Welcome to the institutional newsletter, Crypto Long & Short. This week:

- Sygnum Bank’s Pascal Eberle writes that investors are recognizing that custody is less about holding assets and more about proving you’re holding them correctly.

- CoinDesk Indices’ Andy Baehr provides a “Vibe Check,” writing about how on the heels of NYC election day, among other political activity, the crypto market is awaiting a new leader to spark its next rally.

- In “Chart of the Week,” we examine the ETH price relative to average DeFi pool yields and BTC/ETH funding rates.

-Alexandra Levis

Expert Insights

Redefining the Custody Standard for Banking

– By Pascal Eberle, chief of staff, Sygnum Bank

The walls between traditional and future finance are dissolving faster than most realize. Regulated institutions are no longer dismissing blockchain-native features. In fact, they’re adopting them. As a result, the next custody standard will be built on cryptographic accountability.

Investors are recognizing that custody is less about holding assets and more about proving you’re holding them correctly. Multi-signature technology (multisig) provides that proof, continuously and cryptographically.

Where traditional custody falls short

Legacy custody operates on the premise of centralized control. When you deposit assets with a traditional custodian, you surrender authority to an external entity. This model demands absolute trust in institutional processes that remain invisible to clients and are based on legal/regulatory regimes, which can come with their own intricacies. This can create significant counterparty risk depending on the regulatory regime under which the lender operates. Certain regulatory regimes provide better customer protection than others. For instance, banks in Switzerland are legally required to segregate client assets, effectively making them bankruptcy remote, and collateral rehypothecation is not allowed unless the client explicitly agrees to it. However, this ultimately still requires trust in banks, the banking law and banking regulators to enforce these rules. But hope, trust and belief aren’t security features.

Multi-signature technology flips the entire custody paradigm. Instead of one party holding all the keys (literally), control is distributed. No single entity can move funds unilaterally. Clients hold their own keys as part of the security architecture. Every transaction requires multiple approvals, which makes for an unprecedented level of accountability. Instead of relying on the (banking) law, “code is the law” becomes the new paradigm. The enforcement of the law is not dependent on any regulator, but guaranteed by the blockchain. In the case of Bitcoin, this is the world’s most powerful computing network.

It’s a philosophical revolution as much as a technological one. Multi-signature custody embodies the cypherpunk principle: “Don’t trust, verify.” Clients can monitor their assets on-chain in real-time. They see exactly where their holdings are and how they’re secured. They participate in their own asset protection rather than outsourcing it entirely to an institution.

Prior to blockchain technology, this shared custody model was simply impossible. Banks had no mechanism to distribute control while maintaining security and efficiency. Now they do. Multi-factor authentication transformed how we access applications by requiring multiple verification methods. Multisig wallets will similarly transform how we secure assets by requiring multiple signing authorities.

Cryptographic accountability changes everything

Henry Ford once said customers would have asked for faster horses, not automobiles. Similarly, most investors don’t yet know to ask for multi-signature custody. But once they experience the transparency of monitoring assets on-chain, the security of distributed key management and the control of participating in their own asset protection, traditional custody models will feel as outdated as paper stock certificates.

Banks clinging to legacy opacity will lose their place in the competitive market. Just as the industry once standardized around SWIFT for messaging and clearinghouses for settlement, the next standard will be cryptographic accountability. Multisig is becoming the baseline expectation clients will demand because it’s objectively superior. It reduces single points of failure, prevents internal fraud, enables real-time verification and gives clients actual control over their assets. Once customers experience this level of transparency and security, they won’t accept anything less.

Customers want visibility, control and accountability. Multisig custody delivers all three.

Expert Insights

Promises Made, Timing Hard

– By Andy Baehr, CFA, head of product and research, CoinDesk Indices

On Sunday, New York City (and, I suppose, much of the rest of North America) plunged into Standard Time darkness; the sun set at 4:49pm. Yesterday, New Yorkers elected a new Mayor, plunging the city into a polarized new phase. The mood in crypto has felt similar of late: resigned, hunkering down, wondering where the endless summer days have gone. With the government shut down for a month, crypto legislative progress paused and Fed policy offering little upside convexity, catalysts for an uptrend are hard to come by. Commentators are constructing hopeful narratives and pushing back on end-of-cycle FUD, but the weight of poor price performance and the bruises left by the October 10th event are keeping the mood sour. It doesn’t help that equities are firing on all cylinders — the Nasdaq Composite hasn’t had a string of up months this long since 2017.

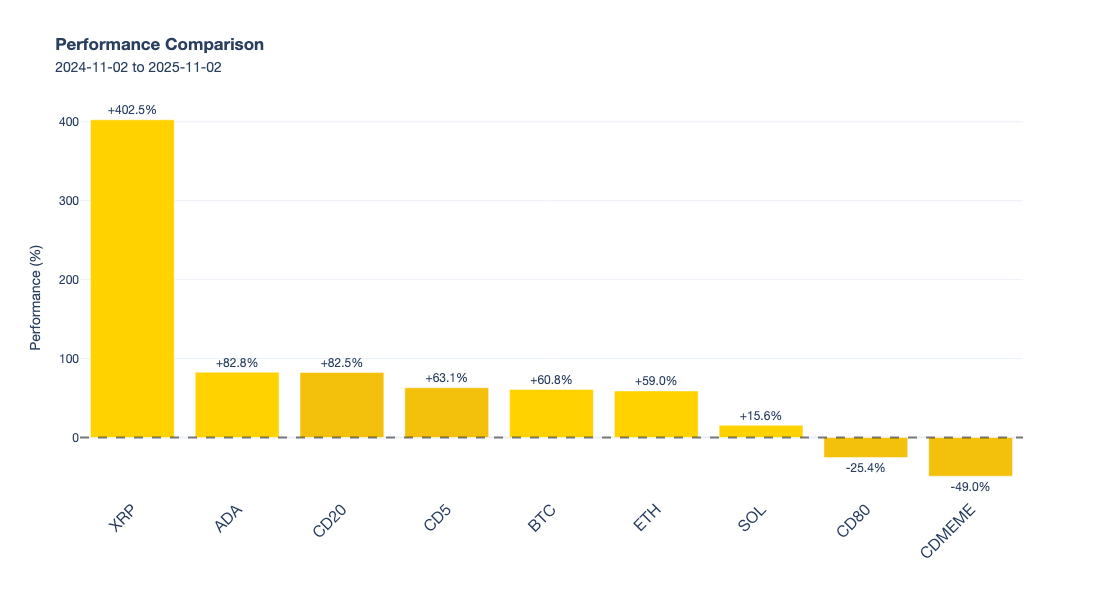

Sober Uptober – CoinDesk 20 names fared poorly in a traditionally positive month

It may be helpful to look back to a year ago, days before the 2024 presidential election, for perspective. The CoinDesk 20 Index sat below 2,000. Bitcoin was in the high $60K’s. By the end of November, CD20 had nearly doubled, ETH touched 4,000 and bitcoin was on its way towards $100K, its champagne moment. The market knew that support for digital assets was coming (and it has), but market timing and asset selection have been painfully difficult. The Q1 Tariff Tantrum tested faith, and the snapback was too fast for most to anticipate. ETH was nobody’s favorite portfolio item in early Q2, until it led the entire market to all-time highs.

Performance since Election Day 2024 – big numbers mask difficult timing

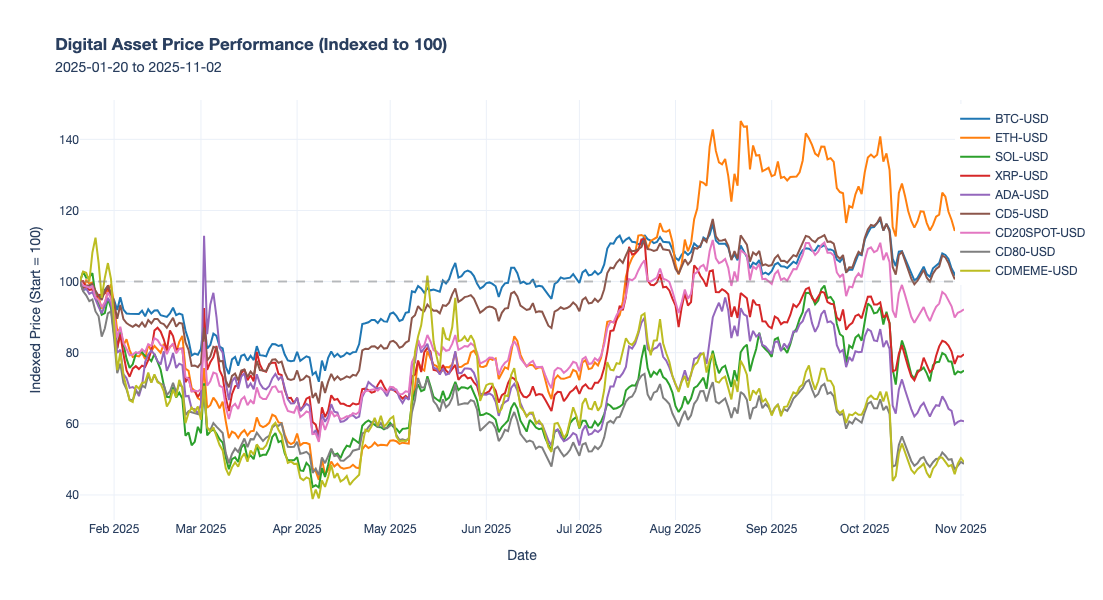

Within weeks, those jubilant periods after the election and into Inauguration Day will be baked into 1 year returns, and we will feel the need to demonstrate some more durable asset class performance. To wit, look at performance since Inauguration Day through today; only ETH’s power rally stands out as impressive.

Price action since Inauguration Day – only ETH has led the way higher among top names

The crypto market is searching for leadership to incite another broad rally. Bitcoin led in 2024, carving its path into investment portfolios through ETFs and treasury adoption. Ether led in 2025, benefiting from stablecoin growth and tokenization narratives that finally gained institutional traction. XRP — and Ripple — have posted remarkable performance despite their story remaining largely absent from the talking points that move allocators. Solana has become increasingly public-facing — sponsorships, conferences and consumer adoption — yet SOL’s performance has lagged its ambitions. Which narrative, and which asset, will provide the next spark? The market seems to be waiting for an answer.

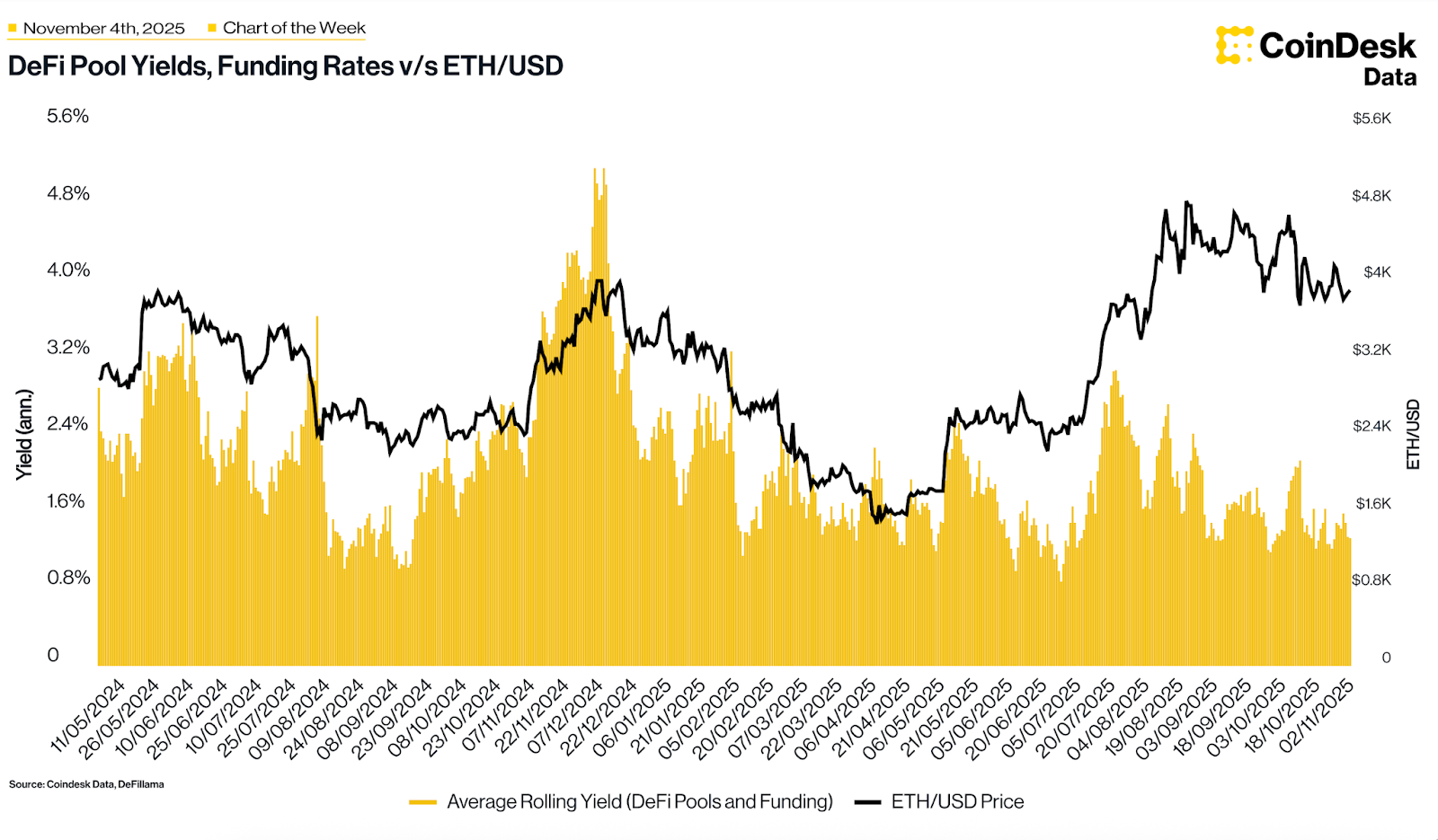

Chart of the Week

This week, we look at ETH price relative to average DeFi pool yields and BTC/ETH funding rates. Since August 2025, ETH price has risen while both the 7d rolling DeFi pool APY (yield on all pools tracked by DeFillama) and ETH funding rates have consistently trended lower. This divergence strongly suggests the rally is a “Digital Asset Treasury” (DAT) narrative/flow-led trade, not a demand-driven move based on utility or high yield. The sustained low base DeFi yield is a key signal of weak underlying demand for ETH’s core DeFi utility, a factor that will likely become a headwind and challenge the continuation of the DAT narrative as institutional flows continue to slow down.

Listen. Read. Watch. Engage.

- Listen: Did you hear? CoinDesk was live at Ripple Swell 2025. Citi’s global head of digital assets, Ryan Rugg, breaks down the bank’s strategy for tokenized assets.

- Read: Nasdaq CEO Adena Friedman outlines three ways blockchain can fix finance.

- Watch: David LaValle, president of CoinDesk Data & Indices, joins Asset TV to address the top 3 things advisors should know when it comes to crypto.

- Engage: On November 7, in Flatiron Public Plaza in NYC, Grayscale Investments will host a pop-up event, featuring Grayscale CoinDesk Crypto 5 ETF (GDLC). CoinDesk will be onsite from 10:30am-12pm ET. Join us!

Looking for more? Receive the latest crypto news from coindesk.com and market updates from coindesk.com/indices.