Tokenization platform Securitize has predicted that Ethereum will be the future hub for real-world asset (RWA) markets, pointing to the blockchain’s dominance in institutional adoption and its potential to capture a multi-trillion-dollar opportunity.

In a guest thread posted on Ethereum’s X account, Carlos Domingo, CEO and founder of Securitize, pointed out the tokenization market’s growth to a $26.5 billion sector, with Ethereum hosting $7.5 billion worth of tokenized RWAs and $5.3 billion in tokenized Treasuries, giving it a 72% market share of on-chain Treasuries.

“It’s where institutions are deploying capital,” the company wrote, adding that even a 1% slice of the $20 trillion-plus RWA opportunity could unlock over $200 billion in on-chain value.

Domingo described 2025 as the year “RWAs found real utility onchain,” highlighting daily dividend payouts, programmability, and faster settlement as key institutional incentives to adopt tokenization.

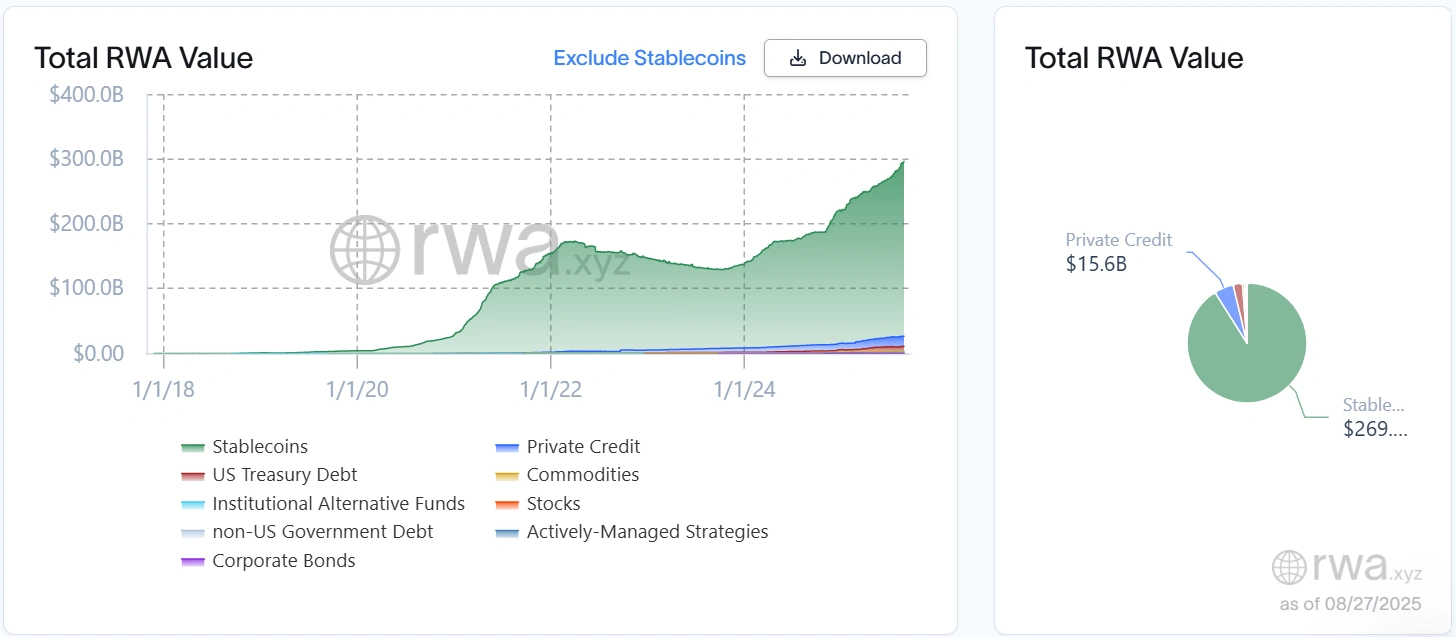

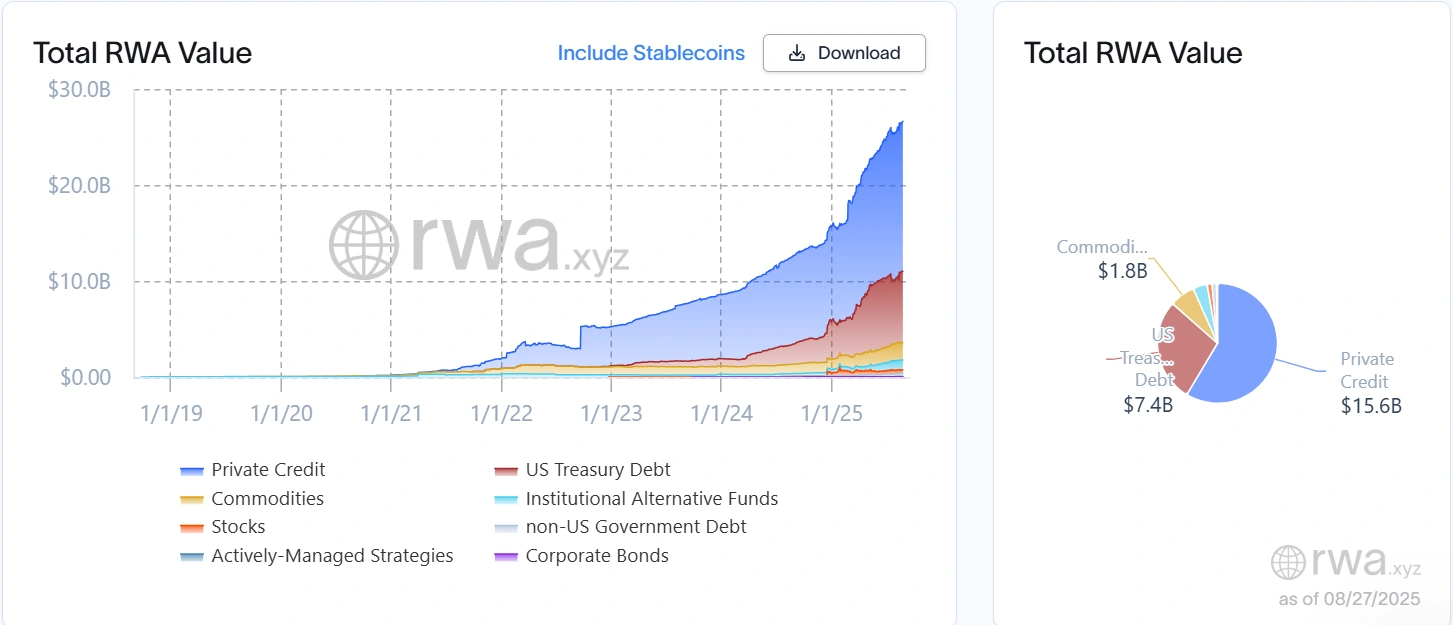

Global market overview of the total RWA value. Source: RWA.xyz

Ethereum’s grip on RWA tokenization

Ethereum has emerged as the leading blockchain for tokenized RWAs by market capitalization. According to data from RWA.xyz, the network accounts for more than half of all tokenized assets, with over $7.5 billion minted on its mainnet.

The share expands further when factoring in Ethereum Layer 2 networks such as Polygon, Arbitrum, Mantle, and Optimism, which together with the main chain, account for around 85% of Securitize’s tokenized assets on Ethereum’s Mainnet.

Industry analysts say Ethereum’s dominance is a product of its deep liquidity pools, composability with decentralized finance (DeFi) protocols, and regulatory-ready token standards such as ERC-1400 and ERC-3643.

“Ethereum offers some of the most secure, composable, and censorship-resistant foundations for tokenized financial products,” Domingo noted in the thread.

Securitize backs institutional adoption to gather pace

Global market overview of the total RWA value, excluding stablecoin data. Source: RWA.xyz

Major asset managers are already experimenting with tokenization at scale, and almost all of the flagship projects are anchored on Ethereum.

BlackRock’s BUIDL fund, issued mostly on Ethereum via Securitize, has grown to more than $2.4 billion, making it the single largest tokenized Treasury vehicle on-chain. Apollo’s $110 million ACRED private credit fund and VanEck’s $75 million VBILL tokenized Treasury are also live on Ethereum, alongside Hamilton Lane’s $9.6 million SCOPE vehicle.

Securitize itself has helped mint over $3.36 billion in tokenized assets, becoming the world’s largest tokenization platform. More than $2.3 billion out of the $3.36 billion sits on Ethereum. The firm also claims the distinction of having five tokenized RWAs worth more than $100 million, the most of any provider.

For institutions, the pitch that draws them to the blockchain goes beyond cost savings. Domingo pointed out that when asset managers see they can distribute dividends daily instead of quarterly, “they immediately see the opportunity.” He described that shift in settlement cycles and value delivery as a “lightbulb moment” for Wall Street.

Domingo notes that utility, liquidity, and composability with DeFi protocols will define the next phase of tokenization. In practice, this could mean equities and credit instruments being used in DeFi lending markets, or funds tapping tokenized assets to optimize capital efficiency.

“Trillions will be tokenized on Ethereum because it’s instant, programmable, and always on,” the Securitize founder said, adding that the infrastructure for mainstream adoption is now in place.