August 2024 was the month with the lowest revenues for Bitcoin mining of the entire year.

Indeed, it is necessary to go back even to September of last year, when the price of BTC was below $30,000, for a month with similar revenues.

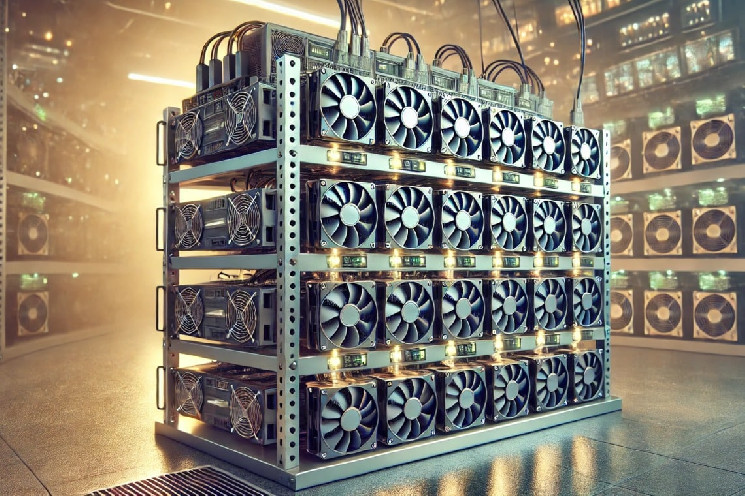

The collapse of revenues in the Bitcoin mining sector

On Bitbo you can find a chart that shows the monthly revenues of Bitcoin mining.

July had closed with approximately 927 million dollars collected overall by BTC miners, but in August, which has the same number of days, revenues dropped by a good 100 million dollars (-10%).

It is worth noting that already in June they had fallen below 900 million, but it had been since September 2023 that they had not fallen below 850.

To tell the truth, a year ago they had also dropped below 800, but September has one day less than August.

Furthermore, in 2021, three years ago, they remained almost constantly above 800 million, with peaks even reaching almost 1,700.

Additionally, during the bear-market of 2022, when the price of Bitcoin dropped significantly below $20,000, the monthly revenue low for mining was reached at $460 million.

So during the course of 2023 these last ones rose from less than 500 to more than 1,200 million, reached in December, and then rose again during the course of 2024 to over 1,900 in March and then collapsed below 900 million from the halving to today.

Bitcoin mining: the reasons for the collapse of revenues

Before examining the reasons for this collapse (-57% from March to August), it is necessary to emphasize that the current levels are not only much higher than those of the bear-market of 2022, but they are also perfectly in line with those of July of last year, before the halving of the premium.

Having said that, obviously the main reason is the halving itself.

Until March of this year, the miner who managed to mine a block would take home 6.25 BTC as a reward, but from April 20, this reward has been halved to 3.125 BTC.

The Bitbo chart also shows the monthly earnings in BTC, which include the fees, and reveals that in March of this year the Bitcoin miners had earned more than 28,500 BTC, dropping to 22,600 in April and to less than 13,800 in May.

But to this problem, another one is added.

In fact, the calculation of the total revenues from Bitcoin mining is actually done in dollars, because the high operating costs of miners must be paid in fiat currency.

And so a drop in the average price of BTC has further reduced the miners’ revenues calculated in dollars, despite the BTC earnings in August being perfectly in line with those of May. However, the fact remains that in BTC the earnings in August were 51% lower than those in March.

Problems for Bitcoin?

Despite all this, no technical problem is found for Bitcoin.

The block-time, that is the average time to validate a block, has always remained around, or below, 10 minutes, with marginal exceptions, and the number of daily transactions is still decidedly high.

Indeed, if in March an average of about 400,000 transactions per day were recorded on the Bitcoin blockchain, lately, the 600,000 mark has often been surpassed.

A different discussion, however, is the one that concerns the price of BTC.

In fact, the more the revenues of the miners decrease, the more they are forced to sell Bitcoin.

Generally, miners sell only the BTC necessary to finance their activity, trying not to sell those that are not necessary to sell. In this way, over time, an accumulation of BTC is created, but when revenues fall, they are forced not only to sell all the Bitcoin they mine, but also part of those accumulated previously.

The profitability of Bitcoin mining has literally collapsed lately, dropping from $0.12 per day per THash/s in March to the current $0.04. The current level is even lower than, for example, a year ago, and this means that miners are really forced to sell a lot of BTC.

The impact on the price of BTC

All this ensures that the selling pressure of BTC on the crypto market remains significant.

Although overall it has decreased, from March until today, it has not decreased as much as many had hoped.

In fact, the buying pressure has actually decreased more, and the inevitable consequence is a reduction in price.

In order for this trend to reverse, it would be necessary for the miners to stop selling so many BTC.

For this to happen, at this moment it is not conceivable that an increase in the value of Bitcoin alone would be sufficient. Instead, a cut in the difficulty would be essential, in order to significantly reduce the expenses of the miners.

On the other hand, the difficulty is currently close to all-time highs, despite the halving that occurred a few months ago, so much so that the block-time remains close to 9 minutes. The hypothesis is even that the next difficulty adjustment, scheduled for September 11, will be upward, and if that happens, the aforementioned problem would be further exacerbated.

Hashrate and difficulty levels

All this is caused by a curious dynamic, absolutely unexpected.

In fact, with the halving of the reward for miners, in theory, they should have significantly reduced their hashrate. This would have inevitably led to a reduction in the difficulty, and therefore the costs of mining, thus also reducing the need for miners to sell BTC.

And yet it did not happen.

The hashrate in April, before the halving, had exceeded 650 Eh/s of weekly average, and after the halving it had dropped to 580 in May.

At the end of May, however, it had marked a new peak above 650, and in July even a peak above 670 Eh/s.

However, on average it has decreased from 640 to 630, which is a reduction too small to cope with the inevitable collapse in revenues due to the halving.

At this point, it would be necessary for the miners to start shutting down a significant number of old machines to decrease the hashrate, thus also lowering the difficulty, but whoever does this risks seeing their revenues collapse further. As long as the miners do not capitulate, this situation seems destined to persist.