[ad_1]

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Introduction:

The Bitcoin Volatility Premium AMC, an innovative investment product, has quickly become the largest actively managed bitcoin-only financial product in Europe and the second largest globally. Despite this achievement, to date this bitcoin-only AMC has flown under the radar and has received no media coverage to date until now. What makes this investment product offering particularly interesting is its dramatic rise was due to the seed investment of $50 million to launch from an enigmatic early Bitcoin miner from 2010. The product is designed to curb Bitcoin’s volatile pricing, fostering its adoption as a reliable medium of exchange.

What is an AMC?

AMC stands for Actively Managed Certificate. It is a type of structured security that is popular in Europe. Jurisdictions such as Luxembourg and Jersey allow asset managers to create these certificates in order to raise capital from investors. Certificates provide a “wrapper” for an investment strategy, or specific underlying assets. The certificate is sold to investors and the capital is used to implement the strategy.

Who is the Mysterious Whale?

In response to inquiries about the identity of the Bitcoin Whale behind the new Bitcoin Volatility Premium AMC, Zeltner & Co. confirmed that the seed investor is indeed an early Bitcoin miner who has been involved in Bitcoin since 2010. However, respecting the investor’s request to preserve privacy and avoid public scrutiny, Zeltner & Co. declined to reveal any further details about their identity. The motives behind such a significant move by an individual with substantial Bitcoin holdings are particularly intriguing. The creation of this AMC, aimed at stabilizing Bitcoin’s price, showcases a strategic approach to managing digital assets. By personally allocating their holdings to develop this investment product, the Bitcoin Whale not only addresses the issue of Bitcoin’s volatility but also enhances its viability as a stable medium of exchange. This AMC stands out as a unique market-making instrument that not only seeks to manage risk but also differentiates itself through its operational approach, targeting a more stable and predictable market for Bitcoin.

Why is this AMC Relevant?

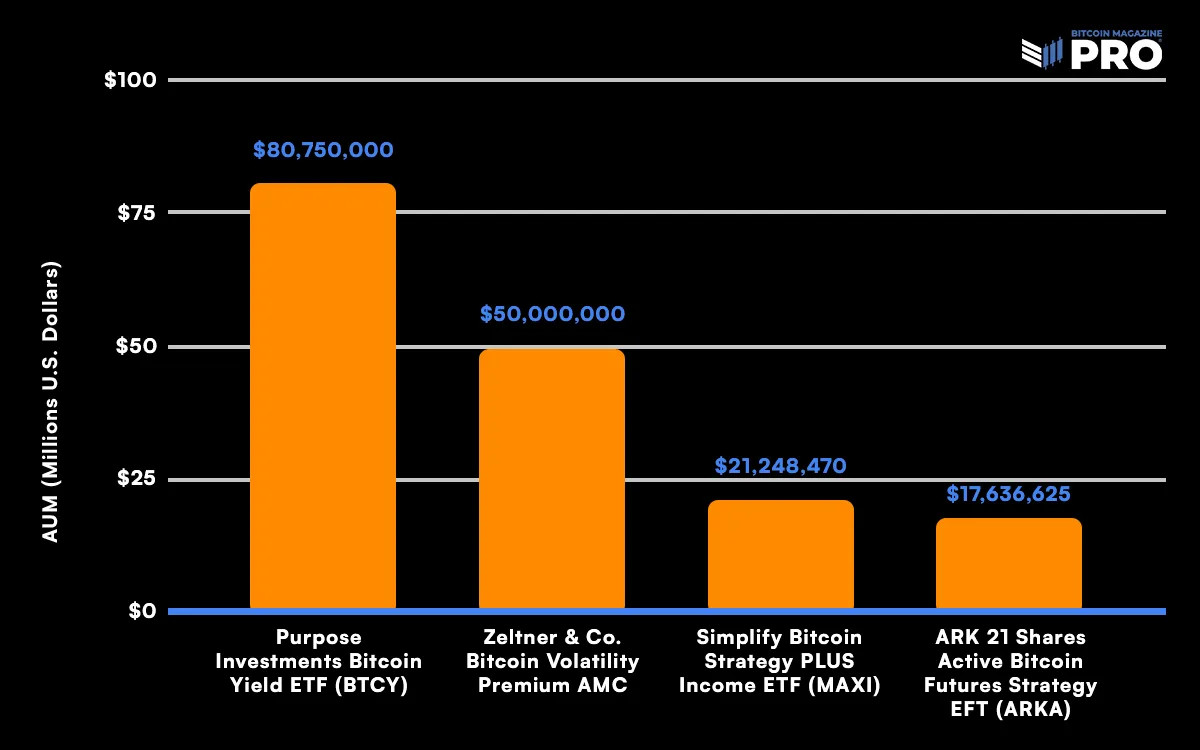

The Bitcoin Volatility Premium AMC, has already become the largest actively managed bitcoin-only financial product in Europe and the second largest globally after the Purpose Investments Bitcoin Yield ETF (BTCY), with over $109 million CAD ($80.750 U.S.). There are several large Bitcoin ETFs that actively manage futures positions, such as the ProShares Bitcoin Strategy ETF (BITO), with over $2.82 billion in assets under management; however, these are not actively managed funds in the traditional sense. Instead of trying to outperform or optimize the risk/return of a direct investment in bitcoin, futures ETFs aim to track the price of bitcoin 1:1.

The difference between an ETF and an AMC is that ETFs are passively managed. That means that they track the underlying asset. Whereas AMCs are actively managed, which means they try to outperform the underlying assets on either an absolute return or a risk-adjusted return.

Figure 1: Largest Active Bitcoin-Only Funds and Structured Products

Source: Bitcoin Magazine Pro

How is its Investment Strategy Unique?

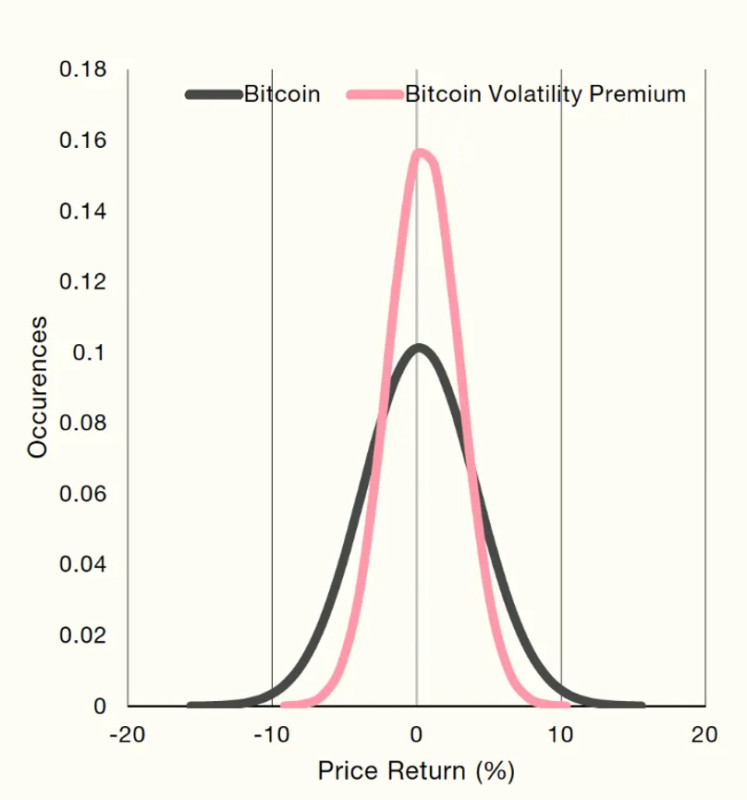

The certificate invests algorithmically in bitcoin and U.S. dollars, aiming to collect a volatility premium while optimizing the risk-return profile directly by investing in bitcoin. The strategy provides liquidity to the BTC/USD spot market with market making on leading exchanges such as Kraken. This leads to small gains, which can accumulate between 2% and 6% per annum, depending on volatility. The volatility premium is generated when the market moves from filling the buy orders generated by the algorithm to filling the sell orders, and vice versa. The algorithm buys low and sells high at each dip or peak, respectively.

Figure 2: Risk Profile of Bitcoin Versus Zeltner & Co. Bitcoin Volatility Premium

Source: Zeltner & Co.

Similar to ETFs, as more investors invest in certificates of the Bitcoin Volatility Premium AMC, the certificate must purchase more bitcoin, therefore increasing the demand for bitcoin, which already outpaces the newly created daily supply by several factors. The market making targets an allocation of 70% Bitcoin and 30% U.S. dollars, meaning that the strategy currently owns over 540 Bitcoin.

Market Impact and Future Prospects:

The goal of the Bitcoin Volatility Premium AMC is to mitigate the price fluctuations of Bitcoin, making it more stable and functional as a medium of exchange.

Dr. Demelza Hays, a portfolio manager at Zeltner & Co., shared insights with Bitcoin Magazine Pro:

“Bitcoin’s potential to become a global medium of exchange and money hinges significantly on achieving stable purchasing power. Currently, the volatility inherent in Bitcoin’s price poses a barrier to its widespread adoption for everyday transactions. However, if Bitcoin were to stabilize in value, it could emerge as a viable alternative to traditional fiat currencies, offering benefits such as decentralization, security, and lower transaction costs on Bitcoin scaling solutions such as Liquid, AQUA, and the Lightning Network.”

By becoming the largest actively managed bitcoin-only financial product in Europe and a major player globally, the AMC leverages an algorithmic strategy to invest in Bitcoin and U.S. dollars. This strategy aims to profit from market volatility, which in turn influences Bitcoin’s demand and price dynamics.

Swiss Family Office Involvement:

The strategy is managed by the prestigious family office Zeltner & Co., based in Zurich, Switzerland. Founded by Thomas Zeltner, Zeltner & Co. is continuing the legacy of Thomas’s father, the late former president of UBS’ wealth management, Jürg Zeltner. Zeltner & Co., renowned for its discretion and expertise in wealth management, has lent credibility to this venture, solidifying confidence in the strategy’s legitimacy and potential for success.

Regulatory and Geographic Advantage:

Choosing Zurich, Switzerland for its headquarters, the AMC benefits from the region’s favorable regulatory environment and its reputation as a global finance and innovation hub. This strategic location enhances the security and appeal of the Bitcoin Volatility Premium AMC to investors seeking to diversify into digital assets.

Conclusion:

The launch of the Bitcoin Volatility Premium AMC comes at a time of heightened interest, with bitcoin recently surpassing all-time highs and capturing the attention of institutional investors and mainstream media alike. As the market continues to mature and attract greater institutional participation, the emergence of innovative investment vehicles such as this certificate highlights the evolving nature of digital asset management.

[ad_2]