[ad_1]

According to the betting site Polymarket, Bitcoin is projected to reach new all-time highs above 108,000 dollars in 2025.

Investors firmly believe that the cryptocurrency will surpass its ATH within the first six months of the year, subsequently entering a phase of price discovery.

Let’s see everything in detail below.

Bitcoin aims for new all-time highs in 2025: watch out for these price levels

Bitcoin opened 2025 with a crucial rebound from the 50-period exponential moving average (EMA) on the daily chart, momentarily recovering $96,000.

After the price correction triggered in the second half of December, the cryptocurrency now seems to want to recover the lost ground and soar towards new highs.

For the bulls, it will be crucial not to lose the support of 91,500 dollars, the break of which to the downside would trigger a new negative impulse down to at least the target of 87,000 dollars.

In the case of another leg down, there would still be no need to tear one’s hair out: the technical structure remains bullish up to 80,000 dollars.

On the contrary, if Bitcoin manages to surpass the psychological resistance of 100,000 dollars in a short time, lost since December 19, it could continue the rise rapidly.

A similar scenario would easily push the cryptocurrency close to the last stop at 103,000 dollars before the stretch towards the ATH within the first months of 2025.

At the moment, the probabilities seem to favor the question, with the price outlook favoring a new bull momentum rather than a bear reversal.

The trading volumes, despite the disengagement of the Christmas holidays, remain good enough to support a new bull push.

Furthermore, the MACD indicator seems to be in a bullish crossover phase, with the trend line about to return to green territory, ready to accompany a positive trend.

In any case, it is worth noting the presence of a large bear divergence RSI between the values of November 11 and the current ones, which could complicate the overall picture.

It will be crucial to see how Bitcoin behaves in the first quarter of 2025: historically, every Q1 of the year following the halving offers great emotions to the holders of the cryptocurrency.

Source: https://it.tradingview.com/chart/1hwwyywT/?symbol=CRYPTOCAP%3AUSDT.D

The Polymarket forecasts on Bitcoin’s ATH in 2025

To evaluate the possible chart trend of Bitcoin in 2025, we rely on the data from the prediction market Polymarket.

According to this platform, there are high chances that the currency will manage to cross the threshold of its all-time highs by the end of the year.

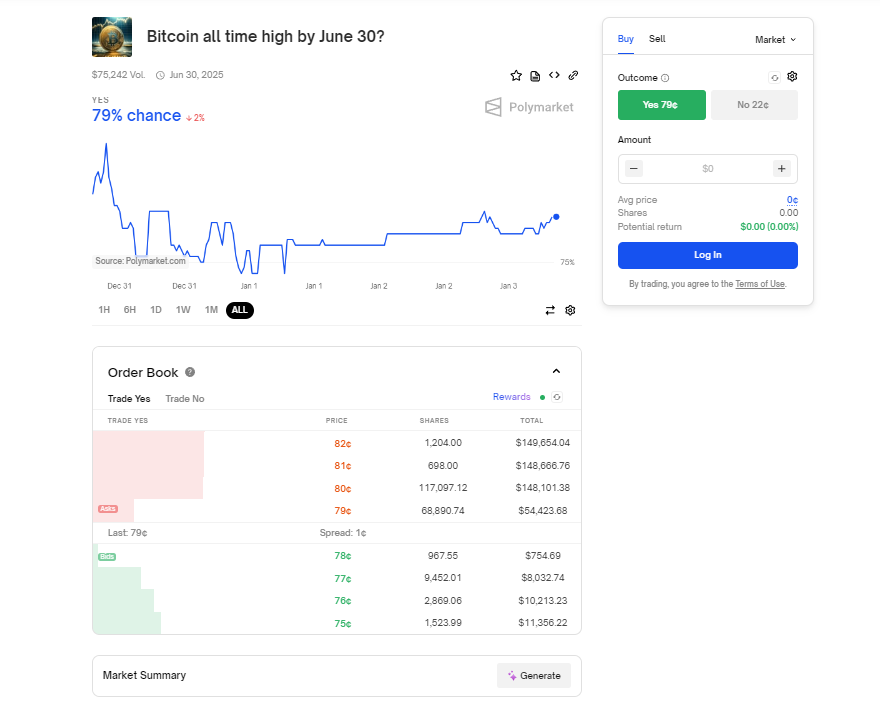

In particular, it emerges that Bitcoin will likely surpass its ATH by June 30, 2025, with a 79% probability in favor.

Investors take for granted that Bitcoin will achieve the goal within the first 6 months of the year, also considering the outlook from the bull market.

According to the rules of the query “Bitcoin all time high by June 30?”, the bet will resolve with a “yes” if any 1-minute candle for the trading pair BTC-USDT on Binance has a maximum price greater than the ATH at 108,230 dollars.

We point out, however, that despite the optimism of Polymarket, there are only 75,000 dollars in volume that justify the probability at 79%.

There are therefore not enough trades to firmly confirm these values.

Source: https://polymarket.com/event/bitcoin-all-time-high-by-june

Another very interesting market on Polymarket that can help define the price trend of Bitcoin in 2025 is the following.

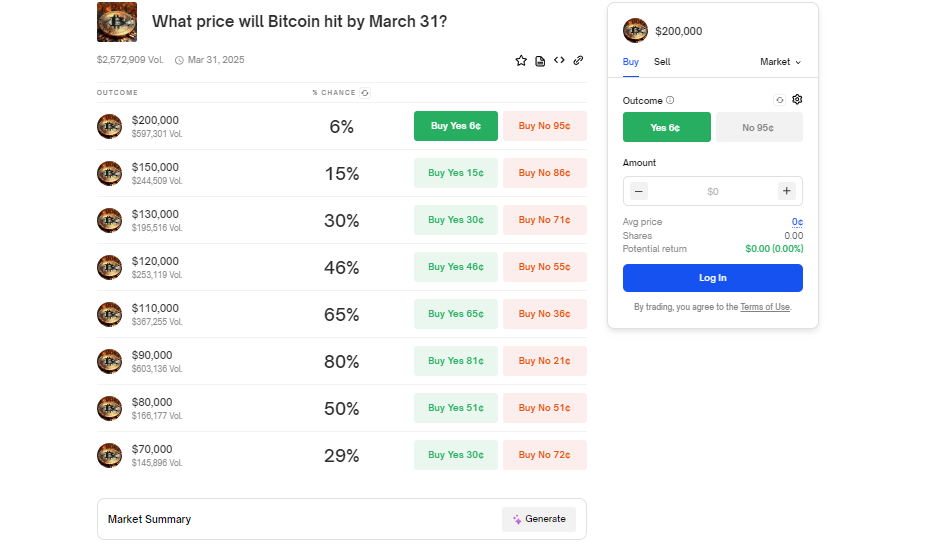

Based on the query “What price will Bitcoin hit by march 31”, it emerges that Bitcoin has a 65% probability of reaching new highs at 110,000 dollars by the end of Q1.

At the same time, there is also an 80% chance of a price drop to 90,000 dollars, while a drop to 80,000 dollars seems more unlikely.

Curious to note how reaching 200,000 dollars by March 31, 2025, the dream of all Bitcoiners, is quoted at 6%.

This market also takes as a reference the prices of Binance on the trading pair BTC-USDT on a 1-minute time frame.

In this case, however, the volumes are higher compared to the previous one, with 2.57 million dollars in bets that provide more truthful results.

Source: https://polymarket.com/event/what-price-will-bitcoin-hit-by-march-31?tid=1735892929001

Attention to the Bitcoin forecasts of the Deribit options market

If the forecasts of Polymarket on Bitcoin can be somewhat unreliable, we can still compare them with the metrics of Deribit.

The cryptocurrency options market offers a much more comprehensive view of investors’ bets regarding the future price of the cryptocurrency in 2025.

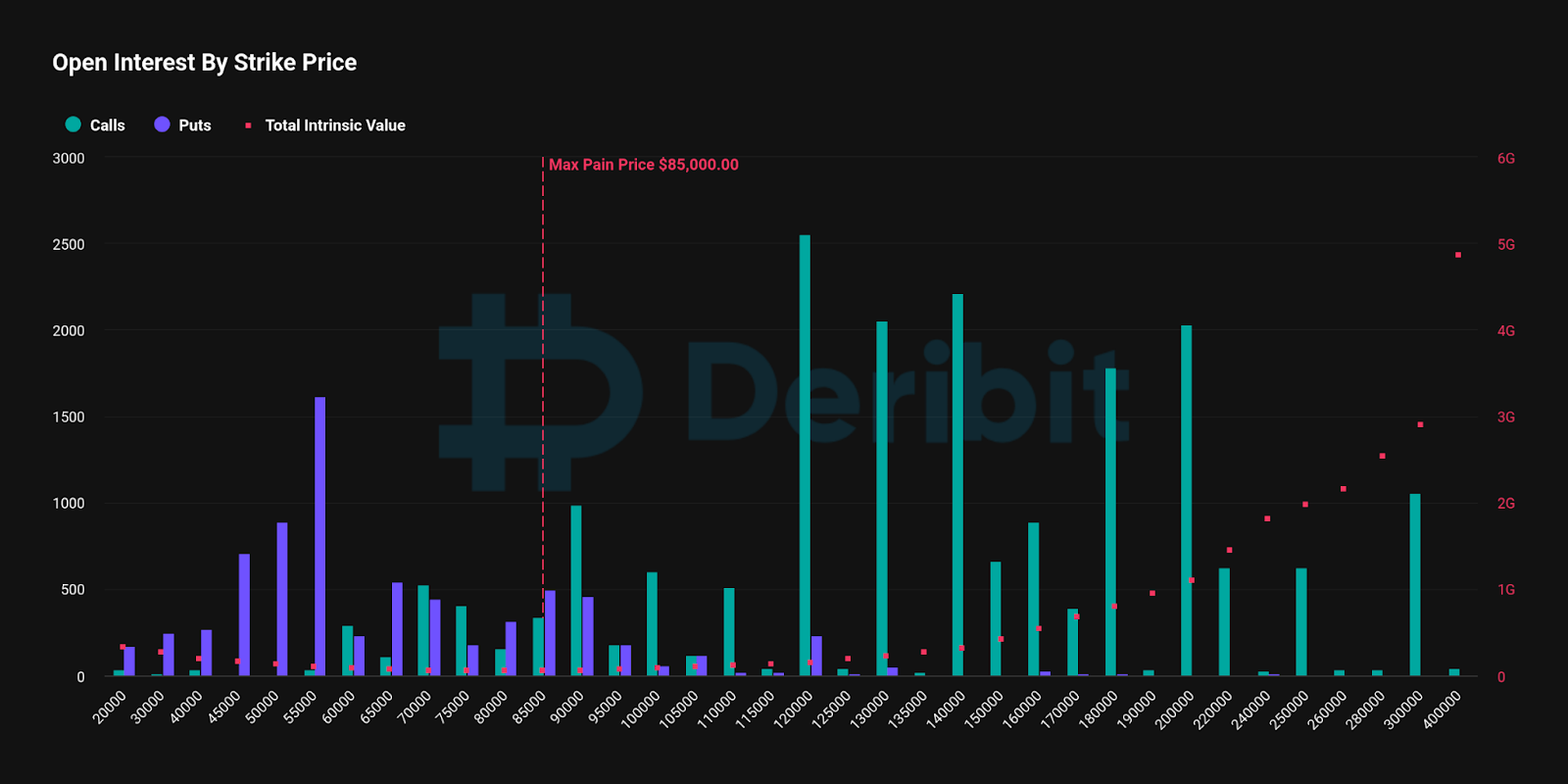

In particular for the expiration of June 27, 2025, the investors of Deribit have positioned themselves in favor of surpassing the historical highs.

The chart “Open Interest By Strike Price”, which identifies the price targets where there are more bets, shows a high interest for 120,000 dollars.

Over 245 million dollars are positioned in call contracts on this figure, suggesting that investors expect a higher price by the predetermined date.

Significant call positions also for the targets of 130,000, 140,000, 180,000, and 200,000 dollars, where there are slightly lower volumes than the previous target.

Very interesting to note how there are 100 million dollars in calls oriented towards 300,000 dollars, as evidence of the bull sentiment of some investors.

The bear seem unwilling to bet on Bitcoin price levels slightly below the current ones and are playing all their cards in put positions between 45,000 and 55,000 dollars.

The max pain price for the June 2025 expiration, or the price that would cause the highest level of financial losses for all option holders, is set at 85,000 dollars.

Overall, the notional value is 2.6 billion dollars with almost 27,000 open contracts, of which 72% are arranged in call positions.

From the Deribit framework, it emerges that Bitcoin forecasts are very optimistic for 2025, especially in the first 6 months of the year.

Source: https://www.deribit.com/statistics/BTC/metrics/options

[ad_2]