[ad_1]

Within the past week, financial publications like the Wall Street Journal and Financial Times have published features about Donald Trump ringing in a “stablecoin gold rush.”

With a newly accommodative Securities and Exchange Commission (SEC), a Tether-friendly US Commerce Secretary, and the US Office of the Comptroller of the Currency’s (OCC) rescission of anti-crypto banking rules, stablecoins seem ostensibly poised for a banner year.

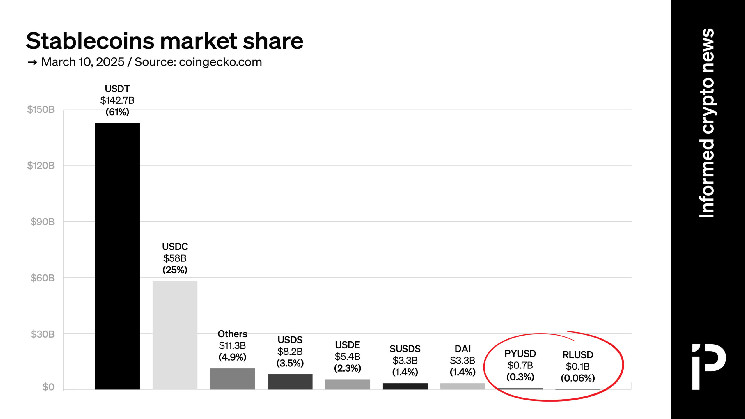

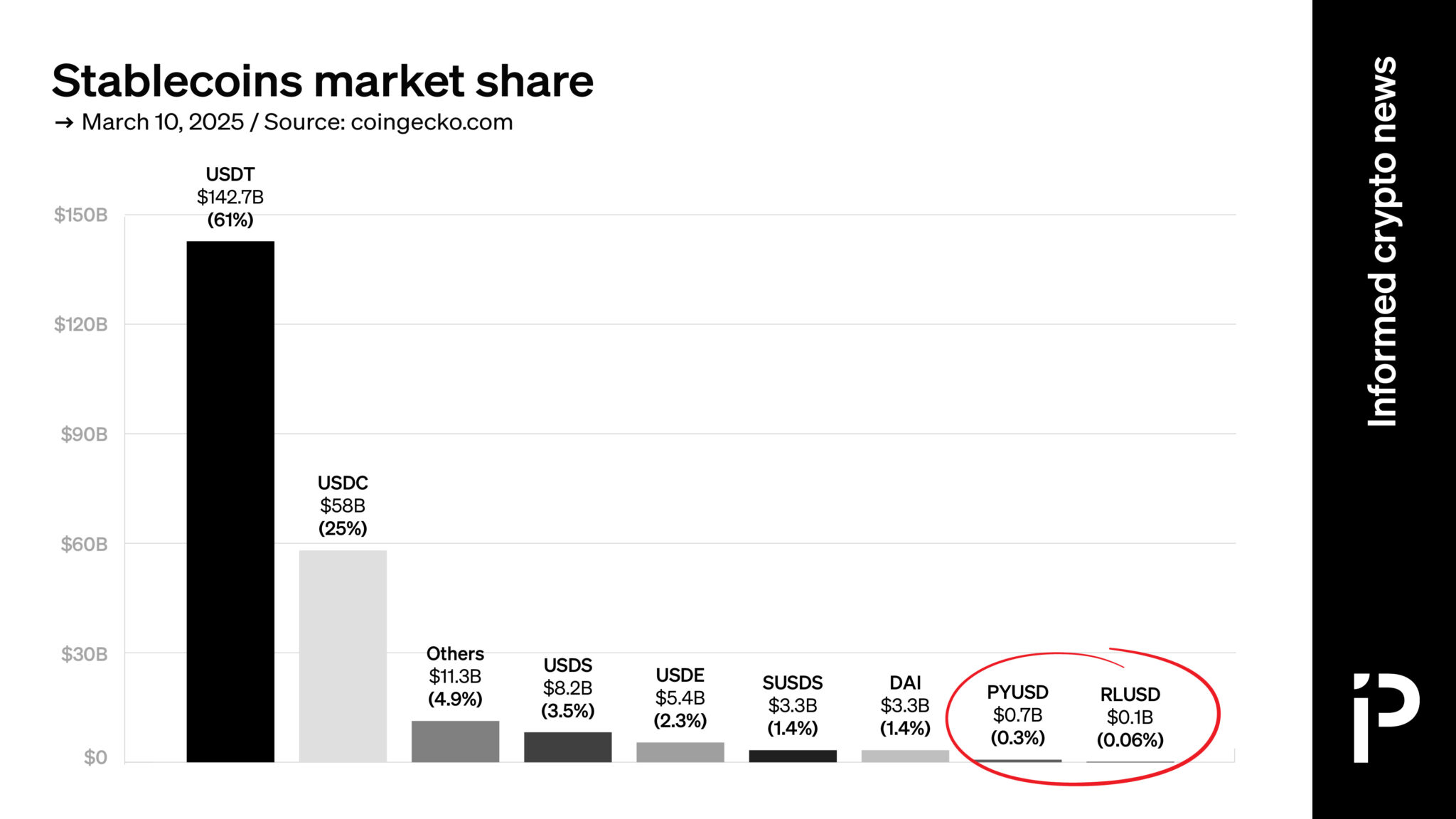

Despite this nearly perfect political environment, however, PayPal’s PYUSD and Ripple’s RLUSD have still failed to attract even a single percentage point of their target market.

Squint to see PYUSD and RLUSD dominance

Ripple launched RLUSD in December as “the first enterprise-ready stablecoin” hosted on its XRP Ledger (XRPL). Apparently, not many enterprises were ready. Nearly three months since its debut, RLUSD has displaced less than 0.7% of its competition.

Worse, a strange first-week spike in RLUSD’s price caused concern about its ability to maintain its $1 peg. To its credit, the stablecoin is currently trading at $1.

PayPal has also struggled to gain traction for its PYUSD coin despite integrating it into a variety of its own apps and a number of third-party products. Although it remains committed to its proprietary coin and doubts that anything will arise out of a Joe Biden-era subpoena, market forces continue to dampen PYUSD’s momentum.

Despite Trump’s pro-US crypto business promises and stablecoin-friendly changes by regulators, offshore and transnational incumbents like Tether’s USDT, Sky’s USDS, Ethena’s USDE, and Maker’s DAI have retained overwhelming market dominance.

[ad_2]