[ad_1]

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

United States President Donald Trump signed an executive order to create a sovereign wealth fund. While the media speculates whether the US government will invest in crypto, let’s take a broader look at the past and the potential future of Bitcoin (BTC).

You might also like: The focus is on strengthening US leadership in crypto tech | Opinion

What formed Bitcoin’s trends?

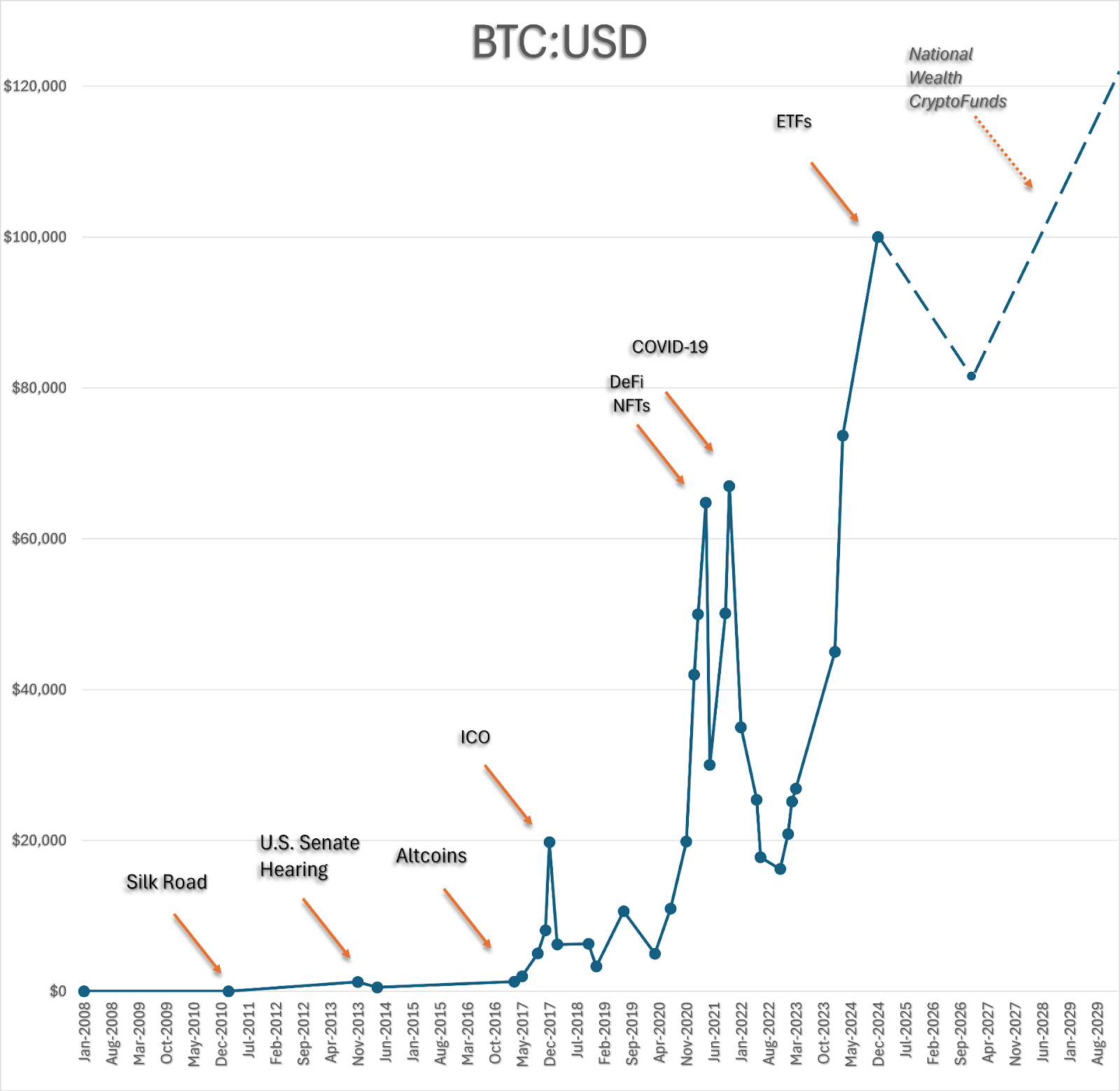

Over the last 17 years, Bitcoin’s price climbed from $0 to a historic high of $110,000, yet its trajectory has been anything but linear. In 2010, for instance, you needed five thousand BTC just to buy a pizza. The dawn of the infamous Silk Road marketplace in 2011 contributed to an early price spike. When the US authorities took down the marketplace, the subsequent US Senate public hearing unexpectedly propelled Bitcoin’s price from several hundred dollars to over $1,200 per coin.

Bitcoin price chronology: Main trends and milestones | Source: Courtesy of the author

Then came the first altcoin season, fueled by the arrival of Ethereum (ETH) in 2016 and the initial coin offering boom ending in 2017. This period pushed Bitcoin to an unbelievable high of $20,000. After its first crypto winter of 2017–2018, Bitcoin gradually rebounded. The rise of decentralized finance and the explosion of nonfungible tokens injected renewed energy as innovative projects and enthusiastic adopters bid up prices again. Although Bitcoin itself was not the driving force behind DeFi—Ethereum’s smart contracts took that role—Bitcoin remained the main gateway for crypto investments, with its “wrapped” version appearing on decentralized exchanges and automated market makers from 2018 to 2020. NFTs also accompanied Bitcoin’s climb. After a modest rollback, COVID-19 struck, and governments all over the world poured out a rain of freshly printed money to their citizens, fueling another wave of investor interest.

Just as it appeared trends were slowing, institutional investors entered the scene. Traditional financial institutions began embracing Bitcoin, launching exchange-traded funds around 2022, which peaked in popularity between 2024 and 2025. This broadened access for both retail and institutional investors and reinforced Bitcoin’s status as “digital gold.”

National wealth funds

Now, with rumors swirling that the US government might soon hold direct crypto investments through newly initiated Sovereign Wealth Funds, it’s worth considering what would happen if this becomes reality.

Undoubtedly, the United States would set a global precedent for other countries. This trend could shape the next two to five years and potentially send Bitcoin’s price skyrocketing, perhaps fulfilling the wildest dreams by reaching $1,000,000 per coin. There is a catch, though. Even the most powerful financial organizations can suffer from short-sightedness.

What drives Bitcoin’s value?

Bitcoin never fully became the “electronic cash” envisioned in Satoshi Nakamoto’s white paper. Its Silk Road era may have been its golden age for real-world transactions. For clarity, it remains the go-to option for shady trades worldwide. In legitimate markets, Bitcoin functions primarily as a store of value—a speculative asset traded by investors with little regard for its original utility.

We’ve seen it evolve through multiple eras, and we now stand on the threshold of potentially the biggest one yet: national investments. Many governments already own some BTC, often seized from criminal enterprises. Still, if treasury departments jump in late, they might miss significant profits, while early movers like El Salvador could enjoy a larger windfall. Each trend so far has expanded Bitcoin’s investor base, but what could surpass the participation of institutional organizations, superannuation funds (yet to embark), and national treasuries? Eventually, you run out of buyers on Earth—there’s certainly no one on the Moon to continue the trend once Bitcoin gets there.

That is why I consider it short-sighted to expect that Bitcoin’s speculative value will continue to be fueled by these trends indefinitely. Those who could shape Bitcoin’s future and make its use truly sustainable, beyond mere speculation, unfortunately, show few signs of having a long-term vision. My prediction is that they will quietly exit before the trend turns downward.

Alternative (sustainable) future

Many question Bitcoin’s reliability, but such skepticism often relies on flawed assumptions. Bitcoin is neither centralized nor vulnerable: it has operated as a publicly accessible ledger for over 17 years without major disruptions—an unparalleled feat.

If national treasuries recognize Bitcoin’s resilience, it could pave the way for long-overlooked applications. Bitcoin has the potential to evolve into a robust application platform similar to Ethereum. While some engineers debate this, I believe their skepticism stems from a lack of in-depth expertise in this area.

Imagine leveraging Bitcoin’s blockchain for a national land registry, a decentralized alternative to ICANN’s TLD system, or even a voting system for democratic countries. Bitcoin’s higher fees could be justified by its unprecedented security—particularly for mission-critical public and private systems that handle valuable assets. While cheaper, less secure blockchains may appeal to speculative or experimental projects, Bitcoin is designed for scenarios where reliability trumps cost.

Conclusion

I’ve long advocated for building dApps and smart contracts on Bitcoin (and I am deeply involved in the technical side), contending that its high fees are a worthwhile trade-off for top-notch security. It’s for the “big boys”—sectors where reliability is non-negotiable. If national treasuries finally embrace Bitcoin as the ultimate digital store of value, it will open the door to its true utility as the digital fortress for the most critical pieces of public infrastructure—its price will never turn back, literally reaching the Moon and even Mars.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Read more: Will Bitcoin survive the coming financial collapse? | Opinion

[ad_2]