[ad_1]

The launch of a Bitcoin staking Exchange-Traded Product (ETP) powered by Core on the London Stock Exchange in September 2025 has prompted discussions in financial circles about the potential for a similar staking Exchange-Traded Fund (ETF) to emerge next.

This ETP, developed in partnership with Valour, a subsidiary of DeFi Technologies, allows investors to track Bitcoin’s price while earning yields through staking on the Core Chain. CoreDAO itself has indicated in a recent statement on X that staking ETFs represent the next phase after spot Bitcoin ETFs, alongside structured products and expanded derivatives markets.

Bitcoin ETFs were step one.

Next comes staking ETFs, structured products, and expanded derivatives markets.

This is only the beginning. 🔶 pic.twitter.com/6O5cQzALMw

— Core DAO 🔶 (@Coredao_Org) September 23, 2025

This development aligns with ongoing efforts to integrate Bitcoin into yield-generating mechanisms, though regulatory and technical hurdles remain before a staking ETF could materialize.

Details of the Bitcoin Staking ETP

The Bitcoin staking ETP, listed on the London Stock Exchange, represents an initial integration of CoreDAO’s technology into regulated financial products. Issued by Valour, the ETP tracks Bitcoin’s market price and incorporates staking yields from the Core Chain. Investors can stake wrapped Bitcoin without transferring custody, utilizing Bitcoin’s CheckLockTimeVerify (CLTV) timelock feature to secure assets in their own wallets.

Yields from this staking process are distributed in CORE tokens, with an annualized return reported at 5.65% as of May 2024. The product complies with regulatory standards, enabling it to be made available to both institutional and retail investors through the exchange. Assets are stored in cold wallets managed by custodians such as BitGo, Copper, or Hex Trust. The ETP carries a management fee of 1.9%, which covers operational costs associated with the staking mechanism.

This ETP builds on CoreDAO’s non-custodial staking model, where Bitcoin remains under investor control during the staking period. The minimum lock-up time for staked Bitcoin is 24 hours, after which assets can be unstaked. Additionally, CoreDAO offers a Dual Staking option, where combining Bitcoin with CORE tokens can increase yields. CoreDAO has also introduced lstBTC, a liquid staking token developed with partners like Maple Finance, BitGo, Copper, and Hex Trust. This token allows staked Bitcoin to remain tradable and usable as collateral, enhancing liquidity within the system.

Differences Between ETPs and ETFs

ETPs and ETFs share similarities but differ in structure and regulation. ETPs encompass a range of securities that trade on exchanges and track underlying assets or indices, including notes and structured products. The CoreDAO-powered Bitcoin staking ETP falls into this category, enabling complex features such as staking yields.

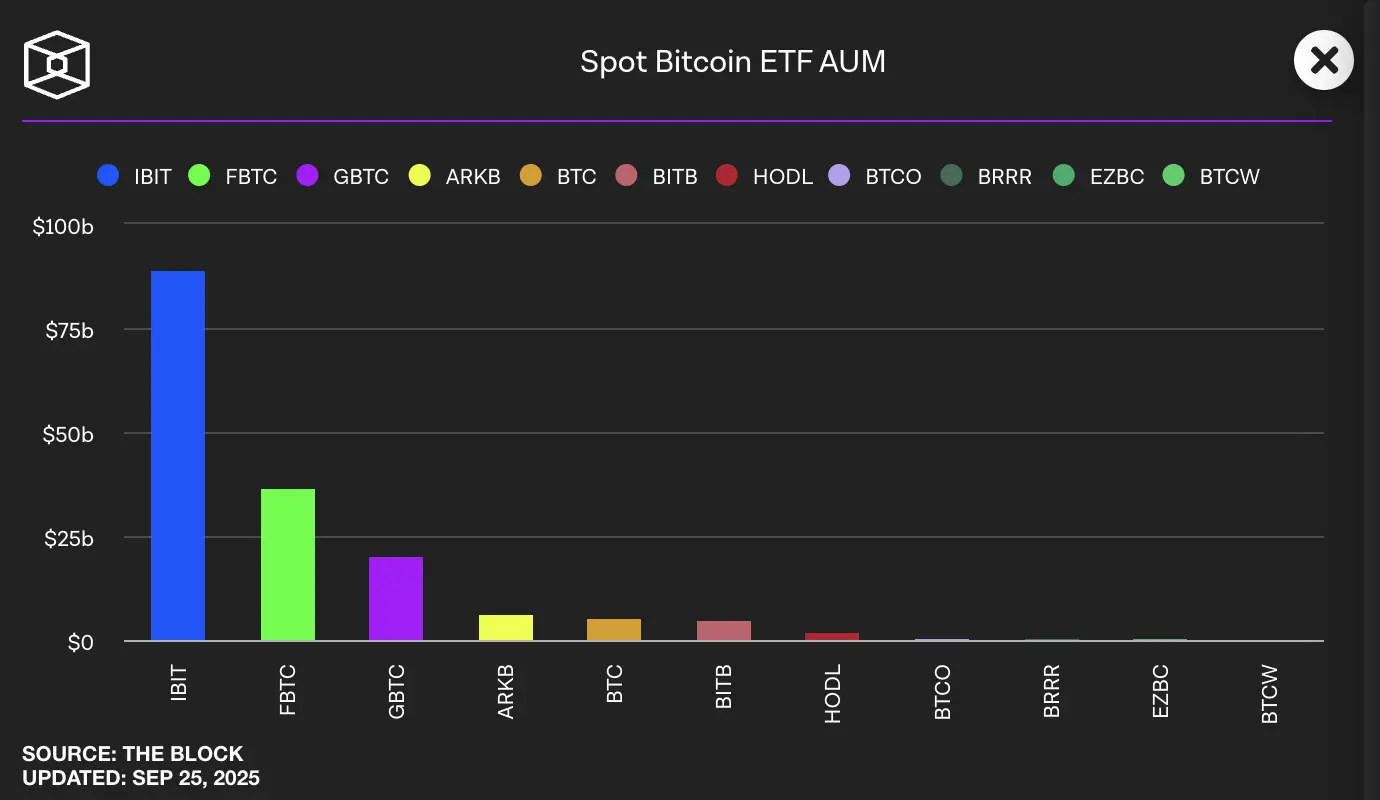

In contrast, ETFs are a specific type of ETP governed by stricter rules, such as the U.S. Investment Company Act of 1940. They typically track indices or asset baskets with lower fees and broader accessibility through brokerage accounts. Spot Bitcoin ETFs, approved by the U.S. Securities and Exchange Commission (SEC) in January 2024, have accumulated $136 billion in assets by September 2025, but focus solely on price tracking without staking elements.

Spot Bitcoin ETF AUM As of September 25 | The Block

European markets often favor ETPs for cryptocurrency due to more flexible regulations, whereas U.S. ETFs require rigorous compliance with custody and investor protections. These distinctions mean that transitioning Core’s staking model from an ETP to an ETF would involve adapting to heightened scrutiny, particularly around yield generation and asset security.

Feasibility of a Bitcoin or CORE Staking ETF

Market Demand

Institutional investors, including pension funds and wealth managers, are showing increasing interest in cryptocurrency products that offer income streams comparable to traditional dividends or bonds. Bitcoin’s proof-of-work consensus does not inherently support staking, unlike proof-of-stake networks such as Ethereum. CoreDAO addresses this by enabling Bitcoin to participate in the Core Chain’s proof-of-stake validation, generating yields through validator rewards.

The ETP’s launch follows the pattern seen with Ethereum’s shift to proof-of-stake in 2022, which boosted staking product inflows. In Europe, ETPs for assets like Ethereum, Solana, and even memecoins such as Dogecoin have gained traction, indicating a receptive market for yield-bearing Bitcoin instruments.

Technological Feasibility

Core’s infrastructure supports potential ETF integration. The non-custodial staking utilizes Bitcoin’s CLTV to temporarily lock assets without third-party control, thereby reducing custody risks. The lstBTC token ensures that staked assets remain liquid, meeting ETF liquidity requirements.

The Dual Staking model adds flexibility by boosting returns when CORE tokens are paired with Bitcoin. CoreDAO’s ecosystem also features integrations bolstering its technical foundation. An upcoming Fusion upgrade aims to improve re-staking capabilities across partner chains, potentially enhancing ETF compatibility.

Regulatory Considerations

In the United States, the SEC’s approval of spot Bitcoin ETFs marked progress; however, the introduction of staking features introduces complexities. Concerns include validator penalties (slashing), centralization risks, and liquidity issues related to redemption.

European regulators, such as the UK’s Financial Conduct Authority and Germany’s BaFin, have approved similar products, including Ethereum staking ETPs like Bitwise’s ET32. This environment facilitated the listing of the ETP powered by Core, suggesting fewer barriers for an ETF. Proposals for U.S. Ethereum staking ETFs, such as one filed by 21Shares in February 2025, could set precedents.

The REX-Osprey Ethereum staking ETF launched in the U.S further indicates the evolving acceptance of this technology, although Bitcoin’s proof-of-work nature differentiates it. Core on the other hand, may be feasible in the nearest future.

Opportunities for Development

The ETP provides a tested framework that could extend to ETFs, especially in Europe, where regulatory paths are clearer. The institutional adoption of Bitcoin, as seen in BlackRock’s inclusion in its $58 billion iShares portfolios, underscores the demand for yield options.

Additionally, CoreDAO’s partnerships with custodians and its growing stake of over 2,900 Bitcoin position it well for scaling. The non-custodial approach mitigates common ETF concerns, and success in Europe could influence U.S. regulators.

Going forward, staking ETFs is regarded as a subsequent development after spot Bitcoin ETFs. The ecosystem’s metrics, including over 4,800 staked Bitcoin, 19 million unique addresses, and significant transactions since its inception, demonstrate the platform’s capacity to support such expansions within DeFi applications like decentralized exchanges and lending protocols.

Sources

- Valour Debuts Bitcoin Staking ETP in London Stock Exchange: https://www.coindesk.com/markets/2025/09/19/valour-debuts-bitcoin-staking-etp-on-london-stock-exchange-in-move-outside-mainland-europe

- Core DAO: https://coredao.org/

- Spot Bitcoin ETF Assets Under Management: https://www.theblock.co/data/etfs/bitcoin-etf/spot-bitcoin-etf-assets

- ETF Adoption in North America: https://www.chainalysis.com/blog/north-america-crypto-adoption-2025/

- Core Launches Dual Staking: https://news.bitcoin.com/core-launches-dual-staking-with-fusion-upgrade-for-enhanced-btc-yields/

- REX-Osprey Ethereum Staking ETF Launched in the US: https://www.businesswire.com/news/home/20250925055445/en/REX-Osprey-Launches-First-Ethereum-Staking-ETF-in-the-US

[ad_2]