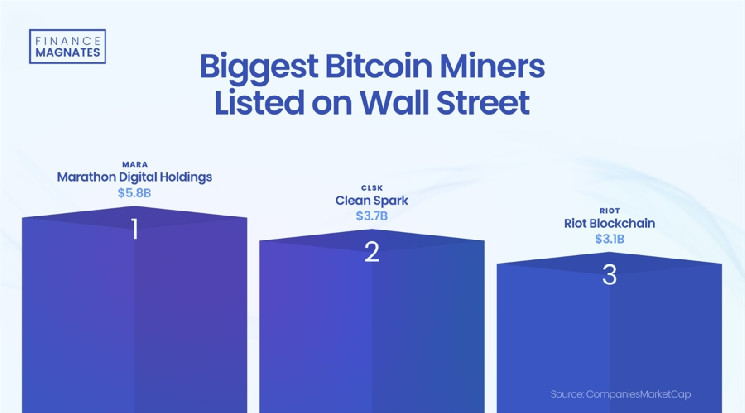

Over 20 companies engaged in Bitcoin (BTC) mining, the process of extracting the oldest cryptocurrency for profit, are now listed on global stock exchanges. Wall Street is home to the vast majority of them, and it’s where we find the largest publicly traded BTC miners. But which one is the biggest? Let’s find out!

Marathon Digital Holdings (NASDAQ: MARA) is the undisputed leader in the industry, with a market capitalization approaching $6 billion. The company’s stock has gained more than fivefold since its low at the end of the crypto winter, currently trading at around $20 per share.

CleanSpark (NASDAQ: CLSK) takes second place with a market capitalization of $3.7 billion. The company has been around since 1987 but only recently decided to focus on cryptocurrencies, a move that has proven profitable so far.

Riot Blockchain (NASDAQ: RIOT) occupies the third spot with a valuation of $3.1 billion. Listed on Wall Street since 2003, the company decided to dive deeper into the world of cryptocurrencies during the pandemic, which at one point boosted its market cap to nearly $5 billion.

Cipher Mining (NASDAQ: CIFR) and Core Scientific (NASDAQ: CORZ) are the youngest companies in the ranking, both with market caps of around $1.7 billion. Although they’ve only been available on the stock market for a few years, they’ve quickly won over investors’ hearts by positioning themselves in the BTC mining industry from the start.

Key Information About the Biggest Bitcoin Miners

Marathon Digital Holdings, incorporated in 2010, is a digital asset technology company based in Las Vegas, Nevada. Led by CEO Fred Thiel since April 2021, the company focuses on mining cryptocurrencies, particularly Bitcoin, using a large fleet of specialized ASIC miners.

The company recently faced a setback and had to pay a $138 million fine to the founder of a competing mining company. It is alleged that Michael Ho from Hut 8 developed a growth strategy for Marathon, but was not properly compensated.

“There was no wrongdoing on the company’s part,” Marathon Digital commented in an emailed statement. “We also believe that the damages awarded have no legal basis. We intend to challenge this verdict and commence the appeal process as soon as practicable.”

Fred Thiel, CEO of Marathon Digital

CleanSpark, founded in 1987, is a sustainable Bitcoin mining and energy technology company headquartered in Henderson, Nevada. The current CEO is Zachary Bradford. CleanSpark operates environmentally-conscious Bitcoin mining facilities and develops software solutions for energy management and optimization.

Zach Bradford, CEO of CleanSpark

At the beginning of August 2024, the 2nd biggest BTC miner on Wall Street announced the execution of 75 megawatts (MW) of power contracts and the acquisition of its first Bitcoin mining site in Wyoming.

“We are thrilled to expand in a state so publicly supportive of our industry,” Bradford stated. “Working together with local, state and national leaders, CleanSpark plans to grow its footprint beyond Cheyenne, throughout the beautiful state of Wyoming.”

Riot Blockchain, established in 2000, is one of North America’s largest Bitcoin mining companies. Based in Castle Rock, Colorado, Riot is led by CEO Jason Les. The company focuses on expanding its mining operations and developing blockchain technologies.

Jason Les, CEO of Riot Blockchain

Nevertheless, the company is seeking profitability beyond its mining operations. Riot is concentrating on energy sales, generating record revenues for the company.

“Riot achieved a new monthly record for Power and Demand Response Credits, totaling $31.7 million in August, which surpassed the total amount of all Credits received in 2022,” Les commented last year. “Based on the average Bitcoin price in August, Power and Demand Response credits received equated to approximately 1,136 Bitcoin.”

Tyler Page, CEO of of Ciper Mining

Cipher Mining, founded in 2021, is a US-based Bitcoin mining company headquartered in New York City. Tyler Page serves as the CEO. Cipher Mining aims to become a leader in low-cost, large-scale Bitcoin mining operations in the United States.

Core Scientific, incorporated in 2017, was a major player in blockchain infrastructure and hosting services. Based in Austin, Texas, the company was led by CEO Michael Levitt. However, it’s important to note that Core Scientific filed for Chapter 11 bankruptcy in December 2022 and has since undergone significant restructuring. Currently the company is run by Adam Sullivan.

Adam Sullivan, CEO of Core Scientific

In 2023, the company purchased 27,000 Bitcoin mining rigs from Bitmain in a significant deal worth $77 million. The transaction includes $23.1 million in cash and $53.9 million in common stock.

“Core Scientific is an important contributor to the strength and stability of the Bitcoin Network, and we look forward to working closely with their team to help realize Bitcoin’s full potential,” the company commented on the transaction.

Tough Times on the Stock Exchange for Crypto Miners

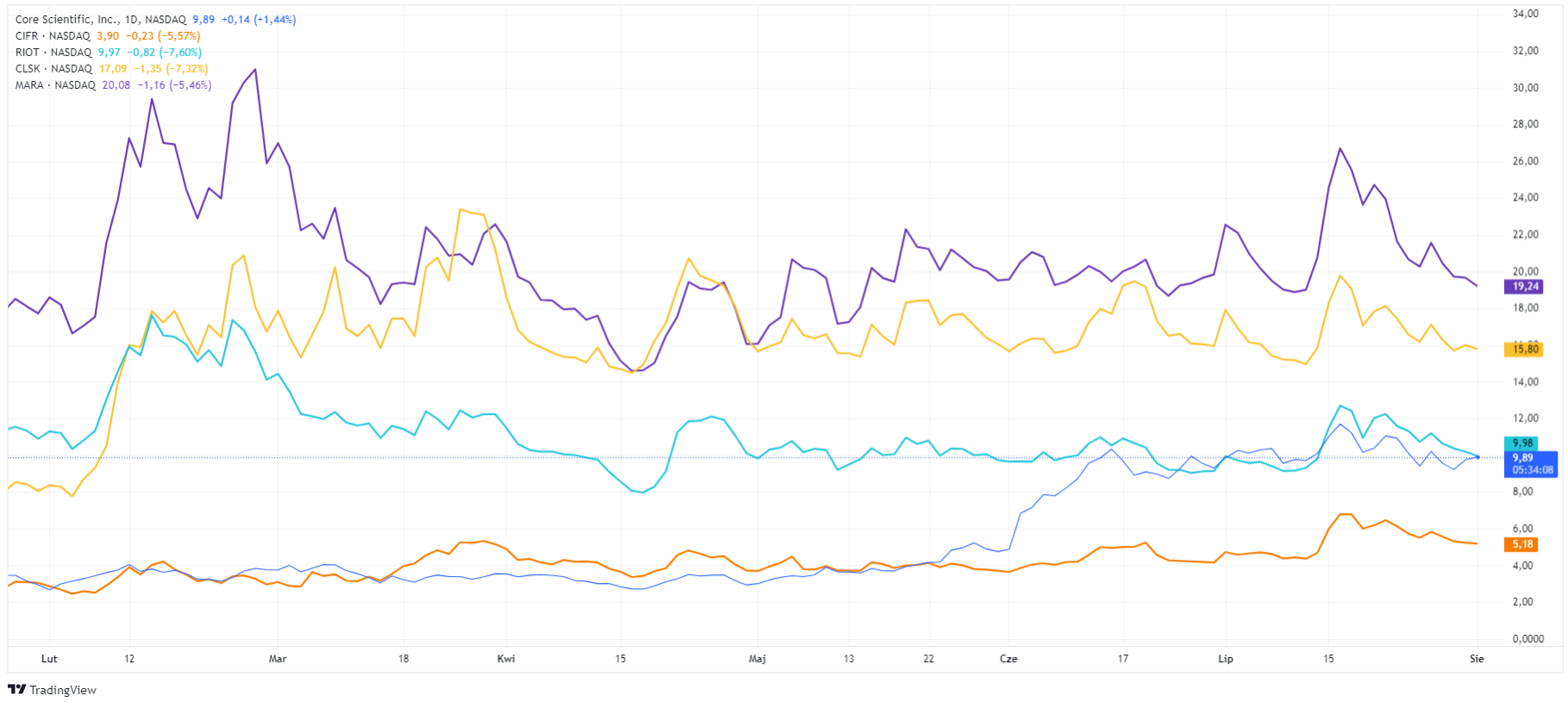

Although the price of Bitcoin has been close to its historical highs for many months, rising more than 50% this year, not all cryptocurrency miners are equally fortunate. Year-to-date (YTD), MARA shares have fallen by 18% and RIOT has dropped by as much as 35%.

The situation looks better for CleanSpark, which is bucking this trend with a YTD gain of over 43%. Shares of CIFR are also on the rise, increasing in value by 25%. On the chart for CORZ, a company that debuted this year, we see a movement of 75% since the end of January.

The recent Bitcoin halving event, which took place April 2024, created some uncertainty in the market. The halving reduced the block reward for miners by 50%, cutting into their revenues. Some miners were selling off their Bitcoin inventories to prepare for this event, which can be seen as a bearish signal by investors.

Rising energy costs have also put pressure on mining companies. Bitcoin mining is an energy-intensive process, and increased electricity prices can significantly impact operational costs and profit margins. This has made it challenging for some miners to maintain profitability, especially during periods of lower Bitcoin prices.

FAQ about Bitcoin mining

Who is the largest Bitcoin miner on Wall Street?

As of 2024, Marathon Digital Holdings (NASDAQ: MARA) is the largest publicly traded Bitcoin miner on Wall Street, with a market capitalization of approximately $6 billion. Over 20 companies engaged in Bitcoin mining are currently listed on global stock exchanges, with the majority being on Wall Street.

How long does it take to mine 1 Bitcoin?

The time to mine 1 Bitcoin varies greatly depending on mining hardware and network conditions. On average, it takes about 10 minutes to mine one block, which currently yields 3.125 BTC in block rewards. However, for an individual miner, it could take years to mine 1 full Bitcoin due to the high competition and network difficulty. Most miners join pools to receive smaller but more frequent payouts.

How much Bitcoin does MARA hold?

As of their latest financial report in Q2 2024, Marathon Digital Holdings (MARA) held a total of 18,536 Bitcoin. This amounts to nearly $1.2 billion in dollar terms.

Is it legal to be a bitcoin miner?

Bitcoin mining is legal in many countries, including the United States. However, regulations vary by jurisdiction. Some countries have banned or restricted cryptocurrency mining due to concerns about energy consumption or financial regulations. It’s important to check local laws before engaging in mining activities.

Does BTC miner really pay?

Legitimate Bitcoin mining operations do pay out rewards to miners. However, many mobile apps or websites claiming to be “BTC miners” are often scams. Real Bitcoin mining requires specialized hardware (ASICs) and significant electricity. Most individual miners join reputable mining pools to receive more consistent payouts. Be cautious of any service promising unrealistic returns or “free” Bitcoin mining.