[ad_1]

Bitcoin’s price traded at $108,776 on May 29, 2025, supported by a market capitalization of $2.16 trillion and a 24-hour trading volume of $32.47 billion. The intraday price ranged from $107,107 to $109,057, reflecting ongoing volatility amid consolidating price action.

Bitcoin

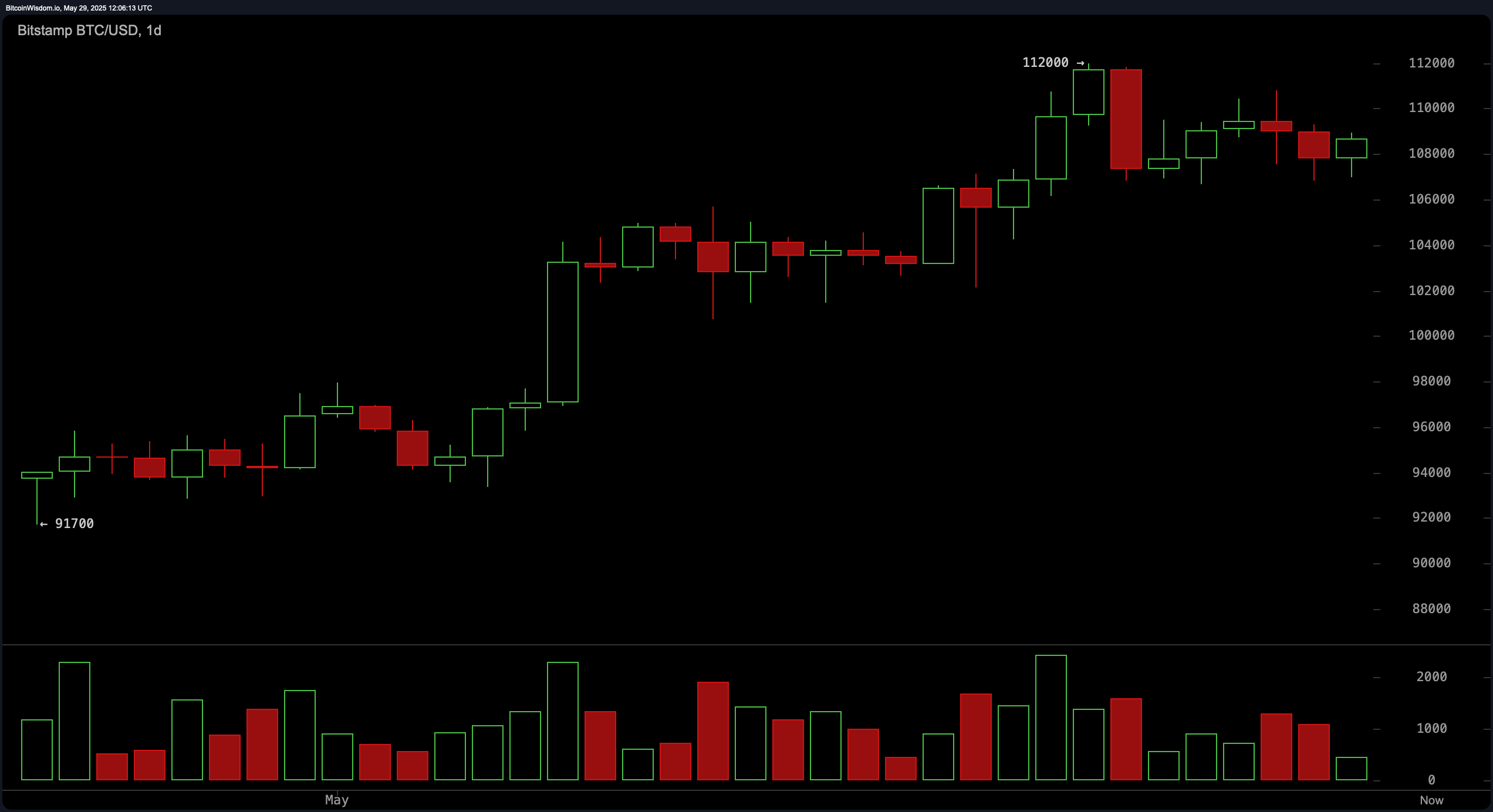

The daily chart reveals that bitcoin is sustaining an uptrend originating near $91,700, though recent candles suggest waning bullish momentum after a peak close to $112,000. Price action around $108,000 to $109,000 coincides with weaker follow-through and a declining volume trend, implying a potential short-term consolidation or even a reversal. A dominant red candle followed by smaller-bodied indecisive candles further underscores this stalling behavior. For swing traders, the $105,000–$106,000 zone offers a historically significant demand region, while resistance looms near the $111,000–$112,000 level. A break above or rejection at these levels could define the near-term trajectory.

BTC/USD 1-day chart on May 29, 2025.

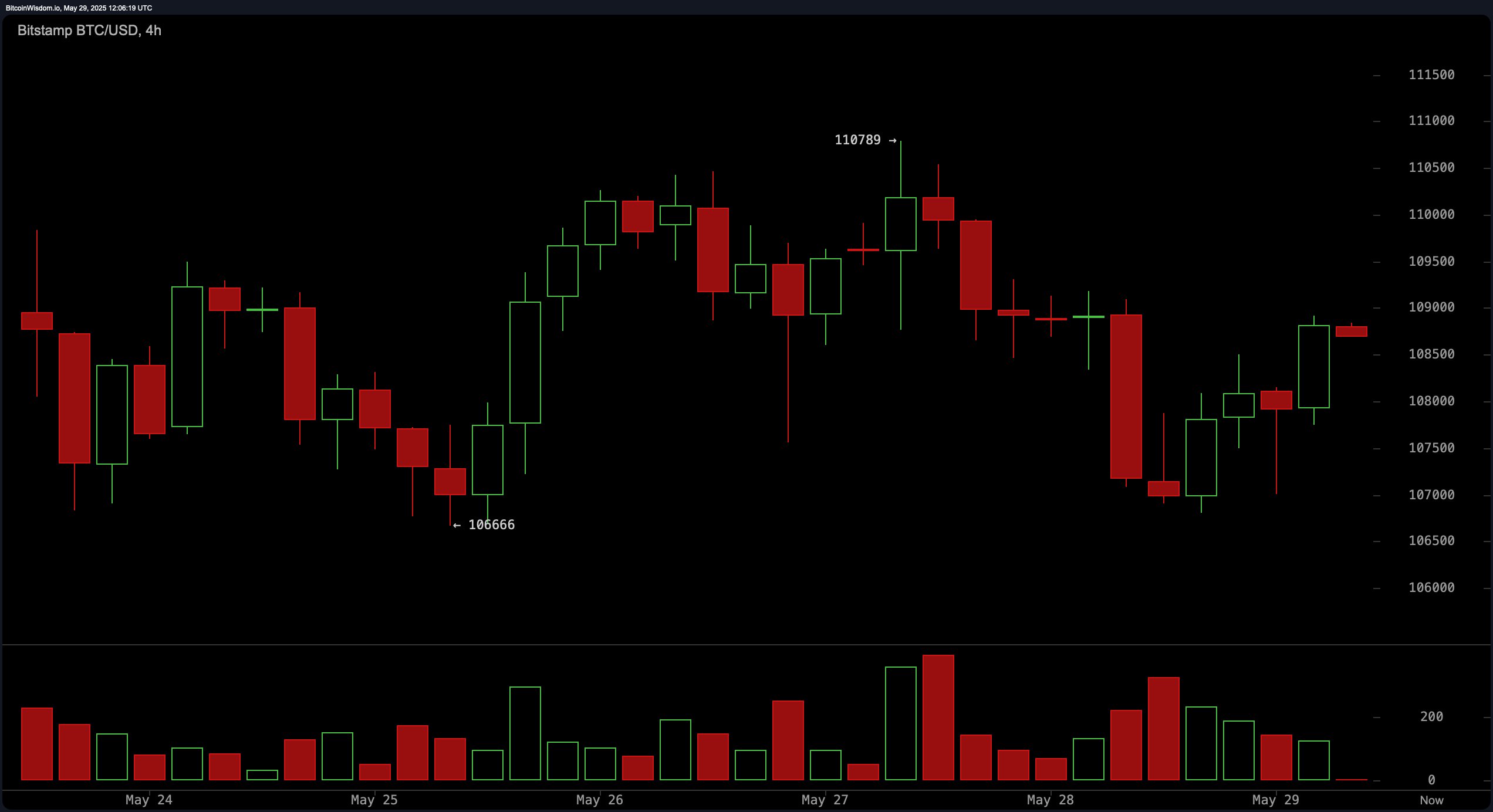

On the 4-hour chart, bitcoin’s price behavior appears more erratic. After peaking at $110,789 and retracing to a bottom at $106,666, bitcoin formed a bullish engulfing pattern, indicating a short-term relief rally. Despite this, the pattern of lower highs remains intact, creating ambiguity in the trend. Entry opportunities could emerge between $107,000 and $107,500 on pullbacks, targeting exits near $110,000 where prior selling pressure intensified. A sharp sell-off on a recent red candle points to potential capitulation, suggesting traders should monitor volume closely.

BTC/USD 4-hour chart on May 29, 2025.

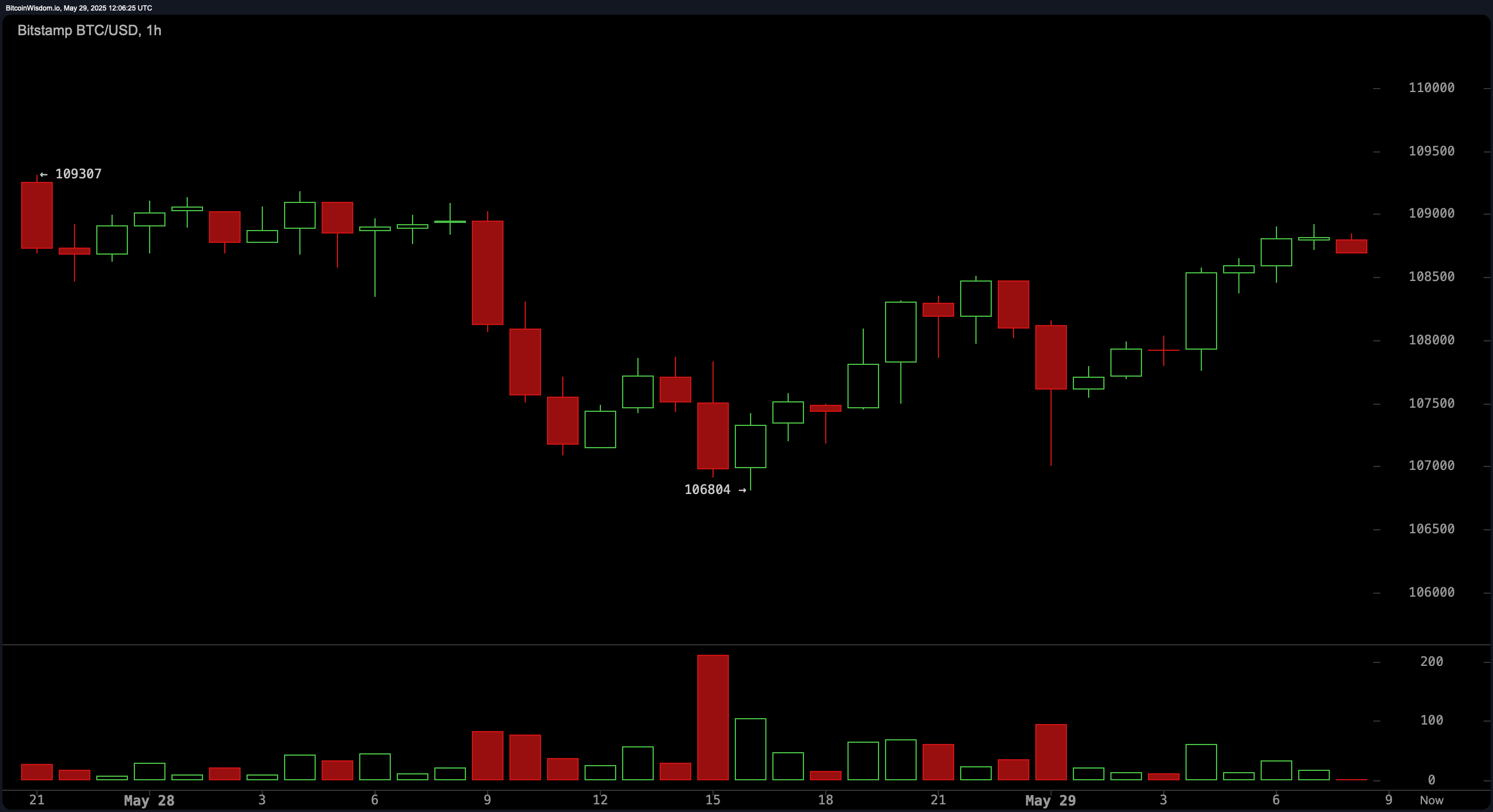

The 1-hour BTC/USD chart highlights a V-shaped recovery from $106,804 to around $109,000, reflecting strong intraday buying. However, the price increase on diminishing volume indicates a possible stall. The near-term structure suggests micro pullbacks to the $107,500 level are optimal entry points if accompanied by bullish confirmation signals like a hammer candlestick. Resistance remains firm near $109,300, the previous intraday high. The current trend favors short-term buyers, but further gains need volume support to be sustained.

BTC/USD 1-hour chart on May 29, 2025.

Oscillator readings for May 29 show a predominantly neutral sentiment. The relative strength index (RSI) at 63, Stochastic at 66, commodity channel index (CCI) at 56, and average directional index (ADX) at 29 all suggest equilibrium without extreme momentum in either direction. The Awesome oscillator at 6,524 also reflects neutral momentum. Notably, momentum indicates a positive signal at 3,130, whereas the moving average convergence divergence (MACD) level suggests a bearish signal at 3,261, revealing divergence and caution in interpretation.

Fibonacci retracement levels drawn from February’s swing low at $91,700 to the high at $112,000 identify key support areas. The 23.6 percent retracement level at approximately $106,210 marks current support, while deeper levels at 38.2 percent ($103,460), 50.0 percent ($101,850), and 61.8 percent ($100,240) offer additional downside cushions. A break below $106,000 could trigger further retracement toward the 38.2 percent level or even lower. For bulls, maintaining above the 23.6 percent retracement is critical to sustain upward pressure.

Bitcoin’s moving averages (MAs) as of May 29 present a unified bullish bias. All short- and long-term averages are positioned below the current price, suggesting support across timeframes. The exponential moving averages (EMAs) and simple moving averages (SMAs) for the 10, 20, and 30 periods indicate bullish signals, with the EMA (10) at $108,017 and the SMA (10) at $108,749. Similarly, longer-term EMAs and SMAs—such as EMA (100) at $95,521 and SMA (200) at $94,601—underline the strength of the trend. As long as the price remains above these averages, the structural integrity of the uptrend is maintained.

Bull Verdict:

Bitcoin’s price action remains supported by a consistent series of higher lows on larger timeframes, combined with broad buy signals across all key moving averages. The maintenance above the 23.6 percent Fibonacci retracement and resilience at intraday support zones indicate that bulls still have control, particularly if the price stays above $107,500. A breakout above $109,300 could reignite momentum toward $112,000 and beyond.

Bear Verdict:

Despite the prevailing uptrend, signs of exhaustion are becoming evident. Bearish divergences such as weakening volume during rallies, a sell signal from the moving average convergence divergence (MACD), and a stalling RSI raise caution. If bitcoin breaks below $106,000 with conviction, it may trigger a deeper retracement toward $103,000 or even $101,000, eroding recent gains and shifting momentum in favor of sellers.

Final Verdict:

Bitcoin stands at a technical crossroads, balancing between bullish continuation and corrective pullback. As long as key support levels hold and moving averages remain aligned, the trend favors further upside—but caution is warranted amid weakening momentum indicators. Traders should remain agile, with stop-losses in place and eyes on the $106,000 threshold as the short-term inflection point.

[ad_2]