SoSoValue has become the first project to disclose data via a trial spot listing feature on Bybit in a bid to provide investors with more clarity regarding its development status and positively influence their decision-making.

The act of disclosing such critical data has just been introduced on Bybit and is still in the trial phase. It is similar to Binance’s proof-of-reserve, which became a thing after the eventual bankruptcy of the defunct FTX cryptocurrency exchange and the crash of other similar platforms.

Bybit believes the new feature communicates its commitment to promoting transparency in project data and hopes the information translates into informed decisions.

Some of the data included in the disclosure

As earlier stated, the data SOSO disclosed aims to provide potential investors with a clearer view of its development status and is expected to aid informed decision-making.

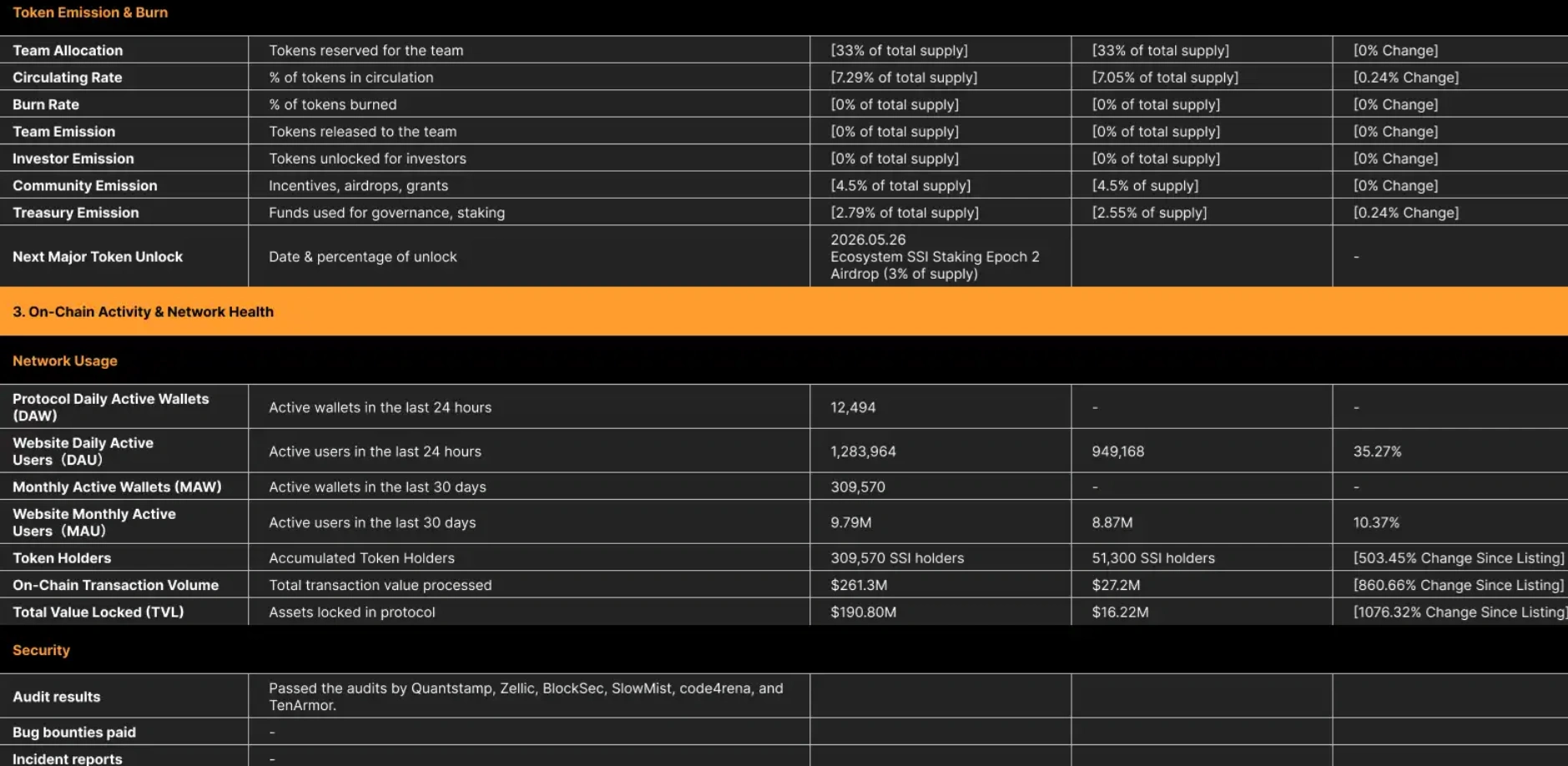

According to the data, one month after listing, SOSO’s circulating supply is $72,908,333, with an inflation rate of 3.41% since listing. As far as SSI staking goes, it shows that 95.11% of the total supply is staked.

SoSoValue’s data publication on Bybit. Source: Bybit

33% of the total tokens are reserved for the team and none has been released to them so far. No tokens have also been unlocked for investors and the next major token unlock is not expected until 2026 when there will be another airdrop for those who staked.

SoSoValue’s data publication on Bybit. Source: Bybit

The data also shows that SOSO has passed audits by reputable sites like QuantStamp, Zellic, BlockSec, and TenArmor.

Bybit’s new data disclosure feature is similar to Binance’s proof-of-reserve

Bybit’s new effort at transparency comes years after its contemporary, Binance, the world’s largest crypto exchange, announced plans to implement a proof-of-reserve system on November 8, 2022.

As earlier stated, Binance made the decision after a couple of exchanges, including FTX, fell which led to a significant financial crisis, with billions vanishing. It used Merkle Trees, a cryptographic data structure, to achieve this as it ensures transparency and security when it comes to the verification of its digital asset holdings.

The proof-of-reserve system allows Binance users to verify that the custodian is in possession of all the assets it claims to have. CZ, who championed the course, hoped the mechanism would prevent exchanges from misusing client funds and increase the overall trust people have in centralized exchanges.

The system involves audits that confirm the accuracy of any reported reserves, and it has been very useful over the years in helping investors make informed decisions.

After it was announced, many industry leaders and KOLs praised the initiative, claiming it was a step in the right direction. Since then various other exchanges like OKX have done the same.

Quite a lot of crypt users still think “not your keys not your funds” when it comes to centralized exchanges, but the proof-of-reserve system has become a way to “vibe check” projects, ensuring they are what they say they are.

Still, it is crucial to note that while proof-of-reserve works to promote transparency, there is no accepted standard for these attestations, so not all reports are created equal.

For example, exchanges like Binance offer proof-of-reserves that are, for the time being, simply self-attestations not completed by an independent third party like Bybit’s. This means users have to take Binance’s word that a project is being transparent unlike when a third party is involved and is able to certify the attest actions are on point. Other exchanges besides Bybit that use a third party to audit projects include Kraken, Uphold, and Bitstamp.