[ad_1]

The Bitcoin halving was supposed to be a day of celebration and the end to Bitcoin’s woes of the prior four years. On that late Friday night (and in technical, computer geek UTC time, a party-perfect date of 4/20), Bitcoin turned the page to its fifth epoch.

Fans cheered the end of its 28-month-long bear market and waved goodbye to the fourth epoch’s 6.25 BTC block reward, welcoming a halved inflation rate of just 3.125 BTC per block. They hoped that the disinflationary shock might boost the price, and usher in a suite of upgrades to Bitcoin’s functionality that would fund a wellspring for its security budget.

Unfortunately, reality has failed to live up to their expectations. The price of bitcoin hasn’t rallied since the halving, nor has the halving increased Bitcoin’s security budget.

A cornucopia of new activity was supposed to arise from a suite of Bitcoin-branded protocols at the halving. This was to be based on Ordinals, a software program that pretends to track satoshis, the smallest denomination of 1 BTC.

Ordinals were supposed to empower active secondary markets for numismatics (collectible markets for unique satoshis or ‘rare sats’) and enable permanent data storage and on-chain software with inscriptions. Most importantly, they were designed to underpin Runes, a brand new fungible token protocol for trading ERC20-like tokens and meme coins on Bitcoin.

Buy the rumor, sell the news

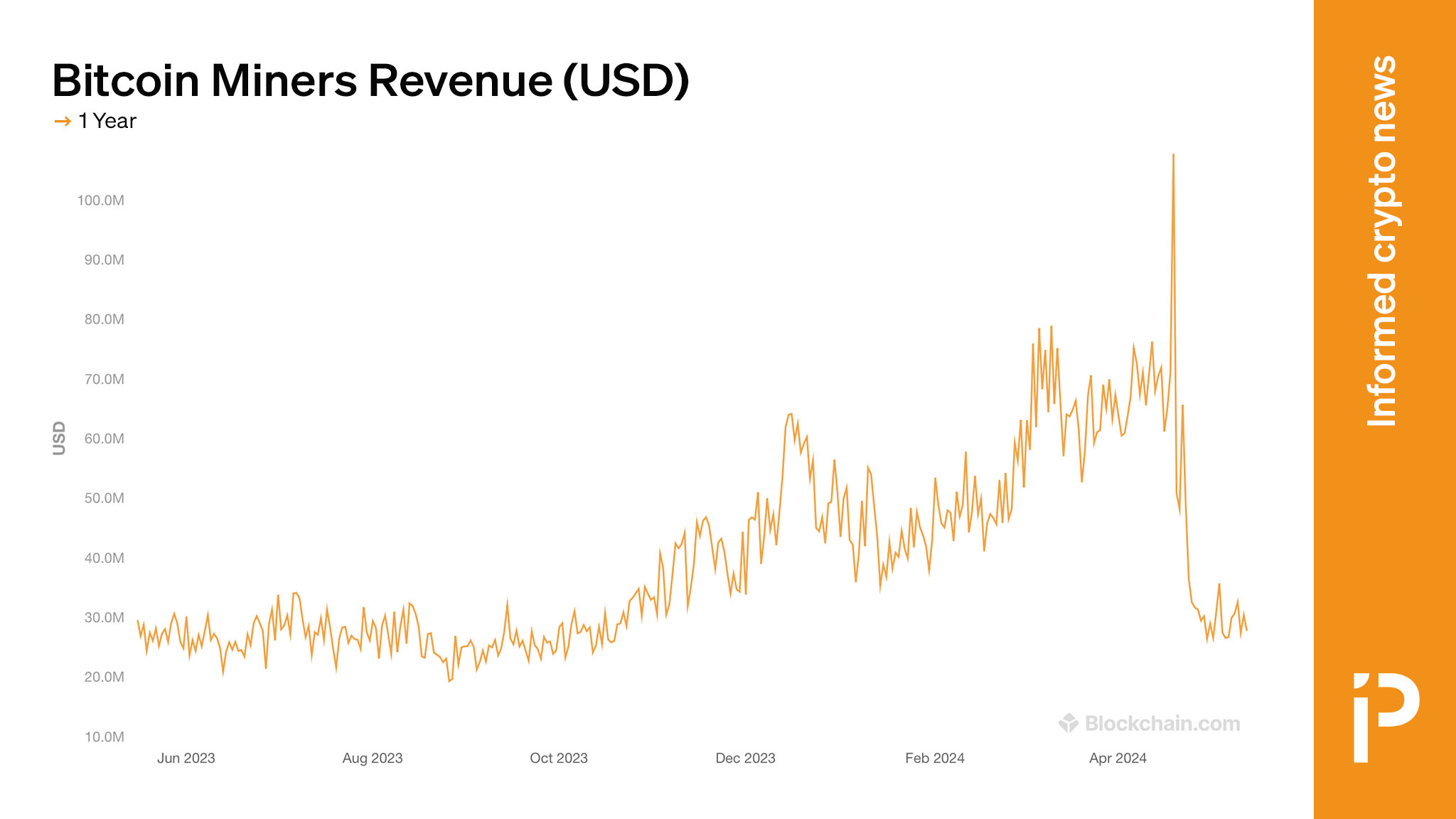

All of those fantastic debuts have lifted Bitcoin’s USD-denominated miner’s revenue — the definitive measure of the blockchain’s security budget against real-world adversaries — exactly nowhere.

At block 840,000, Casey Rodarmor’s highly anticipated Runes protocol launched to fanfare and prompted the largest-ever amount of money paid for a single block in Bitcoin’s history: 74 BTC ($4.7 million). A single satoshi, the so-called ‘epic sat’ number 1,968,750,000,000,000, resold at auction for $2.1 million.

It was a promising start. Just imagine, fans of Rodarmor thought: a single satoshi (commonly valued at 1/100 millionth of bitcoin’s current price, $62,000) reselling for millions of dollars.

However, there’s no free lunch. Only a small amount of speculative new money actually entered the secondary markets for these collectible satoshis. As a result, Ordinals, Inscriptions, Rare Sats, and Runes traders could no longer afford to continually overpay miners for on-chain transaction fees.

Runes failed to help Bitcoin’s security budget

Fees from this nascent community — heralded as the leading source of revenue for Bitcoin’s security budget post-halving — have evaporated. Runes, like so many Bitcoin-branded projects for creating altcoins before it, failed to sustain its hype for even two days after the halving.

In all, bitcoin miners’ revenue is down 75% since the halving. Worse, Bitcoin’s security budget (approximately $30 million daily) is now lower than miners’ median revenue this year (approximately $50 million daily).

Read more: Prices of Bitcoin Runes dip two days after launch

The chart of Bitcoin’s security budget says it all. In the run-up to the halving, excitement swelled about a supposed new era for Bitcoin. Fans cheered the rising transaction fees, which spiked on the day of the halving. Traders spent millions to buy satoshis commonly valued at 1/100 millionth of 1 BTC and gladly overpaid miners with obscene transaction fees.

Less than one month later, all of their bids have made no difference to Bitcoin’s ongoing security budget. Runes failed its fans. As of today, neither Ordinals, Inscriptions, Numismatics, or any other protocol for trading satoshis have lifted Bitcoin’s security budget above its prior average.

[ad_2]