Today, approximately $3 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire, creating significant anticipation in the crypto market.

Expiring crypto options often leads to notable price volatility, prompting traders and investors to monitor today’s developments closely.

$2.87 Billion Bitcoin and Ethereum Options Expiring

According to Deribit’s data, 23,481 Bitcoin contracts, with a notional value of approximately $2.29 billion, are set to expire today. Bitcoin’s put-to-call ratio is 1.11. The maximum pain point — the price at which the asset will cause financial losses to the greatest number of holders — is $97,000.Here, most contracts will expire worthless.

Bitcoin Options Expiration. Source: Deribit

Based on this, analysts at Greeks.live explained the current state of the crypto market through its official account on X (formerly Twitter).

“Bitcoin managed to hit $100,000 from zero in a decade which created a legend. Trump tweeted his congratulations, taking crypto from geek to mass. Near the end of the week, a sharp downward shot cleared a wave of leverage, other coins didn’t follow suit. The long side of the overall crypto market is very strong…market sentiment is very optimistic with solid long forces in the spot bull market,” Greeks.live noted.

Nevertheless, it is impossible to ignore that high funding rates for leveraged contracts, which suggest overextended bullish bets, increase the likelihood of a market pullback. This aligns with BeInCrypto’s recent report, which highlighted that Bitcoin options traders are hedging against potential declines. There is growing interest in put options.

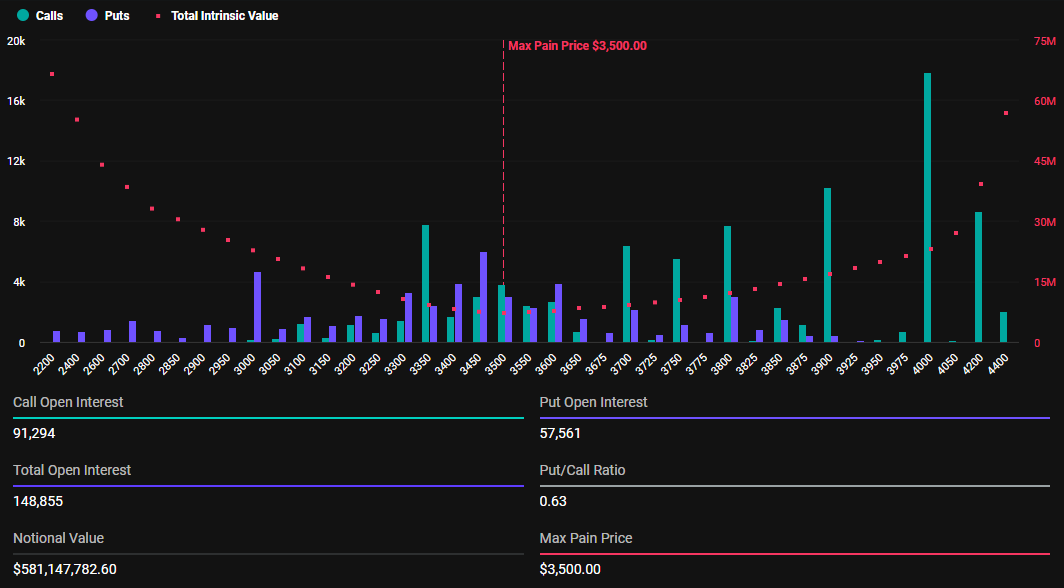

Bitcoin’s put-to-call ratio remains above 1, signaling a predominantly bearish sentiment. In contrast, Ethereum’s put-to-call ratio sits at 0.63, indicating a generally bullish market outlook for ETH.

Expiring Ethereum Options. Source: Deribit

Based on Deribit data, over 148,733 Ethereum contracts will expire today. These expiring contracts have a notional value of approximately $581 million, with a maximum pain point of $3,500. Ethereum has seen a modest increase of 0.73% since Friday’s session opened, to trade at $3,902 as of this writing.

Bitcoin Options Traders Hedging Against Potential Declines

Recently, Bitcoin established a local top around the $104,000 level. However, it has corrected to trade for $97,693 as of this writing.

The rapid decline appears to be driven by several factors. Among them is an overleveraged market, where many traders were using borrowed funds to bet on BTC’s price increase.

This caused massive liquidations when the price dropped. Profit-taking after the $100,000 milestone also contributed to the correction. Massive sell orders around the $110,000 threshold may also have triggered profit booking.

According to analysts at Greeks.live, nearly two weeks of options market data have shown caution among market makers. The impact of BTC shattering the $100,000 milestone, coupled with the latest retracement, caused short-term implied volatility (IV) to increase significantly.

“…market makers are avoiding exposure to expose exposure to the market. The probability of the market continues to be extremely bullish now,” they added.

As these Bitcoin and Ethereum options contracts near expiry, the prices are likely to draw towards their maximum pain levels. Nonetheless, markets must remember that the option expiration’s impact on the underlying asset’s price is short-term. Generally, the market will return to its normal state thereafter and compensate for strong price deviations.