[ad_1]

Artemis, a blockchain analytics platform, stressed that while several issuers tried to make inroads in the non-USD stablecoin market, they have failed to dent the dollar hegemony in the asset class. Nonetheless, euro stablecoins have shown consistent growth.

Artemis: Non-USD Stablecoins Are Virtually Non-Existent, Euro Stablecoins Show Consistent Growth

The Facts

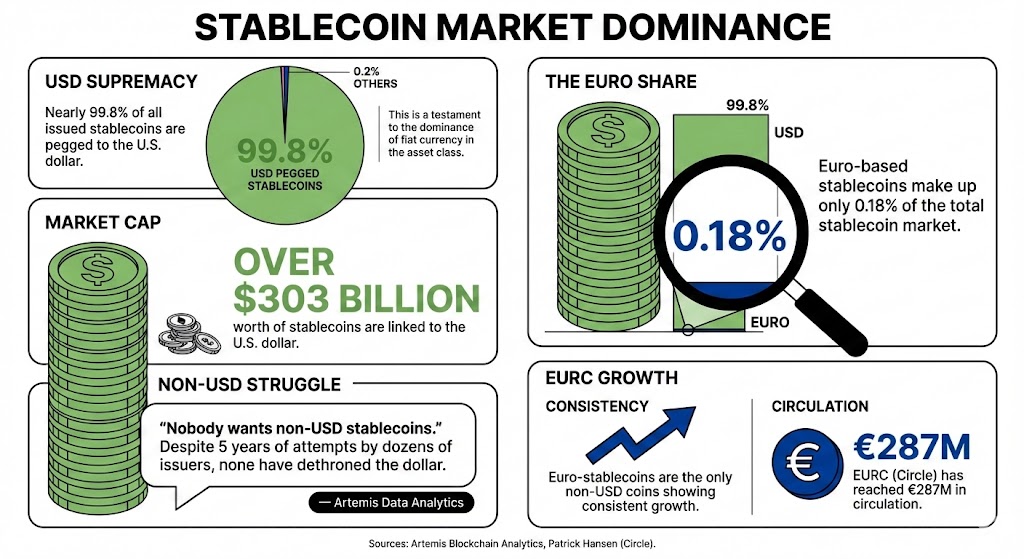

Data from Artemis, a platform that provides blockchain analytics, shows that nearly 99.8% of all the stablecoins issued are pegged to the U.S. dollar, a testament to the dominance of the fiat currency in the asset class.

Over $303 billion worth of stablecoins are linked to the U.S. dollar, figures that dwarf all other currencies combined. On social media, Artemis referred to this fact, claiming that attempts to introduce stablecoins linked to currencies have been unsuccessful so far.

It stated:

Nobody wants non-USD stablecoins. Five years, dozens of new issuers, every major currency tried, and none have made any progress in dethroning the dollar.

Euro-based stablecoins only reached 0.18% of the stablecoin market, a marginal number compared to the dollar stablecoin share. Nonetheless, Circle’s Patrick Hansen highlighted that this number was poised to grow.

Hansen explained that while the dollar’s dominance was indeed true, the evolution of euro-pegged stablecoins was significant. “Euro-stablecoins are essentially the only non-USD stablecoins showing consistent growth over the past year, driven primarily by EURC, which has now reached €287M in circulation,” he pointed out.

Why It Is Relevant

The undeniable dominance of the U.S. dollar in the stablecoin ecosystem might offer an insight into the true value of these instruments. While it is undoubtedly true that they offer transactional improvements over traditional dollars, their true value lies in expanding the offer of U.S. currency to jurisdictions facing difficulties in accessing actual dollars.

This is because the value of the underlying fiat currency is transferred to stablecoins, offering holders the same properties that the dollar has as an inflation and devaluation hedge.

Read more: Historic: Bolivia to Integrate Stablecoins Into Its Banking System, Use Them as Legal Tender

Looking Forward

While the dominance of U.S. stablecoins is unlikely to be defied in the short term, stablecoins pegged to other currencies, like the euro, are expected to keep growing as more markets start adopting national stablecoins for payments and other transactions.

FAQ

-

What percentage of stablecoins are pegged to the U.S. dollar?

Nearly 99.8% of all issued stablecoins are linked to the U.S. dollar, highlighting its dominance in the market. -

How much value do dollar-pegged stablecoins represent?

Over $303 billion worth of stablecoins are associated with the U.S. dollar, significantly surpassing those linked to any other currency. -

What is the market share of euro-based stablecoins?

Euro-based stablecoins account for only 0.18% of the stablecoin market, reflecting the challenges they face in gaining traction against dollar-pegged alternatives. -

What trends are emerging for euro-pegged stablecoins?

Despite the dominance of the dollar, euro-pegged stablecoins, particularly EURC, are showing consistent growth, with €287M now in circulation.

[ad_2]