[ad_1]

On-chain active loans have returned to levels not seen since the peak euphoria of 2021. The proxy metric for DeFi activity shows borrowers had confidence in the bull market up to this point, seeking gains through collateral-based loans.

DeFi lending has become one of the leading apps in 2024. While the overall DeFi value locked is still lower than in 2021, on-chain loans are just as active as during the previous bull cycle.

The on-chain leverage metric reveals a more mature market, where the leading protocols have spread to multiple chains. Additionally, the current on-chain leverage is only similar to 2021 in nominal terms.

The metric was reached at a time when Bitcoin (BTC) is at a crossroads that has once again raised questions about its cycle peak. In 2021, peak lending coincided with price euphoria, but ended up spreading contagion to multiple protocols. Since then, the growth of DeFi lending has been more conservative, taking into account the value of the collaterals.

Additionally, some protocols switched to T-Bills as collateral, removing a layer of risk tied to crypto prices.

Lending gets a boost from a larger pool of stablecoins

As a percentage of the available money supply in the crypto market, this cycle is still using a smaller percentage of the available stablecoins. This has led to expectations for even wider lending, which could in turn boost DEX swaps and other activities.

With a higher stablecoin supply, DeFi lending is also limiting its contagion in case of a market drawdown.

Leverage is building, but as % of the money supply, #DeFi active loans have only crossed 50% of the level reached last cycle. pic.twitter.com/2kysPxjyQg

— Jamie Coutts CMT (@Jamie1Coutts) December 17, 2024

During the 2024 cycle, DeFi and centralized trading have exposure to nearly 200B in various stablecoins. The DeFi space also has new algorithmic or asset-backed coins and tokens that can create niche sources of liquidity, as in the case of USDe, USDS, the remaining supply of DAI and other minor stablecoins.

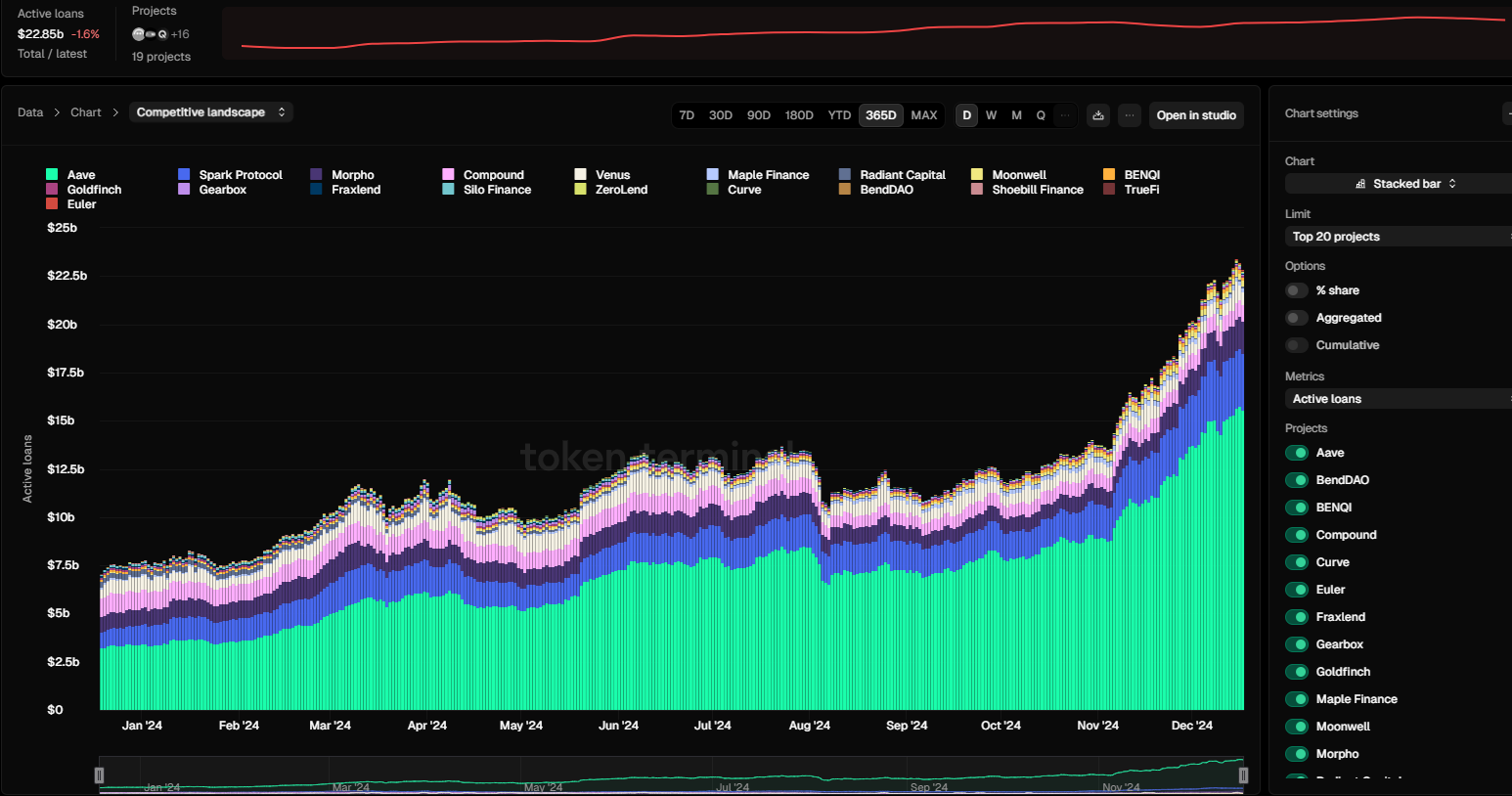

On-chain loans have exceeded $22.85B, as lending protocols from 2021 were replaced by new hubs. The market for DeFi lending has recovered from the crash following the Terra (LUNA) unraveling, as well as the subsequent crash of FTX.

On-chain leverage works as far as the underlying collateral is stable and in excess of the loan. The loans are then often used in other DeFi protocols. Loans are usually in the form of stablecoins, which can then be used to purchase assets or to park in high-yield vaults.

Reporting on DeFi lending hinges on the method used to track value. The current level of active loans, as measured by Token Terminal, is lower compared to other leverage metrics.

Based on DeFi Llama data, lending protocols lock in more than $50B in value, the highest level since before the crash of LUNA and UST.

Aave leads the lending movement

While other protocols grew with some level of caution, Aave (AAVE) was the leading app in terms of active loans and value locked.

Aave is the leading protocol for on-chain loans with crypto collaterals. | Source: Token Terminal

Aave was available during bear market years, building up its infrastructure and user base. The lending protocol is now growing aggressively, offering its lending pool model to other DeFi hubs.

The value in Aave is now above $22B, including the reported loans and collaterals. The project also issues its own stablecoin, GHO, although the growth is limited and relatively conservative.

Aave still relies mostly on WETH and WBTC, while also including smaller tokens in its lending vaults. Even other lending protocols have moved their activity to Aave, in a bid to consolidate liquidity and offer users a simpler approach.

The native AAVE token recently failed its climb to $400, instead sinking to $343.61. AAVE observers expect it to rise to four-digit valuations as it is seen as being early in the lending cycle.

Recently, AAVE also got a boost from whale buying. On-chain lending is sometimes rolled back into DeFi tokens, as in the case of a recently reported whale activity. The whale took GHO as an on-chain loan and used the proceeds to buy more AAVE. Those practices can boost a token’s price. However, that can also expose the loans to liquidation.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.

[ad_2]