[ad_1]

Today, enjoy the Lightspeed newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Lightspeed newsletter.

Howdy!

It’s a cold world out there, but the return of fast food meal deals has been giving me joy lately. Over the weekend, I stopped by Taco Bell to get their new $7 meal, which came with a chalupa, taco, burrito, chips, and a drink — what value! McDonalds’ new $5 combo isn’t bad either.

There are always reasons to smile. Anyways:

One market maker to rule them all

Stablecoins are like the liquidity lifeblood of crypto — helping assets on- and off-ramp to protocols. They also carry the promise of real-world transactions, from remittances to Coinbase’s USDC Pizza promotion in New York City.

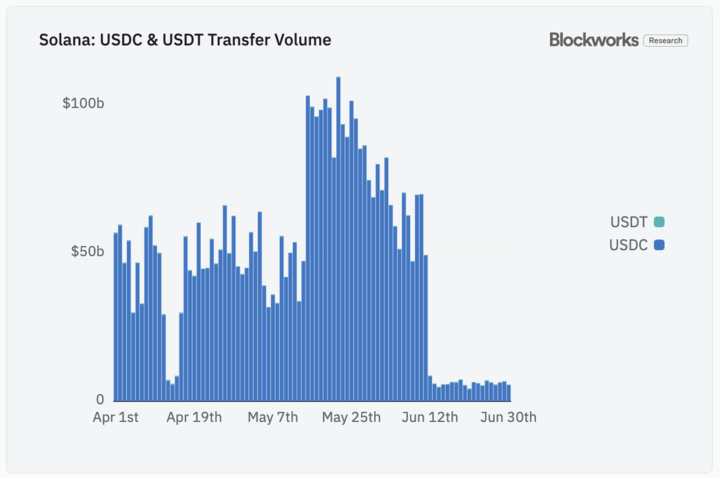

At first glance, Solana’s stablecoin volume appears to have fallen off a cliff during June. In the past two weeks, Solana USDC and USDT transfer volume has been at its lowest point in 2024, according to Blockworks Research.

Weekly volume was around $43 billion after topping $500 billion three different weeks in May.

The drop-off was largely caused, it seems, by a single market maker on the Solana DEX Phoenix changing its strategy.

Blockworks Research data shows a single wallet address — carrying out market making activities on Phoenix — accounted for nearly 50% of Solana stablecoin transfer volume in May and part of June. I confirmed with Phoenix Developer Ellipsis Labs that this single Phoenix market maker was responsible for the large transfer volume.

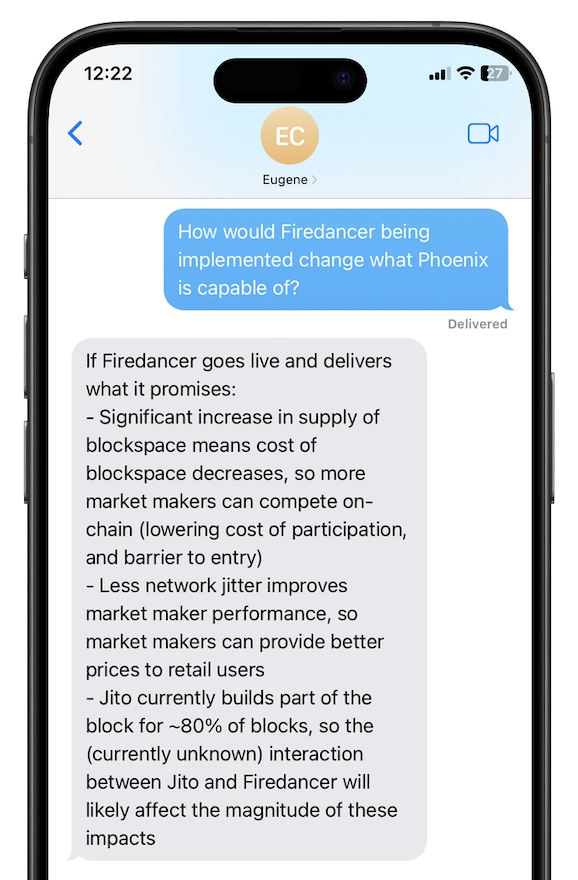

Phoenix is a Solana decentralized exchange and onchain orderbook — which discovers the price of assets onchain as opposed to on offchain venues like Binance, for instance.

This orderbook — which is basically a list of all pending buy and sell orders on the exchange — confirms and settles trades quickly in part because Solana is built to be fast. The exchange is enabled by market makers which place buy and sell orders to ensure the orderbook stays liquid enough to support trading.

As part of high-frequency trading, which is the sort of thing Phoenix hopes to enable, market makers will quickly place and cancel orders to make sure their prices are in line with the rest of the market, an Ellipsis Labs spokesperson said. This one market maker (whose contract address is here) appears to have been placing and canceling trades in such a way that they would deposit and withdraw their entire USDC balance repeatedly.

This drove up the USDC transfer volume on the Solana network as a whole and — at first blush — made Solana’s stablecoin usage appear far higher than it actually is.

When this market maker stopped moving so much USDC around, Solana may have lost nearly 50% of its daily stablecoin transfer volume. In an email, Ellipsis said trading volume is a much more useful metric than transfer volume in measuring economic activity.

The inflated numbers were pointed out as early as January, when a video was making the rounds showing Solana’s stablecoin volume dwarfing other blockchains. It was brought up again last week when the stablecoin transfer volume decreased suddenly.

I asked Sphere Labs’ Arnold Lee about the lower Solana stablecoin figures.

“I’d say they are used fairly significantly, just overshadowed by the insane activity on Phoenix,” Lee said of stablecoins on Solana.

“That said, we see the majority of stablecoin activity on Tron/BSC because stablecoins are most relevant outside of the West, and Tron/BSC have the most local presence (lindy) and ancillary infrastructure (eg. Huobi, Binance) despite being significantly slower and more expensive,” Lee added.

Following Ethereum, Tron and BSC have the second- and third-largest stablecoin market capitalizations, at 35% and 3% of the total, according to DeFiLlama.

Solana is in sixth, trailing Ethereum layer-2s Arbitrum and Base.

— Jack Kubinec

Zero In

The prospect of spot solana ETFs didn’t do much to close the price gap between SOL and ETH, it turns out.

Kaiko’s weekly data debrief examined market sentiment following SOL ETF filings from VanEck and 21Shares. It largely found that traders were unenthused. The ETH to SOL ratio, which shows how many SOL one ETH is worth, trended relatively flat during the SOL ETF news cycle. In other words, the two assets performed roughly the same.

Solana outpaced ether starting in March, but the script flipped following the SEC’s approval of spot ether ETFs. ETH has slowly widened the gap since.

Kaiko chalked up the market’s indifferent reaction over the ETF filings to doubts about the approval of spot SOL ETFs. This likely stems from the asset’s lack of a sizable futures market, and the SEC’s prior assertion that SOL is a security.

— Jack Kubinec

The Pulse

Helius Labs CEO Mert Mumtaz sparked some light debate on Sunday, tweeting that the crypto industry should focus on scaling existing apps rather than developing new ones. He argued that scaling these apps to handle 1,000,000x demand is crucial for growth.

Responses varied. @fearthewave_eth skeptically remarked, “if they [are] so useful… they shouldn’t have any issue scaling.” @crackberrypi highlighted concerns about market concentration, adding “Sounds like a monopoly.” Some responses were outright dismissive. The ironically named @ProfOptimist joked, “Name 1 app” while the more appropriately titled @timetofud noted, “mostly all these apps are for gambling.” @doompr0ntweets asked, “Aside from video games, what apps in crypto are useful outside of crypto?”

Others seemed to take the suggestion more seriously. @jayantkrish and @itechnologynet emphasized the importance of user experience in achieving scale, with the latter noting that retail users prioritize UI/UX over fancy features. Others warned against neglecting new, disruptive projects, and raised concerns about potentially missing out on groundbreaking innovations by halting funding for new apps.

Speculative discourse aside, there are ample resources to do both. The crypto industry’s superpower has long been its funding capability. And anyway, isn’t it more in line with the crypto ethos to diversify across different approaches, rather than risk a single point of failure?

— Jeffrey Albus

One Good DM

A message from Eugene Chen, co-founder of Ellipsis Labs:

[ad_2]