[ad_1]

The bitcoin market is seeing unusual activity, hinting at increased adoption of the U.S.-listed spot ETFs for purely directional plays rather than arbitrage strategies.

Since Nov. 20, the ETFs have seen strong daily uptake — other than Nov. 25 and 26 — capturing over $3 billion in net inflows, according to data source Farside Investors. On Tuesday, BlackRock’s IBIT registered a $693.3 million net inflow, the most since in the period, bringing the lifetime tally to $32. 8 billion.

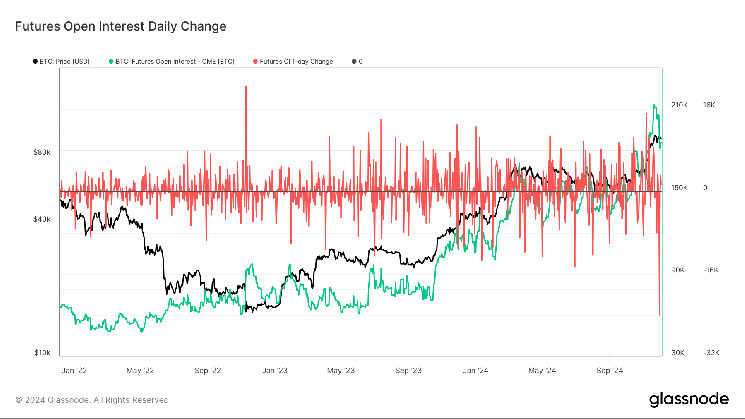

Meanwhile, open interest in CME futures has declined by almost 30,000 BTC ($3 billion) to 185,485 BTC, according to data source Glassnode.

The divergence is unusual and might be a sign of market participants buying the ETFs as outright bullish plays rather than as part of a price-neutral cash-and-carry strategy.

Since the ETFs debuted in January, institutions have primarily used them to set up that strategy, involving a long position in the ETF and a short position in the CME futures. The opposing positions let institutions pocket the futures premium while bypassing price risks. That’s why ETF inflows and the CME open interest have tended to move in tandem.

Carry yield is still attractive

Note that the carry strategy is still attractive, offering returns far more attractive than the U.S. 10-year Treasury note or ether’s staking yield.

As of writing, the annualized three-month basis in CME’s BTC futures was 16%. In other words, setting up a cash and carry trade would earn you 16%, although it’s a far cry from actually holding the cryptocurrency, which is up over 100% this year.

CME BTC futures: annualized basis/premium. (VeloData)

The cash-and-carry yield, represented by the futures premium, peaked above 20% in the first quarter.

[ad_2]