[ad_1]

NFTs are securities — or so the SEC seems to be preparing to argue in court, with OpenSea the potential defendant.

Putting aside the merits (or lack thereof) of a case against the firm, most NFT activity happens elsewhere these days.

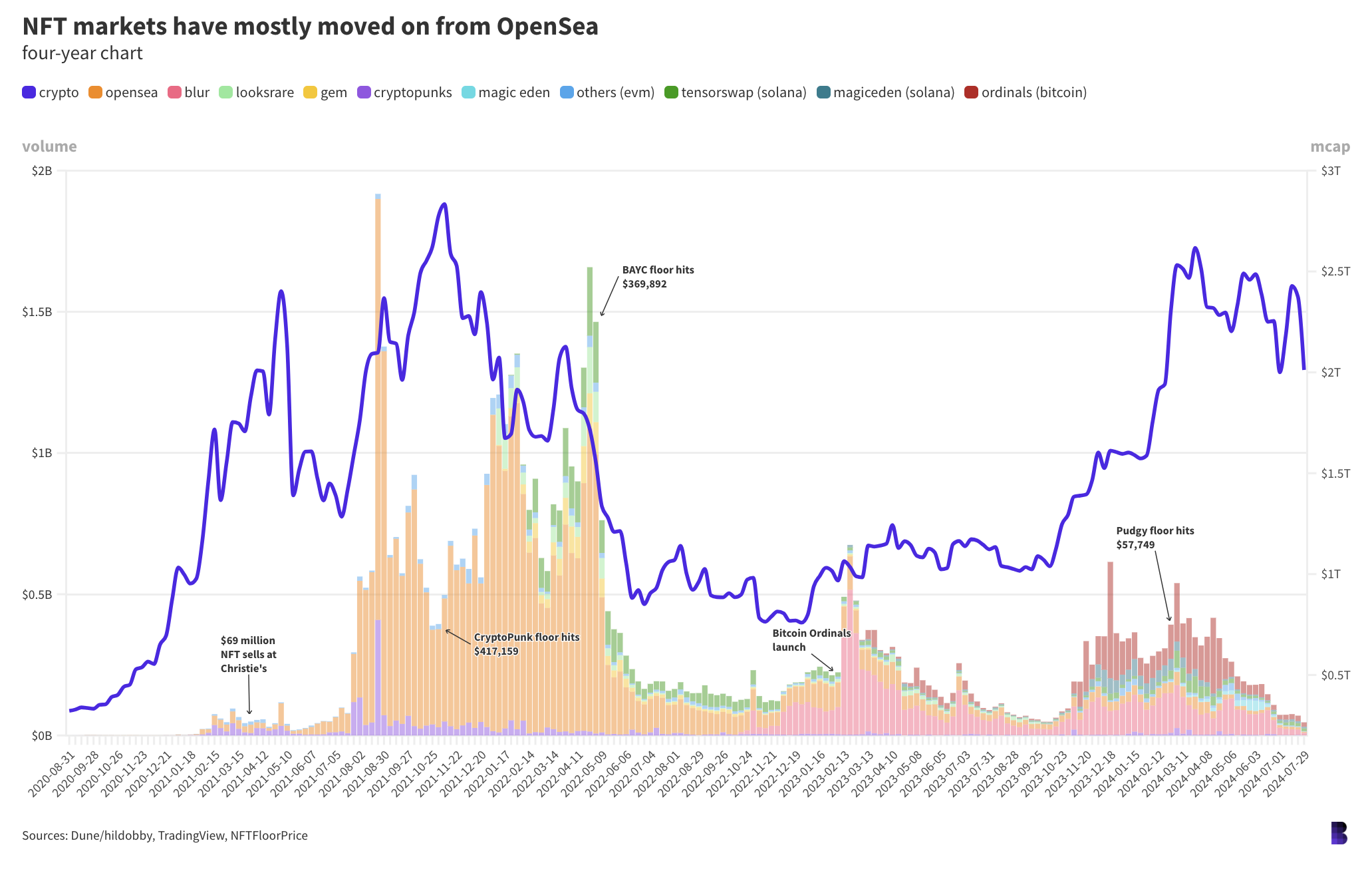

The chart below plots US-dollar denominated trading volumes for NFT marketplaces on EVM chains, shown by the colorful columns in the background. Crypto’s total market cap is otherwise reflected by the blue line.

It includes NFT trades on Ethereum, Base, Blast as well as Solana and Bitcoin, over the past four years.

The data points to over $62.75 billion in NFT trade volumes since August 2020, with OpenSea facilitating nearly 58% of it.

A look at just the past year shows a total of $11.37 billion in NFT trading volume. OpenSea, based in New York, only contributed 10% of those trades.

Blur alone processed $3.75 billion, about one-third of the total, while Solana marketplaces Tensorswap and MagicEden made up 6.6% and 8%, respectively.

If we bundle all Ordinals trading under one umbrella, $3.8 billion in Bitcoin-native collectibles were traded in the past year (up until the start of August), making up almost 34% of yearly volume. Ordinal volumes are shown in the dark red columns on the chart.

(EVM data was sourced from this Dune dashboard by user @hildobby, and from here for the Solana volume. The Bitcoin data came from CryptoSlam.)

(Both hildobby’s data and CryptoSlam filter out volumes suspected to be the result of wash trading, so actual onchain volumes are higher, but this should reflect organic trading activity for most of the NFT market.)

NFTs going their own way (NGTOW)

Granted, a loss for OpenSea would probably bode poorly for other NFT marketplaces.

So there’s still room for the SEC to “protect investors,” as the agency sees it, even if that’s become a meme in the crypto space.

It’s unproven whether a securities ruling would put an end to NFTs as a valuable concept in crypto. It would likely just drive artists, issuers and other creatives to distance themselves from their work, avoiding a pass of the Howey test.

Perhaps, in the worst case, there could be less incentive for venture capitalists to ape into various NFT ecosystems — especially if the promise of future gains from the efforts of others were truly no longer part of the allure. And there’s more to crypto than venture capital, even if it might not seem that way at times.

In any case, NFTs have long been an easy target for haters. Barring the more ridiculous use cases — from burning artworks to tokenizing farts in jars — even the most popular NFT markets are usually much less liquid than top fungible cryptocurrencies, not to mention much smaller.

This usually makes them far more prone to mini bubbles and other kinds of manias. Which draws a lot of attention, both positive and negative.

It could be that NFT markets are following their own cycle schedules, potentially separate from the rest of the crypto market.

NFTs have only been traded with any real size for three years, with its largest cycle to date mostly occurring within the first.

Blur (in coral pink on the chart above) reignited some of the fire when it launched late 2022. Bitcoin did it again through Ordinals. And while those volumes have recently dried up, sillier things have happened in crypto than NFTs finding sustained market interest.

Unless the SEC ruins the fun for everyone with its potential OpenSea case, that is.

If only it had rained on the parades of Sam Bankman-Fried, Alex Mashinsky, Su Zhu, Kyle Davies and Do Kwon a little earlier. Maybe we’d still be in the throes of NFT mania.

[ad_2]