[ad_1]

Bitcoin (BTC) continues to struggle with sideways movement, keeping the cryptocurrency from reclaiming $100,000 as a support level.

Amid this price action, veteran trader Peter Brandt has highlighted a similarity to Bitcoin’s 2018 pattern, sparking speculation about the next move for the crypto king.

Bitcoin Strategy Reinvented

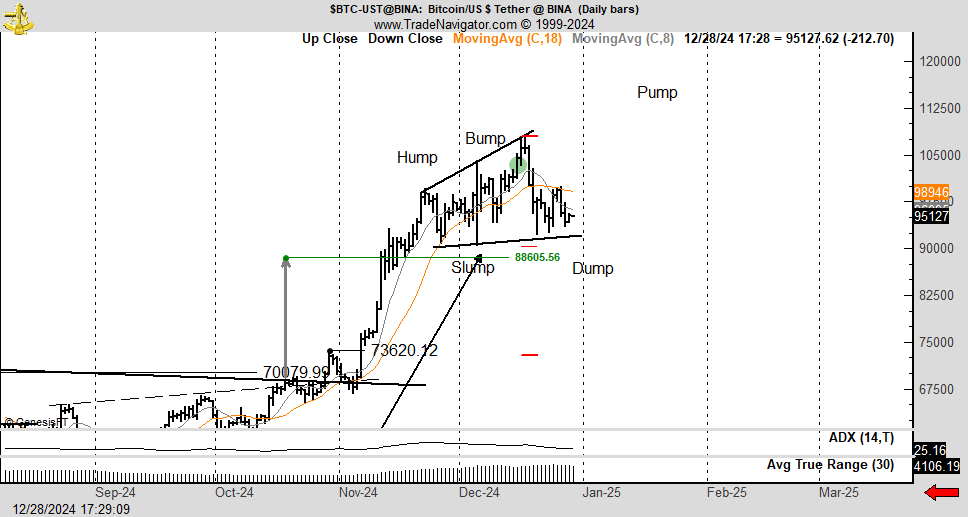

Peter Brandt noted that Bitcoin resembles an old 2018 pattern, which occurred before BTC broke its Parabolic Advance. The pattern, known as BHLD (Bump, Lump, Hump, Dump), has a derivative called Hump-Slump-Pump-Dump, which appears to align with Bitcoin’s current trajectory and could be its next trajectory.

“If you are a Bitcoiner, take a look at this post from several years ago. It describes the famous Hump Slump Bump Dump Pump chart construction in $BTC. Same thing could be happening now,” Brandt stated.

Bitcoin Pattern. Source: Peter Brandt

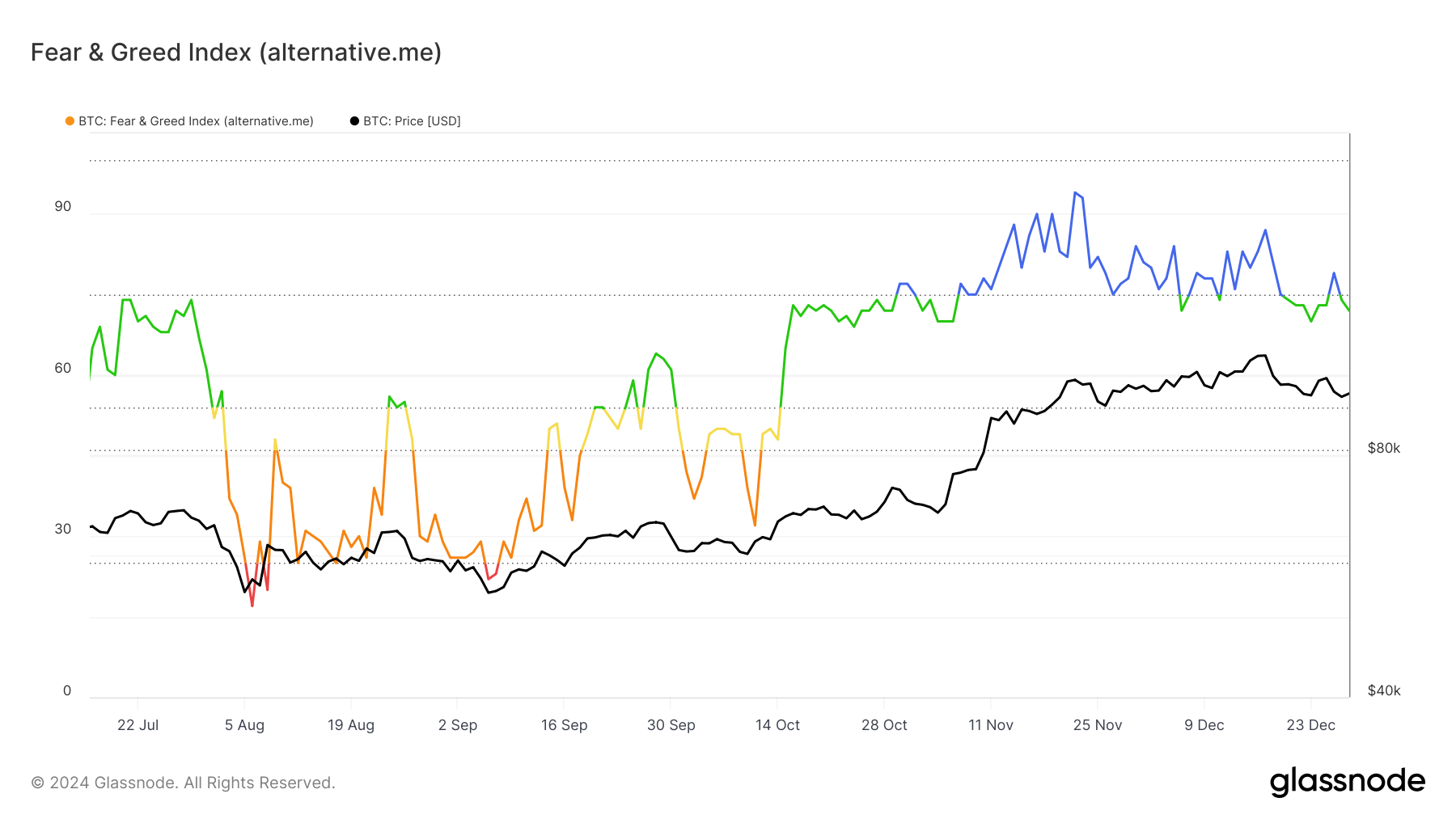

Bitcoin’s macro momentum, as reflected in the Fear and Greed Index, is transitioning from Extreme Greed to a lower greed zone. Historically, BTC has corrected sharply during phases of extreme greed, making this shift a relatively positive sign for stabilizing its price.

The current greed level indicates potential for recovery as long as it doesn’t escalate into excessive selling pressure. While selling remains a possibility, the moderation in market sentiment could provide Bitcoin with a window for short-term gains.

Bitcoin Fear and Green Index. Source: Glassnode

BTC Price Prediction: Securing Support

Bitcoin is trading at $94,224, attempting to secure $95,668 as a support level. For this to happen, investors must resist booking profits, enabling BTC to stabilize and recover lost momentum.

Should Bitcoin reclaim $100,000 as support, it could signal a short-term bullish trend. This would help BTC recover its recent losses and potentially resume its upward trajectory, strengthening investor confidence.

Bitcoin Price Analysis. Source: TradingView

Conversely, failure to hold $95,668 could lead Bitcoin to drop further, testing support at $89,800. Such a decline would invalidate the bullish outlook and push BTC’s recovery timeline into January 2025, prolonging uncertainty for investors.

[ad_2]