[ad_1]

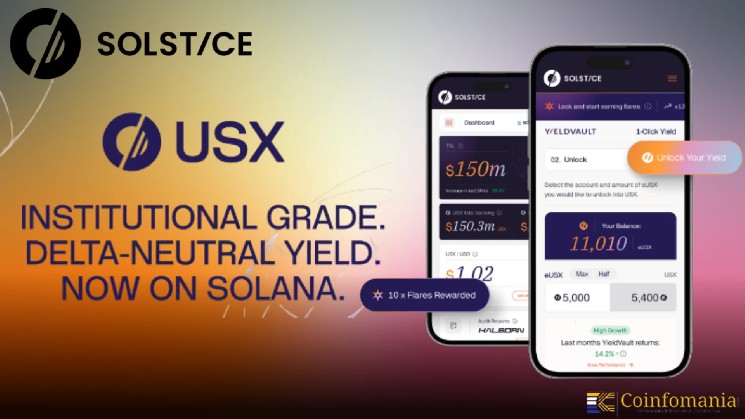

Solstice (@solsticefi) has launched a Solana-native yield strategies protocol called YieldVault, which aims to offer institutional-grade and delta neutral yield strategies. The post was announced by Da Vinci (@OxDavinci) on October 6, 2025, and it puts an emphasis on intelligent, transparent yield generation, without hype or high-risk speculation. Users lock the $USX to mint the yield bearing token, $eUSX, which continues to earn profits over time with the protection of principal.

The future of onchain yield: Delta-Neutral Strategies with @solsticefi

Solstice is building a transparent, institutional-grade yield layer on Solana.

No hype, no degen risk, just smart strategies built to last.At its core is YieldVault, where you lock $USX to mint $eUSX and… pic.twitter.com/2M4R4ArxXn

— Da Vinci (@OxDavinci) October 6, 2025

How YieldVault Works

YieldVault has several strategies that would help it to produce sustainable yield. First, funding rate arbitrage takes advantage of disparities in perpetual futures funding rates across exchanges, with daily returns of between 0.01 and 0.1 per cent. Third, tokenized treasury transfers invest in low-volatility assets, which also provides security of the principal to a greater extent.

Performance and Track Record.

YieldVault has recorded good performance since its establishment. The platform also had a 2024 annualized revenue of 21.5, which was much greater than the traditional finance interests of 415% and even better than most DeFi protocols which had an average of 1015% APY. This protocol has a zero principal loss since 2020, and has survived large crypto market crashes in May 2021 and November 2022.

Market Context

The Solana ecosystem has now grown into its prime, and total value locked (TVL) has crossed the 5 billion mark in 2025. The general crypto market is optimistic, with $BNB at the price of $1,164.53 and Bitcoin nearing the mark of 100,000, which is an encouraging factor in the development of DeFi. YieldVault has a stable yield of 21.5% APY with a competitive yield only to those yield farms with risky yields of over 100% APY and is also a competitive yield to those protocols such as Aave (15% APY) and Compound (12% APY). Solstice will reinforce the ecosystem by providing institutional yield strategies on Solana, which will increase investor confidence.

Strategic Implications

The Solana yield layer YieldVault is the first institutional-grade yield layer on Solstice. Investors would have an opportunity to find a conservative, high-yield DeFi solution with minimal entry barriers, and Solana would have the opportunity to operate in a more mature ecosystem, leaving speculative token projects behind and entering sustainable financial products.

Risks and Considerations

YieldVault cannot completely avoid exposing itself to the extremities of the market despite the delta-neutral approach, including black swan events. Global DeFi regulations and local crypto taxes could become sources of regulatory scrutiny, which can affect adoption. Moreover, the protocol is mostly based on audited smart contracts and oracles, violating which may affect trust and user confidence.

YieldVault is a unique institutional-grade DeFi, which is on Solana and integrated delta-neutral strategies, a solid history of 21.5% annualized returns, and protective of principal since 2020. It has a bootstrapped liquidity of more than $100 million, and an open operational structure, which makes it accessible to any wallet compatible with Solana. By offering a reliable option to risky yield farms in the context of an optimistic crypto market, YieldVault will secure the maturity of the Solana ecosystem and a longer commitment of its investors.

[ad_2]