[ad_1]

The report asserts that the dominant cryptocurrency is slowly shifting from being a store of value to being a medium of exchange once again.

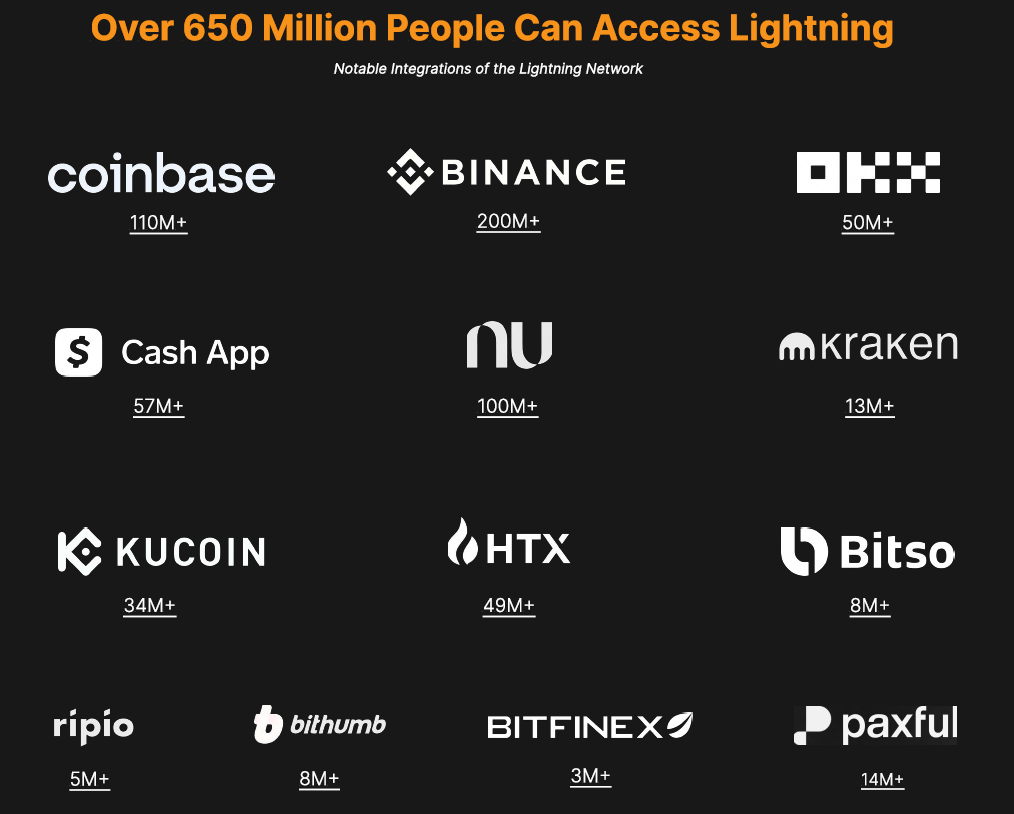

Bitcoin Adoption Expands: 650 Million People Now Have Access

Satoshi created bitcoin (BTC) as “peer-to-peer digital cash,” but over time, the cryptocurrency has morphed into what many call “digital gold,” with investors choosing to “hodl” the asset rather than spend it. But Bitcoin scaling firm Breez co-authored a report that it published last week, showing how bitcoin might be staging a comeback as digital cash.

The Lightning Network, a layer two solution for cheaper and faster bitcoin payments, is the technology responsible for that comeback, according to the report, which describes Lightning as the backbone of bitcoin payments.

And now, with Lightning integration across multiple uses cases, from retail and luxury goods to global remittances, bitcoin has reached more than 650 million people worldwide, marking a shift from being a store of value to once again being a medium of exchange, the report says.

“Lightning transforms Bitcoin into the scalable medium of exchange initially envisioned,” the report states. “But Lightning isn’t just an improvement on bitcoin’s early limitations… Lightning unlocks entirely new utilities that weren’t possible before.”

(Bitcoin micropayments can be used to buy coffee / Shuttershock)

This new genre of payments includes pay-per-use and microtransactions. For example, paying for one-time access to digital content or even just paying for a cappuccino at the local coffee shop.

So where did the 650 million estimate come from? The report points to customer bases of major bitcoin platforms such as centralized exchanges like Coinbase and Binance, and peer-to-peer platforms like Paxful. Binance alone has nearly 260 million users.

(How the 650M estimate was arrived at / Breez)

Real-World Use Cases: From Retail to Remittances

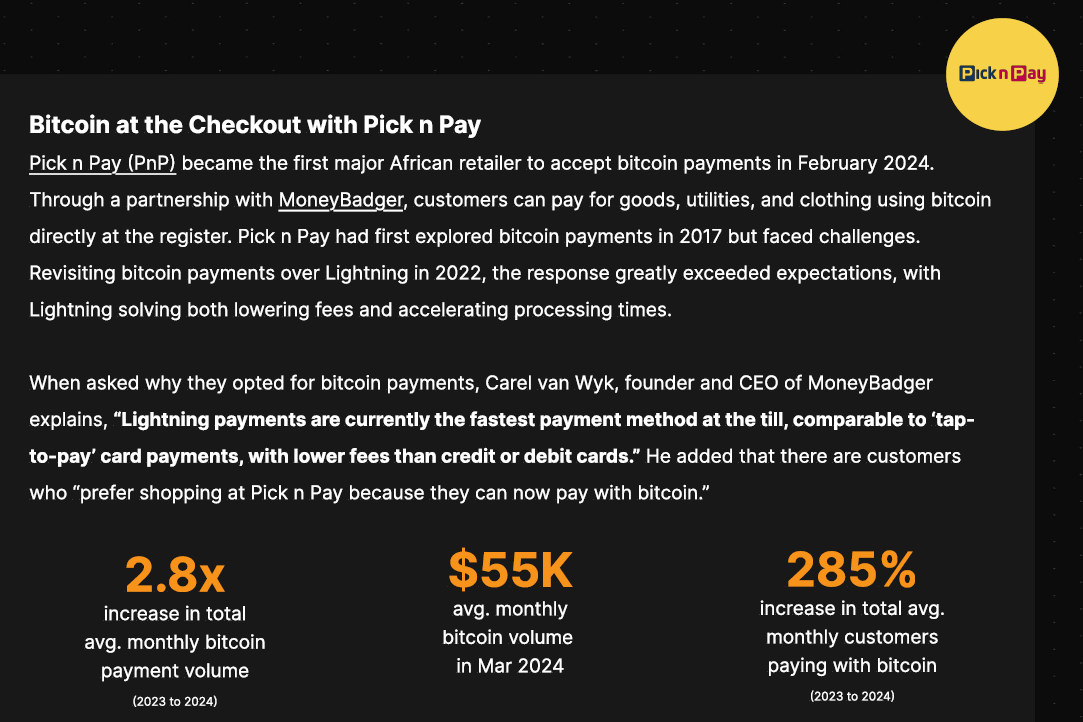

Bitcoin investors tend to be concentrated in developed countries where fiat systems are relatively efficient and reliable. But in the global south where inflation is rife and monetary systems are less stable, bitcoin shines as digital cash. The report gives the example of Pick n Pay, a major African retailer that uses Lightning to integrate bitcoin payments.

“Lightning payments are currently the fastest payment method at the till, comparable to ‘tap-to-pay’ card payments, with lower fees than credit or debit cards,” said Carel van Wyk, founder of MoneyBadger, which implemented Pick n Pay’s Lightning integration.

That speed and low cost is also making Lightning a viable solution in the remittance space. “The same way [someone] pays for a cup of coffee in New York City is the same way [they] can now casually send $10 back home to Nigeria,” said Bernard Parah, CEO of payments firm Bitnob.

(South African retailer Pick n Pay accepts bitcoin / Breez)

Bitcoin vs. Stablecoins

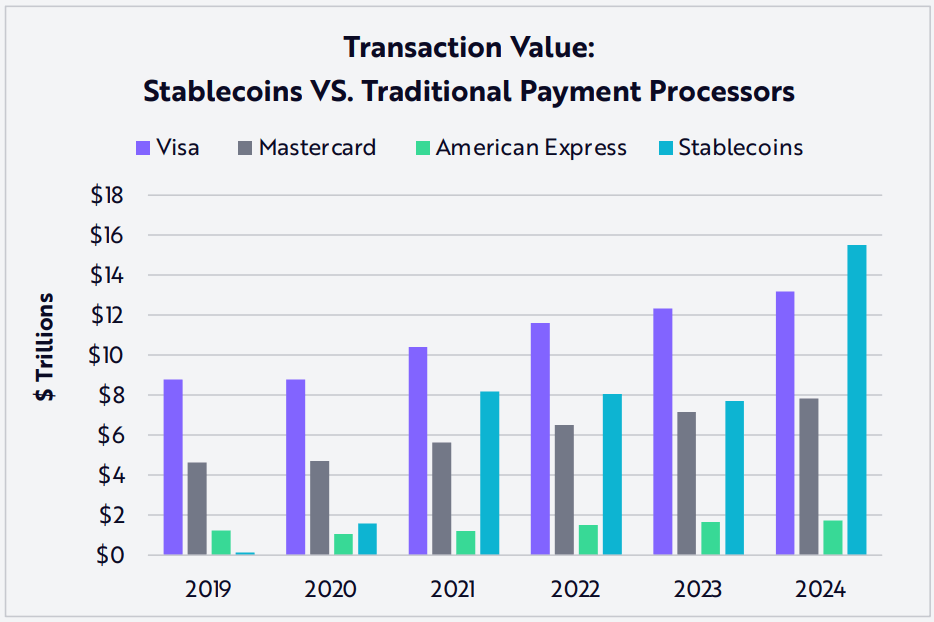

Stablecoins have been touted as one of the most useful forms of crypto. In fact, recent data from Ark Investment Management shows that last year, the transaction value handled by stablecoins was higher than that of Visa and American Express combined.

(In 2024, stablecoins handled more transaction value than Visa and American Express combined / Ark Investment Management LLC)

Their primary use is to function as a non-volatile medium of exchange or as a store of value for crypto traders. However, the report argues that they face the same risks as the underlying fiat currencies they represent – centralized government control, corruption, and censorship.

“Stablecoins are not digitally native,” the report states “Rather, they are digital representations of non-Internet native assets like the U.S. dollar,” the report explains, adding that stablecoins are “essentially IOUs that promise to be redeemable for reserves held in the traditional financial system.” The report contrasts stablecoins with bitcoin by emphasizing that BTC “cannot be devalued” and that its value is a function of decentralized global consensus.

Digital Case or Digital Gold?

While the report makes a case for 650 million people having access to bitcoin and Lightning, those people don’t necessarily use the cryptocurrency as digital cash. In fact, most exchange customers are either trading BTC or holding it for investment purposes. But the report does make a good case for how bitcoin can be digital gold in some regions and digital cash in others.

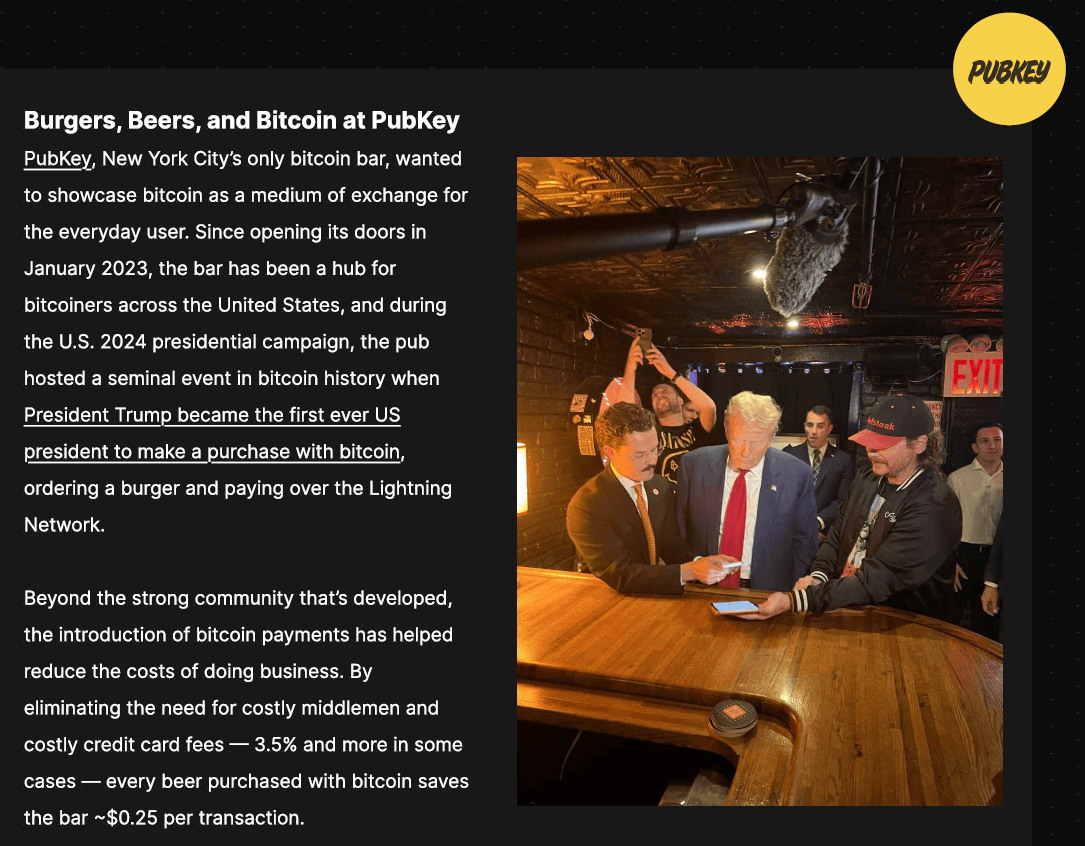

(Donald Trump buys burgers with bitcoin at Pubkey in 2024 / Breez)

“Bitcoin is already a viable currency. Now. Today,” the report explains. “People are using it to buy a round in their local pub, to send money to important charities on the other side of the planet, and to engage in high-frequency trading.”

[ad_2]