The total amount raised in the global cryptocurrency market has surpassed $10 billion, marking the highest level in the past three years.

Backed by supportive U.S. government policies and large-scale investment, the crypto industry is experiencing its strongest recovery phase in three years.

The Crypto Fundraising Overview

The latest report from data platform CryptoRank reveals that in Q2 2025, the total amount raised in the global cryptocurrency market surpassed $10 billion. This figure serves as a symbolic marker and a clear signal that the crypto industry is entering a phase of strong recovery and reshaping.

It reflects the growing involvement of institutional investors and increasing support from governments.

Crypto VC investments. Source: Cryptorank

One of the foundational drivers is the more crypto-friendly policies of the new U.S. administration. After years of regulatory uncertainty and even hostility during 2022–2023, the market is now receiving fresh “oxygen” to expand. This renewed support is enabling it to attract capital aggressively.

A notable shift is also occurring in the structure of capital flow. No longer are funds pouring into early-stage projects with unfinished products, as seen in the previous bull run.

Instead, the proportion of late-stage financing is rising rapidly. This reflects growing confidence in projects that have demonstrated their ability to build products. It also highlights their success in growing their user base and generating sustainable revenue.

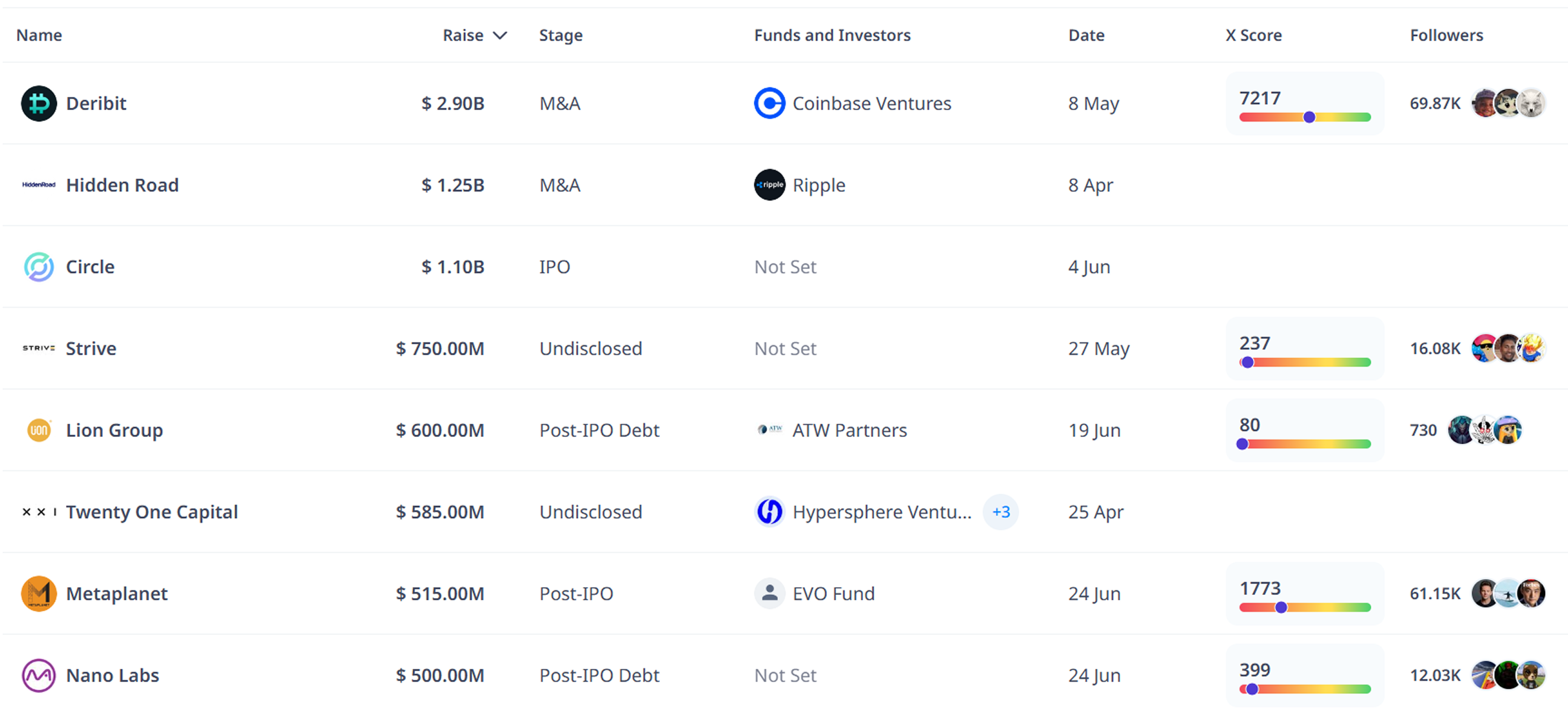

In addition, IPO and M&A deals are more active than ever, indicating a significant shift in the market. This suggests that the market is no longer a playground for small experimental teams but is transitioning toward the scale of true fintech enterprises.

Deals such as exchanges acquiring DeFi startups demonstrate a growing trend in the industry. Additionally, blockchain infrastructure companies like Circle, which is now trading in the US markets, prove that crypto fundraising is becoming more “mainstream” in the eyes of traditional finance.

Late-stage deals in Q2 2025. Source: Cryptorank

This maturity is driving more selective and high-quality capital flows. Investors are no longer chasing short-term “trends” but are starting to evaluate operational efficiency, business models, and the ability to generate real-world value.

As many Web3 products have progressed beyond experimental stages to serve millions of actual users, the crypto market is undergoing a significant transformation. It is evolving from a “tech lab” into a global financial-technology ecosystem.

Future Outlook

Mason Nystrom, an investor at Pantera Capital, recently shared in-depth insights on the current state of crypto VC via a series of posts on X. The posts revealed structural changes in fundraising approaches, investment choices, and capital development strategies. While the early part of 2025 still shows signs of difficulty, there are “hot spots” that founders and followers should not overlook.

Nystrom predicts tokens will become the primary investment vehicle instead of the traditional token + equity structure. Each token will represent the project’s value and potential for profit.

Fintech VCs are transitioning into crypto, paving the way for platforms in payments, digital banking (neobanks), and tokenized assets. VCs that remain outside fintech risk being left behind.

“Liquid Venture”—investing via liquid tokens—is trending. Capital flows are more flexible, entry and exit are easier, and governance is more agile. Funds are also beginning to use their treasuries to hold BTC like Metaplanet and ETH like Fenbushi Capital to benefit in the long term.

“Crypto continues to innovate on new capital market formation. And, as more assets move onchain, more companies will look towards onchain-first capital formation.” Nystrom stated.

However, this doesn’t mean the road ahead will be smooth. The industry is becoming increasingly competitive, demanding clear strategies, professional execution, and superior technology from projects. Macroeconomic tailwinds and fresh capital are just catalysts—true success will depend on each team’s ability to adapt and innovate continuously.