The last time the DXY index was above 103, it was during the Yen carry trade unwind back on Aug. 5 when bitcoin dropped to $49,000.

Over 94% of the bitcoin circulating supply is now sitting in profit, historical data tell us profit-taking should start to build up.

Bitcoin {BTC}}, the largest token by market cap, has surged 12% this week, likely setting the stage for a record high in the coming weeks.

The expected progress toward new highs, however, may be slow due to profit-taking. That’s because data tracked by Glassnode show approximately 5% of the BTC circulating supply is in loss, while the rest of 95% is in profit.

The latter means there could be selling pressure from profitable holders liquidating their coins in a rising market.

Historically, bitcoin has faced selling pressure, resulting in price corrections, whenever the percent of supply in profit has crossed the 94% threshold.

Long-term holders (LTH), defined by Glassnode as those holding coins or at least 155 days, could be the one taking profits, living up to their reputation of being smart traders or those that buy when prices are depressed and sell into a rising market. As of writing, LTHs hold only 500,000 BTC at a loss, which is a small fraction, considering they hold 14 million BTC as a cohort.

Meanwhile, short-term holders currently own 235,000 BTC at a loss, the lowest since March during bitcoin’s all-time high.

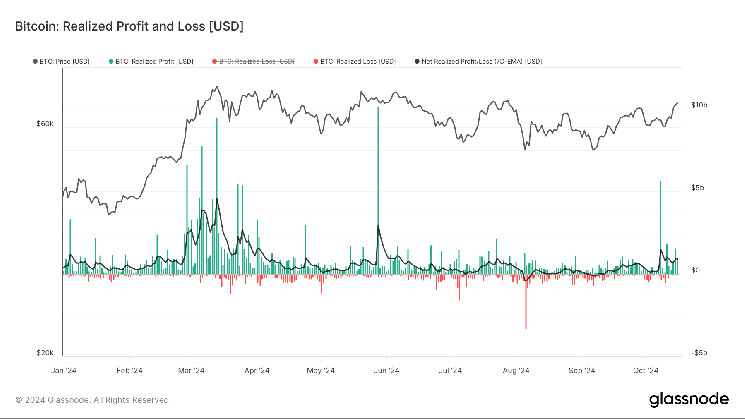

Profit-taking has begun

Realized profit has increased over the past week, signaling profit taking from some investors.

Glassnode data shows that over $11 billion in realized profit has taken place in just over a week, with $5.6 billion on Oct. 8 alone, making it the single biggest profit-taking day since May 28.

Strong momentum

Two factors show the true strength of this rally: bitcoin dominance making new cycle highs and approaching 60%, which was last seen in April 2021.

In addition, BTC remains resilient even as the DXY index continues to climb higher, now above 103.5. The last time the DXY index was above 103 was during the yen carry trade unwind on Aug. 5, which sent bitcoin plummeting from $65,000 to $49,000 over a few days.