Ethereum (ETH) price is flirting with the $4,000 level once again, rising over 2.5% in the past 24 hours and trading near $3,877. That has reignited hopes of a new leg higher and possibly a fresh all-time high.

The setup might feel familiar, but the backdrop this time is very different. As July draws to a close, ETH finds itself caught in a web of converging catalysts: heavy leveraged bets, deep-pocketed ETF inflows, thinning exchange supply, and rising strength versus Bitcoin. And all of it sets the stage for a potentially explosive August. Fingers crossed!

Leverage Stack is Heavy Below: Can ETF Inflows Stabilize the Zone?

According to the latest Bitget ETH/USDT liquidation map, over $5.78 billion in cumulative long leverage is currently stacked between $3,358 and $3,875. With ETH trading right around the upper end of this zone, it’s hovering near a danger pocket.

A push higher could flip this zone into a price launchpad; or, if it slips, it could trigger a cascade of liquidations.

ETH liquidation map: Coinglass

What makes this cluster different from previous leverage buildups is the kind of money backing it.

In July 2025, ETH ETFs (Exchange Traded Fund) recorded $5.12 billion in net inflows, the highest monthly tally over the past year, in dollar terms. This isn’t just retail. It’s institutional firepower piling in, showing up both in spot allocations and, clearly, in derivatives.

ETH ETF inflows in USD: SoSo Value

That conviction is what gives bulls some breathing room in what would otherwise be a high-risk leverage trap. There is no good reason to believe that the July ETF fever won’t trickle down to August.

Should ETH reclaim $3,900 with momentum, it could trigger a forced short squeeze, especially with $1 billion+ in short positions waiting to be taken out. Yes, even short positions are considerable.

Exchange Reserves Add Another Bullish Layer

Adding to the bullish narrative is the low exchange reserve data. Despite ETH gaining over 57% from last month’s lows, exchange holdings haven’t increased. In fact, monthly exchange reserves are at their second-lowest point in over a year.

Ethereum price and exchange reserve: Cryptoquant

This isn’t just about low supply. What’s more striking is that despite large wallets selling, reserves haven’t spiked.

This suggests supply absorption, where retail and institutional demand are soaking up the sell-side pressure.

When ETF money is entering and exchange reserves are shrinking during a price rise, the takeaway is simple: conviction is strong, and sellers are being outpaced.

ETH/BTC Ratio Surges; Altseason in the Air?

Zooming out, the ETH/BTC ratio is telling its own bullish story. The pair has climbed to 0.032, up nearly 40% from June’s lows, and now sits at the brink of completing a rare sequence of golden crossovers across the 20D, 50D, 100D, and 200D EMAs (Exponential moving averages).

ETH/BTC ratio: TradingView

Only one move remains: the 50-day EMA (orange) overtaking the 200-day (blue). Once that happens, it would confirm a full-fledged bullish structure; the same kind that historically precedes extended altcoin runs.

Given the context: strong ETF inflows, thinning exchange reserves, and long leverage stacks — this crossover wouldn’t just be symbolic. It could be the technical validation bulls need to extend momentum deeper into August.

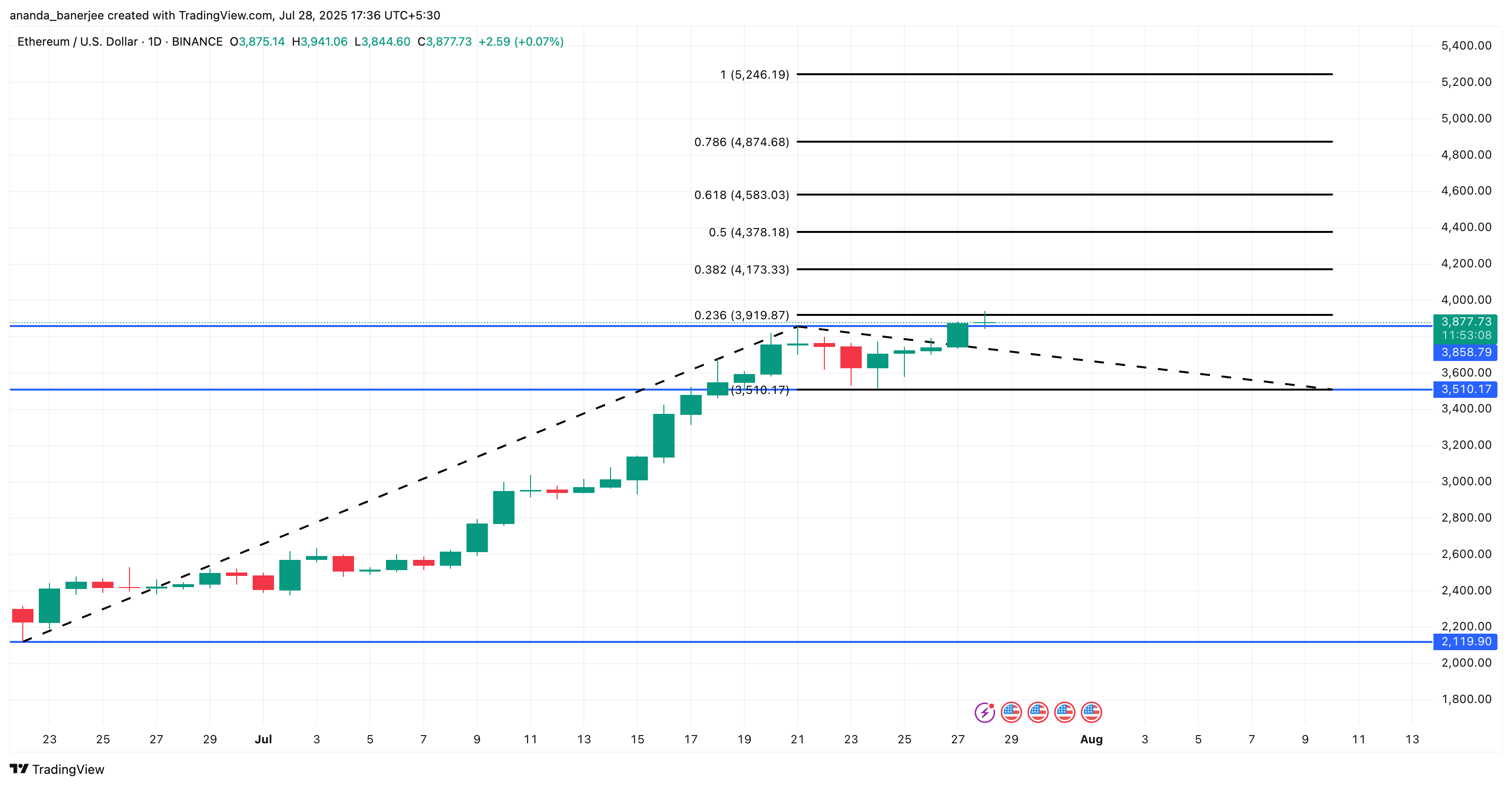

Ethereum Price Action: Key Resistance Defines the Battle Zone

With Ethereum’s outperformance against Bitcoin gaining traction, that strength may soon spill over into ETH/USD price action. The ETH/BTC ratio has historically acted as a lead indicator for USD breakouts, and with a golden crossover nearly complete, ETH’s momentum looks ready to shift gear

ETH is now pressing against the 0.236 Fibonacci extension level at $3,919. A clean break and daily close above this could ignite upside momentum, with targets at:

- $4,173 (0.382 Fib)

- $4,378 (0.5 Fib)

- $4,583 (0.618 Fib)

- $4,874 (0.786 Fib)

A move above $4,874 would prime the Ethereum price for a new all-time high (ATH). And with ETH doing a 55% rally in July alone, the “ATH” probability looks increasingly possible.

ETH price analysis: TradingView

However, a failure to hold above $3,919 would stall the rally, leaving ETH vulnerable to a retest of support around $3,510; the trendline invalidation level. That’s the line bulls need to defend to avoid re-entering a broader consolidation range. And remember, price drips can trigger the liquidation levels that were discussed earlier.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.