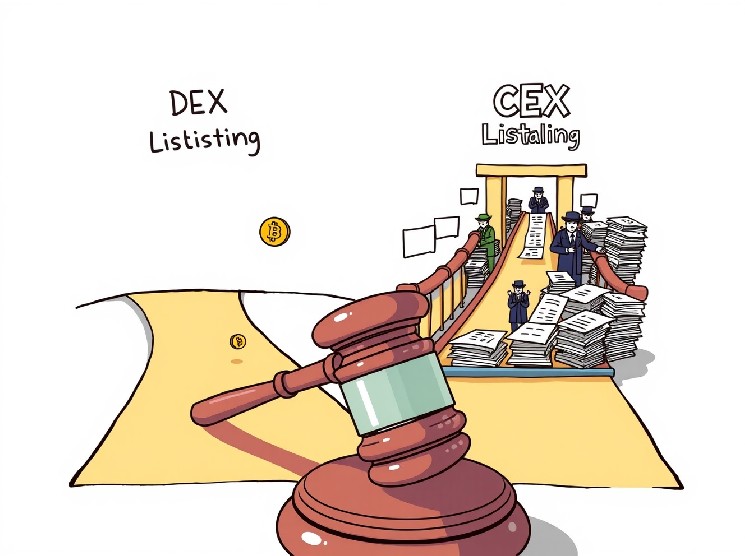

The world of cryptocurrency is constantly evolving, bringing with it new legal precedents and clarifications. A recent landmark decision by a South Korean court has provided crucial insight into the distinct challenges involved in DEX CEX listing. This ruling formally recognizes the significant difference in difficulty between getting a token listed on a decentralized exchange (DEX) versus a centralized exchange (CEX), a distinction that could profoundly impact how projects approach their market entry and contractual agreements.

Why is DEX CEX Listing So Different? Understanding the Core Divide

Understanding the court’s perspective requires a closer look at the fundamental operational models of these two primary types of cryptocurrency exchanges. The South Korean court’s ruling underscores that the process for a DEX CEX listing varies dramatically, primarily due to their underlying structures and regulatory environments.

On one hand, centralized exchanges (CEXs) act as gatekeepers in the crypto world. They operate with strict regulatory compliance, extensive due diligence, and often demand a lengthy, rigorous review process for any token seeking a listing. This comprehensive evaluation typically includes assessing the project’s legitimacy, its technological innovation, the credibility of its development team, market potential, and adherence to various legal frameworks.

Conversely, decentralized exchanges (DEXs) function on a permissionless model. This means that virtually anyone can initiate trading for a token by simply creating a smart contract and establishing a liquidity pool. This design inherently removes the need for a central authority’s approval, making the barrier to entry significantly lower and the process far more accessible for new tokens.

The Seoul Court’s Definitive Stance on DEX CEX Listing Requirements

The specific case that brought this crucial distinction to light involved a dispute over a performance bonus tied to a cryptocurrency listing contract. A plaintiff argued that listing a carbon credit-linked token on a DEX fulfilled a contractual requirement for an “overseas exchange” listing.

They sought a substantial payment of six million tokens, firmly believing their actions had met the agreement’s terms. However, the 33rd Civil Affairs Division of the Seoul Central District Court, on September 4th, rendered a definitive verdict that challenged this interpretation.

The court decisively rejected the plaintiff’s claim. It explicitly emphasized that the ease of creating a smart contract and establishing a liquidity pool on a DEX cannot be equated with the stringent, multi-faceted review process required by a CEX. This landmark ruling sets a clear precedent for how “exchange listing” might be interpreted in future contractual agreements, especially concerning DEX CEX listing conditions and their associated rewards.

What Are the Far-Reaching Implications for Crypto Projects and Contracts?

This South Korean court ruling carries significant weight for cryptocurrency projects, developers, and investors, not just locally but across the global blockchain ecosystem. It underscores the critical importance of clear, precise language in any contracts related to token listings and performance metrics.

Key takeaways and actionable insights for the industry include:

- Enhanced Contractual Clarity: Future agreements should explicitly define whether a “listing” refers specifically to a CEX, a DEX, or encompasses both. Ambiguity, as seen in this case, can lead to costly and time-consuming legal disputes.

- Strategic Listing Planning: Projects aiming for broader market adoption and perceived legitimacy might still prioritize CEX listings, despite their higher barrier to entry. However, DEX listings remain an invaluable initial step for establishing early liquidity and community engagement.

- Refined Investor Perception: Investors and institutional players are likely to view CEX listings as a stronger validation of a project’s credibility, stability, and long-term viability, given the rigorous vetting process involved. This could influence investment decisions and project valuations.

- Regulatory Scrutiny: The ruling highlights the increasing legal and regulatory scrutiny on the crypto space, pushing for more defined terms and responsibilities for all participants.

Ultimately, the ruling provides a robust legal framework that distinctly separates the two types of listings, impacting how performance bonuses, equity releases, and other contractual obligations tied to DEX CEX listing are viewed and enforced.

Navigating the Future of DEX CEX Listing: A New Standard?

The Seoul Central District Court’s decision is more than just a verdict in a single case; it represents a foundational clarification for the entire crypto ecosystem. By formally acknowledging the vast disparity in difficulty for DEX CEX listing, the court has provided much-needed legal precedent that the industry must heed.

This ruling encourages greater precision and accountability in legal and business dealings within the blockchain space. It serves as a powerful reminder that while decentralization offers incredible accessibility and innovation, the path to mainstream acceptance often involves navigating the more stringent requirements of traditional financial gateways.

Cryptocurrency projects and stakeholders must now carefully consider these distinctions when drafting contracts, setting development milestones, and strategizing their market presence. This decision sets a new standard for understanding the value and effort associated with different types of exchange listings.

Frequently Asked Questions (FAQs)

Q1: What is the main difference between a DEX and a CEX, according to the court’s ruling?

A1: The court ruled that CEXs require a rigorous review process for token listings, involving extensive due diligence and compliance. In contrast, DEXs allow anyone to easily initiate trading by creating a smart contract and liquidity pool, making the listing process significantly simpler and permissionless.

Q2: Why did the South Korean court rule that DEX listings are easier?

A2: The court’s reasoning was based on the operational models. CEXs have central authorities that vet projects, while DEXs are decentralized, allowing anyone to list tokens without approval, simply by setting up the necessary smart contracts and liquidity.

Q3: How does this ruling impact cryptocurrency project contracts?

A3: This ruling emphasizes the need for extreme clarity in contracts. Agreements involving token listings should explicitly state whether a “listing” refers to a CEX, a DEX, or both, to avoid future legal disputes over performance bonuses or other obligations.

Q4: Does a DEX listing provide the same benefits as a CEX listing?

A4: While DEX listings offer accessibility and early liquidity, CEX listings often provide broader market reach, increased investor trust due to rigorous vetting, and perceived legitimacy. The court’s ruling suggests they are not equivalent in terms of the effort and validation they represent.

Q5: Is it always better to list on a CEX than a DEX?

A5: Not necessarily. The “better” option depends on a project’s goals. DEXs are excellent for early-stage projects seeking immediate liquidity and community engagement. CEXs are often preferred for projects aiming for mainstream adoption, institutional investment, and higher visibility, despite the more challenging DEX CEX listing process.

Was this article helpful in understanding the crucial distinctions in cryptocurrency exchange listings? Share your thoughts and this article with your network on social media to keep the conversation going and inform others about these vital legal developments in the crypto world!

To learn more about the latest explore our article on key developments shaping cryptocurrency exchange price action.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.