[ad_1]

Bitcoin has smashed past the $70,000, after the release of the Consumer Price Index (CPI) report signaling surge of inflation in the United States.

Previously, many investors somewhat predicted the $70,000 price surge, despite the prior dip to $67,000. The main contributing factor to this surge are high inflation rates, which have positioned Bitcoin as a potential hedge against the diminishing purchasing power of traditional currencies.

Additionally, there’s been a noticeable boost in the performance of stocks and other alternative assets, as investors are redistributing resources to protect their portfolios from inflation. In the past, Bitcoin has been considered a ‘safe haven’ asset, much like gold, due to its finite supply and independence from monetary policies of various governments. However its volatility is what usually keeps investors from utilizing it at a full scale.

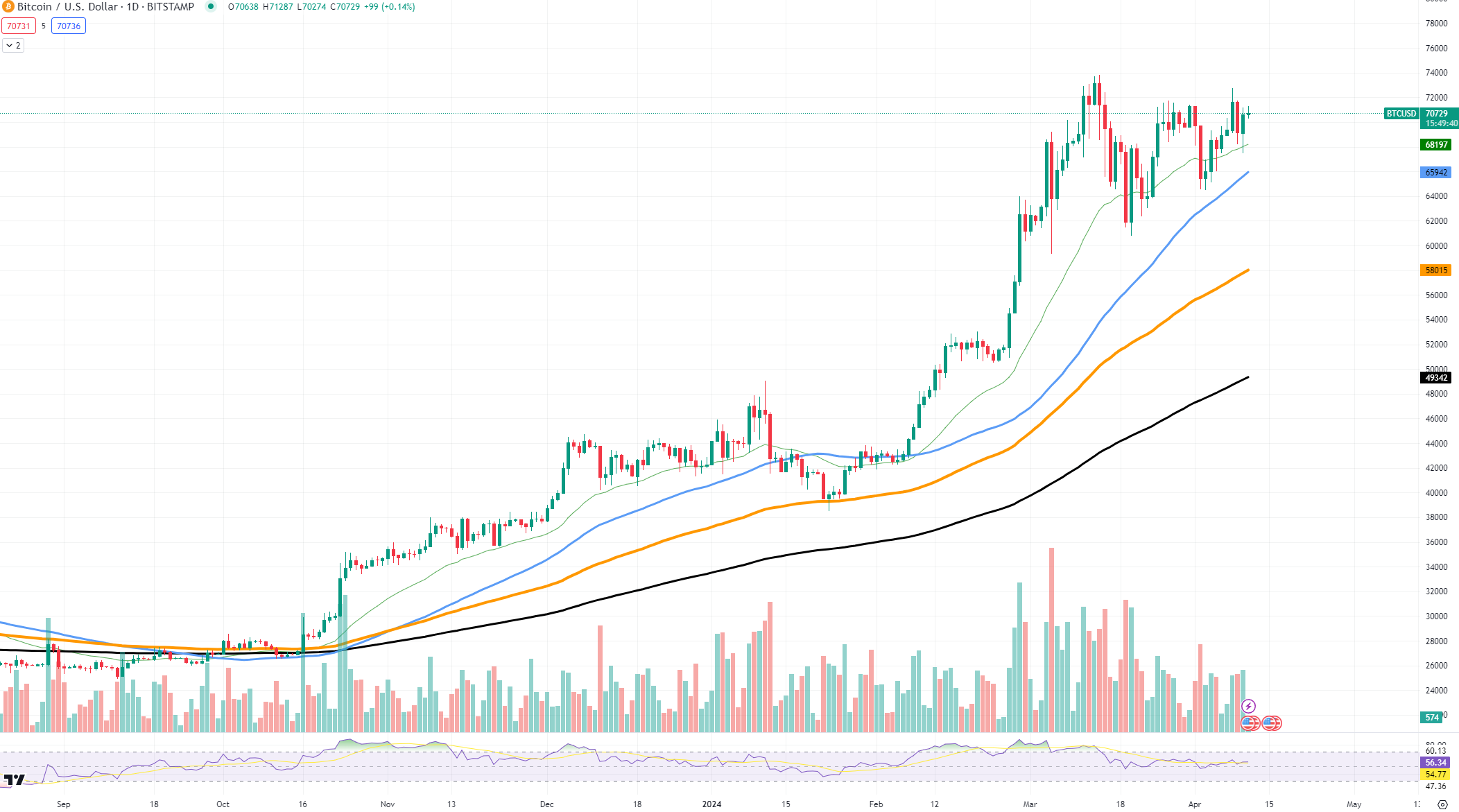

Bitcoin’s price performance

The breakout past the psychological barrier of $70,000 has solidified Bitcoin’s bullish outlook. Support levels are placed around $68,220. A sustained rally could see Bitcoin targeting the next resistance level at $72,000. If this level is breached, it may clear the path toward higher peaks, possibly retesting previous all-time highs.

As we scrutinize Bitcoin’s trajectory, its capability to maintain this momentum could signal a new era of maturity for the cryptocurrency as an investment class. The digital asset’s performance amid economic pressures suggests a growing confidence in its role within diversified portfolios.

The current market conditions present a strong case for Bitcoin’s growing status as a safe haven asset. With inflation rates surging, Bitcoin’s decentralization and limited supply offer a strong case for its usage as a diversification and protection tool amid periods of high inflation.

[ad_2]