As February unfolds, the cryptocurrency market continues to witness significant developments. Among the key events, Nasdaq’s decision to review Grayscale’s applications for Exchange Traded Funds (ETFs) based on XRP, Litecoin (LTC), and Solana has captured the attention of investors, analysts, and market participants. Additionally, Cardano, a prominent player in the blockchain space, continues to show strength, with growing interest from both institutional and retail investors. This news update provides a comprehensive overview of these developments, their potential impact on the market, and what to expect in the coming weeks.

Nasdaq, one of the world’s leading stock exchanges, has begun the process of reviewing Grayscale’s applications for the creation of cryptocurrency ETFs based on several popular digital assets: XRP, Litecoin (LTC), and Solana. This move has sparked a renewed sense of optimism within the cryptocurrency community, particularly as institutional interest in digital assets continues to rise.

Snap | Source: Solid Intel on X

Grayscale, a major player in the cryptocurrency investment sector, is known for its successful Bitcoin and Ethereum Trust products, which have allowed institutional investors to gain exposure to these digital assets through traditional financial markets. However, the company’s latest push to launch ETFs based on alternative cryptocurrencies such as XRP, LTC, and Solana marks a significant expansion of its product offerings.

Grayscale’s Vision for the Future of Crypto ETFs

The proposed ETFs are designed to provide investors with easy access to XRP, Litecoin, and Solana in the same way they would invest in traditional stocks. These products are especially appealing to those who are hesitant about directly purchasing and managing cryptocurrency holdings. By introducing these ETFs, Grayscale aims to offer a safer and more regulated way for investors to participate in the market, without the complexities associated with cryptocurrency exchanges, wallets, and the associated risks.

XRP, Litecoin, and Solana each have their own unique characteristics and communities, and their inclusion in the ETF lineup reflects Grayscale’s desire to diversify its product portfolio. XRP, for instance, is known for its use in cross-border payments and its strong association with Ripple, while Litecoin is often seen as the ‘silver’ to Bitcoin’s ‘gold.’ Solana, on the other hand, has gained popularity due to its high scalability and low transaction fees, positioning it as a promising platform for decentralized applications (dApps) and smart contracts.

The Nasdaq review process is crucial for the approval of these ETFs, as the exchange must evaluate the applications to ensure they meet regulatory standards and align with market practices. Nasdaq’s involvement lends a layer of credibility to the endeavor, providing assurance to institutional investors that these products will be subject to rigorous oversight and compliance measures.

Should Nasdaq approve Grayscale’s applications, these ETFs would mark a historic moment in the cryptocurrency market, as they would provide broader market exposure and increase the liquidity of these digital assets. Approval could also signal a new era of mainstream adoption, further blurring the lines between traditional financial markets and the decentralized world of cryptocurrencies.

Cardano’s Growing Momentum: A Solid Foundation for Future Growth

While the spotlight has been on Nasdaq and Grayscale’s ETF developments, Cardano (ADA) continues to build momentum as one of the most prominent smart contract platforms in the cryptocurrency space. Founded by Ethereum co-founder Charles Hoskinson, Cardano has steadily gained attention due to its unique proof-of-stake consensus mechanism, which is considered more energy-efficient and environmentally friendly than the proof-of-work systems used by Bitcoin and Ethereum.

Cardano’s recent focus has been on improving its ecosystem with the launch of several key upgrades, including smart contract functionality and decentralized finance (DeFi) tools. These advancements have allowed Cardano to position itself as a serious contender in the blockchain space, particularly for developers seeking a scalable, secure, and sustainable platform for building decentralized applications.

Institutional interest in Cardano has been steadily increasing, as investors look for alternative assets to diversify their portfolios. This growing institutional adoption is reflected in the rising demand for ADA tokens, which have seen significant price increases over the past year. The network’s strong focus on academic research and peer-reviewed development processes has earned it a reputation for being one of the most methodical and secure blockchain projects in the industry.

Cardano’s ecosystem is also gaining traction with developers, thanks to the network’s enhanced capabilities. The launch of smart contracts has unlocked new use cases, particularly in the DeFi space, where platforms like SundaeSwap, a decentralized exchange (DEX), have begun to gain popularity. As Cardano continues to grow its ecosystem, it is expected to play a key role in the ongoing evolution of the blockchain industry.

Looking ahead, the future for Cardano appears promising. The network’s continued development of scalability solutions and its focus on interoperability with other blockchains will be critical in driving adoption. Additionally, Cardano’s commitment to expanding its ecosystem of dApps, DeFi projects, and NFTs will further solidify its position in the market.

Furthermore, Cardano’s partnership with major organizations and governments, particularly in developing countries, highlights its potential to drive real-world impact. These partnerships, along with its emphasis on sustainability, could position Cardano as a leading blockchain platform in the years to come.

Nasdaq ETF Approvals and Cardano: Cryptocurrency Turning Point

The potential approval of Grayscale’s ETF applications for XRP, Litecoin, and Solana, combined with Cardano’s growing influence, could have a profound impact on the cryptocurrency market as a whole. These developments suggest that institutional adoption of digital assets is accelerating, paving the way for further innovation and investment opportunities.

The introduction of ETFs focused on XRP, Litecoin, and Solana would likely drive increased trading volumes and liquidity, providing greater access to these assets for investors who may have previously been hesitant to enter the market. Furthermore, the approval of these ETFs could attract more institutional players to the cryptocurrency space, potentially leading to increased price stability and broader acceptance of digital assets in traditional financial markets.

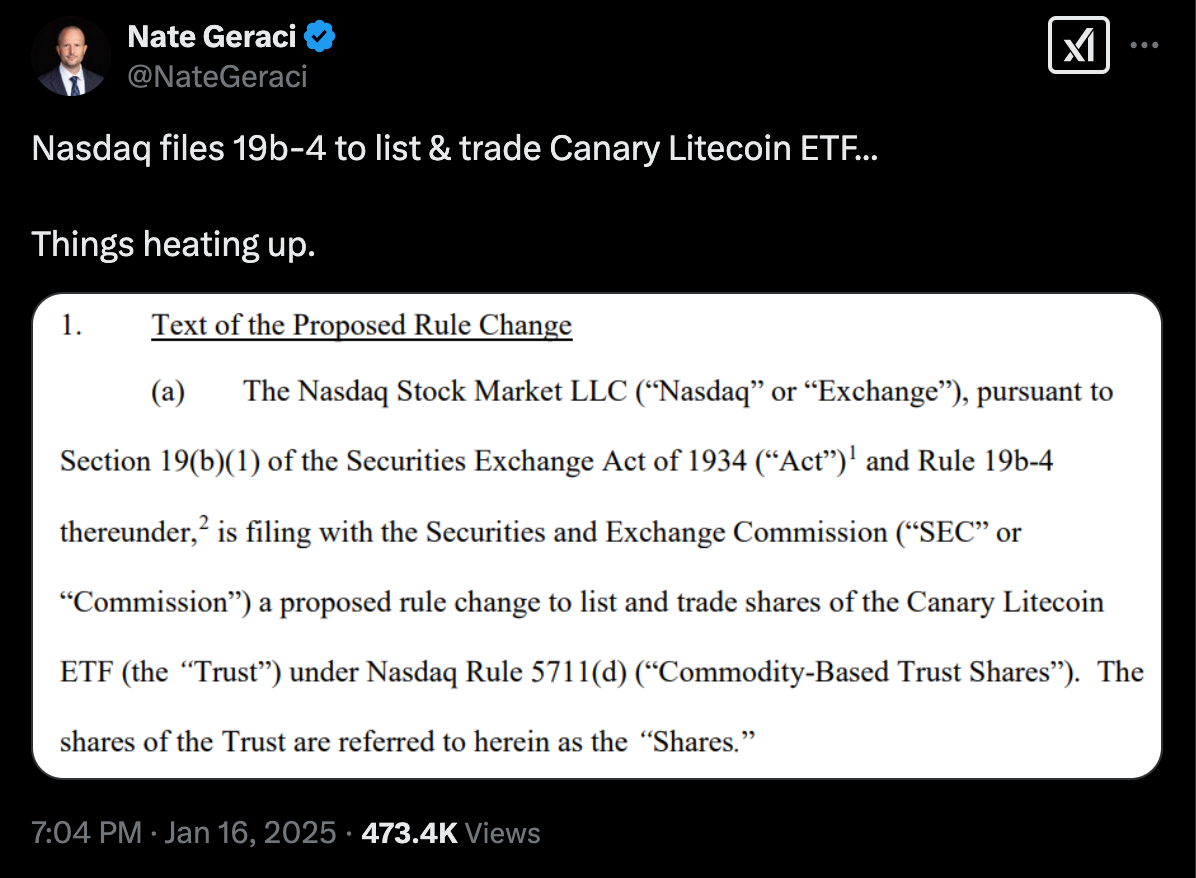

Snap | Source: Nate Geraci on X

For Cardano, the continued growth of its ecosystem and its institutional adoption could lead to greater integration of ADA into mainstream finance and enterprise solutions. If the network can continue to deliver on its promises of scalability, security, and sustainability, Cardano could emerge as a leading platform for decentralized applications and smart contracts, further cementing its position in the global blockchain landscape.

As February progresses, Nasdaq’s review of Grayscale’s ETF applications for XRP, Litecoin, and Solana, combined with Cardano’s rising prominence, signals a pivotal moment for the cryptocurrency market. With the potential for mainstream adoption on the horizon, these developments are reshaping the landscape of digital assets and creating new opportunities for investors, developers, and entrepreneurs alike.

The cryptocurrency market is evolving rapidly, and the coming months will likely witness even more groundbreaking advancements. Whether through the approval of new ETFs or the continued growth of blockchain ecosystems like Cardano, the future of digital assets is increasingly intertwined with the broader financial landscape. For investors and market participants, staying informed on these developments will be key to navigating the exciting and ever-changing world of cryptocurrency.