[ad_1]

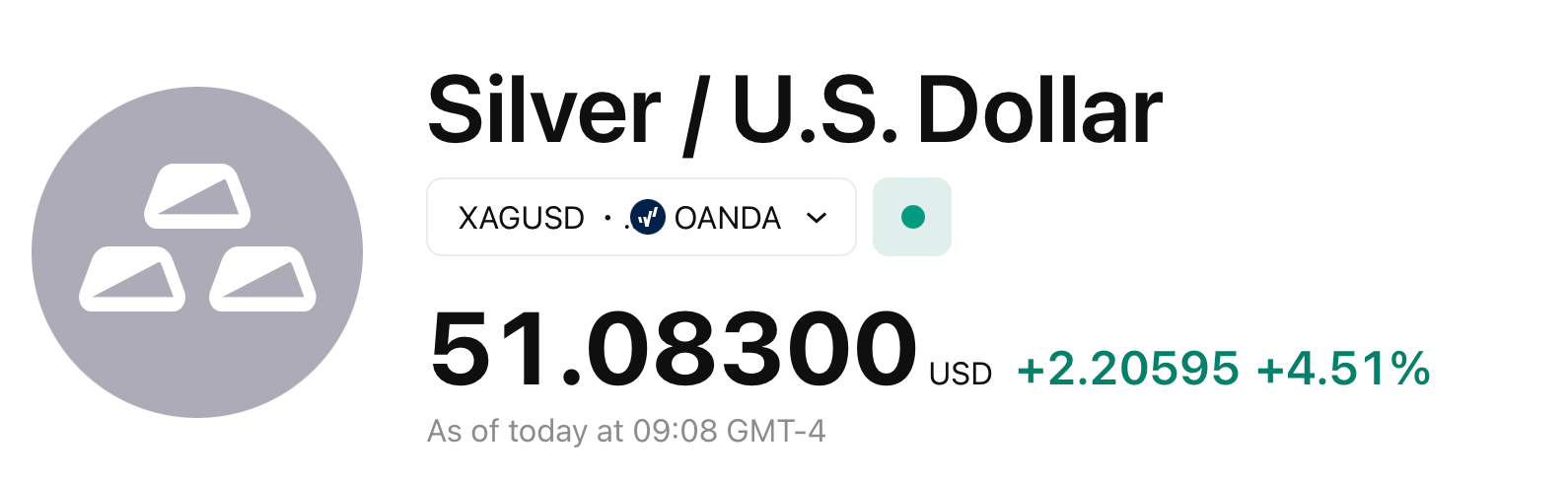

Silver prices surged to a record high of $51.08 per troy ounce on Oct. 9, 2025, marking a 4.51% daily increase and surpassing the 1980 peak of $49.45 amid strong industrial and investment demand.

Silver Hits Record $51 High Amid Surging Demand

The rally capped a robust week for the metal, with prices climbing 6.5% from $47.96 on Oct. 3. Daily gains accelerated mid-week, including a 2% rise to $49.44 on Oct. 8 and the final push to $51.08. Year-to-date, silver has gained 59.91%, outperforming gold‘s 43% advance, while monthly gains stand at 21.02%.

Industrial applications drive much of the momentum, with silver‘s use in solar panels accounting for 16% of global demand and growing 14% annually. Electric vehicles contribute another 2.9%, as renewable energy transitions intensify. Supply deficits persist due to mining constraints and regulatory hurdles, exacerbating shortages.

Investment flows have amplified the surge, as silver serves as a hedge against inflation and geopolitical instability. Exchange-traded funds saw sharp intraday gains, and the gold-silver ratio of 1:86 indicates potential undervaluation. Central bank easing and U.S. budget concerns further bolster safe-haven buying.

Geopolitical tensions in mining regions and broader commodity rallies, including platinum’s 85% year-to-date gain, add pressure. Physical market shortages, such as in India, have led to stockpiling by traders.

Analysts forecast continued upside, with projections ranging from $52 to $55 by year-end and some eyeing $60 in early 2026. Bearish views warn of pullbacks to the $30s if economic slowdowns curb industrial use, though technical patterns suggest potential for $100 if the breakout sustains.

FAQ ⚙️

-

Why did silver prices surge past $51? 🪙

Strong industrial demand, investment inflows, and tight supply pushed silver to record highs. -

How is industrial demand influencing silver’s rally? ⚡

Expanding solar and EV sectors are sharply increasing global silver consumption. -

What role does investor sentiment play in silver’s rise? 💰

Inflation worries and geopolitical risks boosted safe-haven buying and ETF flows. -

Could silver prices keep climbing in 2025–2026? 📈

Analysts see potential gains toward $55–$60, though short-term pullbacks could occur.

[ad_2]