[ad_1]

In a development that has captured the attention of the cryptocurrency community, Whale Alert, a platform tracking large cryptocurrency transactions, has reported the transfer of 7,999 Bitcoin (BTC) from the prominent U.S. exchange Coinbase to an undisclosed address. At the current market rate of approximately $62,200 per BTC, this transaction amounts to nearly half a billion dollars.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 7,999 #BTC (494,138,045 USD) transferred from #Coinbase to unknown new wallethttps://t.co/VVnMEFFAHy

— Whale Alert (@whale_alert) May 15, 2024

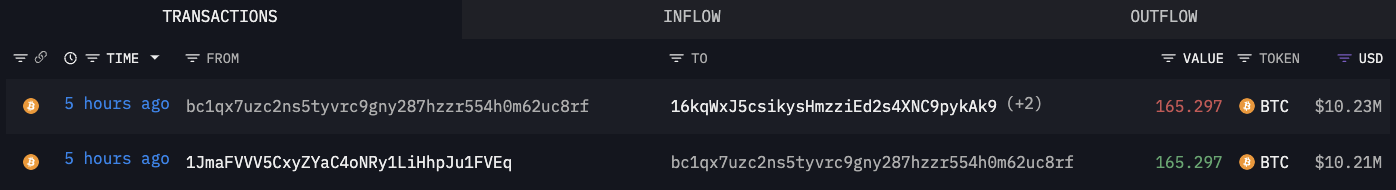

A closer examination of blockchain data reveals a notable pattern in the movement of these funds. Following the initial transfer to a new address identified as “1JmaF,” the Bitcoin was subsequently divided into smaller portions and distributed across 62 other addresses.

Each of these subsequent transfers involved approximately 165.3 BTC, equivalent to roughly $10.2 million, raising questions about the motives behind the fragmentation of funds and the identity of the parties involved.

CPI Day

The timing of this substantial withdrawal is particularly noteworthy, coinciding with heightened anticipation surrounding updates on U.S. consumer inflation. Analysts speculate that the forthcoming release of the Consumer Price Index (CPI) could have significant implications for financial markets, including the cryptocurrency sector.

While expectations suggest that the April CPI may not signal a significant uptick in inflation, uncertainties persist regarding the potential market reaction to the data.

The outcome of the April CPI report holds significant sway over market sentiment. A higher-than-expected CPI could trigger increased market volatility, while a more subdued report might temporarily ease concerns about inflation.

The question of the unknown entity’s expectations behind this significant Bitcoin withdrawal looms large. Is the whale, as such holders are often referred to in cryptocurrency circles, banking on favorable economic data and subsequent market growth?

[ad_2]