Tokenized real-world assets (RWAs) slipped slightly this month, with total distributed value falling 1.09% as $268 million quietly exited the sector since the first of November.

Worldwide RWA Value Eases Lower

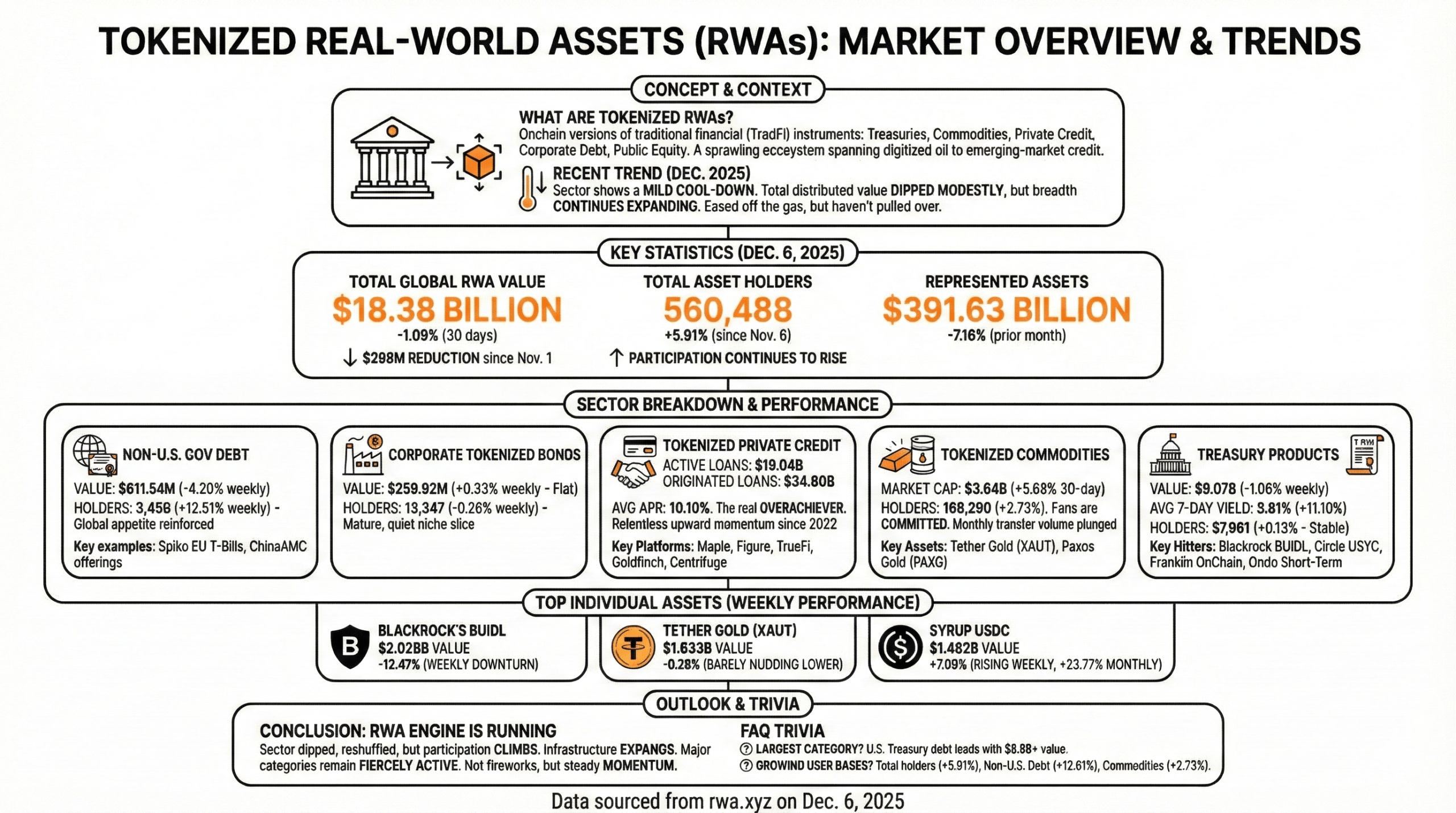

Tokenized RWAs—onchain versions of traditional financial (TradFi) instruments like treasuries, commodities, private credit, public equity, and corporate debt—continued expanding in breadth even as total distributed value dipped modestly over the past month.

Despite the mild cool-down, the sector still reflects a sprawling ecosystem that spans everything from tokenized T-bills to digitized oil exposure and emerging-market private credit pools. In short, RWAs may have eased off the gas at the end of 2025, but they certainly haven’t pulled over.

Global RWA market on Dec. 6, 2025, via rwa.xyz.

As of Dec. 6, the total distributed global RWA value stands at $18.38 billion, a 1.09% decline from 30 days ago, marking a $268 million reduction since Nov. 1, according to rwa.xyz metrics. Meanwhile, represented assets total $391.63 billion, down 7.16% from the prior month. Even so, participation continues to rise, with 560,488 total asset holders, up 5.91% since Nov. 6.

Non-U.S. government debt clocks a total value of $611.54 million, which is 4.20% lower than seven days ago, but holder participation is doing its best victory lap at 3,430 holders, up 12.61%. Funds like the Spiko EU T-Bills Money Market Fund and ChinaAMC’s various digital money market offerings make up the bulk of this category. Data shows a steady climb through 2025, reinforcing global appetite for tokenized sovereign-adjacent debt—even if value took a tiny haircut this week.

Corporate tokenized bonds sit at $259.92 million, essentially flat with a 0.33% weekly gain, though holders dipped slightly (down 0.26% to 13,347). Ten assets make up this niche slice of RWAs, which continues to mature quietly without the pyrotechnics seen in tokenized treasuries or credit.

Speaking of credit, tokenized private credit remains the real overachiever of the space. Active loans total $19.04 billion, while total originated loans hit a beefy $34.60 billion, with a current average APR of 10.10%. Platforms like Maple, Figure, TrueFi, Goldfinch, and Centrifuge continue to expand issuance, with the long-term chart showing relentless upward momentum stretching back to 2022.

Tokenized commodities weighed in this weekend with a $3.64 billion market cap, up 5.68% over 30 days, even as monthly transfer volume plunged 54.73% to $3.89 billion. Monthly active addresses sank 41.22%, but holders rose 2.73% to 168,290, proving gold and oil fans may not be chatty, but they’re certainly committed. Tether gold (XAUT) and paxos gold (PAXG) remain the category’s anchor assets.

Read more: Coinbase Opens 24/7 Trading for All Altcoin Monthly Futures, Perpetuals Next

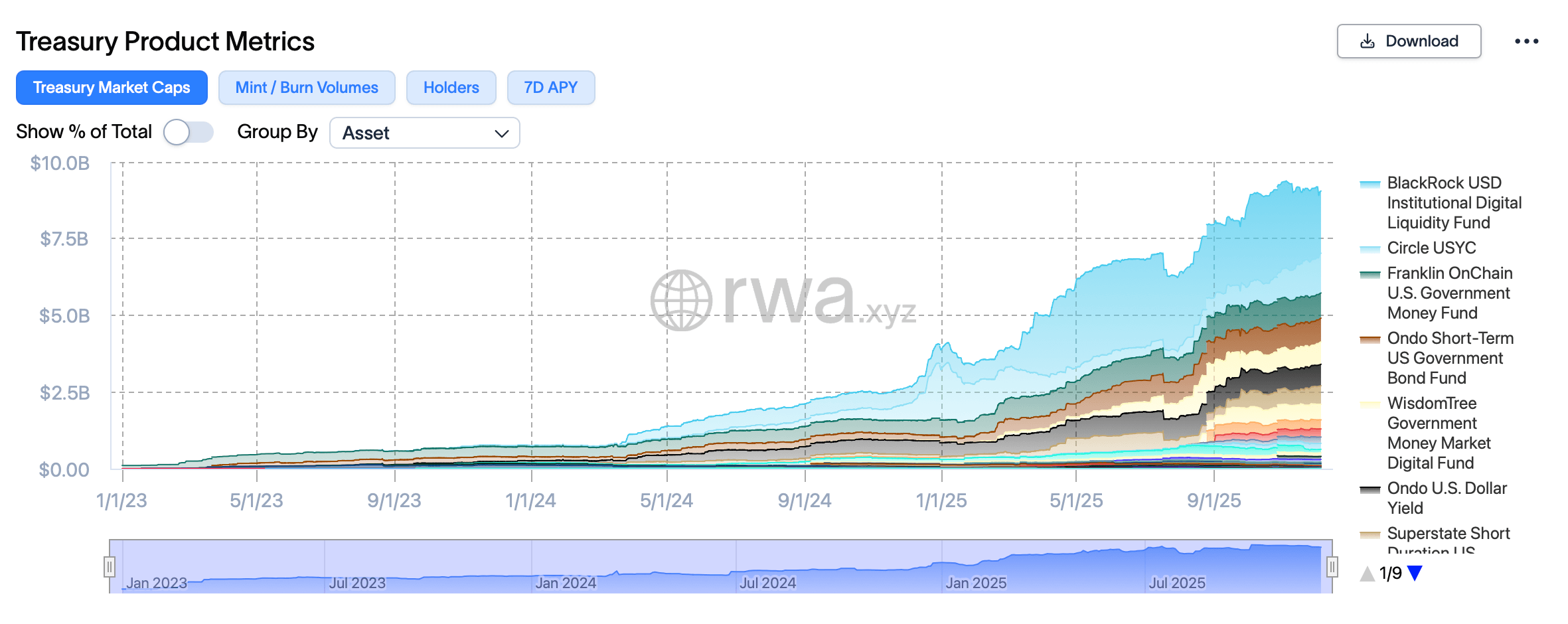

Treasury products alone account for a sizable $9.07 billion, slightly down 1.06% week-over-week, though the average seven-day yield climbed 11.10% to 3.81%. The space includes heavy hitters like Blackrock’s BUIDL fund, Circle’s USYC, Franklin Templeton’s onchain government money fund, and Ondo’s short-term treasury offerings. Holder counts remain virtually unchanged at 57,661, up 0.13%—one could call it stability, or simply a refusal to do anything interesting.

U.S. Treasury RWA market via rwa.xyz on Dec. 6, 2025.

Looking at individual assets, Blackrock’s BUIDL commands the throne at $2.028 billion, though down 12.47% on the week. Tether Gold follows with $1.633 billion, barely nudging lower at 0.28% down. Meanwhile, Syrup USDC has been hitting the gym, rising 7.99% weekly and 23.77% monthly to $1.482 billion. Circle’s USYC also flexed, up 8.12% weekly and 30.92% over 30 days.

In short, RWAs dipped, reshuffled, and occasionally broke into a jog. The sector’s overall value may have slipped 1.09%, but participation continues climbing, infrastructure keeps expanding, and major categories like private credit, treasuries, and commodities remain fiercely active. December may not be delivering fireworks—but the RWA engine is very much still running.

FAQ ❓

-

What are tokenized real-world assets?

They are blockchain-based representations of TradFi assets like treasuries, commodities, corporate bonds, and credit. -

How much have RWAs declined since November?

The sector fell 1.09%, losing $268 million since Nov. 1. -

Which segments grew their user bases?

Total asset holders climbed 5.91%, non-U.S. debt holders rose 12.61%, and commodity holders increased 2.73%.