as “weak.” S&P flagged under-collateralization, heavy reliance on on-chain collateral and uncertainty about future collateral plans.

Tether’s USDT was rated 4, or “constrained,” for limited clarity on where and with whom reserves are held, investments in riskier assets, and limits on direct redemption options. By contrast, USDC, GUSD and USDP scored 2, or “strong,” showing more clarity on reserve makeup, including safer short-term assets, and greater transparency, according to S&P Global.

It’s unclear how S&P decides which stablecoins to review, as it hasn’t shared any formal selection rules. Since late January, when it released a report on Ethena’s USDe, the credit rating agency hasn’t issued any new stablecoin-specific assessments.

When asked whether S&P had stopped rating stablecoins, O’Neill clarified in comments to The Defiant: “The most recent new stablecoin stability assessment that we assigned was indeed in January 2025, but we continue to monitor all 12 of the assessments that we’ve published, on an ongoing basis.”

The pause has left some relatively large-cap stablecoines without an assessment. Among the stablecoins yet to be rated is USD1, launched earlier this year by World Liberty Financial, the DeFi venture closely tied to President Donald Trump. USD1 is currently the seventh-largest stablecoin by market cap, with about $2.2 billion at press time.

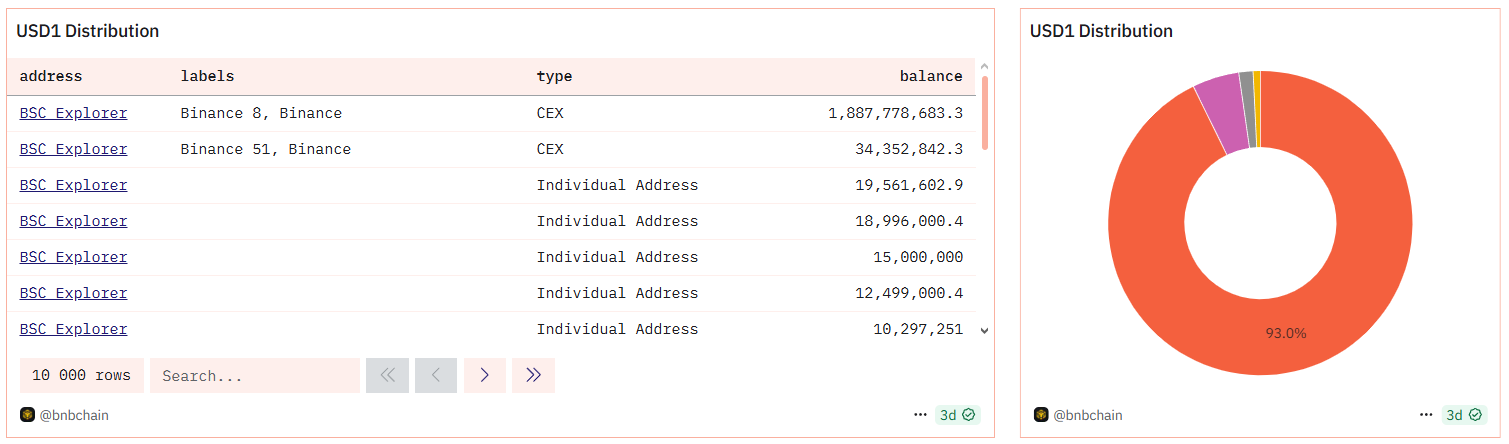

USD1 distribution. Source: Dune Analytics

USD1 was launched on BNB Chain and, according to data from Dune Analytics, has more than 90% of its supply held on a single exchange, what appears to be Binance.

When asked about plans to rate new stablecoins, including USD1, O’Neill said the firm “cannot comment on any potential future publications of new assessments.”

[ad_2]