Crypto mining equipment makers created improved machines, giving solo miners a chance to solve blocks or share rewards with larger mining pools. Technical innovations have turned the tide for Bitcoin mining. Let’s step back and look into the industry that spawned the cryptocurrency economy and its ramifications.

What is Cryptocurrency Mining?

Cryptocurrency mining is the process of performing so-called proof of work, using high-level computing power to provide cryptographic security and process transactions. Miners competing with more computational power also make the network more secure since no single miner can control cryptocurrency transactions or alter the state of the network.

Bitcoin mining is a highly competitive operation that combines several factors to be successful. Miners face the challenge of local regulations, as well as the technicalities of securing the right mining hardware. Big mining operations usually have the foresight to secure electricity contracts at a low price, as well as reliable spots for their data centers.

Crypto mining operations have grown over the past few years, competing with large-scale corporate players. Some mining pools are even ready to absorb losses while still fighting for block rewards and transaction fees. Miners also often retain their proceeds for a longer time frame, benefitting from BTC appreciation. Bitcoin mining opportunities and limitations are shifting for all participants.

Taking up crypto mining privately after over 13 years of Bitcoin history is a matter of calculating costs versus benefits. Mining Bitcoin is extremely competitive and requires investment in specialized hardware. Bitcoin miners can still choose to run a solo operation and absorb all computing costs. They often join one of the leading mining pools to earn a proportional share of the block reward.

How Bitcoin Mining Works

The Mining Process

Bitcoin mining is, at its heart, energy-intensive number generation, where each output is tested against a predetermined value. It involves generating random numbers and then testing each of those numbers against the target value.

To mine Bitcoin also means to discover the alpha-numeric string to satisfy that value is the new block header. The header is a number that cannot be easily faked, and contains within it the hash of the previous block header. This process ensures blockchain security.

Each new block secures the Bitcoin network by making the previous block immutable. Any changes to the contents of the previous block will not produce the same header number and will reveal the tampering. Block production is thus the real proof of the immutable distributed ledger.

Miners produce block headers, which undergo additional cryptographic operations to produce the next block header. This process ensures that all transactions included in a block cannot be changed without leaving undeniable digital evidence. The Bitcoin mining process ensures the blockchain is protected against brute-force attacks and is the central tenet of building a secure digital currency.

As a reward for the energy—and computation-intensive task, miners receive a payout for each block. Rewards fall over time until they reach the targeted 21M BTC supply. Bitcoin has already gone through four halvings, cutting the reward from 50 BTC to 3.125 BTC per block.

Each block may also contain fees, which are also shared with miners. Fees have no predetermined level and grow during times of high network overload. Fees have grown up to 70% of the block reward and, in the future, may be the only payout for miners.

Mining is also a mix of power and luck, as some miners may produce the required number earlier. Every few months, a solo miner produces a block, taking the whole reward, where even the biggest pools do not succeed.

Profitability depends on the mining difficulty level

Miners have to compete at a predetermined metric of difficulty. A higher mining difficulty means the required block header is harder to discover. Difficulty is the metric that depends on available hashing power and adapts to the number of miners. Over time, Bitcoin miners pushed the hashrate to a record level.

The Bitcoin hashrate is near peak levels at 700 EH/s. | Source: Bitinfo

The Bitcoin network matches its difficulty to currently active miners and their hashrate. Whether it’s just Satoshi Nakamoto on one computer or millions of rigs around the world, it always takes 10 minutes to find a Bitcoin block header. Thus, if miners point more machines at the problem, the Bitcoin algorithm will just give them a more difficult problem, so it will take the same 10 minutes to solve.

Bitcoin mining requires the SHA-256 algorithm, which is one of the most widely used encryption tools. The cryptographic algorithm also defines the need for powerful mining rigs to create unbreakable cryptographic protection for each block.

SHA-256 chains cannot be brute-forced. Several coins use a similar mining approach, while other assets like Litecoin require Scrypt mining. Each mining algorithm requires specialized mining equipment with the right firmware to produce blocks in the most power-efficient way possible.

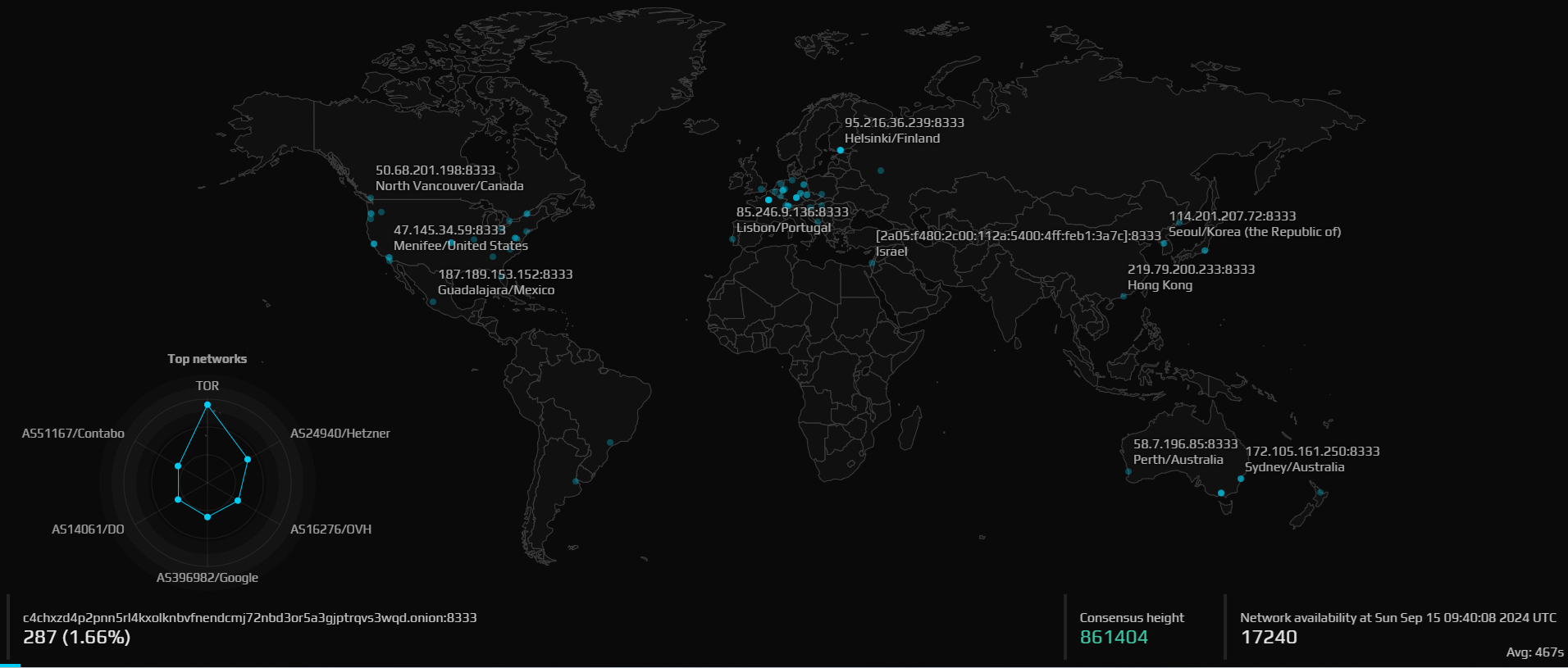

Miners also have another task – to keep track of the blockchain record and verify transactions, broadcasting them to other node operators. The presence of miners is easily visualized through the Bitnodes service, revealing the geographic distribution of Bitcoin’s network and the addition of new nodes.

Bitcoin nodes are distributed worldwide, though some use cloud services. | Source: Bitnodes

Node propagation is not rewarded, but requires some additional resources. The Bitcoin blockchain in its unpruned state is more than 200 GB. Running a node while mining requires additional RAM or even an SSD for higher speed. Storing a partial or pruned copy of the Bitcoin blockchain may require only 20GB in extra space.

Mining Hardware and Software

Mining rigs specialize in producing and testing potential block headers at a great speed. They can do that energy-efficiently but cannot discover an indefinite number of blocks. The goal is to produce a block just 10 minutes apart, on average. If the time between blocks starts to shorten, the Bitcoin algorithm will require a block header that is more difficult to discover. If time between blocks increases, the difficulty will drop.

Buying a mining rig can be a major upfront investment, and the cost of acquiring the hardware must be compared to just buying BTC on the open market. Mining rigs also move through market cycles, with the latest models commanding the highest rates.

Bitmain is still the biggest producer of mining machines and side equipment. The Antminer series always introduces new versions, usually launching at presale prices. As of September 2024, Bitmain’s S21 XP model retailed at $8,289 per unit or $5,800 with a discount. Buying the model would also require some upfront purchases of crypto coins, as Bitmain sells its machines for BTC, ETH, or USDT.

Antminer S21 Pro is the most powerful SHA-256 machine on the market and the only one competitive enough to be profitable. | Source: Bitmain

Having the newest mining rig is also no guarantee of receiving higher block rewards. By the time mining hardware hits the open market for small-scale crypto miners, large pools or even the producer Bitmain has used the model to front-run others. Additionally, even a high-capacity model can vary in their day to day revenue and profit.

Despite this, a new buyer can rationally decide based on currently available hardware and its comparative profitability. The best approach is to compare hardware through the Hashrate Index tool, choosing the best combination of upfront cost and profit margin.

Bitmain S21 XP, the latest ASIC machine, has varied revenues and profits depending on market conditions. | Source: Hashrate Index

Mining software for rig owners is simply a self-custodial wallet. Miners must always keep their private phrase well-protected. Mining hardware for cloud mining is not necessary, and may not be profitable. Mining rigs will also perform based on their latest firmware version from Bitmain, which is a key part of their efficiency profile. Owning a mining rig means also tracking firmware upgrades.

Choosing a mining solution may also involve some form of cooling or air circulation, especially if using more than one machine. Energy efficiency is also key to lowering mining costs.

Is Bitcoin mining still profitable?

Bitcoin’s network went through three halvings, cutting the block reward to 25 BTC, then to 12.5, 6.25 and 3.125 BTC. At the same time, the price of BTC continued to grow, allowing miners to cover costs and retain reserves. Crypto mining is only profitable after selling the rewards, otherwise the earnings from Bitcoin mining work are hypothetical. Crypto miners compete not only to discover blocks, but also to sell their coins at a favorable price.

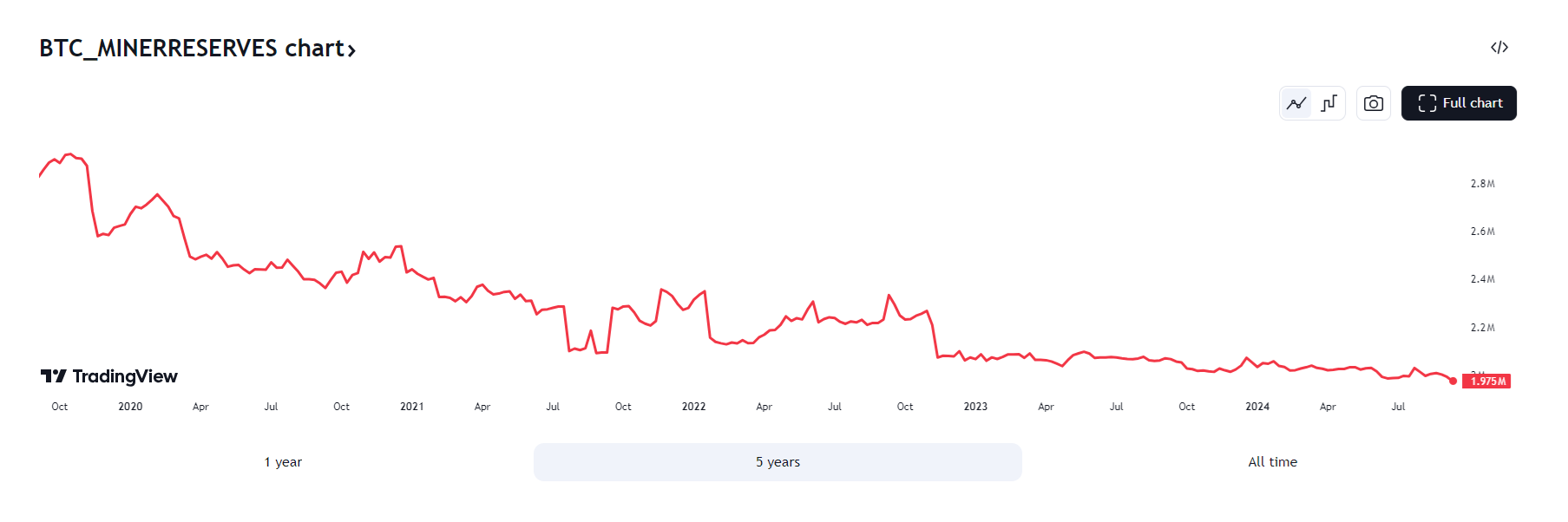

Bitcoin miner reserves inched down, but are still close to 2M coins. | Source: Tradingview

Bitcoin solo mining is still possible, though not viable. A miner with a handful of machines has a better chance of sharing the block reward as part of a mining pool. Despite this, solo miners with sufficient hashing power solve a block every few months and retain the whole block reward. However, mining with a pool may offer more regular rewards, with the ability to sell and cover upfront and operating costs.

Mining profitability can be re-calculated periodically, to avoid mining during less profitable conditions. In the long term, Bitcoin profitability falls with each halving, but there are days or weeks where miners receive slightly higher rewards. If the profitability falls too much, some mining operations will shut down temporarily, until the difficulty metric turns more favorable.

The other factor for miners is their ability to hold onto the coins earned. In the long run, mining operations that were not profitable even at $6,000 ended up holding a reserve of coins. As of 2024, miner reserves remain close to 2M coins.

Miners in 2024 have an estimated cost basis between $43,000 and $75,000. The cost basis of mining one BTC varies for each operation and has risen significantly after the halving. The reason for that is that miners use the same or bigger hashing power only to produce 50% of the daily BTC.

Best mining pools to join

The landscape of mining pools will change in 2024. More than 40% of blocks solved will go to miners based in the USA. China is still a mining powerhouse, but it has lost its primacy as investments and technology shift to US-based operations.

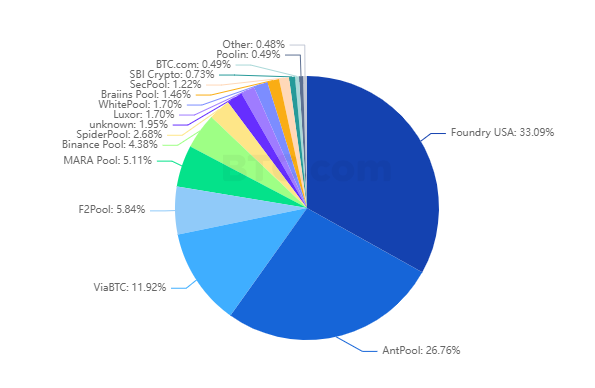

Larger pools have a bigger chance to solve a block, but split the reward between a larger number of miners. | Hashrate Index

Mining pools show their track record of producing a share of the blocks on a daily or weekly basis. Top pools have the biggest share of the block, but they also share it with the widest circle of participants. A mining pool can combine computing power from both small-scale miners and big facilities, with no limits to geographic distribution.

The payout from pools varies according to periods and depends on how many miners have joined, how many blocks have been solved, and the pool’s payout policy. Almost all large pools can offer rewards over time.

The top five pools based on blocks solved are Foundry USA, F2Pool, Antpool, ViaBTC, and Binance Pool. Smaller pools solve blocks much more rarely.

Each pool also charges a withdrawal fee, ranging from 0% to 4%. Some pools offer additional services, such as multi-coin mining or savings plans. ViaBTC has automated withdrawals through CoinEx.

The main thing is to pick a pool that doesn’t have simulated mining or require upfront investments or additional payments. Some forms of mining may be non-viable and are in fact not real mining, but a simulation.

Solo mining is not viable at this point, except for large mining operations that also function as a pool. A solo miner, even with powerful rigs, can hope to solve a block once every few months.

Choosing the right mining hardware

Mining hardware or a mining rig is also known as ASIC, short for Application-Specific Integrated Circuit. The chips are tailored to solving specific hashing tasks for only one type of cryptographic algorithm. Blockchain technology can also use a graphics processing unit (GPU), but those are tailored to different cryptographic algorithms and other types of coins.

ASIC machines get rebuilt for efficiency every few years. The newer models often have dramatically higher daily earnings and are more efficient and competitive. The potential earnings of each rig depend on the market price of BTC.

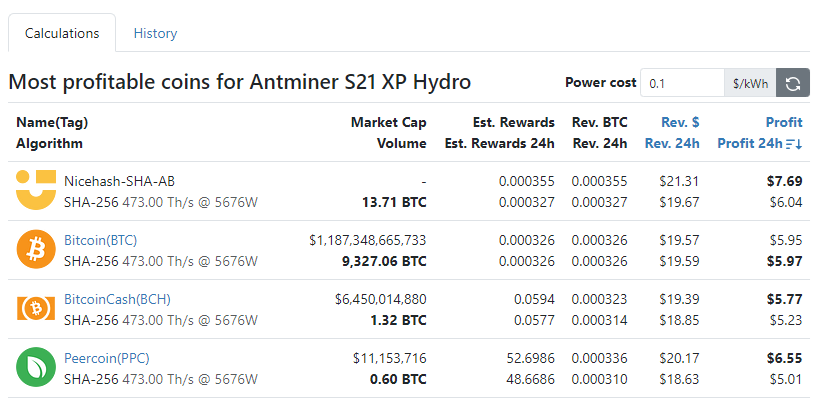

S21 can mine Bitcoin, but also other SHA-256 algorithm coins like Bitcoin Cash and Peercoin. | Source: Bitmain

The profitability of general mining also depends on electricity costs and the ASIC hashrate. As usual, mining is not always viable and machines may be shut down during periods of unfavorable difficulty and increased competition.

Hardware is the biggest initial outlay, which can determine whether the investment in mining is viable. Even during profitable times, a small-scale miner will have to cover the upfront cost of the rig first.

One good metric for mining viability is the time period to pay down the initial investment. All initial investments in mining can be checked for ‘days to payback’, keeping in mind that electricity and other costs must also be covered even before the first Satoshi is mined.

Mining operations are becoming more competitive

Mining operations are in no danger of a capitulation event. The Bitcoin hashrate, an indicator of mining activity, constantly prints all-time highs. Mining operations may have a thin profit margin, but instead of giving up, miners are actually doubling down.

The highly competitive conditions mean a single miner will have to hope for a small share of the total rewards. While mining may be viable for small sums of money, the bottom line may not always work out. Mining does not mathematically guarantee rewards and may take time before offsetting the investment in a top-grade mining rig.

Mining operations are heavily subsidized and paid with outsized earnings. The constant addition of new mining facilities with high-powered machines may make small-scale operations less viable.

ASIC producers are also trying to retain viability, achieving more efficient hashing operations with lower power requirements. However, small-scale miners are fighting for small and diminishing profit margins. While big pools or Bitcoin mining operations can absorb some of the extra expenses, for a one-machine miner, the expenses may easily surpass all potential gains.

High energy consumption and carbon footprint

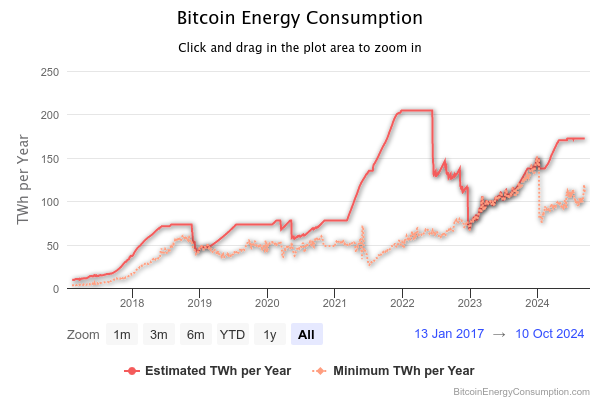

Mining Bitcoin has an estimated electricity usage of 91 TW/h, roughly the energy consumption of Finland. By 2027, the IMF estimates mining will make up 2% of global electricity use and 1% of global carbon dioxide emissions. Bitcoin mining has expanded its energy consumption 10 times since 2018, ranging between 110 and 172 TW/h for Q4, 2024.

Bitcoin energy consumption expanded again during the 2023 market recovery. | Source: Digiconomist

Bitcoin mining has slowed down during bear markets, but has not shown signs of capitulation. Rising local and domestic electricity costs, without alternative sources, may make personal mining operations less viable, but big companies can still absorb the costs.

Bitcoin mining legal limitations can also stall the work of both big operations and individual miners. Local laws on domestic electricity usage may ban mining cryptocurrency.

Miners can still choose to mine Bitcoin, which is still accessible to small-scale miners. However, bottom-line profitability may vary widely, and new mining equipment may not pay for itself for months or even years. Yet mining remains a popular tool for acquiring new bitcoins, with sufficient resources and technology available to start from zero.