By Omkar Godbole (All times ET unless indicated otherwise)

While bitcoin

On Monday, the nine spot ether ETFs recorded total net outflows of $465 million — the largest on record — following Friday’s $152 million drawdown, according to SoSoValue. Bitcoin ETFs also saw substantial outflows, bleeding $333 million after Friday’s $812 million, suggesting that institutional capital is not as sanguine as the spot market.

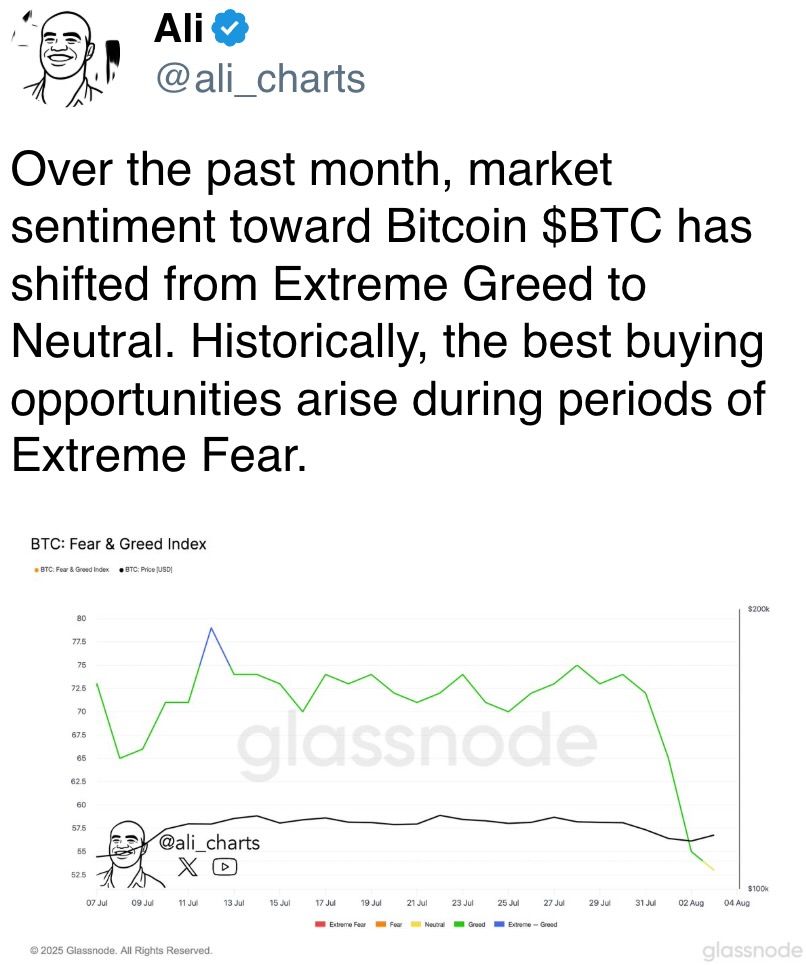

Meantime, long-term bullishness has evaporated from BTC options as concerns of renewed U.S. inflation and a labor-market slowdown weigh on investors’ risk appetite.

On the flip side, some analysts still hold a largely constructive market outlook while anticipating Fed interest-rate cuts.

“Despite the short-term volatility, structural data still suggests the U.S. is undergoing a growth slowdown, not a full recession,” Chloe Zheng, a research analyst at HTX, told CoinDesk. “Household debt remains low relative to income, credit stress is contained, and business lending growth continues. This mix of softening labor data and easing inflation expectations historically precedes monetary easing — placing risk assets like BTC in a high-volatility, liquidity-sensitive window.”

Data from the CME’s FedWatch tool shows that traders have priced in three rate cuts by the January 2026 meeting, meaning the Fed is expected to lower borrowing costs in three out of the next four meetings.

According to Paul Howard, a senior director at crypto market-making firm Wincent, new crypto market highs hinge on Fed rate cuts.

“The next big piece of macro news will likely come with U.S. rate changes, possibly as early as September,” Howare said. “If that does happen, then we can expect prices to catapult through current ATH as cheap money looks for yield. My sense is BTC and the major alts would then see strong outperformance in Q4.”

Speaking of the broader market, on-chain stablecoin volume hit a record high of over $1.5 trillion in July, according to analytics firm Sentora. Uniswap v4, which debuted at the end of January, has surpassed $100 million in trading volume, according to data tracked by 21Shares.

In traditional markets, U.S. stock futures traded flat to positive, indicating a dull open following Monday’s 1.3% gain. The dollar index traded slightly higher near 99.00, while gold dropped to $3,360 per ounce, as the freight market cratered, sending a warning to the economy. Stay alert!

What to Watch

- Crypto

- Aug. 5, 1:30 p.m.: Stellar Development Foundation (SDF) will host an AMA session on Reddit. CEO Denelle Dixon, Chief Marketing Officer Jason Karsh and Chief Growth Officer José Fernández da Ponte, will answer questions.

- Aug. 7, 10 a.m.: Circle will host a webinar, “The GENIUS Act Era Begins,” featuring Dante Disparte and Corey Then. The session will discuss the first U.S. federal payment stablecoin framework and its impact on crypto innovation and regulation.

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 5, 10 a.m.: The Institute for Supply Management (ISM) releases July U.S. services sector data.

- Services PMI Est. Est. 51.5 vs. Prev. 50.8

- Aug. 5, 2 p.m.: Uruguay’s National Institute of Statistics releases July inflation data.

- Annual Inflation Rate Prev. 4.59%

- Aug. 6, 12:01 a.m.: U.S. tariff of 50% kicks in on most Brazilian imports.

- Aug. 6, 2 p.m.: Fed Governor Lisa D. Cook will deliver a speech titled “U.S. and Global Economy”. Livestream link.

- Aug. 7, 12:01 a.m.: New U.S. reciprocal tariffs outlined in President Trump’s July 31 executive order become effective for a broad range of trading partners that did not secure deals by the Aug. 1 deadline. These tariffs range from 15% to 41%, depending on the country.

- Aug. 7, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases July consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.39%

- Core Inflation Rate YoY Prev. 4.24%

- Inflation Rate MoM Prev. 0.28%

- Inflation Rate YoY Prev. 4.32%

- Aug. 7, 3 p.m.: Mexico’s central bank, Banco de México, announces its monetary policy decision.

- Overnight Interbank Target Rate Est. 7.75% vs. Prev. 8%

- Aug. 8: Federal Reserve Governor Adriana D. Kugler’s resignation becomes effective, creating an early vacancy on the Board of Governors that allows President Trump to nominate a successor.

- Aug. 5, 10 a.m.: The Institute for Supply Management (ISM) releases July U.S. services sector data.

-

Earnings (Estimates based on FactSet data)

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: CleanSpark (CLSK), post-market, $0.19

- Aug. 7: Coincheck Group (CNCK), post-market

- Aug. 7: Cipher Mining (CIFR), pre-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 11: Exodus Movement (EXOD), post-market

- Aug. 12: Bitfarms (BITF), pre-market

- Aug. 12: Fold Holdings (FLD), post-market

- Aug. 14 (TBC): Core Scientific (CORZ), post-market

- Aug. 15: BitFuFu (FUFU), pre-market

- Aug. 18: Bitdeer Technologies Group (BTDR), pre-market

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Compound DAO is voting to select its next Security Service Provider (SSP). Delegates are choosing between ChainSecurity & Certora, and Cyfrin. Voting ends Aug. 5.

- Balancer DAO is voting on creating “Balancer Business,” a for-profit subsidiary of Balancer OpCo Ltd. This new legal entity would formalize protocol fee management and on-chain operations, replacing the current DAO multisig model. Voting ends Aug. 5.

- Arbitrum DAO is voting to renew its partnership with Entropy Advisors for two more years starting September. The proposal includes $6 million in funding and 15 million ARB for incentives for Entropy to focus on treasury management, incentive design, data infrastructure, and ecosystem growth. Voting ends Aug. 7.

- BendDAO is voting on a plan to stabilize BEND by burning 50% of treasury tokens, restarting lender rewards, and launching monthly buybacks using 20% of protocol revenue. Voting ends Aug. 10

- Aug. 5, 1:30 p.m.: Stellar Development Foundation’s CEO, CMO, and Head of Strategy & Partnerships to participate in an Ask Me Anything (AMA) session on Reddit.

- Aug. 7, 12 p.m.: Celo to host a governance call.

- Unlocks

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating supply worth $12.40 million.

- Aug. 12: Aptos to unlock 1.73% of its circulating supply worth $48.07 million.

- Aug. 15: Avalanche to unlock 0.39% of its circulating supply worth $37.45 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating supply worth $14.95 million.

- Aug. 15: Sei to unlock 0.96% of its circulating supply worth $16.42 million.

- Aug. 16: Arbitrum to unlock 1.8% of its circulating supply worth $36.35 million.

- Aug. 18: Fasttoken to unlock 4.64% of its circulating supply worth $91.6 million.

- Token Launches

- Aug. 5: Keeta (KTA) to be listed on Kraken.

- Aug. 5: USDC, tron , ondo , chainlink , cardano , and polkadot to be listed on Arkham Exchange.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Day 2 of 3: The Science of Blockchain Conference 2025 (Berkeley, California)

- Aug. 6-7: Blockchain Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 15: Bitcoin Educators Unconference (Vancouver)

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole, Wyoming)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

- Aug. 25-25: WebX 2025 (Tokyo)

Token Talk

By Shaurya Malwa

- Hyperliquid closed its best ever month, hitting $320 billion in trading volume in July — a 47% increase driven by activity in ether and other altcoins .

- The DEX also broke past $15 billion in total open interest for the first time, with ETH open interest nearly doubling month-on-month.

- Hyperliquid consistently generated over $4 million in daily fees in the period, with no significant slow days, reflecting record trader engagement.

- With $597 million in TVL, the exchange now commands nearly 12% of Binance’s derivatives market share, bolstered by whale activity and high-leverage trades.

- The platform’s HYPE token slid to $38.54 after nearly touching $50 to mark the end of its sustained rally.

- HYPE open interest dropped to a one-month low at $1.46 billion, with 70% of traders long, increasing chances of a coordinated liquidation flush.

- Price discovery has shifted to external exchanges, damping the reflexive momentum that powered HYPE’s early gains.

Derivatives Positioning

- BTC’s futures open interest dropped over 1% in contrast to the increased participation in futures tied to other major tokens, including ether and XRP.

- Funding rates are hovering at an annualized 5%-10% for most major coins, indicating a bullish positioning in the market.

- On Deribit, long-term BTC calls now trade at par with puts, signaling a bullish-to-neutral shift in sentiment. Block flows over Paradigm featured calendar spreads in bitcoin, short straddles in Aug. 8 expiry ETH options.

Market Movements

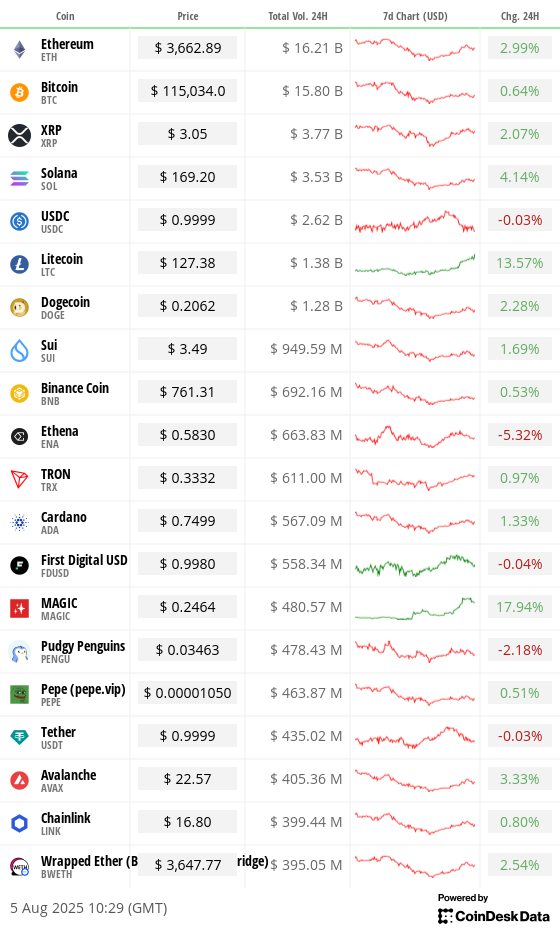

- BTC is unchanged from 4 p.m. ET Monday at $114,615.76 (24hrs: 0.18%)

- ETH is down 0.87% at $3,661.62 (24hrs: 2.9%)

- CoinDesk 20 is up 3.14% at 3,839 (24hrs: +1.95%)

- Ether CESR Composite Staking Rate is down 6 bps at 2.857%

- BTC funding rate is at 0.0189% (20.69% annualized) on KuCoin

- DXY is up 0.18% at 98.97

- Gold futures are down 0.39% at $3,413.10

- Silver futures are up 0.13% at $37.38

- Nikkei 225 closed up 0.64% at 40,549.54

- Hang Seng closed up 0.68% at 24,902.53

- FTSE is up 0.32% at 9,157.57

- Euro Stoxx 50 is up 0.24% at 5,254.78

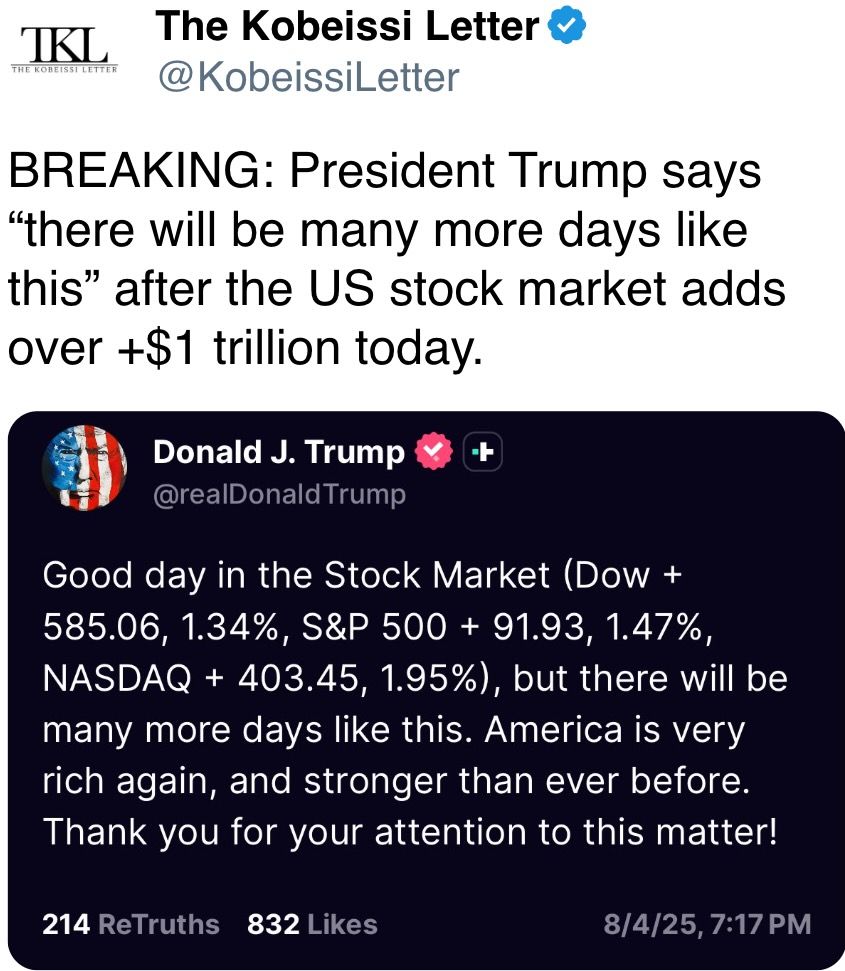

- DJIA closed on Monday up 1.34% at 44,173.64

- S&P 500 closed up 1.47% at 6,329.94

- Nasdaq Composite closed up 1.95% at 21,053.58

- S&P/TSX Composite closed down 0.88% at 27,020.43

- S&P 40 Latin America closed up 0.72% at 2,572.27

- U.S. 10-Year Treasury rate is up 1.6 bps at 4.214%

- E-mini S&P 500 futures are up 0.17% at 6,366.50

- E-mini Nasdaq-100 futures are up 0.23% at 23,349.00

- E-mini Dow Jones Industrial Average Index are up 0.11% at 44,351.00

Bitcoin Stats

- BTC Dominance: 61.6% (0.27%)

- Ether to bitcoin ratio: 0.03192 (-1.24%)

- Hashrate (seven-day moving average): 926 EH/s

- Hashprice (spot): $56.83

- Total Fees: 3.33 BTC / $382,733

- CME Futures Open Interest: 136,145 BTC

- BTC priced in gold: 34 oz

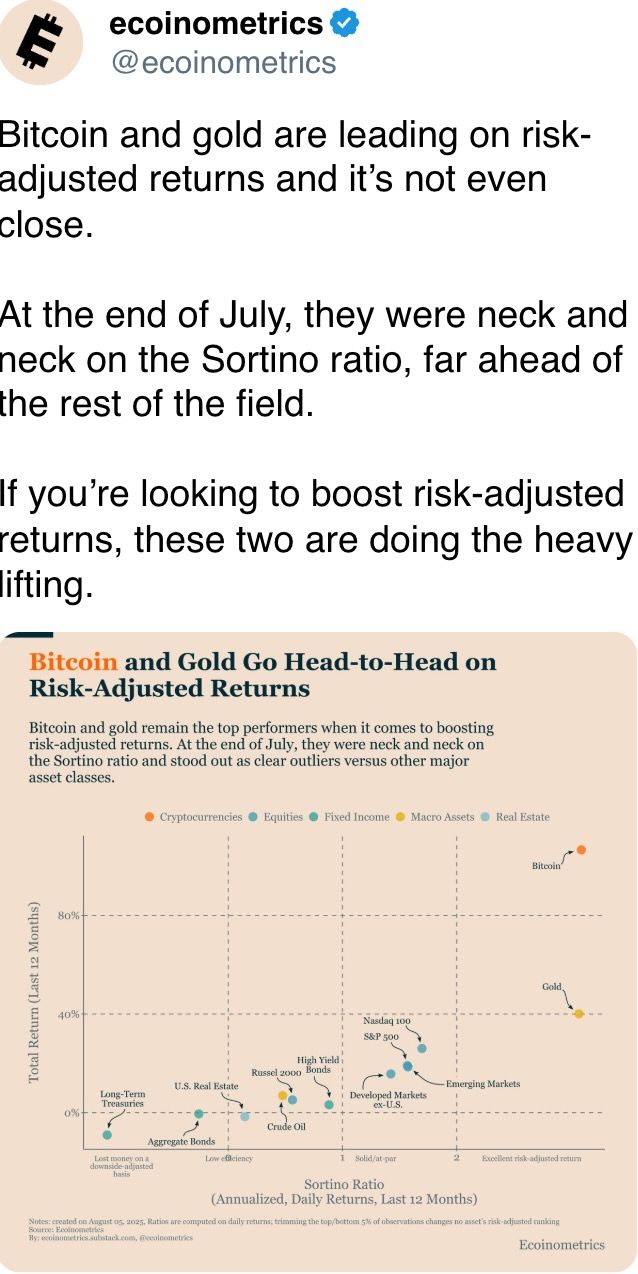

- BTC vs gold market cap: 9.61%

Technical Analysis

- The XRP/ETH ratio has carved out a head-and-shoulders pattern on the daily chart.

- A break below the horizontal support line would confirm a bearish trend reversal, signaling ether outperformance relative to XRP.

Crypto Equities

- Strategy (MSTR): closed on Monday at $389.24 (+6.17%), -0.42% at $387.59 pre-market

- Coinbase Global (COIN): closed at $318.17 (+1.11%), unchanged pre-market.

- Circle (CRCL): closed at $164.82 (-1.95%), -1.65% at $162.18.

- Galaxy Digital (GLXY): closed at $28.89 (+7.48%), +5.23% at $30.40.

- MARA Holdings (MARA): closed at $16.04 (+3.48%), -0.19% at $16.01

- Riot Platforms (RIOT): closed at $11.42 (+3.54%), unchanged.

- Core Scientific (CORZ): closed at $13.65 (+7.91%), +0.81% at $13.76.

- CleanSpark (CLSK): closed at $10.62 (+1.72%), +0.19% at $10.64.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.83 (+6.02%)

- Semler Scientific (SMLR): closed at $35.37 (+2.64%), unchanged.

- Exodus Movement (EXOD): closed at $29.57 (+4.19%), unchanged.

- SharpLink Gaming (SBET): closed at $19.14 (+11.67%), +2.61% at $19.64.

ETF Flows

Spot BTC ETFs

- Daily net flows: -$323.5 million

- Cumulative net flows: $53.83 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily net flows: -$465.1 million

- Cumulative net flows: $9.04 billion

- Total ETH holdings ~5.69 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Ether ETFs: Daily net flows. (SoSoValue)

- The U.S.-listed ether ETFs registered a record outflow of $465 million on Monday.

- The lack of participation via ETFs raises a question mark on the sustainability of ether’s price recovery since Sunday.

While You Were Sleeping

- Base Network Suffers 1st Downtime Since 2023, Halts Operations for 29 Minutes (CoinDesk): The technical fault was identified and resolved within minutes of investigation. The outage is notable given Base’s growing importance in the Ethereum layer-2 ecosystem.

- Bitcoin’s Long-Term Bullishness Evaporates From Options Market as Inflation Concern Rises (CoinDesk): Bitcoin options market indicators show long-term sentiment has turned from bullish to neutral as analysts warn that U.S. inflation data may complicate potential rate cuts by the Federal Reserve.

- Trump’s BLS Firing Tests Wall Street’s Reliance on Government Data (The Wall Street Journal): Some investors are questioning the reliability of U.S. inflation and jobs data after Trump’s firing of Erika McEntarfer, raising long-term concerns about the transparency and credibility of economic reporting.

- A Year Ago Today, Bitcoin Hit $49K on Yen Carry Trade Unwind, Now It’s Up 130% (CoinDesk): Over the past year, bitcoin rebounded alongside equities and gold despite rising bond yields, while long-term holders doubled their share of supply, signaling stronger conviction through heightened market volatility.

- Brazil’s Supreme Court Places Bolsonaro Under House Arrest (The New York Times): The judge said Bolsonaro showed “contempt for judicial decisions” by using allies’ social media accounts to reach supporters, and ordered police to seize his phone and restrict visits to his home.

- Gold Hovers Near Two-Week High as Weak U.S. Jobs Data Raises Rate-Cut Bets (Reuters): An OANDA analyst said gold’s recent strength reflects interest-rate cut expectations, but further upside may be limited without a stronger catalyst to overcome technical resistance near $3,450.

In the Ether