Crypto’s IPO market is back, but the companies leading the charge aren’t the ones most exposed to token volatility.

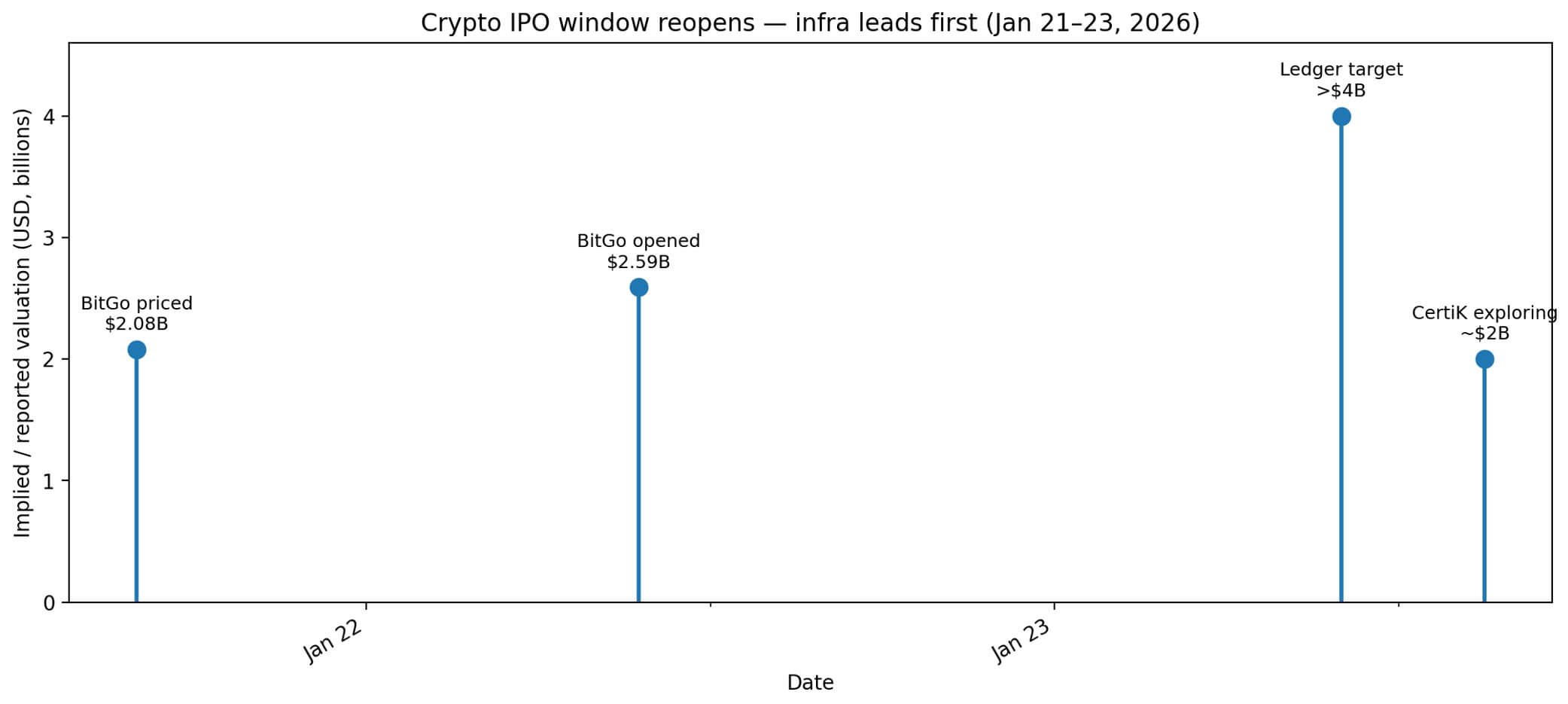

BitGo priced its initial public offering on Jan. 21 at $18 per share, raising $212.8 million and valuing the custody platform at $2.08 billion. Shares opened the next day at $22.43, a 24.6% jump that pushed the implied valuation to $2.59 billion.

Within 24 hours, two more security-focused companies signaled public market ambitions.

Ledger, the hardware wallet maker, is reportedly preparing a New York listing targeting a valuation above $4 billion, with Goldman Sachs, Jefferies, and Barclays leading the process, according to the Financial Times.

CertiK, the blockchain security auditor, confirmed to The Block that it’s exploring a roughly $2 billion IPO.

The pattern is clear: public markets are rewarding regulated infrastructure narratives over token-exposed speculation.

BitGo explicitly positioned itself as a profitable, regulated digital asset infrastructure, emphasizing its national charter approval and $35.3 million in net income for the first nine months of 2025.

Ledger and CertiK are pitching themselves as trust-layer plays, as wallet security and protocol auditing, at a moment when institutional demand for security infrastructure is compounding faster than appetite for cyclical trading platforms.

This is more than a reflexive bounce, a filtering mechanism is being deployed.

The IPO window opened in 2025 with the listings of Circle, Gemini, and Bullish, but performance diverged sharply.

Circle priced at $31, raising $1.05 billion in an upsized offering. Bullish’s shares more than doubled on debut, valuing the exchange at roughly $13.16 billion. Gemini raised $425 million at a $3.33 billion valuation.

However, by Dec. 31, Gemini had fallen roughly 64.5% from its peak, and Circle had pulled back sharply from its highs near $300.

The market rewarded momentum first, then fundamentals. The companies preparing to list now are betting that investors learned the lesson.

Regulated infrastructure reads as less beta

BitGo’s debut validates the thesis that custody and compliance infrastructure carry lower perceived risk than platforms whose revenue moves in lockstep with token prices.

BitGo reported net income of $35.3 million in the first nine months of 2025 and received approval to convert to a national charter, a regulatory milestone that signals durability to institutional investors.

The national charter matters because it places BitGo under federal banking supervision, reducing counterparty risk for clients and creating a clearer path to serving regulated financial institutions.

That’s not cosmetic. It’s a structural moat that competitors operating under state-level trust charters or offshore jurisdictions can’t replicate without years of regulatory engagement.

Ledger’s reported $4 billion valuation target leans into the same logic. The FT notes Ledger generates triple-digit million-dollar revenues and previously reached a $1.5 billion private valuation in 2023.

The company’s pitch centers on secure storage infrastructure and institutional custody demand, framing hardware wallets not as consumer gadgets but as enterprise-grade security tools.

Security is becoming an investable vertical

CertiK’s exploration of an IPO signals that security is shifting from a cost center to an investable category.

Chainalysis estimates $17 billion was stolen in crypto scams and fraud in 2025, a figure that notes why security spending is structural rather than discretionary.

CertiK audits smart contracts and blockchain protocols, positioning itself as infrastructure that reduces systemic risk for developers, exchanges, and DeFi platforms.

The security firm reached a $2 billion private valuation in 2022 and is exploring a public listing at a similar valuation.

The pitch is straightforward: as more capital flows on-chain and regulatory scrutiny tightens, security audits become non-negotiable.

However, CertiK also carries reputational baggage that investors will scrutinize.

The company’s audits have covered protocols that later experienced exploits, raising questions about audit rigor and liability exposure.

Public market diligence will force clearer disclosure on CertiK’s methodology, client concentration, and how it handles reputational risk when audited protocols fail.

Ledger and CertiK represent different slices of the trust layer: wallet security versus protocol security. Still, both are betting that investor demand is clustering around companies that reduce the attack surface rather than those that maximize token exposure.

The FT ties rising security demand directly to data theft and hacking, noting that institutional buyers view secure storage and auditing as non-negotiable infrastructure.

What IPO filings will force into the open

The next three to six months will produce clearer answers on revenue quality, regulatory posture, and client concentration as companies file S-1 documents and roadshow materials.

BitGo’s debut already revealed profitability and regulatory approval, but Ledger and CertiK will face harder questions.

For Ledger, investors will scrutinize the split between consumer hardware sales and institutional custody revenue. Consumer hardware is cyclical and margin-compressed; institutional custody is recurring and higher-margin.

The mix determines whether Ledger is a hardware company with custody upside or a custody platform that happens to sell devices. The valuation gap between those two narratives is billions of dollars.

For CertiK, diligence will focus on audit liability, client retention, and how the company manages conflicts when audited protocols launch tokens or raise capital. Security auditors face an inherent tension: the more protocols they audit, the higher the probability that they will be exploited, which creates reputational risk.

CertiK will need to demonstrate that its audit process is rigorous enough to justify premium pricing and that its client base is diversified enough to withstand individual protocol failures.

Both companies will also likely face questions about exposure to hacks, either through client losses or audited protocol exploits.

Public investors want to understand tail risk, not just average outcomes. The S-1 filings will force disclosure on loss history, insurance coverage, and how companies reserve for potential liabilities.

The three-to-six-month scenario range

The base case is a selective window that stays open for profitable, regulated infrastructure.

Post-2025 performance dispersion reinforces a fundamentals-driven market where companies with clear unit economics and regulatory clarity get funded, while token-exposed platforms face skepticism. BitGo’s debut validates that thesis.

The bull case is for risk-on sentiment to return, broadening the pipeline beyond custody and security. Circle, Bullish, and Gemini’s 2025 debuts showed that when crypto sentiment improves, IPO demand can flood back quickly.

If Bitcoin rallies and macro conditions ease, exchanges, DeFi platforms, and token-exposed businesses could follow the infrastructure leaders to market.

The bear case is macro tightening or risk-off sentiment, forcing postponements and down-round expectations. If BitGo’s shares weaken or Ledger’s roadshow reveals softer-than-expected institutional demand, the window narrows fast.

What to watch

The metrics that matter are filing dates, revenue disclosure, profitability timelines, and regulatory status.

BitGo’s S-1 already revealed $35.3 million in net income and national charter approval.

Ledger’s filing will show whether triple-digit million-dollar revenues translate to profitability and how much of that revenue is recurring institutional business versus one-time hardware sales.

CertiK’s filing will disclose client concentration, audit failure rates, and how the company reserves for reputational risk.

Public markets are pricing regulated infrastructure as lower-beta exposure to crypto growth. That’s a bet that custody, security, and compliance tools capture value regardless of token price swings, because institutional adoption depends on reducing operational and security risk before allocating capital.

BitGo’s debut validated the bet. Ledger and CertiK will test whether security infrastructure commands the same premium as custody.

The IPO window is open, but it’s filtering for fundamentals. Companies that can demonstrate profitability, regulatory clarity, and recurring revenue from institutional clients are leading.

Token-exposed platforms that rely on trading volume and speculative demand are waiting. The next three to six months will determine whether the window widens or whether 2026 becomes a year where only pick-and-shovel businesses go public.